Qualify For Higher Credit Limits And Loan Amounts

The amount of credit a credit card issuer is willing to extend to you is based partly on your credit score. With an excellent credit score, youve likely demonstrated that you can handle credit responsibly. When you apply for most major credit cards, youre more likely to get a higher credit limitprovided your income is enough to handle that credit limit.

Similarly, when you’re applying for a loan, having excellent credit will allow you to qualify for higher loan amounts. This makes a major difference in the price of the home or car you can afford to buy.

Benefits Of A Personal Loan

A personal loan is money that you can borrow from a bank or credit union, which you can use for almost any purpose. Unlike home loans or automobile loans, which are specialized, you can use personal loans for paying off medical bills, emergency home repair, purchasing a new home appliance or even consolidating multiple loans that you may be currently juggling.

Many personal loans have lower interest rates than credit cards. So, people often take out a personal loan to close their credit card payments. These are typically unsecured loans, which means they dont require collateral against the sanction of the loan. Your credit score determines the terms of the loan including the repayment terms, interest rate and the amount. A good credit score should enable you to qualify for a personal loan.

to apply for Standard Chartered Personal Loans

The Utilization Rate For The Revolving Credit Utilization

The utilization rate is an indicator of the extent to which the goal of maxing the amount of credit available on your credit cards. The closer one of these rates reaches 100 percent, the more damaging it is to your score on credit. Utilization rates account for almost one-third percent of the credit score.

Also Check: Does Paypal Report To Credit Bureaus

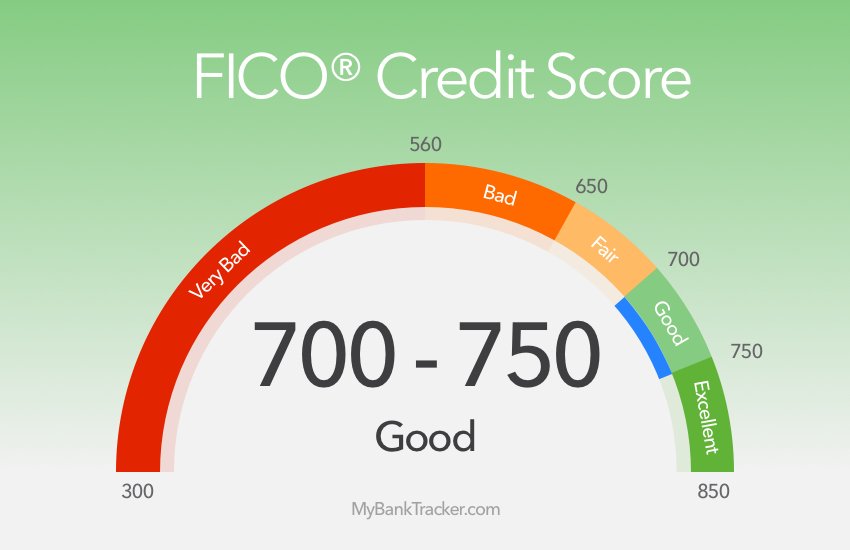

How Good Is A 750 Credit Score

A 750 credit score is better than the U.S. average, which was 711 in 2020, according to credit bureau Experian. Lenders tend to evaluate and offer the same rates to people within the same range.

A 750 credit score generally falls into the excellent range, which shows lenders that youre a very dependable borrower. People with credit scores within this range tend to qualify for loans and secure the best mortgage rates.

A 750 credit score could help you:

- Qualify for a mortgage

- Negotiate the loan terms, since the lender might be willing to compete for your business

- Get low mortgage rates, which makes borrowing cheaper

Some lenders might consider a 750 credit score on the cusp between good and excellent, which could influence the rate you receive. Be sure to monitor your credit score in the months leading up to your mortgage application.

Tip:

Theres no official cutoff that all lenders use, but a higher credit score can generally help when you apply for a mortgage.

Keep Reading: How Your Credit Score Impacts Mortgage Rates

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -90 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Don’t Miss: How Long Does It Take For Opensky To Report

Not All Personal Lenders Report To The Major Credit Bureaus

Trying to use a personal loan to build credit? Imagine finding out that your activity isnt being reported to any of the three major consumer credit bureaus.

Unfortunately, thats the case with some personal loans. If youre not careful, you could spend months or even years making on-time payments without it being reflected on your credit reports.

Read Also: What Do Loan Officers Look For In Bank Statements

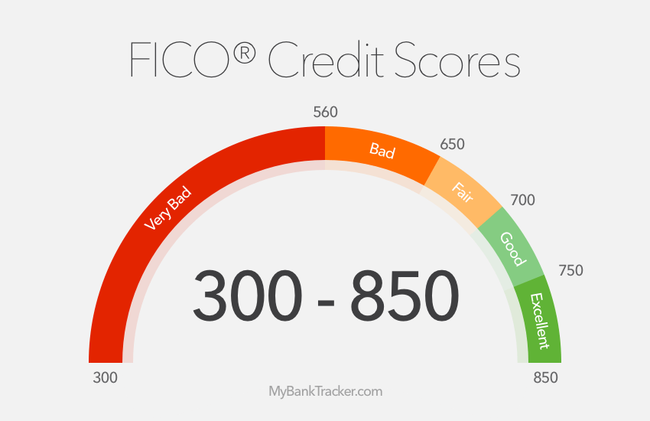

What Is A Credit Score

The FICO score is the most widely used credit rating system in the United States. This company was first established in 1956 by a team that aimed to find ways to determine if people were good candidates for loans. The FICO scoring model has changed some over the years, but it still has 3 main categories of information it takes into account when determining your credit score.

This includes:

Outstanding balances on loans or credit cards 30%

Length of credit history 15%

The most important factor in this system is payment history. Your FICO score will go down if you are late or missed a payment on any bill . Outstanding balances on loans or credit cards are the next most important factor in the FICO scoring system, but only 30% of your overall score is determined by this factor. Length of your credit history makes up 15% of your final number.

When you are trying to buy a house, this FICO score is often used. Some other types of loans may ask for yet another score that incorporates different factors than your general FICO credit rating.

One other type of credit rating is the Beacon 5 score, which was developed by Equifax in 1992. This score looks at more specific information than just how long you have been using credit, but instead analyzes what kind of loans you have had in comparison to how well you have repaid them.

You May Like: What Is Coaf Credit Inquiry

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

What Are The Benefits Of A 750 Credit Score

A healthy credit score can open a lot of doors. A score of 750, or even higher, can have significant benefits.

1. Better mortgage rates

Most mortgage lenders require a credit score of 650 or higher. With a score of 750, youâll qualify more easily and get a better deal, maybe even a lower interest rate. However, home lending takes in many other factors, including your debt-to-income ratio.

2. Better car loan options

Your score plays a crucial role in your car loanâs interest rate. With a 750 score, youâll likely qualify for a lower rate, significantly better than rates offered to people with much lower scores.

A lower interest rate translates to lower payments every month â and the potential for a larger loan for a nicer car!

3. Better credit card options

With a 750 score, youâll have access to with some of the best perks. These include no annual fees, sign-up bonuses and travel rewards. Youâll probably also qualify for higher credit limits, giving you more options for spending throughout every month.

Recommended Reading: Carmax Installment

How A Personal Loan Can Raise Your Credit Score By 20 Points Or More

by Matt Frankel, CFP® | Updated July 21, 2021 First published on Nov. 16, 2019

Most people who consolidate debt with a personal loan see their credit score go up heres why.

Can a personal loan raise your credit score? Several personal finance experts have said that it can, but now we have proof.

Credit bureau and consumer finance company TransUnion recently released a new study at the 2019 Money20/20 conference that examined consumers who used a personal loan to consolidate credit card debt. For 68% of those customers, the study found that their credit scores increased by 20 points or more within three months of consolidating their debt.

The results were even more impressive in subprime and near-prime consumers, where the study found 20-plus-point credit score improvement rates of 84% and 77%, respectively.

This may seem counterintuitive. After all, it is well known that applying for new credit can have a negative impact on your credit score. Whats more, the study found that after consolidating credit card debt with a personal loan, the average consumers overall debt actually increased. However, there are a few key ways that a personal loan can help your credit score far more than it could hurt it.

Before you apply for a personal loan, though, its also important to consider the potential drawbacks. Heres everything you need to know.

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

Don’t Miss: What Is A Serious Delinquency On Credit Report

How To Increase Your Credit Score Until 750

Ensure that your credit cards are always paid on time

Only keep balances on your credit cards that you can afford to pay in full every month

Keep old accounts open, even if you dont service them anymore

Dont apply for multiple loans at once and try to be conservative with new credit inquiries

Build up your income and pay your bills on time, every time

Never ever miss a payment! If you cant afford to make a payment on time, dont use the card. Just set up an automatic payment to prevent the late fee from killing your account balance

What Does A Credit Score Of 800 Mean

Youre still well above the average consumer if you have an 800 credit score. The average credit score is 704 points. If you have a credit score of 800, it means that youve spent a lot of time building your score and managing your payments well. Most lenders consider an 800 score to be in the exceptional range.

If you have a score of 800 points, you should be proud of yourself. You wont have any trouble finding a mortgage loan or opening a new credit card with a score that high. Here are some things your 800 FICO® Score says about you:

An 800 credit score isnt just good for bragging rights. Some of the benefits youll enjoy when you have a higher score include:

Recommended Reading: Paydex Score Chart

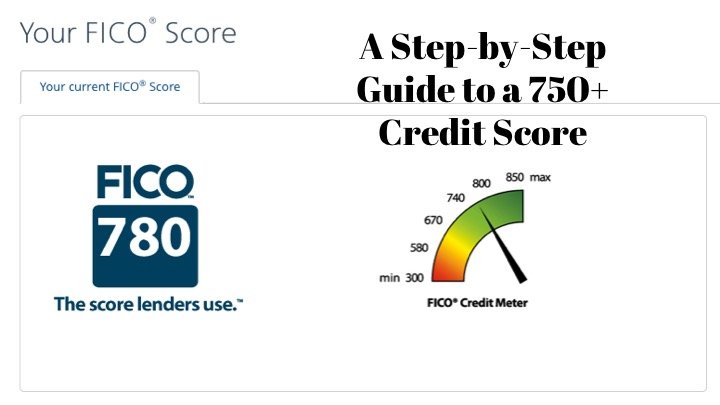

Measuring Your Credit Score

Measuring your credit score is something that has to be done. Every specific credit bureau has a different way of measuring the score. Some measure to 850 while others will measure to 830 and so on. Each one is different and while one might record one default on their records, another might not and so on.

With the three major credit reporting agencies: TransUnion FICO, Equifax and Experian, you can be sure that you have all of the information you need. Youre allowed to have a free print out of your credit score every year from each of these three bureaus. If youre ever curious about what is on your report or ways that you can find out what you can do to fix your report, printing a copy and reading it is the best way to find out more about it, as well as report anything that shouldnt be on the report.

How A Personal Loan Can Boost Your Credit Score

A personal loan that you repay in a timely fashion can have a positive effect on your credit score, as it demonstrates that you can handle debt responsibly.

Perversely, people who are most averse to taking on debt could have lousy credit scores. A person who never acquires debt and pays it off in installments has no payment history.

You can receive a free copy of your credit reports from the three credit bureaus every 12 months, which you can obtain by visiting www.annualcreditreport.com.

You May Like: Usaa Apply For Auto Loan

Don’t Miss: Pre Approval Hurt Credit Score

Credit Score: Is It Good Enough For Business Loans

Your credit score is a representation of your creditworthiness. The higher your score, the more creditworthy youre considered to be. If youve got a score of 750 or above, youre doing pretty well.

This gives you more access to loans, lower interest rates, financing options, and business opportunities. Understanding credit scores, how they operate, and what they mean are important aspects of your financial health.

Were going to look at credit scores today, giving you insight into everything you need to know. After we go through the essentials, well look at how your credit score might affect your ability to get business loans.

Lets get started and Learn if 750 Credit Score is Good Enough for Business Loans.

Contents

- Very Good: 750-799

- Exceptional: 800-850

As you can see, a credit score of 750 falls at the very bottom of the very good range. Its a great score, but theres still a lot you can do to improve it.

Better Chances For Approval

Many businesses use credit scores to determine whether to approve your application. When you have a poor credit score, there’s a greater chance your applications will be denied because creditors may consider you to be a risky borrower. With an excellent credit score, you have a much better chance of being approved since your credit history shows you’ve borrowed responsibly in the past.

Outside those circumstances, youll find its much easier to apply for credit cards and loans when you have an excellent credit score. However, you can quickly ruin an excellent credit score by making too many credit applicationsespecially in a short period of time.

Don’t Miss: Chase Sapphire Required Credit Score

Do You Need An 800 Credit Score

7-minute readSeptember 20, 2020

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Your credit score is a three-digit number that represents how well you manage debt. Your credit score plays a major role in your ability to get a personal loan, buy a home and open a new credit card. A high credit score is important but just how high does your score need to be?

Well take a closer look at the 800-point FICO® Score. Well show you what it means to have a credit score of 800 and whether you should work on improving your score. Well also give you some tips you can use to work your way toward a perfect 850 score.

How Your Credit Affects Your Lending Possibilities

Your credit score is one of the most important factors that lenders consider when youre applying for a loan.

This three-digit number is a reflection of your credit history and borrowing behavior, and it can have a big impact on your ability to get approved for a loan and the interest rate youll pay.

If you have a low credit score, you may find it difficult to get approved for a loan at all. And if you are approved, you may be offered a high-interest rate that will significantly increase the cost of your loan.

Conversely, if you have a high credit score, youll likely qualify for the best interest rates and terms available.

Your credit score is also taken into account when you apply for a mortgage or car loan.

Recommended Reading: Comenity Bank Shopping Cart Trick

Improving Your 750 Credit Score

A FICO® Score of 750 is well above the average credit score of 711, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 750, the average utilization rate is 31.8%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

Average Mortgage Interest Rate With A 750 Credit Score

Since credit scores serve as evidence that a person has managed debt well in the past, consumers with higher scores typically qualify for better interest rates and credit products. Credit scores are not the only factor in determining the interest rate you’ll pay on a mortgage, but they do play a big role. The following is an estimation of the annual percentage rate you could get on a 30-year, $300,000 mortgage with the following scores:

| Average Mortgage Rates by FICO® Score |

|---|

| FICO® Score |

Source: myFICO. Based on national average rates as of August 2020.

Read Also: Does Carmax Have Good Financing