Do You Have Other Negative Information Affecting Your Credit

Do you have other negative marks on your credit reports? Or maybe you dont want to bother disputing inquiries on your own? If so, you can retain a credit repair company that can do the work more efficiently and effectively for you.

A professional performs these tasks hundreds of times a day. However, when investigating credit repair companies, be sure to look for a firm with many years of experience and many happy clients.

Check out our Lexington Law Firm Review to find out more about the company that has over 18 years of experience and hundreds of thousands of happy clients, or call for a free consultation to see how they can improve your credit score.

How Do Credit Inquiries Affect Your Credit

Hard credit inquiries have a negative impact on your credit score.

When a hard inquiry appears on your report, it will reduce your credit score by a few points, usually no more than five to 10 points.

Other factors on your credit report can influence how much each inquiry reduces your score. If you have strong credit, an inquiry will likely have a smaller impact than if you already have poor credit.

Each hard inquiry affects your credit score. If one inquiry drops your score by 5 points, then having two might reduce it by 10, and having four on your report could drop it by about 20.

As time passes, the impact that each hard inquiry has on your credit score decreases. After a few months, youll likely regain most of the lost points, assuming the rest of your credit history remains positive.

How Long Do Hard Inquiries Stay On Your Credit Report

Hard inquiries stay on your credit report for two years. Each time a hard inquiry is made, it is recorded by each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. And each time a hard inquiry is logged, it can potentially impact your credit score.

Read Also: Is 692 A Good Credit Score

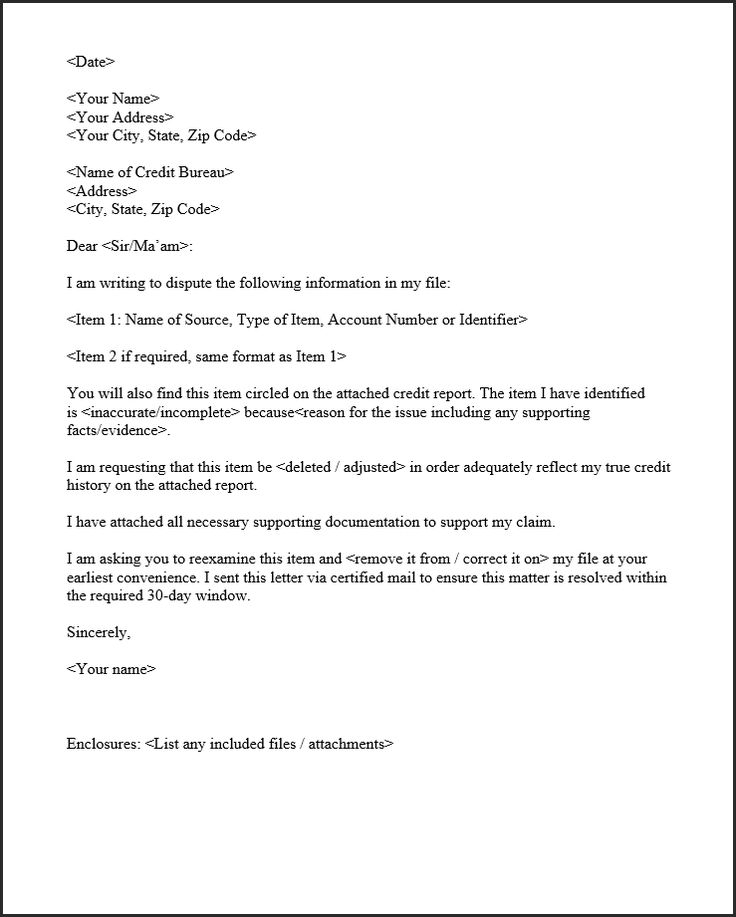

How To Dispute Your Credit Report

The government and the credit reporting industry recognize how important, and how error-prone, credit reports are, so fair credit laws make it relatively easy to dispute your credit report. Relatively. Here are the main steps, discussed in more detail below:

- Step 1: Get a copy of your credit report and review your credit report for errors.

- Step 2: Write a dispute letter or fill out an online form for each error you uncover.

- Step 3: Collect documents that support your dispute claims.

- Step 4: File your dispute through online forms, telephone, or postal mail .

- Step 5: Allow 30 days or less to get back the results of the dispute investigation.

The three credit reporting agencies offer both in-common and unique dispute services, tools, and advice. Each bureaus site explains its error-dispute processes, including:

- Information to include in your dispute letter

- What supporting documentation to include

- How to file your completed dispute package

- How to find updates as your dispute progresses

The agencies urge online filing for more rapid resolution. Each bureau offers information for postal mail and telephone-based filings as well. You can begin the dispute process by obtaining a copy of your credit report from each bureau at annualcreditreport.com, a site established by law and overseen by the three agencies. If you detect errors, experts recommend marking them on the report, which you will copy and include in your credit report dispute package.

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

Read Also: How To Report A Lost Credit Card Bank Of America

Understanding Hard Inquiries On Your Credit Report

When a lender requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry. What does a hard inquiry mean for your credit scores? And how long does a hard inquiry remain on your credit report?

Reading time: 3 minutes

Highlights:

- When a lender or company requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry

- Hard inquiries usually impact credit scores

- Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry

Some consumers are reluctant to check their credit reports because they are concerned that doing so may impact their credit scores. While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is in your credit reportand checking your credit may help you get in the habit of monitoring your financial accounts.

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a hard inquiry on your credit report.

What is a hard inquiry?

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year. Depending on your unique credit history, hard inquiries could indicate different things to different lenders.

Exceptions to the impact on your credit score

How Often Do Errors Require Disputing Credit Reports

In a one-of-a-kind 2012 study, the Federal Trade Commission selected 1,001 Americans at random and asked them to review and dispute credit report information that they felt was wrong.

Heres what happened1:

- 26% of total participants identified one or more errors and disputed their credit reports

- 21% had changes to a credit report based on their dispute

- 13% saw their credit score change as a result

- 5% saw their credit score increase enough to improve their credit risk level by one tier

That last statistic is perhaps most important. As the FTC report notes, the credit report disputes by those 5% resulted in enough improvement to get them better loan terms should they seek one, including a lower interest rate.

Did you know? As an added security measure to help protect against fraud, American Express reports a reference number to credit bureaus instead of your actual account number.

Don’t Miss: Does Affirm Affect Credit Score

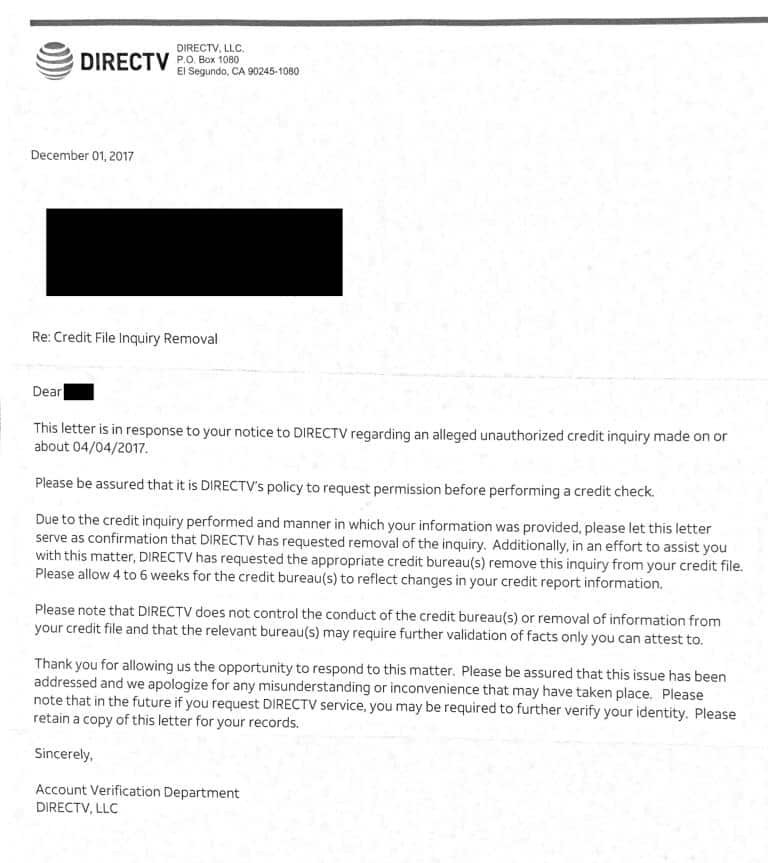

What Is A Credit Inquiry Removal Letter

A credit inquiry removal letter is used to dispute an unauthorized inquiry. It is sent to the credit bureaus to request that a credit inquiry be removed. Once the credit bureaus receive your letter, they are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. Under the Fair Credit Reporting Act, the information provider has 30 days to report back to the credit bureau with proof that you authorized the credit inquiry. If they fail to respond or provide proof, the credit inquiry must be removed from your credit report.

How To Remove Hard Inquiries From Report

When you apply for new credit, the hard inquiry associated with your application stays on your personal credit report for 24 months. Federal law requires hard inquiries to stay on your report for a specific period of time so you know who has had access to your credit file.

You cant force a credit bureau to remove a legitimate hard inquiry from your report early. But you can dispute any item on your credit report thats incorrect or that you want a credit bureau to verify.

The credit bureaus have incentives to correct inaccurate information when you dispute italthough you shouldnt expect mistakes to be fixed overnight. First, the Fair Credit Reporting Act requires the credit bureaus to investigate information you dispute and correct inaccuracies. The credit reporting agencies want to follow the FCRA so they dont face potential consequences of non compliance, like lawsuits or fines.

Next, the credit bureaus are also motivated to correct credit reporting errors, like unauthorized hard inquiries, because having accurate information makes for a better product. The credit bureaus sell credit reports to lenders. The more accurate the reports, the more valuable they are to the people who buy them.

Do you have unauthorized inquiries on your credit report? You may be able to get a credit bureau to remove them by following these steps.

You May Like: How Long Do Defaulted Student Loans Stay On Credit Report

What Can I Expect As A Result Of My Credit Report Dispute

Equifax and TransUnion have a similar dispute process. After you submit your required forms, Equifax and TransUnion will review all the information you give them and even contact the creditor to confirm whether or not they did a hard pull on your file. If necessary, they may contact you for additional information. If there is an error, the credit bureau will update your credit file. If the creditor states that the hard inquiry was legitimate, the credit bureau will not remove it from your report.

Once the investigation is completed, both bureaus will send you a letter or email outlining the results of their investigation. Equifax states that it can take from 5 to 20 business days to process a dispute. TransUnion estimates that investigations take up to 30 days.

Viewing Soft Inquiries On Your Credit Report

You can view soft inquiries on your credit reports. However, not all soft inquiries make it to all credit reporting agencies. For example, while you might see a particular soft inquiry in your credit report from Experian, it might be missing from your Equifax and TransUnion reports. Besides, soft credit inquiries dont show up when lenders check your credit reports through hard pulls they only appear on credit reports you personally request.

Don’t Miss: What Can A 800 Credit Score Get You

Should You Remove Hard Inquiries

The idea of removing hard inquiries from your credit report to improve your credit score may sound appealing. But disputing a genuine hard inquiry on your credit report will likely not result in any change to your scores.

You can, however, dispute ones that are a result of fraud. This can happen when an identity thief uses your Social Security number and other personally identifiable information to open a new account in your name.

For most people, that one extra hard inquiry may drop your credit score by just a few points temporarily, but new lenders likely aren’t going to decline your application for credit just because you have hard inquiries on your credit report. While hard inquiries take two years to fall off your credit report, typically their impact to credit scores lasts just a few months.

However, if you already have several hard inquiries on your credit report from the past couple of years or you have other, more serious, issues that are hurting your credit, one new inquiry could make it more difficult to get approved for a loan or credit card with favorable terms.

How To Find And Evaluate Inquiries

You’re entitled to free credit reports direct from the three major credit bureaus at least once every 12 months. Request them by using AnnualCreditReport.com.

Look over the section labeled inquiries. Youre concerned with hard inquiries, the kind that happen when you apply for credit. Those can cause a small, temporary drop in your score. Soft inquiries, such as when you check your own credit or a marketer screens you for a pre-approved offer, dont affect your score.

Each credit bureau or website presents information in its own way, but all will label any inquiries that might affect your score. If you dont recognize something, its worth investigating. Reasons you might not recognize the entry range from benign to worrisome:

-

A store credit card you applied for may be issued through a financial institution with a different name.

-

Your car loan application may have gone to multiple lenders .

-

Debt collectors are allowed to check credit under the Fair Credit Reporting Act, although most often these are soft inquiries.

-

You may have fallen victim to identity theft and someone is opening fraudulent accounts in your name.

Read Also: How To Add Utility Bills To Your Credit Report

Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports. But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit MyFICO for obtaining your reports and your credit score. Its tempting to not look at your credit too often, but trust me, knowledge is power! Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

Read Also: Does Checking Credit Score Hurt Credit

Search For Unauthorized Hard Inquiries

Once you have copies of your credit reports, review them for mistakes, errors, and fraud. Search for credit accounts you dont recognize, incorrect credit reporting on valid accounts , and other mistakes. Finally, check your credit reports for unauthorized inquiries.

If you discover inquiries you dont recognize on your credit report, it could be a sign of identity theft. Make a list of any suspicious inquiries you find. Youll need this information to complete the next step.

Next Stepscheck Your Credit Score & Report Regularly

Its a good idea to check your credit score at least once per quarter and your credit report once per year to check for errors. Free credit report websites can be a handy source to notify you about any new inquiries on your report. Signing up with one of these sites can help you receive any new updates about your credit reports in real-time.

Read Also: What Is The Minimum Credit Score For A Va Loan

How Do Credit Inquiries Impact My Credit Score

They all check your credit, and by signing the application, you authorize them to do so. Credit scorers understand this is simply a consumer out shopping for the best rate they can get.

They allow for this activity and dont deduct points for each individual hard inquiry when this occurs. Instead, as long as the credit inquiries are all made within a 45-day window, they group them together and count them as one inquiry.

But if you take too long and shop around, the resulting credit inquiries can affect your score negatively.

How To Dispute A Credit Inquiry

Its important to check your credit report once or twice a year to make sure no errors or false inquiries have been listed. Heres how to get started:

Review your credit report.

Start by getting a free copy of both of your credit reports from the credit bureaus and go through all the credit inquiries listed. Count the total number of inquiries and reference them against the inquiries you know youve made like any recent loan or credit card applications. Flag any unfamiliar inquiries that you dont recall approving. Remember that youll want to go through both your Equifax and TransUnion credit reports to check for errors.

Follow up on suspicious inquiries.

If youve identified an inquiry you dont remember approving, contact the lender associated with the inquiry. Find out what the inquiry was made for to figure out whether you approved it or not.

Wait for an outcome.

The credit bureau you filed a request with will then review the details before providing you with an outcome. If youre unsuccessful, the listing will remain. If your request was successful, itll be removed.

You can unknowingly give approval for an inquiry simply by checking a box on a form. For example, if you consent to receiving credit limit increase offers on your credit card and then accept an offer, it could lead to a new inquiry on your credit report. This is why its important to always read the fine print.

Recommended Reading: How Long Do Hard Inquiries Stay On Credit Report

How To Get Rid Of Hard Inquiries

There are three primary ways to get rid of hard inquiries: 1. mail a dispute to the creditor and credit Bureaus, 2. fax a dispute to the creditor and credit Bureaus, 3. call the creditor’s credit department and speak with an agent.

You must have one of four valid reasons to get rid of the hard inquiries on your report: 1) the inquiry was not approved by you, 2) you felt pressured into approving the pull, 3) the number of inquiries was more than expected, 4) the credit pull happened without your knowledge.