Types Of Derogatory Marks On Credit

Here are the different types of factors that can appear as derogatory marks on your credit report, in order from the least to most severe:

Missed /Late Payments: A late payment can be reported when itâs overdue by more than 30 days. It will experience worse consequences after every 30 days.

Student Loan: Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Debts sent to collections: Once an account is overdue by a certain number of days, it might be sold to a collection agency, which can put a derogatory mark on your credit.

Repossessions: If you donât or cannot pay for an item, such as a car, as agreed, the lender can come and get it, often without warning.

Foreclosures: If you fail to make payments on your home and the bank seizes it, the foreclosure will be reported to the credit bureaus and the mark will stay on your credit reports.

Bankruptcies: If you declared bankruptcy in the past seven to 10 years, this event will be listed on your credit reports. It is the most severe form of derogatory marks on credit.

How Long Can Derogatory Credit Items Stay On Your Credit Report

In general, derogatory marks can be reported for up to seven years after the account was first reported as late, which is referred to as the date of first delinquency .

Dispute derogatory items on your credit report that are inaccurate via mail.

If you get a court judgment against you, however, that will remain on your credit report for seven years after the judgment was issued, not seven years from the date you were first late on the original debt.

Certain types of accounts can stay on your credit report even longer. Depending on the type of bankruptcy, for example, bankruptcy may stay on your credit report for up to 10 years.

According to Experian, since a Chapter 13 bankruptcy requires you to pay some of the debts you owe, this type of bankruptcy is removed from your credit report after seven years. With a Chapter 7 bankruptcy, you dont pay back any of the debt, so it is removed 19 years after the date of filing instead of seven years. The individual accounts associated with the bankruptcy will still disappear seven years after the DOFD for each account filing for bankruptcy does not affect the seven-year timeline.

Besides a Chapter 7 bankruptcy, all other delinquencies are required by law to be deleted from your credit report after seven years. However, the impact of a derogatory mark on your credit score will decrease over time, especially if you maintain a positive credit history going forward that can help outweigh the negative items.

How Do You Get A Derogatory Mark On Your Credit Report

In many cases, youll know exactly why you have a derogatory mark on your credit report. If you begin bankruptcy proceedings, for example, that will be reported to the three major credit bureaus, and youll see derogatory marks on each of your three credit reports.

In some cases, you may not know why theres a derogatory mark on your credit report. If your credit report shows that you missed a payment but you remember making all of your payments on time, for example, you may need to contact your credit card issuer or dispute the derogatory mark with the credit bureaus.

Recommended Reading: How To Get Missed Payments Off Credit Report

Also Check: Is 816 A Good Credit Score

Items That Can Cause Derogatory Credit

What is considered derogatory credit? Delinquent credit accounts that are 60 to 90 days past due are considered derogatory credit. Lenders view these delinquent or unpaid accounts as signs that you may not be able to pay them back.

If youâre looking to reverse bad credit or avoid a derogatory mark, itâs helpful to know the types of derogatory marks that can occur on your credit report.

Does Paying The Past

Unfortunately, simply bringing the account current by paying the past-due balance does not make the derogatory mark disappear. It does not negate the fact that you were late paying your bill, which is important information that helps determine your credit score and helps lenders decide whether they want to do business with you.

Payment history is the most important part of both your FICO score and your VantageScore for a reason. It is highly predictive of how much of a credit risk you represent to lenders. For that reason, accurate derogatory information must stay on your credit report even after you have caught up on payments.

However, can still be beneficial to pay off the derogatory items on your credit report. Experian says, While paying off a derogatory account wont automatically remove it from your credit history, it will be updated to show it has been paid, and lenders may view a paid derogatory more favorably than an unpaid one.

Don’t Miss: Is 621 A Good Credit Score

Should I Try To Get Rid Of Closed Accounts On My Credit Report

Donât try to remove a paid-off mortgage, car loan, credit card or other accounts from your credit report if they show a positive payment record. That good record will continue to help your credit scores.

If you have negative marks on the account, however, you want it off as soon as possible. You can use AnnualCreditReport.com to get free reports from the bureaus every 12 months to verify negative information has been removed as required by law. If a negative mark is lingering, you can file a dispute.

Many credit scoring models now exclude paid-up collections accounts. But because some lenders still use older scoring models, you may want to try removing collections from your reports.

Here Is How Long Derogatory Items Stay On Your Credit Report:

Bankruptcy

A bankruptcy is a public record that lists the date filed and date discharged. Accounts included on your credit report will show as BK accounts.

How long does a bankruptcy stay on your credit report?

10 years from the date field for Chapter 7 bankruptcy, Chapter 11 bankruptcy or Chapter 12 bankruptcy. 7 years for Chapter 13 bankruptcy and 7 years for BK accounts.

Tax Lien

A tax lien is a public record relating to your state or federal taxes. Tax liens can stay on your credit report longer than any other type of derogatory item.

How long a tax lien reports on your credit report: 7 years from the date paid. There is no maximum time for unpaid tax liens.

Judgment

A judgment is a public record relating to a decision made by the courts that was filed or awarded.

How long a judgment reports on your credit report: 7 years from the date filed.

Foreclosure / Repossession

A repossession is when a creditor takes back property you used to secure a loan. Foreclosures apply only to real estate.

How long a foreclosure or repossession reports on your credit report: 7 years

Charge-offs

After a debt has been unpaid for 180 days, by law it must be charged off by the creditor. They may report a balance or a $0 balance .

How long charge-offs report on your credit report: 7 years from initial missed payment to the original creditor leading to charge-off.

Collections

Late Pays

You are reported as late for being greater than 30 days late on a payment.

Inquiries

Closed Accounts

You May Like: How Often Does Experian Update Your Credit Score

Strategy : Pay Off Small Balances On Credit Cards

Did you know that a credit card that has a balance can negatively impact your credit score? Itâs true.

Thatâs why if you have small balances on the card, pay them off instead of letting the balances sit there. Also, if you forget about a balance, it could accrue interest that youâll be on the hook for. This strategy will help prevent that as well.

You May Like: Is Paypal Credit Reported To The Credit Bureaus

Negotiate And Pay For Deletion

When the lender has to repo the vehicle, theyâve lost money. If you can pay off your debt, it is often cheaper for them compared to selling your debt to a collection agency. In some cases you may be able to pay less than the monthly payments you owe. Taking this step can be a win for both parties. It may not affect your credit score and may also be a cheaper process for the lender. If you do get them to negotiate, make sure to follow their terms and get everything in writing.

Also Check: Does Acima Report To Credit

Browser And Assistive Technology Compatibility

We aim to support the widest array of browsers and assistive technologies as possible, so our users can choose the best fitting tools for them, with as few limitations as possible. Therefore, we have worked very hard to be able to support all major systems that comprise over 95% of the user market share including Google Chrome, Mozilla Firefox, Apple Safari, Opera and Microsoft Edge, JAWS and NVDA , both for Windows and for MAC users.

Derogatory Accounts Dont Have To Hurt Your Credit Scoreif You Know The Tricks Around Them

Weve all been there. You miss one payment and your creditscore plunges. How does that bad mark on your credit report affect your score?How do derogatory accounts destroy your credit?

More importantlyhow can you fight these credit killers andcome out on top?

Lets start with a quick definition of derogatory accountsand how they hurt your credit score. Ill then show you why not all bad markson your credit are created equal and what to do about them.

Also Check: Is 653 A Good Credit Score

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Review Your Credit Reports

Your credit reports may show closed and open derogatory marks. Closed derogatory marks refer to negative items about closed accounts, such as those in collections, including accounts that have been charged off. An open derogatory mark refers to negative information about an open account, such as your current credit cards or loans.

Make sure all of the information on the reports is accurate, including your personal information, open and closed accounts, and negative information. Check for delinquent payments under all your accounts, and then look for public records and accounts in collections.

You May Like: How To Remove Disputes From Credit Report

How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after theyâve been closed because itâs important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, it’ll remove the risk that youll be sued over the debt.

Read Also: How To Get Annual Free Credit Report

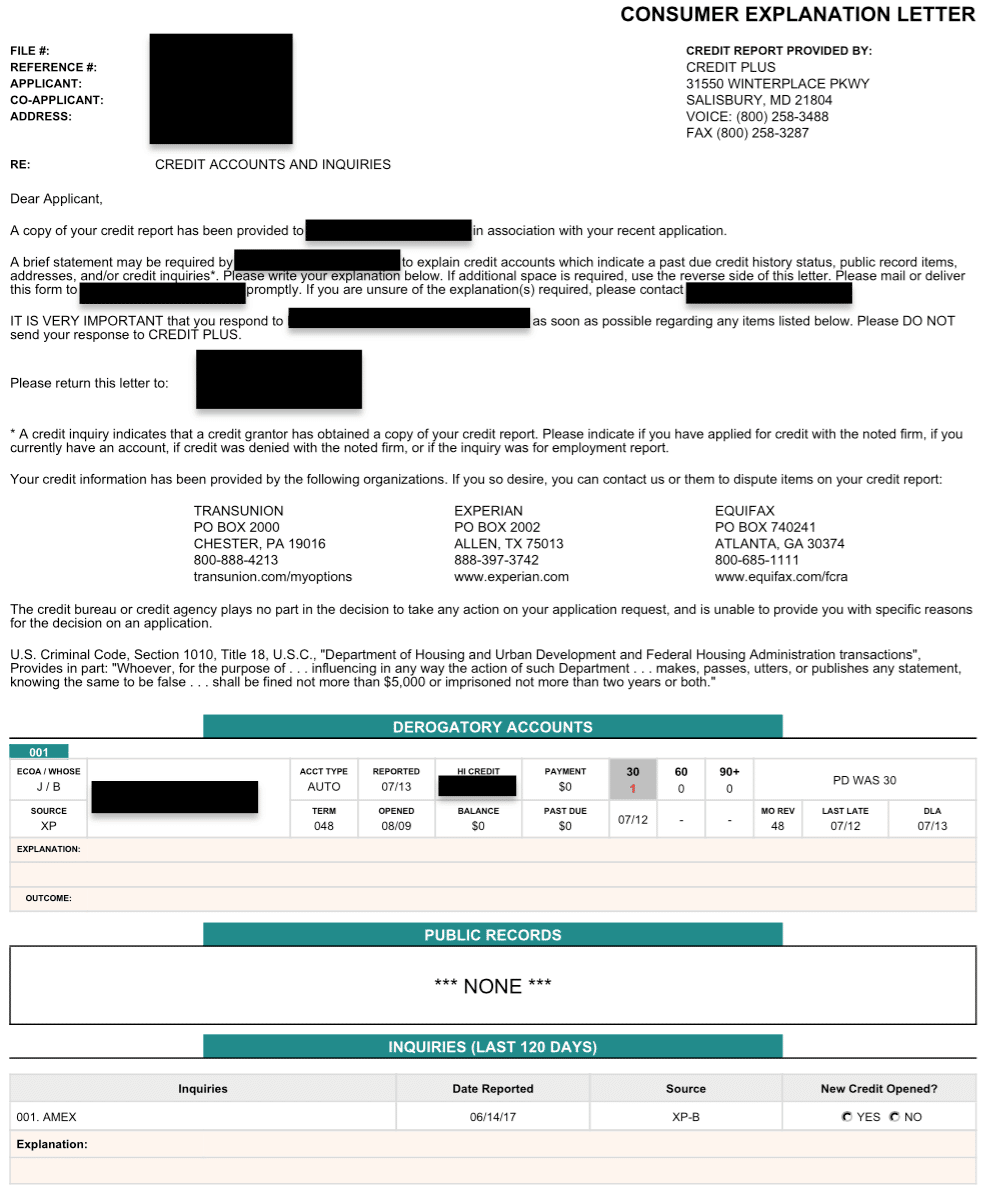

Request And Review Your Credit Report

TransUnion, Equifax and Experian provide one free credit report each year. Request your credit report and review it closely for errors.

Look through both closed and open derogatory marks. Check to see if your personal information is correct and if the creditor reported payments and dates appropriately. Take note of any discrepancies.

The Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

Don’t Miss: Does Creditwise Affect Your Credit Score

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

Time Limits For Different Derogatory Items On Credit Reports

The Fair Credit Reporting Act is the federal law regulating credit reports. The FCRA has several time limits for how long a derogatory mark can remain on your credit report. Collection accounts are accounts placed with the original creditor’s collection department, assigned to a collection agency, or sold to a debt buyer. The creditors are credit card companies, student loan companies, mortgage companies, and other personal lenders.

Missed payments, late payments, repossessions, and foreclosures can remain on your credit report for seven years. Hard inquiries can stay on your report for two years. By law, bankruptcies, whether under Chapter 7 bankruptcy or Chapter 13 can remain on your credit history for 10 years from the filing date. But, all three of the major credit bureausâ Equifax, Experian, and TransUnionâonly report Chapter 13 bankruptcies for seven years. The credit bureaus can change this exception for Chapter 13 bankruptcies at their whim, but you can take comfort that they have followed this rule for the past several years.

What happens if the debt remains with one debt buyer for three years and then it’s sold to a second debt buyer? The second debt buyer can only report the collection account for four more years. The time doesn’t start over just because there’s a new debt collector. It doesn’t matter if it’s assigned to a new collection agency, the seven years donât start over and there are no new 180 days.

Time Limits for Liens and Judgments

You May Like: How To Check Credit Report For Free

Removing Derogatory Credit Items From Your Credit Report

If you have inaccurate negative items on your credit report, its in your best interest to dispute the derogatory items on your credit report as soon as possible.

Your credit reports should have instructions on how to dispute derogatory credit items that have been put on your credit report in error. The best way to dispute inaccurate negative information is to send a separate letter for each dispute via certified mail, along with any accompanying evidence that is needed to verify the validity of your claim.

Make sure to dispute the derogatory items on your credit report with the as well as with the creditor that is furnishing the data.

You can read more about how to dispute inaccurate derogatory items in our article, How to Fix the Most Common Credit Report Errors.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender finds that the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request, which can help the bureau evaluate any information it might have missed the first time around.

Don’t Miss: Which Credit Score Do Apartments Use