What Should You Do Before A Credit Inquiry

Before applying for a new line of credit and consenting to a credit inquiry, use the following tips to limit the impact a credit inquiry will have on your credit score:

Understanding Hard Inquiries On Your Credit Report

When a lender requests to review your credit reports after youve applied for credit, it results in a hard inquiry. What does a hard inquiry mean for your credit scores? And how long does a hard inquiry remain on your credit report?

Reading time: 3 minutes

Highlights:

- When a lender or company requests to review your credit reports after youve applied for credit, it results in a hard inquiry

- Hard inquiries usually impact credit scores

- Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry

Some consumers are reluctant to check their credit reports because they are concerned that doing so may impact their credit scores. While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is in your credit reportand checking your credit may help you get in the habit of monitoring your financial accounts.

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a hard inquiry on your credit report.

What is a hard inquiry?

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year. Depending on your unique credit history, hard inquiries could indicate different things to different lenders.

Exceptions to the impact on your credit score

Soft Inquiries Or Soft Credit Pulls

These do not impact credit scores and dont look bad to lenders.

In fact, lenders cant see soft inquiries at all because they will only show up on the credit reports you check yourself . A soft inquiry happens when there is no credit decision being considered. For example, its a soft inquiry when you check your own credit report or an existing lender checks your credit in a context where youre not applying for new credit .

The next time you get a copy of your credit report, look for the section labeled requests for credit history or something similar. This part of the report will list the names of all of the companies that have recently requested a copy of your credit report.

Equifax®, like Experian and TransUnion®, used to count phone and internet service inquiries as hard inquiries. But, effective April 6, 2020, inquiries on Equifax® credit reports for wired and wireless phone, internet, and pay TV accounts can be counted by service providers as soft inquiries. By June 30, 2020, Equifax® will automatically classify those new accounts as soft inquiries.

Read Also: Does American Express Report To Business Credit Bureaus

How Many Hard Pulls Are Too Many

According to Credit Karmas credit score service, keeping recent inquiries below two is optimal. You start to drift into the red zone once you have five or more on your account.

Take this with a grain of salt, though. FICO only uses new inquiries to make up 10% of your score, and TransUnion lists credit behavior and new accounts as a less influential factor. Many TPGers have seven or eight inquiries on their reports and still have excellent credit scores.

While youll want to avoid unnecessary inquiries on your account, dont let the possibility of having another hard pull on your report stop you from applying for a new credit card if your score is otherwise healthy.

Do Credit Inquiries Affect My Fico Score

FICO’s research shows that opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time , your FICO Scores can be lower as a result. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with higher risk, but most are not affected by multiple inquiries from auto, mortgage or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.

Don’t Miss: Why Is My Credit Score Low

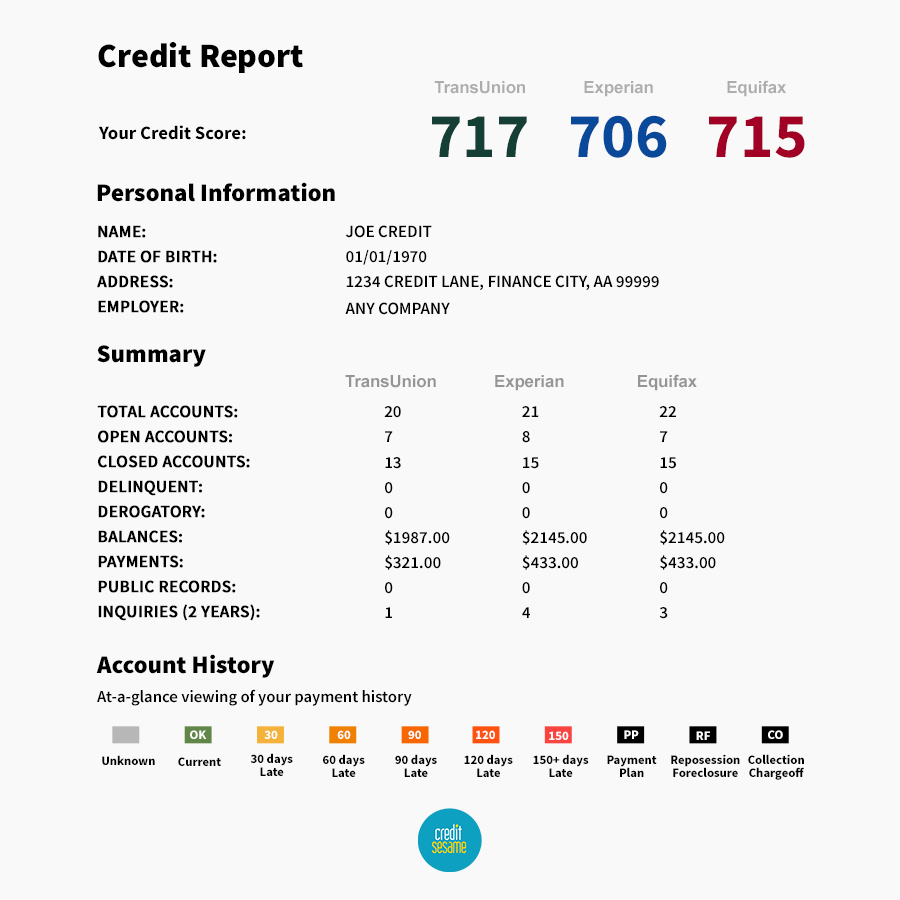

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

Whats The Difference Between A Hard And Soft Pull

A soft pull is an inquiry that does not do damage to your credit score. It can be performed even without your permission.

A soft pull will still show up on some credit reports but it should never result in a drop in your score or be categorized under the inquiry category that really matters to lenders . Soft pulls usually result from credit card pre-approvals, personal credit checks from places like or Credit Sesame, and various other checks like those from employers.

A hard pull is a different story. A hard pull on your credit can only be done with your permission and will almost always result in a temporary drop of your credit score and is something that you want to constantly keep an eye on.

You May Like: What Can You Do With A 700 Credit Score

How To Get Your Credit Report

You can check your credit score for free using the Chase Credit Journey, and if you want to do a deeper dive into your credit history, you can review your credit report using this feature as well.

You can get a free copy of your credit report once a year from each of the three major credit bureaus at annualcreditreport.com

You have the right to a free credit report from AnnualCreditReport.com or 877-322-8228, the ONLY authorized source under federal law.

Myth #: You Can Only Check Your Credit Score For Free Once A Year

You can actually pull your credit report from each credit bureau once per year for free by mail or phone. This only gives you access to the debts that are listed on your report and their ratings. Getting your credit score requires paying an additional fee. Services such as and Borrowell provide free access to your credit score, drawing on information from the credit bureaus, and provide a good ballpark idea of what your score is. However, it should be noted that these third-party services dont always provide the full picture and can sometimes worry Albertans for no reason. The most reliable way to know your score is by ordering it from the credit bureaus directly.

You May Like: Syncb Ppc Card

You May Like: How Long Does A Judgement Last On Your Credit Report

When Are Hard Pulls Performed

As mentioned above, hard pulls are almost always connected to an application for credit of some sort. Credit card issuers generally run hard pulls when you apply for a new card . Mortgage and private student loan lenders will also run a hard pull on your credit. Occasionally, a potential landlord may ask to perform a credit check. Depending on what service they use to run that check, it may result in a hard pull.

Lenders will want a deeper look at your credit report to make sure you are likely to pay back the amount of credit you are requesting.

How To Dispute Or Remove Credit Inquiries

Its possible to dispute or remove some credit inquiries from your credit report. If you initiated the hard credit pull by applying for new credit, you cannot remove the inquiry from your report. However, if the credit inquiry is the result of fraud , you can file a dispute with the credit bureausEquifax, Experian and TransUnionin order to request a hard inquiry removal.

Recommended Reading: What Is On Your Credit Report

Who Performs A Soft Credit Pull

If you have a credit card, your credit card issuer will perform a soft credit pull annually to determine if your circumstances have changed. They use this information to either offer you more credit, or to take away the credit theyve already extended. A mortgage company will perform a hard pull when you apply for a loan, but then perform a soft pull right before they fund your loan again, to determine if your circumstances have changed since you submitted your application. The good news is that a soft credit pull will not hurt your credit score.

A Different Story With Hard Inquiries

A hard inquiry will cause your score to drop because the opposite is true: A hard inquiry only happens when you request new credit or a new loan. Taking on too much new debt or credit makes it more likely that you’ll struggle to pay your bills on time. This makes you a riskier borrower, which is why hard inquiries — the first step to getting new credit or debt — cause your credit score to drop.

The good news is that hard inquiries have only a small effect on your credit score. Opinions vary, but most credit experts say that a hard inquiry will only cause your credit score to drop by five points at the most. And this drop is only temporary.

Mike Pearson, New York City-based founder of the website , says that its helpful to remember that a hard inquiry acts in the opposite way of a soft inquiry.

A soft inquiry can be made without your permission, but it does not impact your credit score in any way. A hard inquiry, though, can only be made with your permission. This inquiry can negatively impact your credit score and will remain on your credit reports for two years, Pearson said.

“Getting a hard inquiry on your credit report every once in a while isn’t a big deal, because your credit score will rebound and the inquiry will roll off,” Pearson said. “Where you have to be careful is applying for too many credit cards in a short period of time.”

You May Like: How To Get Hospital Bills Off My Credit Report

What Is The Difference Between The Two

Credit reports and credit scores can easily get confused with each other so donât be worried if you get them mixed up. To make it simple, a credit report is a statement that has information about any credit activity. This includes the status of your credit accounts and loan history. Your credit score is calculated based on the information from your credit report. Check out our article that takes an even deeper dive into what a credit score is.

Whats A Soft Credit Inquiry

According to the Consumer Financial Protection Bureau , a soft checkâalso known as a soft inquiryâis a review of your credit file and existing accounts. Soft inquiries donât impact your credit scores.

Examples of Soft Credit Inquiries

- Viewing your own credit reports and scores.

- Opening a bank account.

Read Also: What Credit Score Do I Need For Ashley Furniture

Recommended Reading: How To Get Something Removed From Your Credit Report

How Pulling Your Credit Report Impacts Your Credit Score And Other Credit Score Facts

Accessing or âpullingâ your credit report allows you to review your credit behavior. You can see what lenders are reporting about you while you monitor your payment history. Checking your credit report should be a regular part of your routine financial behavior, similarly to reviewing your bank statements or creating a budget.

Some consumers are hesitant to check their credit report because they donât want to impact their credit score. While pulling your credit report does result in an inquiry on your credit report, the good news is that it will not negatively affect your credit score. In fact, checking your credit report may help you get in the habit of monitoring your financial accounts.

Which type of inquiry impacts my credit score?Any request for your credit history is known as an inquiry, but not all inquiries affect your credit score: hard inquiries do whereas soft inquiries do not.

Hard inquiries occur when a potential lender reviews your credit history because you have applied for a loan or a new credit card. These remain on your credit report for 24 months.

If your credit score is fluctuating, it may be because of your other credit behavior. Keep in mind the following three tips in order to help you build a solid credit history.

1. Donât request too much credit at once. Too many hard inquiries can affect your credit score, even if your requests for credit are denied.

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

5 MINUTE READ

Recommended Reading: Will Collection Agencies Remove From Credit Report

Repossession Explained How Long Does It Stay On Your Credit Report Credit Cadabra

A repossession can stay on your credit report for up to seven years. A car repossession can stay on your credit report for seven years and the repossession will initially lower your credit score. If you are late to pay an account and then bring it current, the late payment will be . Youll also see marks for your late payments and the defaulted loan, which will also stay on your .

Within the first year after . What exactly is a credit report pull, and how do credit pulls impact your credit score? If you are late to pay an account and then bring it current, the late payment will be . The fair credit reporting act sets limits on how long most negative information can stay on your credit report.

Lenders generally can repossess the car at any point once youre in default. A car repossession can stay on your credit report for seven years and the repossession will initially lower your credit score. If you are late to pay an account and then bring it current, the late payment will be . Youll also see marks for your late payments and the defaulted loan, which will also stay on your .

Why Do Credit Inquiries Matter

When you apply for a credit card, begin shopping for a loan or prepare to take on a new financial responsibility, like renting an apartment, the lenders and companies involved want to know whether youre likely to be a financial risk. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on the rent.

There are two different types of credit inquiries: hard inquiries, which can have a negative effect on your credit score, and soft inquiries, which dont affect your score at all.

Don’t Miss: Does Loan Me Report To Credit Bureaus