Do Some Research Before You Apply

Getting as much information as you can before you apply for a loan will help you weed out certain offers. Ask potential lenders about features such as the annual percentage rate, or APR, loan requirements, available loan terms and fees so you can begin to compare lenders.

If a lender offers the ability to apply for preapproval or prequalification without a hard credit pull, you get a sense of the estimated loan amount, terms and rates you might qualify for without affecting your credit. But keep in mind, youll still need to apply and if you qualify, your loan terms could be different.

How Do Multiple Credit Checks Work

The good news is that if you are shopping around with different lenders, credit bureaus will typically only dock your score once within a 45 day period, no matter how many mortgage lenders do a hard credit check. Thats great if you think youll close on a mortgage within 45 days, but if youre early on in your homebuying process, the clock will start ticking earlier than you may want. Luckily, a Better Mortgage pre-approval doesnt require a hard credit pull.

You can start your home search with your pre-approved amount, then shop multiple lenders for rates when youre ready to buy. And if you decide to finance your home with Better Mortgage , well only perform a hard credit check once, even if you were pre-approved months before.

This is a great have your cake and eat it too strategy when it comes to house hunting. A pre-approval means youll start your house hunt with useful information like a budget to work with and a pre-approval letter to show sellers youre serious. And by waiting until youre ready to buy to compare mortgages with different lenders, you wont impact your credit score with a hard credit inquiry or prematurely trigger the 45 day mortgage shopping window.

Recommended Reading: Does Rocket Mortgage Affect Your Credit Score

Tracking My Credit Score

There are several ways you can track your credit score. Before we got our mortgage I started using a out of curiosity mostly I wanted to see how they work and what they track. I signed up and got a copy of my credit scores based on the three major credit bureaus .

Getting Your Real Credit Score

Many people say that you should get the FICO credit score directly from MyFICO. This seems to be the obvious option since FICO is the company that creates the scores.

However, you can get your score for less by going through FreeScore360. They offer you a seven day trial and then it is only $19.95 per month going forward, which includes all three of your credit score, credit monitoring, and $1 million of id theft insurance.

Read Also: How To Get Missed Payments Off Credit Report

Do Multiple Loan Inquiries Affect Your Credit Score

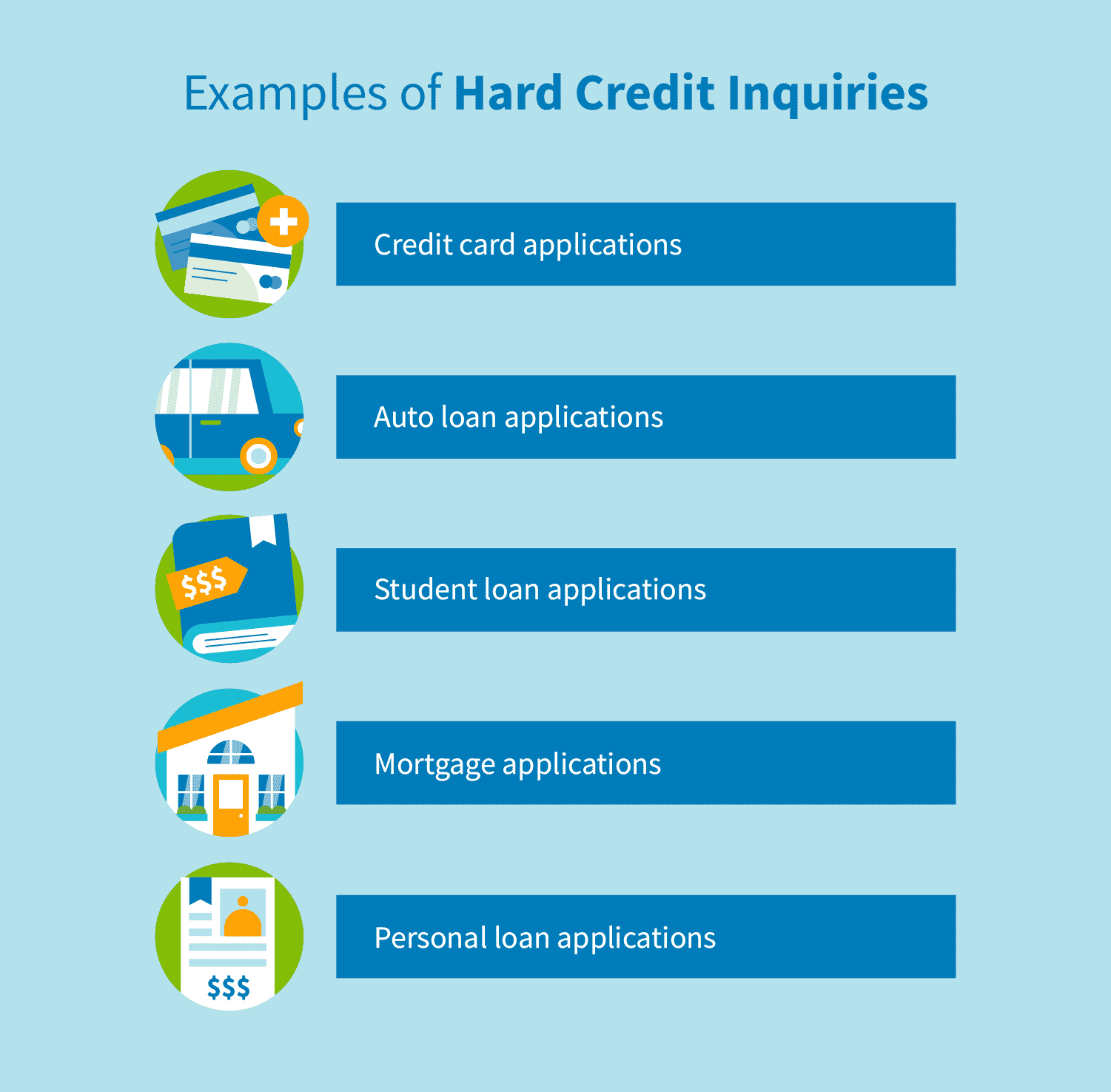

Consumer credit reports contain a wealth of information about you and your financial relationships with lenders. Auto loans, credit cards, mortgages, student loans and other creditor relationships commonly appear on your credit reports. What they all have in common is that you likely applied for credit with these lenders and they, in turn, pulled a copy or copies of your credit reports before approving your application.

Each time your credit report is pulled, that credit inquiry appears on your credit report for a period of time. Credit inquiries include the date they were made and the inquiring company’s name. Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a short period of time are either entirely ignored or treated as a single search for credit, thus protecting your credit scores.

As You Pay Down Your Mortgage

In the long run, having a mortgage and paying it off as agreed can help you build a stronger credit profile.

A study by LendingTree found that U.S. borrowers saw an average credit score drop of 20.4 points after getting a mortgage. It took an average of 165 days after closing for credit scores to reach their low points, and another 174 to rebound. In total, the decline and rebound averaged 339 daysjust shy of a year.

While your score will likely drop initially, a track record of on-time monthly payments on the sizable loan will help to improve your score and trustworthiness as a borrower.

Don’t Miss: Do Insurance Quotes Affect Credit Score

How Mortgage Rate Shopping Affects Your Credit Score

A credit inquiry occurs when a lender or other entity checks your credit.

Too many inquiries could have a significant impact on your credit score. It tells the lender that you are aggressively seeking credit.

That could mean you are in financial trouble, or that you are about to get in over your head in debt.

According to MyFico, consumers who have six or more inquiries are eight times more likely to declare bankruptcy than people with no inquiries at all.

Seeking too much credit in a short period, then, drags down your credit score. A lower credit score typically means a higher interest rate, and a harder time getting a mortgage.

For most people, though, a hard credit pull affects their credit scores by less than 5 points.

The negative impact will vary according to the type of creditor behind the inquiry, the type of loan, and the strength of the homebuyers current credit profile.

Does Shopping Around For A Mortgage Hurt Your Credit Score

< Back to Articles | Time to Read:5 minutes

We serve a variety of clientsthose who don’t have a credit history and those who do. If you’re someone who does have a FICO® Score, you need to protect it and avoid any activity that may hurt it.

It’s important to know what happens to your credit score if multiple lenders all do a credit check. This question comes up a lot so lets get down to the basics on how mortgage credit inquiries really affect your credit score.

First things first: The effect of a mortgage inquiry on your credit score is small. Heres why: Your FICO® Score is typically used with a mortgage credit inquiry estimated to lower your credit score a mere 3-5 points. This small hit to your credit should fade away in within a year if everything else on your credit report remains in good shape.

Quick tip: Shop for your home loan within a 14-day period.If you shop for your home loan within this 2-week period, you can have your credit checked by an unlimited number of lenders within this time with potentially only one single credit score penalty. With mortgage applications, you only get one approval for that specific home loan, unlike if you apply for three credit cards, you can get approved and use all three cards. Make sense?

- A credit check for a mortgage loan

- A credit check for an auto loan

- A credit check for a credit card application

- A credit check for a store credit card, or consumer loan

Don’t Miss: Can You Pay To Have Your Credit Report Cleared

You Should Be Mindful Of Your Credit Profile Throughout The Entire Process Of Purchasing A Home

Buying a home can be overwhelming for first-time buyers. Lenders will ask you many questions and have you provide documentation to support your application before granting you a loan. And of course, they will require a credit check.

I am often asked if we pull credit more than once. The answer is yes. Keep in mind that within a 45-day window, multiple credit checks from mortgage lenders only affects your credit rating as if it were a single pull. This is regulated by the Consumer Financial Protection Bureau Read more here. Credit is pulled at least once at the beginning of the approval process, and then again just prior to closing. Sometimes its pulled in the middle if necessary, so its important that you be conscious of your credit and the things that may impact your scores and approvability throughout the entire process.

Initial credit check for pre-approval

The first thing I encourage any potential buyer to do is to get pre-approved. Many realtors may not even begin to show you homes until youve taken this first step. You can apply for pre-approval online, face-to-face or over the phone. Lenders want to know details such as history of your residence, employment and income, account balances, debt payments, confirmation of any foreclosures or bankruptcies in the last seven years and sourcing of a down payment. They will need your full legal name, date of birth and Social Security number as well so they can pull credit.

Final credit check before closing

Will A Mortgage In Principle Affect My Credit Rating

This is a common question, and many people also want to know, does mortgage preapproval affect credit scores?

As mentioned, if the search is a soft-search, then no. If hard search, then it is recorded on your file and can impact your credit score with some agencies and lenders, depending on how recent and how many searches are recorded.

Read Also: When Does Chase Report To Credit Bureaus

A Beginner’s Guide To Credit Inquiries

Credit inquiries play an important role for buyers and lenders alike, and they can make all the difference regardless of if you’re a first-time homebuyer or an experienced property owner.

The key to a successful credit inquiry is understanding how they work and how they impact your credit score. Below are answers to some of the most common questions about credit inquiries and how you can help make your next inquiry a favorable one.

What Are Hard Inquiries

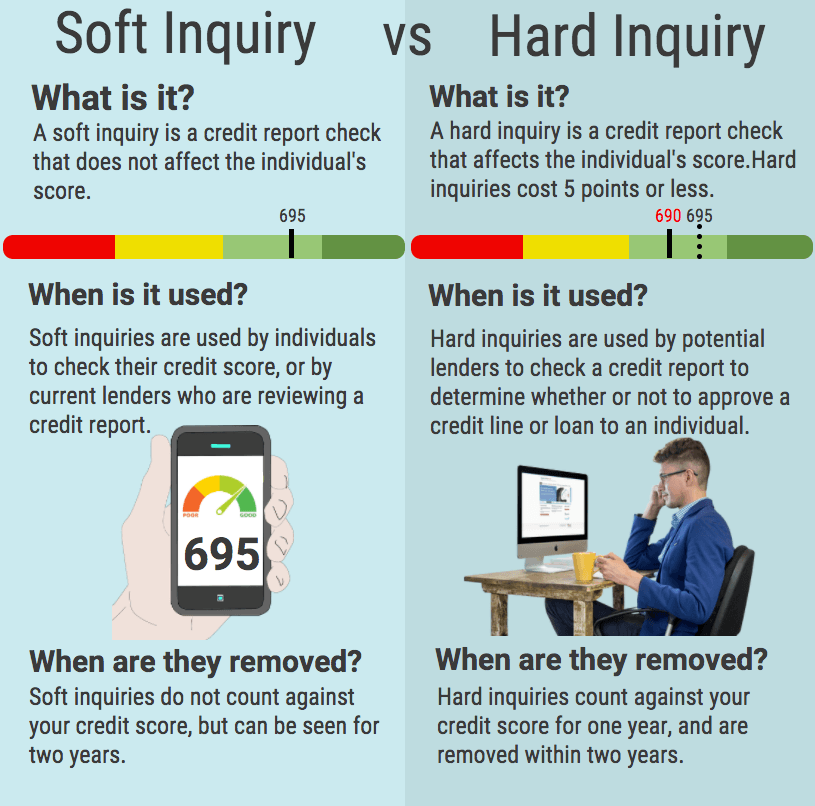

Credit checks made when you apply for a loan are considered “hard” inquiries, meaning they’re the result of an application you’ve made. These are in contrast to the “soft” inquiries that come from you checking your own credit or a company generating a promotional credit offer for you. Hard inquiries can hurt you. They account for roughly 10% of your credit score and remain on your credit report for two years. Only the inquiries from the past 12 months are included in your credit score, however.

Recommended Reading: How To Remove Debt Collection From Credit Report

Why Does A Credit Check Lower My Score Even If Only Temporarily

Sometimes it helps to know why something is the way it is. FICO explains that opening several new accounts in a short time period can be an indicator of greater credit risk, such as someone defaulting on those obligations. Their scoring system reflects that amount of risk given the type of loan youre applying for and your credit history.

You dont need to worry about inquiries too much, though, since they only make up a small percentage of your credit score calculation. In the FICO scoring model, inquiries make up just 10% of the score. Paying bills on time and your debt-to-income ratio are much larger components of your score

Donât Miss: Reverse Mortgage On Condo

Rate Shopping Can Minimize The Impact Of Hard Inquiries

Sometimes when you apply for credit, each application triggers a hard inquiry. Thatâs how credit card applications work, for example. That means applying for multiple credit cards over a short period of time will lead to multiple hard inquiries. And that could hurt your credit scores more than a single hard inquiry.

But some types of creditâlike auto loans, student loans and mortgagesâwork a little differently. Shopping for auto, student or home financing within a short time frameâusually 14 to 45 daysâcould be treated as just a single hard inquiry. And that could have less of an impact on your credit scores than multiple hard inquiries could have over a short period of time.

So take it from FICO: âIf you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.â

Read Also: What Do Credit Rating Agencies Do

The Fico Mortgage Shopping Period

If your mortgage shopping spans a few months, it will look back at older inquiries grouped together in those specified shopping periods and treat them as just one inquiry.

So if you shopped with mortgage lenders A, B, and C in a 14-day period two months ago, but didnt actually close your loan, then decide to restart the process, those three credit pulls would only count as one.

Unlike a credit card application where you apply just once, a home loan may involve multiple credit pulls with a variety of different lenders.

Instead of making it appear like youre on a debt rampage, they bundle these similar inquiries into one group if they occur in a designated time period.

Ultimately, you could have your credit pulled by 10 mortgage lenders in a week and it would only count as a single inquiry.

This shopping period can range from 14-45 days, depending on which version of the FICO scoring formula is being used.

The latest FICO version allows a 45 day shopping period, while the oldest just 14 days. Unfortunately, many mortgage lenders use older versions of FICO.

Either way, one credit inquiry will likely only lower your credit score by five points or less, so it may not even be a concern if you already have a solid credit score.

Of course, mortgage inquiries can and will affect consumers differently based on their credit profile, so theres no absolute rule in terms of impact.

When You Pay Off Your Mortgage

When you make your final mortgage payment and own your home free and clear, what will happen to your credit? The loan will be marked closed in good standing on your credit report for 10 years. As for your credit score, dont expect any dramatic change.

Closing a mortgage has very little impact on your credit score, unlike closing a revolving credit card, which can hurt your score by reducing your available credit. However, you may see a drop if the mortgage was your only installment loan, as it will impact your credit mix.

Don’t Miss: How To Get Inquiries Off Your Credit Report

How Does My Credit Score Affect My Ability To Get A Mortgage Loan

Your credit score, as well as the information on your credit report, are key ingredients in determining whether youll be able to get a mortgage, and the rate youll pay.

Your and your are two different things. Your credit score is calculated based on the information in your credit report. Higher scores reflect a better credit history and make you eligible for lower interest rates.

You have many different credit scores, and there are many ways to get a credit score. However, most mortgage lenders use FICO scores. Your score can differ depending on which credit reporting agency is used. Most mortgage lenders look at scores from all three major credit reporting agencies Equifax, Experian, and TransUnion and use the middle score for deciding what rate to offer you.

Errors on your credit report can reduce your score artificially which could mean a higher interest rate and less money in your pocket so it is important to check your credit report and correct any errors well before you apply for a loan.

Your credit score is only one component of your mortgage lenders decision, but its an important one.

Other factors include:

- The amount of debt you already have

- How much you have in savings

- Your total assets

Also Check: How Does Rocket Mortgage Work

Learn How Credit Inquiries Can Impact Your Credit And Whether Theres Such A Thing As Too Many Inquiries

First things first: Thereâs no definitive answer to the question âHow many credit inquiries is too many?â Why? Because there are two different kinds of . And while one of them doesnât affect credit scores, the other one does. Soft inquiries are simple reviews of your credit file and existing accounts that donât impact your credit scores. But hard credit inquiries can have an impactâand theyâre triggered whenever you apply for credit.

Read on to learn more about credit inquiries, how they can affect your scores and what you can do to manage their impact.

You May Like: What Does Derogatory Mean On Credit Report

What About Rate Shopping

You can typically check your interest rate with a lender without a hard credit check through a prequalification process. After you prequalify and choose a lender, thats when it will run a hard credit check.

However, not every lender offers prequalification and you may encounter hard credit checks while rate shopping for some products. For example, if you shop around for mortgage preapprovals, lenders are likely to run a hard credit check from the start.

In these cases, theres still good news. If you do all of your rate shopping for mortgages, student loans or auto loans within a short period of time, itll be recorded as a single hard credit inquiry on your report, even though multiple lenders may have done a hard credit check.

The time period you have to complete your rate shopping varies. FICO has many different credit scoring models that lenders can request. For some of these models, your rate-shopping period is 14 days, while for others, its 45 days. Plan on doing all of your rate shopping within the same two-week period if you can to be on the safe side.

What Kind Of Credit Score Do You Need To Get A House Loan

Conventional banks generally want to see a credit score thats 620 or higher, although some have more stringent criteria. VA loans also require a credit score of 620 or higher, while FHA loans can be obtained with a score as low as 500. Those with low scores may also need a cosigner for a bigger down payment to get a loan.

All that being said, its wise to know that your credit scores change all the time, and you can take control of the situation before you ever apply for a loan. With an eye to the future, you should:

Read Also: What Credit Score Does Capital One Use