How Much Can You Borrow With 720 Credit Score

With fixed-rate conventional loans: If you have a credit score of 720 or higher and a down payment of 25% or more, you don’t need any cash reserves and your DTI ratio can be as high as 45% but if your credit score is 620 to 639 and you have a down payment of 5% to 25%, you would need to have at least two months of …

How To Get A Free Credit Score

Most card issuers provide free credit score resources that can help you track your progress toward good credit. And there are dozens of free credit score services available that offer your free FICO Score or VantageScore, regardless if you’re a cardholder. Here are some popular free credit score resources.

For rates and fees of the Discover it® Balance Transfer, click here.

Information about the Capital One QuicksilverOne Cash Rewards Credit Card, and the Capital One Platinum Credit Card has been collected independently by CNBC and has not been reviewed or provided by the issuer of the cards prior to publication.

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

Editorial Note:

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

You May Like: How To Increase Transunion Credit Score

How To Build Your Credit

If you want to build and maintain good credit over time, all you have to do is use the five factors that your credit score is made up of as guiding principles. Through these principles, you learn to make regular payments, keep debts down, maintain a healthy credit utilization ratio and have diverse credit. Some factors, such as your credit history length, are out of your control and just require patience.

Don’t let an inaccurate credit score keep you from your dreams work to repair your credit with Lexington Law instead

Strategies To Build Your Credit In The Long Run

Regardless of whether youre able to remove any negative marks from your credit report , dont neglect long-term methods for building your credit. To achieve a really good score, you also need to take steps to ensure youll have a well-rounded credit file in the years to come.

To build your credit, do the following:

- Make small, regular purchases on your credit cards to add positive payment information to your credit reports. If you dont have any loans , look into getting a , which is a type of easy-to-get loan thats specifically designed for boosting your credit score.

- Manage your credit accounts well and maintain good habits going forward. Dont overspend on your cards and pay off your credit cards in full every month.

- Get out of debt, particularly if you have any harmful, high-interest debts . You can make an exception for long-term debts like a mortgage that youve factored into your monthly budget.

- Add alternative data, such as your regular payments on your utility accounts, to your credit report with Experian Boost. You can also use a third-party service that reports your rental payments, such as PayYourRent or eCredable.

Boost your credit for FREE with the bills you’re already paying

5.0/5

No credit card required. Results may vary, see website for details.

Boost your credit for FREE with the bills you’re already paying

You May Like: What Is A Good Credit Score For 20 Year Old

Is A 720 Credit Score Good

A 720 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Fha Loan With 669 Credit Score

FHA loans only require that you have a 580 credit score, so with a 669 FICO, you can definitely meet the credit score requirements. With a 669 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

Lower Your Credit Utilization Rate

Your credit utilization rate is the percentage of your available credit that youre using. For example, if you have a single credit card with a limit of $1,000 and you owe $500, you have a credit utilization rate of 50%.

Generally speaking, the lower your credit utilization rate, the better for your scores. A good rule of thumb is to keep your credit utilization rate below 30% and even lower than that, if possible. A 50% rate is an example of a high credit utilization rate that could negatively affect your credit.

You can decrease your credit utilization rate by paying off debt . You can also lower your credit utilization rate by increasing the amount of credit available to you. One way to do that is by reaching out to your lender to ask for a higher credit limit or opening a new loan or credit line though you probably wont want to open too many too often, as that could have a negative impact on your credit as well.

Ways To Reduce Your Auto Loan Interest Rate

With a credit score between 670 and 679, you are going to qualify for prime loans. You will have solid offers at attractive rates. If you can get into the super-prime range youll qualify for even better rates and promotions!

The time and money spent would put you in a lower risk bracket and open the doors to much more financial freedom and better opportunities.

Additional Auto Loan Resources

* Annual Percentage Rates , loan term, and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information. All loan information is presented without warranty, and the estimated APR and other terms are not binding in any way. Lenders provide loans with a range of APRs depending on borrowers credit and other factors. Keep in mind that only borrowers with excellent credit will qualify for the lowest rate available. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. All loans are subject to credit review and approval. When evaluating offers, please review the lenders Terms and Conditions for additional details.

Recommended Reading: How To Increase Credit Score With Credit Card

How Much Of A Home Loan Can I Get With A 720 Credit Score

With fixed-rate conventional loans: If you have a credit score of 720 or higher and a down payment of 25% or more, you don’t need any cash reserves and your DTI ratio can be as high as 45% but if your credit score is 620 to 639 and you have a down payment of 5% to 25%, you would need to have at least two months of …

What Can I Do With A 669 Credit Score

Luckily, when you have a 669 credit score, your hands arent tiedyou have options. Most notably, you should be able to get approved for a credit card quite easily. You can then use this credit card to build up your credit and improve your score.

However, you should also be very careful when taking out any new credit. Lenders know you have few options with a 669 score, and some will try to take advantage of you.

For example, you might be approved for loans with an incredibly high interest rate and strict loan terms. Youll want to be careful and thoroughly research any new loans you take on. The last thing you want to do is end up in a situation where you make your credit worse.

For example, lets say you take on a loan with a high interest rate of 25 percent. If you miss one payment and dont realize theres a penalty that increases your interest by 4 percent, your loan will now be sitting at 29 percent. This is just one way that lower credit scores can end up costing you significantly more.

Not sure how your credit compares? Find out with our free credit Assessment

Don’t Miss: Is 793 A Good Credit Score

The Ground For Your Credit Score

There are many factors that go into a credit score, such as the FICO® Score. Your is based on your credit history, which is everything that is recorded in your credit file. This includes things like how well you have handled credit and bill payments in the past. If you have good credit habits, this will tend to lead to a higher credit score such as 700 credit score. On the other hand, if you have had poor or erratic credit habits, this will likely result in a lower score such as 600 credit score.

Public Information: Negative public records, like bankruptcies, on your credit report, can have serious negative impacts on your credit score.

Payment history: An individual’s credit score can be negatively impacted by delinquent accounts and late or missed payments. Conversely, a history of punctual bill payments will help improve one’s credit score. This is a direct relationship- the single biggest influence on your credit score is payment history accounting for up to 35% of your FICO® Score.

Length of credit history: There’s not much new credit users can do about their length of credit history, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score, so it’s important to keep that in mind when building your credit.

The average credit utilization rate is 78.2% for consumers with FICO credit scores of 669.

Who Has The Best Auto Loan Rates Credit Unions Banks Or Online Lenders

Trying to figure out who has the best auto loan rates can feel like an impossible task.

It is natural to want to use your local Credit Union or Bank because you feel loyalty to the financial institution that you trust with your monthly banking needs.

In some instances, going directly through your Credit Union or Bank can be your best bet. Your bank or credit union knows your finances and may consider information other than your credit score when they make an offer.

However, local Credit Unions and Banks may be limited in the loan programs they can offer. They may not be able to compete with the lowest online auto loan rates.

You also have to consider the time it takes to go to your local financial institution to obtain a quote for an auto loan. Online lenders may give you a quote in seconds.

Be Careful!Be careful if you get an auto loan from a Credit Union or Bank that you have a checking, savings, or CD account with. Some financial institutions require you to sign a document allowing them to take payment without your permission if you do not pay.

In comparison, you can obtain four loan offers within two minutes of filling out a short, one-page application with Auto Credit Express®.

Even if you decide to see what your bank or credit union has to offer, getting an online lender quote is free and takes next to no time.

Purchasing a car can be a stressful endeavor because of all the decisions you must make with that helpful high-pressure car salesman stuck to your hip.

You May Like: Is Annual Credit Report A Safe Site

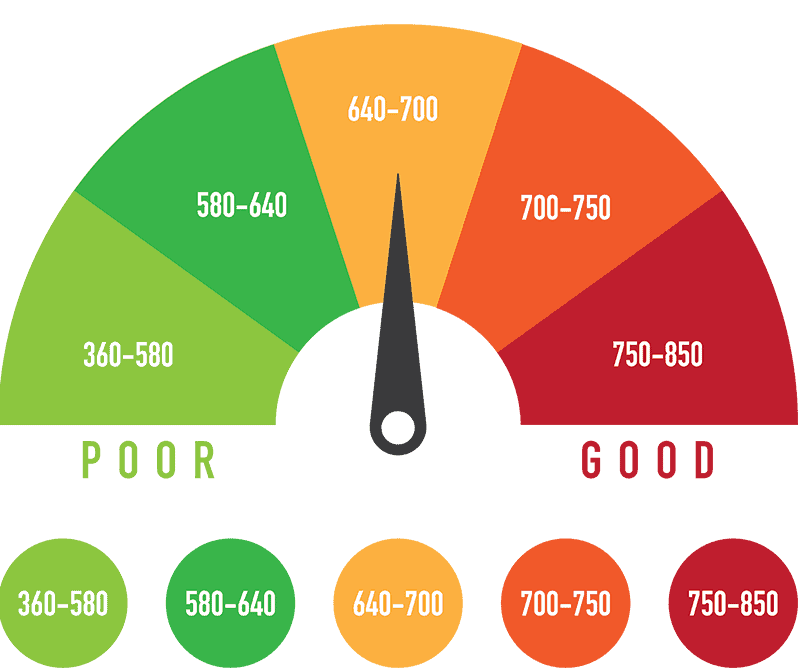

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

Use A Secured Credit Card

When conventional credit cards are unavailable due to credit history blemishes, turn to secured credit cards.

A secured credit card works by putting down a deposit that is the full amount of your spending limit. This can be as little as a few hundred dollars, and acts as the security for the credit you are being extended. Then as you use the card and make on-time payments, those are reported to the credit bureaus and will improve your credit score.

Don’t Miss: How Do You Get A Credit Report

Is 699 A Good Fico Credit Score

A 699 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Improving Your Credit Opens Up Many Possibilities For Your Future

You will be allowed to apply for different types of loans with better interest rates and lower fees. Lenders will sometimes offer lower rates to those who have high credit scores in confidence that the loan theyre applying for will be paid off on time.

Having to climb out of the financial hole that having a low credit score buries you in is time-consuming, expensive, and stressful. Its easier to pay more attention to a fair credit score now and work on raising it to good or excellent than it is to be surprised by a low credit score and work on raising that to fair.

You May Like: Does Afterpay Show On Credit Report

How To Turn A 669 Credit Score Into An 850 Credit Score

There are two types of 669 credit score. On the one hand, theres a 669 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 669 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

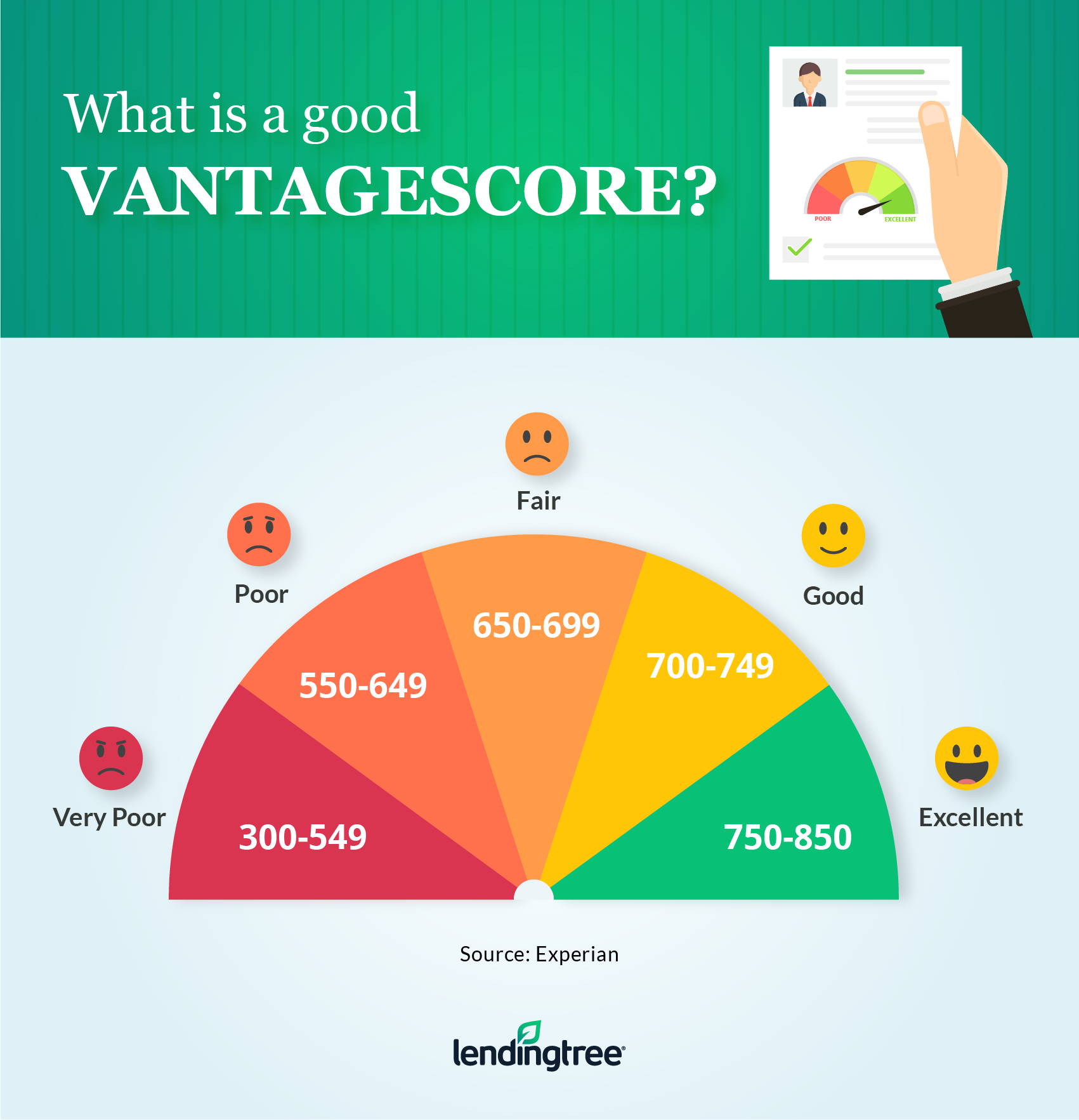

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Read Also: How Long Default On Credit Report

What Is The Highest Credit Score

The highest score is 850 for most credit score ranges. However, you don’t need to hold your breath to be close to 850 in order to have a good credit score.

Once you earn a very good credit score, you wont gain much from having an 850 FICO score instead of a 760. Its like how SPF 100 sunscreen doesnt work significantly better than SPF 50. A perfect score isnt necessary.

Still, its good to know how your credit score is calculated and how you can improve it. With FICO scores in particular, your credit score is influenced by five categories of information all of which can be found in your credit report.