How Will Accepted Disputes Affect Your Fico Score

Often your score will improve when errors on your credit report are corrected. In some situations, however, your score may not improve when credit information is corrected or updated. For example:

- It is often thought that closing credit card accounts will improve your score. This is not true. Closing an account will neither remove it from your credit report, nor will it prevent the payment history from continuing to be displayed and considered in the calculation of your FICO Score.

- Removing negative information from your credit report may not have the impact on your FICO Score that you expect. There could be additional negative information remaining that will prevent an immediate increase in your FICO Score.

- FICO Scores only consider credit-related information on your credit report. If you change personal information , the credit information on your report will not be impacted and your FICO Score will probably not change. The FICO Score only considers credit account, collection, and public record information.

It typically takes the credit bureau 30-45 days to respond to your dispute.

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

How To Get Something Off Your Credit Report

According to the Federal Trade Commission, no one can legally remove accurate and timely negative information from a credit report.

But, if the item is questionable or doesnt quite tell the entire story, you have the right to file a dispute and request an investigation with each credit bureau thats reporting it. You also have the right to file a dispute if an account results from fraud or identity theft.

Don’t Miss: What Credit Score Do I Need To Get Care Credit

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Settle The Debt And Dispute It Again

Many debt collectors will allow you to settle the debt for less than the amount owed. Since they purchased the debt for pennies on the dollar, they can accept half of the balance and still make a significant profit.

Just call the collection company and tell them you wish to settle the debt. Usually, they will want the full payment and will knock between 20%-60% of the balance to settle the account in full.

When you pay the debt, it does not help your score and doesnt delete your reports account. But, you will now be able to go back to the Credit Bureau and dispute the item again and hope the creditor does not go through the hassle of validating a debt thats been paid. They have no incentive to do, so they may not respond to the Credit Bureaus request.

Don’t Miss: How To Remove Repossession From Credit Report

Rebuilding Your Credit Rating

Since the charged-off account will still show up on your credit report, it will continue to impair your credit score. But the good news is that as charge-offs and other negative information ages, its overall impact can lessen.

In the meantime, you can work on rebuilding a positive credit history by doing things like paying your bills on time, keeping your low, and limiting how often you apply for new credit.

When Removing A Charge

If you’ve tried to negotiate with a creditor for the removal of a charge-off but hit a dead end, your only option may be to simply wait it out until the seven-year mark passes. Once that period is up, the charge-off will fall off your credit report naturally and no longer be included in your credit score calculations.

Again, this doesn’t mean that you can ignore the debt altogether. You’re still legally obligated to pay it. At some point, however, the statute of limitations on the debt may expire. When that occurs, debt collectors can no longer sue you to recover the money. The statute of limitations for different types of debt varies from state to state.

Don’t Miss: Affirm Credit Score Approval

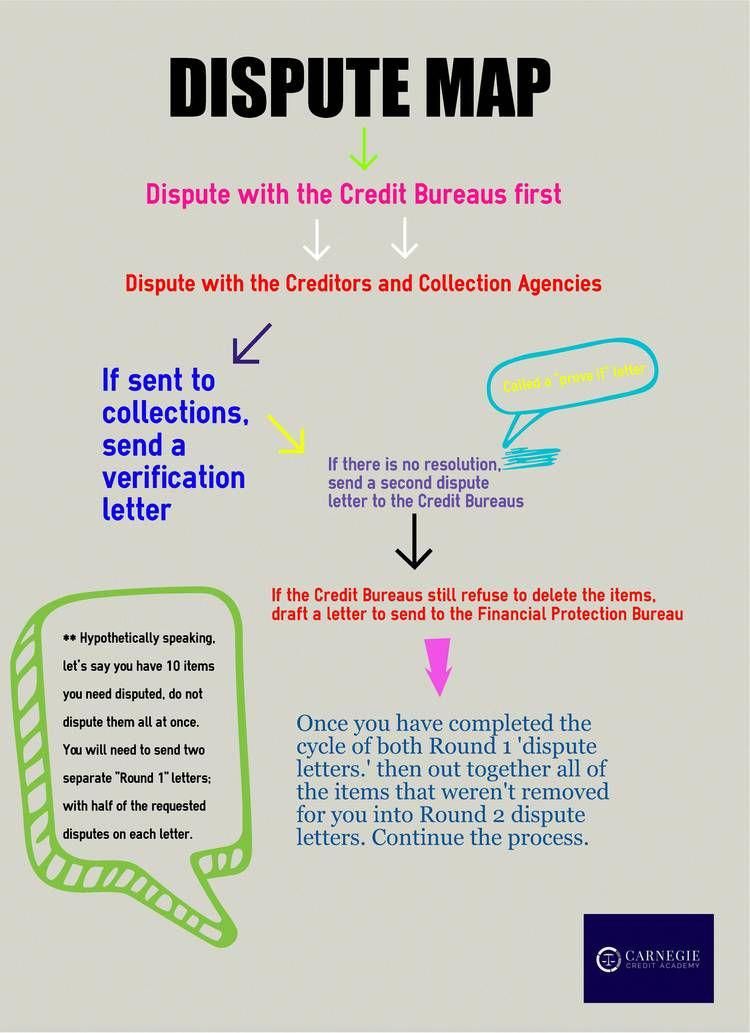

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

Does The Open Date Of A Collection Account Determine When It’s Removed

It sometimes takes a year or more between an account’s charge-off and its sale to a collection agency, and collection agencies that fail to collect their debts sometimes resell them to still other agencies. That means multiple collection account entriesall related to the same unpaid debtmay appear on your credit reports.

While that’s not great news, you need not worry that each new entry has its own seven-year countdown to expiration. Any collection entries related to the same original debt will disappear from your credit report seven years from the date of the first missed payment that led up to the charge-off.

Recommended Reading: Does Kornerstone Credit Report To The Credit Bureaus

Wait For The Items To Age Off Your Reports

You should know two things regarding the effects of negative information on your credit score:

The following chart summarizes the maximum time a negative item can remain on your credit report.

The longest-lived item is a Chapter 7 bankruptcy, which hangs around for up to 10 years. In Chapter 7, all your debts are forgiven, and you owe nothing. A Chapter 13 bankruptcy, in which you agree to pay back some or all of your debts, remains on your report for seven years.

Credit bureaus are supposed to promptly remove any items that age off your credit report. If they forget, you can remind them by filing a dispute. The bureau should then remove the item within 30 days.

How Long Does It Take To Rebuild Credit After Debt Settlement

Your overall credit history will play a role in how fast your credit bounces back after settling a debt. If you otherwise have a solid credit history and have successfully paid off loans or are in good standing with other lending institutions, you could rebuild your credit more quickly than if you have a larger history of late payments, for example.

The further in the past your debt settlement, the better your credit report will look. Still, there are some things you can do to help your over time by focusing on establishing a solid credit repayment pattern:

Also Check: How Personal Responsibility Affects Credit Report

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

You May Like: What Credit Bureau Does Capital One Report To

How Resolve Can Help

If youre dealing with debt and not sure what to do, were here to help. Become a Resolve member and well contact your creditors to get you the best offers for your financial situation. Our debt experts will answer your questions and guide you along the way. And our platform offers powerful budgeting tools, credit score insights and more.Join today.

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

Recommended Reading: Unlock Transunion Credit Lock

How To Remove Closed Accounts From Your Credit Report

If you need to attempt to remove a closed account from your especially one that includes inaccurate information or negative itemsthere are three ways to do so. You can either dispute inaccurate information with the , write a formal goodwill letter to request removal or simply wait until the account is removed after a period of time. Each of these approaches can be useful depending on your particular situation.

Read on to learn more about when to try each of these different methods for getting a closed account off your credit report.

Common Mistakes That Cause Credit Report Errors

To begin, it’s important to know if the person responsible for the error is you. Often, a person may have applied for credit under different names . Make sure you’re consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person with a similar name. Likewise, apply the same consistency and care with things like your Social Security number and address.

Or it could be a case of what you didn’t put in your report. If you were denied credit because of an “insufficient credit file” or “no credit file,” it may be because your credit file doesn’t reflect all your credit accounts. Though most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus, nor are they required to report consumer credit information to credit bureaus.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus.

Other common errors to look for:

Read Also: Itin Credit Report

What Happens When An Item Is Deleted From Your Credit Report

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

Why Get Something Removed From Your Credit Report

If negative items are dragging your credit score down, youre essentially capping your earning potential and limiting your choices. Your credit score impacts what types of good credit loans you can take out and your overall financial options. You should always try to have as high a credit score as possible.

Spending a little bit of time getting negative items removed from your credit report will save you a lot of work in the long term. Additionally, negative items on your credit report can often be removed with less effort than you might think.

You May Like: Does Usaa Report Authorized Users

Get Your Negative Items Professionally Removed

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

A Credit Report Is Complex Yet Simple

Your credit report changes every month. All your lenders add and subtract information. Your report from each credit bureau is different from the other two bureaus files on you.

Then, all this data gets distilled into a three-digit number that most lenders equate with your identity. Its easy to see why credit is so confusing and frustrating.

But heres a simpler way to look at it: To get rid of your bad credit, you can:

- Remove Negative Information

- Add Positive Information

- Be Patient

Ultimately, thats how you play this game. This post has been about removing negative information because doing this can increase your score quickly.

But adding positive information is just as important. You can add positive data by making on-time payments, keeping your credit card balances paid down and applying for new credit only when you feel certain youll get approved.

Over time youll start seeing your credit score climb.

Also Check: Fico Score 820