What Credit Score Do Mortgage Lenders Use

October 25, 2021 by Barron Rothenbuescher

As you get ready to delve into the mortgage and homeownership process, you have likely come up with a number of questions about what impacts your ability to secure favorable terms for your mortgage or to be approved for a mortgage at all. One of the main areas a mortgage lender will consider when determining whether you qualify for a mortgage is your credit score.

However, the credit score that you view for yourself and the score that they analyze to determine your lending worthiness are not always the same. In order to present the best case for favorable terms on your loan, it is important to understand which credit scores mortgage lenders will examine during the approval process.

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

Intuitive Finance The Smart Choice

You can now see, theres more to being approved for a personal loan or a home loan than just filling out some paperwork and blindly hoping for the best.

Your ability to consistently manage credit and repay debt is but one of the ways that can influence how your credit score is calculated.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 weve focused on providing outstanding service and business standards.

This approach was vindicated when we received the Finance Broker Business Award at the 2018 Mortgage and Finance Association of Australia Excellence Awards.

Understanding what constitutes a good credit score as well as the ways that you can improve your score is vitally important in todays financial world. So why not contact Intuitive Finance today to ensure you have the right information and expert support on your side no matter what stage of the property ownership journey you are on?

Discuss your specific needs & formulate the right strategy for you. Get in touch to organise your complimentary 60min session today!

Also Check: What Credit Score Do You Start Out With

How Does Credit Score Determine Loan Type

Conventional loans require that you have a higher credit score, while Federal Housing Administration loans are a bit more forgiving when it comes to your score.

With an excellent credit score, you can expect to pay less for your loan because your interest rate will be lower.

Not only will a poor score affect your ability to get a loan, but if you do qualify for one, you could be paying thousands of dollars extra over the life of your loan due to a higher interest rate.

Want To Make Sure You Have The Ideal Credit Score To Buy A House Learn What Credit Score Youll Need And Which Loans Are Best For Certain Credit Ranges

Looking to buy a home? Heres what you need to know about your credit score.

Lenders use your three-digit credit score as a way to predict how likely a borrower is to repay a loan on time. Higher scores signal a great likelihood of repaying a loan lower scores a lower likelihood. Lenders tend to give the best rates to someone with a higher score, though other factors typically play into who gets the best rates.

What is your credit score made up of?

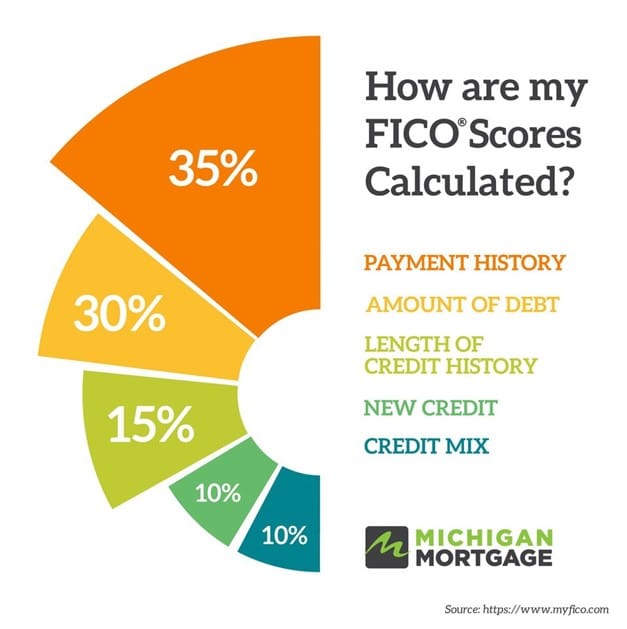

A credit score is composed of a number of factors, though there can be small variances among the percentages that making up a credit score, according to FICO. The factors making up a credit score include ones payment history, unpaid debt, the number of outstanding loans, how long loan accounts have been open, how much available credit is being used and whether bankruptcy has ever been declared.

| Amount owed | 30% |

Need help making sense of this chart? Heres what each term means: The credit mix includes all the types of credit cards, retail accounts, loans and mortgages one has while new credit indicates the opening of accounts . Meanwhile, length of credit history includes how long your accounts have been established and how long its been since youve used certain accounts. Amounts owed reveals how much outstanding debt you have and payment history shows whether youve paid past accounts on time.

What is a good credit score to get a home loan?

What are the various credit score levels?

| Poor credit |

*Source: Experian

Don’t Miss: Does Aarons Report To Credit

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

Keep An Eye On Your Credit Score

You can keep tabs on your credit report by visiting AnnualCreditReport.com to get a free copy of your credit report from each credit reporting agency once every 12 months . In addition to monitoring your credit report, make it a habit to check your credit score before applying for any credit or at least once a year.

Your credit score can affect your ability to get loans and credit cards, the interest rates youll pay, and the credit limits youll enjoy. A good credit score can even make it easier to get car insurance, a job, or an apartment. Keep your credit score healthy, and youll make your life much easier.

Also Check: What Is A Good Transunion Credit Score

Get A Credit Strong Credit Builder Loan

One of the best ways to build payment history is to get a Credit Strong credit builder account. Credit Strong is part of an FDIC insured bank and offers credit builder loans. Credit builder loans are special types of loan accounts that build credit easily.

When you apply for a loan from Credit Strong, you can select the term of the loan and the amount of the monthly payment. Credit Strong does not immediately release the funds to you. Instead, the company places the money in a savings account for you.

As you make your monthly payments, it improves your credit by building your payment history. Credit Strong will report your payments to each credit bureau.

When you finish paying off the loan, Credit Strong will give you access to the savings account it established for you, making the program a sort of forced savings plan that also helps you build credit.

Ultimately, with interest and fees, youll pay a bit more for the loan than youll get back at the end, but this can still be a solid option for a borrower who wants to improve their credit while building savings.

Unlike some other credit builder loan providers, Credit Strong is highly flexible, letting you choose from a variety of payment plans. You can also cancel your plan at any time so you wont damage your credit by missing payments if you fall on hard times.

See the credit builder loan pricing and plans here.

$10000 Personal Loans: How To Qualify For $10k Fast

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

If you need to cover a personal expense, a personal loan could be a good option. Heres what you should know before getting a $10,000 personal loan.

Whether you need to consolidate credit card debt, remodel your bathroom, or cover another large expense, a personal loan might be a good choice. If you decide to take out a loan such as a $10,000 personal loan be sure to carefully consider your lender options to find a loan that best suits your needs.

Heres what you should know before getting a $10,000 personal loan.

Don’t Miss: What Can A Landlord See On My Credit Report

Transunion Creditvision New Account Score 20

The credit bureau TransUnion also offers its own score, the New Account Score 2.0, which has a range of 400 to 925. This score helps financial institutions managing their existing accounts determine their levels of risk. Again, it is not a score that lenders will use to determine who qualifies for a loan or a new credit.

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively build your credit score or maintain it to give yourself the best chance of qualifying for a mortgage.

One of the most common scores used by mortgage lenders to determine creditworthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

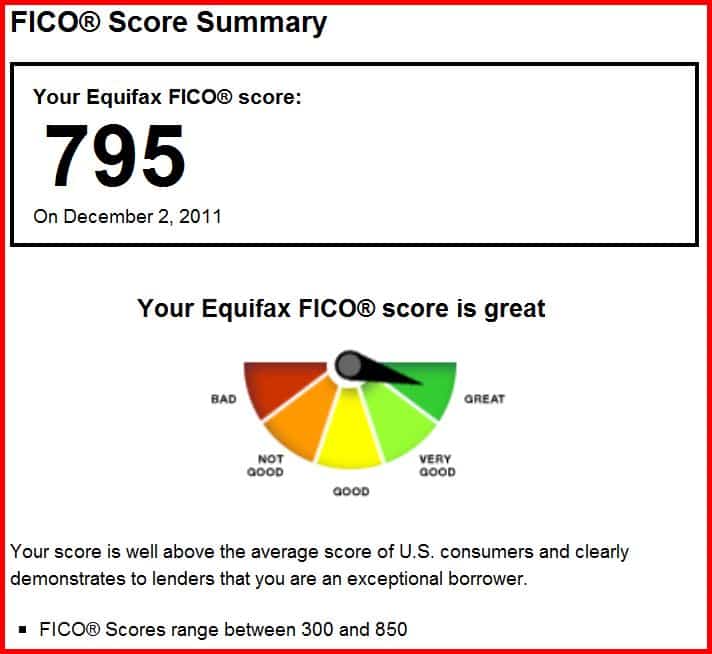

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your , such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

- Types of credit

The higher your score, the easier itll be to qualify for a lower interest rate on a great mortgage.

Recommended Reading: How To Raise My Credit Score Fast

Which Credit Score Do Lenders Actually Use

Consumer Financial Protection Bureau Director Richard Cordray speaks during a a hearing in Denver… where he discussed his agency’s proposal on arbitration, in Denver, Colo., on Oct. 7, 2015.

There was some big news in the world of credit scores this week. The Consumer Financial Protection Bureau ordered TransUnion and Equifax to pay more than $23 million in fines and restitutions “for deceiving consumers about the usefulness and actual cost of credit scores they sold to consumers.” I’ve used these and the other credit scoring services described below extensively, and these services are advertisers on my personal finance blog, so I was particularly interested in the CFPB’s orders.

The orders explained that the credit score models most often used by lenders are those developed by Fair Isaac Corporation. You may know these scores by their common name, FICO scores. In contrast, the scores offered by TransUnion and Equifax used proprietary scoring models, sometimes referred to as “educational credit scores.” The name comes from the idea that these scores help educate consumers about their credit scores generally.

The problem, according to the CFPB, was that TransUnion and Equifax misled consumers by suggesting that the educational credit scores they offered were the same scores lenders used to make credit decisions. According to the CFPB, however, these scores were “rarely used by lenders to make credit decisions.”

Many Credit Scores

- Equifax Beacon 5.0

Why Do You Need A Good Credit Score

A better score could mean better offers. That might look like lower interest rates on a loan or a higher credit limit on a .

Lenders want to know you can pay back the money you borrow, whether thatâs on a credit card, loan, car finance or mortgage. If you have a good credit score, and your report shows you have a history of making payments on time and in full, lenders may decide itâs less risky to lend to you.

Don’t Miss: What’s The Highest Credit Score You Can Get

What Credit Score Is Needed To Buy A House

For most loan types, the credit score needed to buy a house is at least 620. However, a higher score significantly improves your chances of approval. Borrowers with scores under 650 tend to make up just a small fraction of closed purchase loans.

Applicants with scores of 740 or higher generally get the lowest interest rates.

If your credit score is on the low side, it may make sense to work on building it up before buying. Due to current economic uncertainty, many lenders have raised minimum credit score requirements on loans, even those that allowed for lower scores in the past.

Lenders Look At More Than Just Your Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you’re in the market for a loan, your credit score is one of the biggest factors that lenders consider, but it’s just the start.

Lenders like to see an applicant’s full financial profile when deciding whether to approve a loan and when setting the interest rate. So when you fill out a loan application, be prepared to share more than just your credit score.

You May Like: How Long Is A Credit Report Good For Mortgage

Trailer Financing Bad Credit

Category: Credit 1. Trailer Financing | Bad Credit | Capital Solutions Looking for trailer financing for your trucking business? Have bad credit? Call Capital Solutions today so we can help you grow your business. Here are six lenders who can help, regardless of your credit history: Capital Solutions, RockSolid Funding,

Why Do Mortgage Lenders Look At Credit Scores

In the 1980s, the top three credit reporting agencies were struggling to accurately interpret and compare credit reports.

These agencies, known today as Equifax, Experian, and TransUnion, started working with a tech company called Fair, Issac, and Company . The result of this partnership was the FICO Score, which today is used by 90% of lenders.

Credit scores are based on your , which are calculated from the following factors:

- Payment history

- Length of credit history

- Types of credit

The FICO score range helps mortgage lenders determine what type of borrower you are, based on the financial picture provided by your personal score.

For example, an excellent score is considered 800-850, while a poor score is 300-579.

Those top three credit reporting agencies also created VantageScore in 2006, which paints a slightly different credit picture that focuses more on your credit use, available credit, and credit experience.

Each of the reporting agencies generate their own FICO Score and VantageScore for consumers, based on their individual algorithms.

Don’t Miss: How To Read Your Equifax Credit Report

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

How Does The Fico Auto Score Work

According to Experian, auto lenders can use your base FICO Score to decide if you are a worthy borrower. But they will look at your FICO Auto Score. The latter takes your base FICO score and modifies it to estimate your odds of punctually repaying a vehicle loan. Auto lenders employ an industry-specific score that weighs auto loans heavily.

If youve had one or more auto loans in the past, your credit history with these loans will help determine your FICO Auto Score.

A FICO Auto Score is an algorithm designed to determine how likely you are to pay back an auto loan specifically. This means your base FICO score which you see on your personal credit report may differ from your FICO Auto Score, says bankruptcy and credit law attorney Eric Klein. There are currently nine different versions of the FICO Auto Score, each calculated slightly differently. You should find out which FICO Auto Score edition a particular lender or finance company will use and what is factored into that particular score.

For instance, a FICO Auto Score 9 XT closely considers if your credit card balances have been decreasing or increasing, if youve been making more than merely the minimum payments on revolving accounts, and if your credit utilization ratio has been going up or down, Klein notes. This FICOs Auto Score edition can minimize the damage of certain adverse credit report listings.

Read Also: Why Does Your Credit Score Go Down