How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Will My Score Be The Same At All Three Credit Bureaus

The three major credit bureausTransUnion®, Experian and Equifaxare responsible for collecting and maintaining consumer credit reports in the U.S. These reports are then provided to subscribers, such as landlords, mortgage lenders, credit card companies and others who are deciding whether or not to extend you credit.

It can be confusing when your score seems high but you still get denied for a new line of credit. Chances are you’re not looking at the same score as your bank or finance company. Subscribers dont work with every credit reporting agency, so the credit report information included in one report might be slightly different from that in another.

Check your credit scores and reports from each bureau annually to ensure all the information is accurate. By law, you’re entitled to one free annual credit report. You should also use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, like Credit Lock and Instant Alerts. These services will help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

I Have An Excellent Credit Score But Was Refused Credit Why

A good credit score does not guarantee a successful credit application, so even people with maximum credit scores and high levels of wealth can still be denied a loan, mortgage or credit card.

Common reasons to be refused credit with a good credit score include:

- Financial associations: According to Check My File, financial associations dont affect your credit score at all but they can influence applications. If the financial associate has a very poor credit history, your application may be damaged.

- Employment status: If you are out of work, the likelihood of you making every repayment is lower as you have less money coming in.

- Inconsistent information: If you claim to be earning £20,000 per year on one application and then £200,000 per year on another, the legitimacy of your information may be questioned, and dishonesty can lead to a rejected application.

- Negative markers: Minor negative markets like single missed payments may not have a significant impact on your credit score, but they could affect your credit application.

There are many things that can lead to a rejected credit application, so its worth getting a multi-agency credit report in order to cover all bases before applying for a loan, mortgage or any other type of credit.

We recommend doing so before applying because, generally speaking, a failed credit application can make it even more difficult to get credit in the future.

You May Like: How Often Does Capital One Report To The Credit Bureaus

Does Getting A 650 Score Mean That Irstly Credit Score Get You

You are a credit risk on any scale if you have a score of 650 or above. The financial products you can often qualify for typically include a mortgage or car loan, but youll probably end up paying more for these loans than someone with a better credit history. There is a reasonable credit range of 690 to 1 000 dollars.

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Don’t Miss: Auto Buying Program Navy Federal

What Does A Transunion Credit Score Look Like

Each credit reference agency has its own scoring system. TransUnion scores range from 0 to 710: the higher your score, the better your chances of obtaining credit.

- TransUnion: 0-710

- Equifax: 0-1,000

- Experian: 0-999

Depending on your score, youll be rated as having excellent, good, fair, poor or very poor credit:

| TransUnion credit score | |

|---|---|

| Excellent | Youre very likely to be approved for competitive credit offers. |

If you want to find out your credit score, you can do so for free from all of the credit reference agencies. If you want to access your credit report and find out the reasons behind negative marks to your score, youll usually have to pay, although some agencies offer a free one-month trial subscription.

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Recommended Reading: How To Check Your Credit Score With Itin

What Is A Credit Score

A credit score is an objective summary of the information contained in your credit report at a particular point in time. If you have any credit accounts, such as credit cards, mortgage or loans, you likely have a credit report. Your credit report is a record of how you manage your credit obligations. This data is then distilled and calculated to create your credit score. Your credit score is a number that lenders may use to help them decide whether or not to extend you credit. It represents the risk related to whether or not they can expect you to repay, according to the agreement you sign with them. Credit scores can give lenders a quick, objective and impartial snapshot of a credit file and are helpful in making approval decisions

Checking it won’t lower it.

While the overall purpose of credit scores is universal, each lender will use his or her own criteria to measure an individuals credit worthiness

When Is Your Credit Score Important

Like it or not, your dictates a lot nowadays. It is a deciding factor in whether or not you qualify for a student loan, a car loan, or a mortgage. If you are at a life stage where you are working towards owning your own home, car, or furthering your education, a good credit score can help you get approved for that mortgage, car loan, or student loan. A lender will see that they have a high chance of their money being paid back.

Don’t Miss: Tri Merge Credit

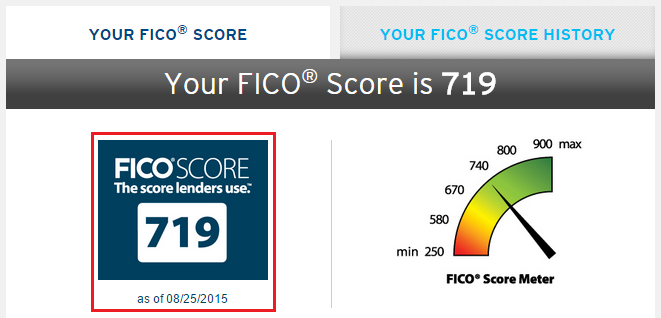

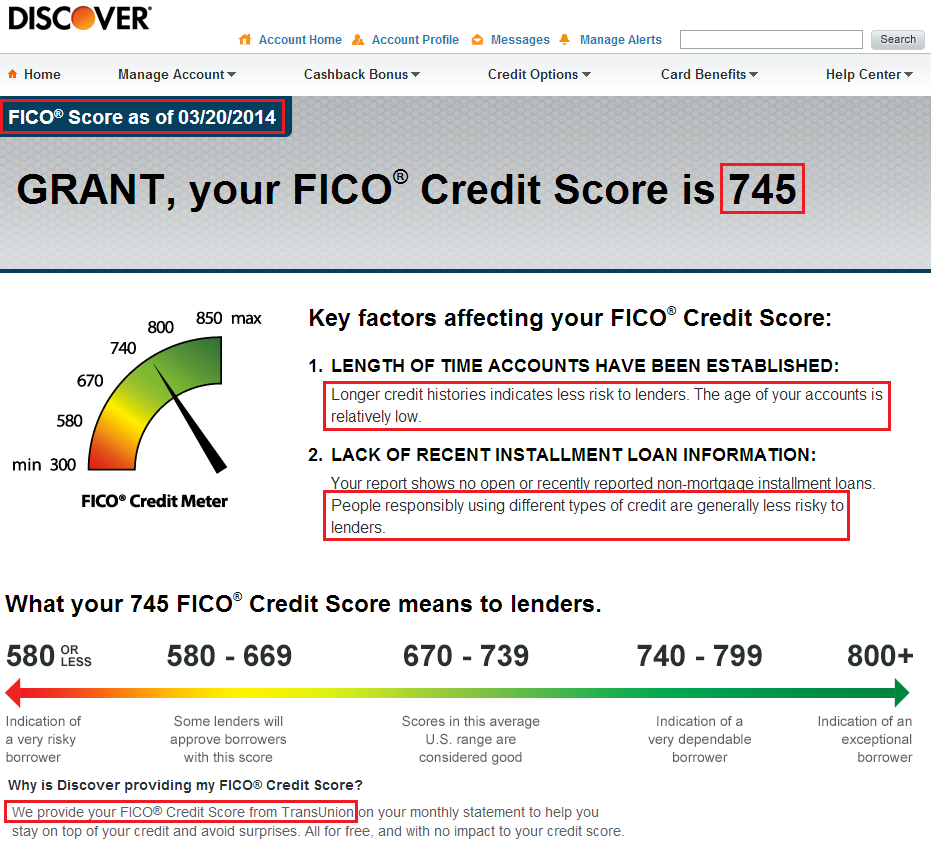

Fico Is The Most Widely

Since there are so many free credit score options out there, you should know that FICO is the most widely used credit score among lenders. In fact, 90% of lenders check FICO Scores rather than any other types of credit scores. So if youre looking to take out a loan anytime soon, we recommend checking your FICO Score.

FICO actually has multiple scoring models, such as FICO Auto Score and FICO Bankcard Score, used in different lending industries. The most popular score across industries is the FICO Score 8, while the FICO Score 9 is the most recently released FICO scoring model.

You can purchase your FICO credit score and report from each credit bureau individually for $19.95 or all three credit bureaus scores and reports for $59.85. Purchasing your credit score through FICO will include your FICO Score 8, as well as other important industry-specific scores.

Open A Secured Credit Card

Standard loans and credit cards can help you prove your creditworthiness, but if you dont have a score yet or your score is too low to qualify, youll need a specialized product.

A secured credit card is a low-limit card that requires a deposit up front, usually one or two times your credit limit. Companies are willing to give these to just about anyone, because if you dont pay back what you borrow, the card issuer will just take your deposit.

As long as you use your card regularly and pay off your balance on time and in full each month, your payment history will improve and so will your credit score.

After six months you can ask for a higher credit limit, which will bring down your credit utilization ratio.

Recommended Reading: When Does Capital One Report To Credit Bureaus 2020

What Is A Transunion Score

TransUnion uses everything it knows about you in your credit file and boils it down to a number. If you have a good score, you can usually be approved for a loan, credit card or mortgage and receive decent interest rates.

Its important to know that although all lenders use your credit score when going through the approval process, they also have their own qualifying criteria as well.

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Also Check: Dla On Credit Report

Average Age By Credit Score Tier

| West | 687 |

The South has the worst credit, on average , whereas the Midwest has the best . In fact, three of the five states with the highest average credit scores are in the Midwest. With that being said, every region has at least one state whose residents boast good credit, on average.

So, while job opportunities, living costs and other local factors definitely affect credit-score averages, its also true that credit scores can flourish anywhere.

Other Derogatory Factors Which Negatively Affect Your Credit Rating And The Credit Bureaus Dont Like To Mention To You Are:

1. ErrorsOne of the major causes of point loss to your credit rating are bureau reporting errors. Errors can be delinquent accounts reporting on your file that do not belong to you, late payments that were not late, and credit that is created from identity fraud therefore not your credit. The Credit Bureaus are paid by the creditors who pull credit bureau files and in turn who report to them. Credit reporting is done electronically, and Credit Bureaus accept the information they are sent without any investigation into the accuracy of the information. Therefore, is it critical that you pull your credit bureau file at least once every year. Only you will know when there is an error on your file, and it is up to you to have the credit bureaus fix it.

Order your file here: TransUnion and Equifax

Look for these common errors:

- Wrong mailing addresses

- Errors in your credit accounts

- Late payments

- Unauthorized hard inquiries

If there is an error on your file you must contact the Credit Bureau, then it is up to the Bureau to investigate your complaint and to verify the information contained in your file by contacting the reporting creditor. When contacted by the Credit Bureau, the reporting creditor will have to verify the item they have placed on your file. You are entitled to be part of that process.

Don’t Miss: Will Paypal Credit Help My Credit Score

Is A Transunion Credit Score Of 650 Good

scoregood650 credit score650 credit score

. Then, what is a good credit score with TransUnion?

The bureaus each have their own formula for arriving at a for you, and you have a unique score from each one. Your TransUnion credit score ranges from 300 to 850, with the highest number being your goal for the best available. Good credit scores are generally 700 and above.

what kind of loan can I get with a 650 credit score? Home Loan: 600-650 Credit ScoreWith a score below 700, your best bet for finding a home mortgage will likely be with an FHA-insured mortgage backed by the Federal Housing Administration . These loans have low down payment requirements and impose no minimum qualifications.

In respect to this, is 650 considered a good credit score?

A 650 FICO score is generally considered to be Fair. If you have a 650 credit score, you may still be denied some loans and cards and you may be forced to pay higher interest rates for the ones you are approved for. You need at least a 700 score to have Good credit but 650 isn’t considered Poor either.

Is a TransUnion credit score accurate?

TransUnion is Accurate, But May Conflict with Other ScoresThe only way your TransUnion credit score wouldn’t be accurate is if you found errors on your TransUnion credit report, which would in turn affect your . You can check your TransUnion score and report directly from TransUnion for $1.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Don’t Miss: Affirm Credit Score For Approval

Which Should You Check Regularly

Hardeman recommended picking one and sticking with it. It can be surprising to know that there are potentially hundreds of credit scores, she said. However, credit scores are highly correlative. That means if you rated good in one scoring model, you most likely have a good credit rating in all other models. Whether youre building your credit from scratch, working on bouncing back after a hardship, or just in maintenance mode, I recommend tracking one score for changes over time.

Transunion Vs Equifax: Why Your Scores May Differ

The main reason your TransUnion and Equifax scores may look different from one another is that the companies use different algorithms to compute your score.

On the other hand, some credit bureaus may collect information that the others dont. For example, Equifax is known to report longer credit histories for borrowers than TransUnion or Experian. Additionally, TransUnion may report your employment history and personal information to determine your creditworthiness, while Equifax and Experian may only report the name of your employer.

Also Check: Opensky Late Payment

How Many Years Of Credit Do I Need To Have A Good Score

Mortgage lenders will typically look back over the last six years of your credit history. If youre young and only have a couple of years credit to examine, lenders may be more cautious to lend to you. However, theres no set timeframe that will automatically boost your credit score. A 25-year-old in regular, stable employment who uses their credit card sensibly could have a better credit score than a 50-year-old with lots of debts.

The key thing to remember here is that you dont just need years of credit to improve your score those years of credit have to be good credit. Bankruptcy, CCJs, IVAs and other bad marks will stay on your file for six years, so its highly likely youll need to wait for these to be wiped before being accepted for a mortgage.

Understanding Your Credit Score

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process considers a tremendous amount of information, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use several scoring methods. For some credit scores, the amount you owe might have a larger impact on your score than payment history.

View all of your credit reports annually to help ensure the information is accurate. You may also want to use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, to help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

Also Check: Credit Report Serious Delinquency