Factors That Affect Credit Ratings

The agency also looks at the borrowers cash flows and current debt levels. If the organization has steady income and the future looks bright, the credit rating will be higher. If there are any doubts about the borrowers economic outlook, their credit rating will fall.

These are some of the factors that can influence the credit rating of a company or government borrower:

- The organizations payment history, including any missed payments or defaults.

- The amount they currently owe, and the types of debt they have.

- Current cash flows and income.

- The market outlook for the company or organization.

- Any organizational issues that might prevent timely repayment of debts.

Note that credit ratings involve some subjective judgments, and even an organization with a spotless payment history can be downgraded if the rating agency believes that its ability to make repayments has changed.

For example, in 2011, Standard and Poors reduced the credit rating of United States sovereign bonds from AAA to AA+, in response to Congressional roadblocks that could have caused a default. Even though the government ultimately made all of its payments on time, even the mere discussion of nonpayment was enough to cause a more negative outlook on U.S. government debt.

What Should I Do If I Dont Have What Is Considered An Excellent Credit Score Of 760+

First, take a deep breath because thankfully, this wont make or break your life.

Yes, having an excellent credit score will save you money and give you access to better deals, but its not even the most important financial thing you should worry about.

For example, knowing your monthly savings rate is more important, since that will actually impact your long-term quality of life. Dont have and use a monthly budget or spending plan? You need one before you start to worry about your credit score.

Ultimately, 35% of your credit score is determined by your payment history, and having a budget is your first line of defense to ensure that youll always have enough to make on-time payments.

However, this also doesnt mean that your credit doesnt matter and that you should ignore it.

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located .

Also Check: What Is A Fair Credit Score

How Do You Get An 800 Credit Score

How to Get an 800 Credit Score

Is An 823 Credit Score Good

A FICO® Score of 823 is well above the average credit score of 711. An 823 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

You May Like: Do Hospital Bills Affect Credit Score

Why Good Credit Scores Matter

While credit scores help determine your availability of credit and the rate youll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. The greater the risk, the lower your score and the more youll pay to access credit if you can access any at all.

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, lets answer the question you are here to find out:

Read Also: How Do You Get A Credit Score

Read Also: How Remove Late Payments From Credit Report

Raising Your Credit Score

If you’re looking to build up your credit score, then you’ll need to address each of these factors individually to the best of your ability. While you can’t add years to your credit history that don’t exist, you can make a point of paying all future bills on time, and, ideally, in full, to boost your payment history.

Similarly, if you make a point to never use more than 30% of your available credit, you can keep your utilization ratio in that ideal 30% or less range. Keep in mind that the amount of your outstanding debt is less important than what percentage of available credit it constitutes. If you owe $4,000 on a $10,000 line of credit and your neighbor owes $5,000 on a $20,000 line of credit, his credit utilization ratio will be under 30%, while yours won’t, even though his debt load is higher.

Finally, make a habit of reviewing your credit report regularly to check for mistakes. An estimated 20% of credit reports contain errors, and fixing one could boost your score overnight.

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

Read Also: What Is Locking Your Credit Report

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

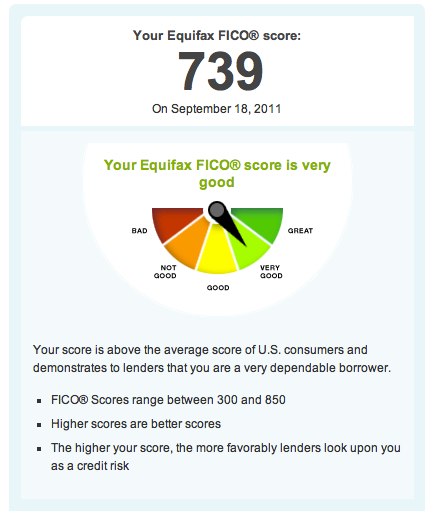

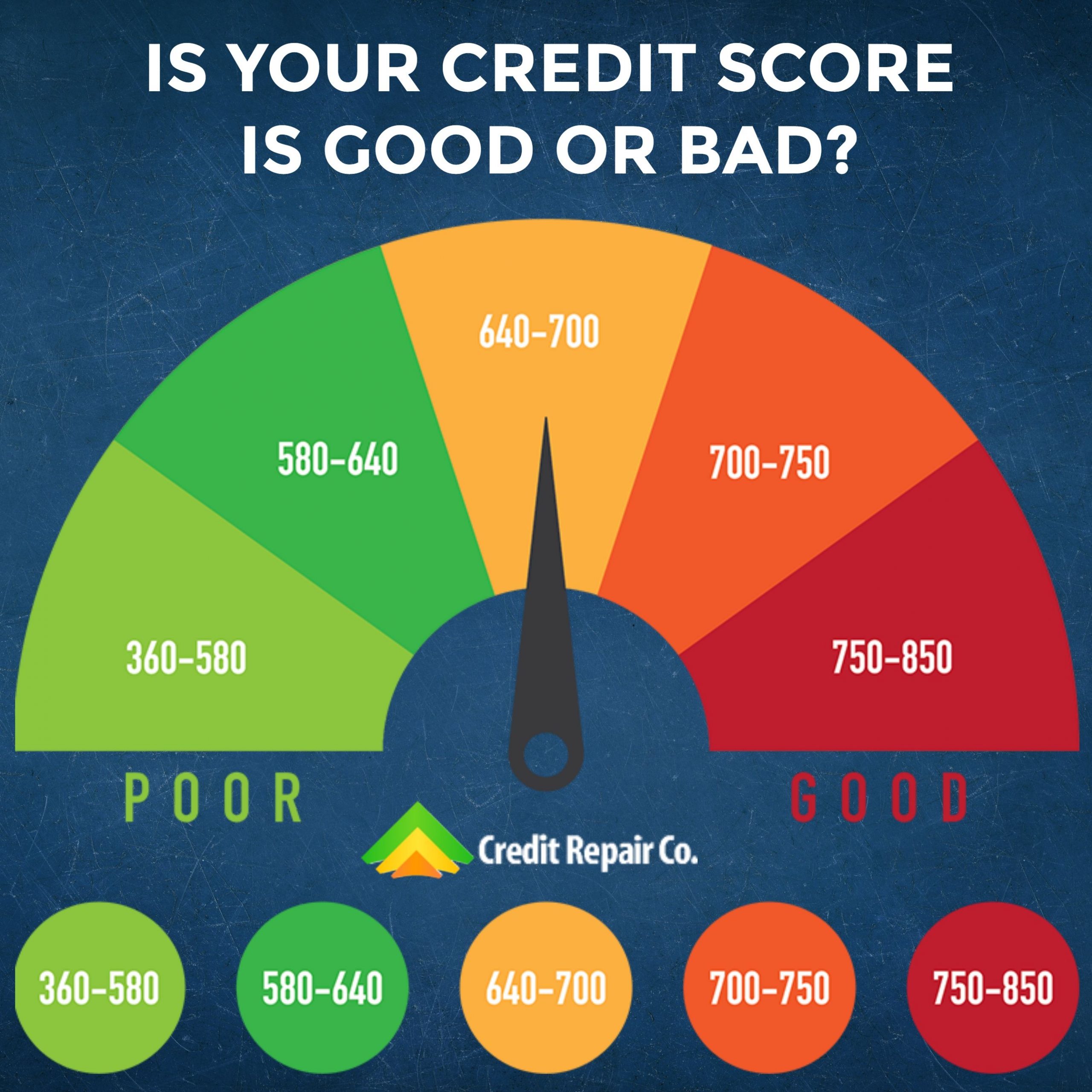

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Recommended Reading: What Is A Good Credit Score To Rent A House

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Was this helpful?

- Check your credit score frequently

- Use a credit card to have lengthy credit history

15. What is the difference between a credit report and credit score?

16. How long will it take to improve your credit score?

17. Can I get a loan or credit card with a credit score of 500?

Recommended Reading: Do Apartment Credit Checks Hurt Your Credit Score

Pay More If Possible When Paying Off Debt

As you make your monthly debt payments on time, consider paying more than just the minimum amount due. With most forms of debt, lenders will charge an interest rate based on the amount a borrower owes. The less your balance is, the less you may pay in interest rates. So, by paying more towards your debt each month, you can end up saving money and paying off your debt faster!

Keep Credit Inquiries To A Minimum

People with excellent credit also keep their credit inquiries to a minimum just two in as many years, on average. When we apply for credit whether it’s for a new credit card, a mortgage, or an auto loan and a lender issues a credit check, it will appear on our and may influence our credit score. This is referred to as a hard inquiry.

Too many hard inquiries may raise red flags for lenders, according to Experian, because they signal a high volume of new accounts in a short period of time, which “may mean you’re having trouble paying bills or are at risk of overspending.” Hard inquiries remain on a credit report for up to two years.

Read Also: How Long Do Inquiries Last On Your Credit Report

Whats A Good Credit Score Range

A good credit-score range depends on where a score comes from, who calculates the credit score and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means that what FICO, VantageScore or anyone else considers good may not be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Whatâs a Good FICO Credit Score Range?

FICO scores that range between 670 and 739 qualify as good scores. Scores in that range are near or slightly above the U.S. average. In total, FICO breaks its scores into five categories:

Learn More Aboutcredit Management

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the issuer’s web site.

As seen on:

Don’t Miss: What Does Age Your Credit Report Mean

Better Chances For Approval

Many businesses use credit scores to determine whether to approve your application. When you have a poor credit score, there’s a greater chance your applications will be denied because creditors may consider you to be a risky borrower. You have a much better chance of being approved with an excellent credit score, since your credit history shows that you’ve borrowed responsibly in the past.

Outside those circumstances, you’ll find that it’s much easier to apply for credit cards and loans when you have an excellent credit score. However, you can quickly ruin an excellent credit score by making too many credit applications, especially in a short period of time.

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores. They are interested in your credit record. Learn more about what landlords really look for in a credit check.

Recommended Reading: How Many Times Can You Check Your Credit Score