Get Credit For Paying Monthly Utility And Cell Phone Bills On Time

If you are already responsible about making your utility and cell phone payments on time, then you should check out *Experian Boost. It’s a free and easy way for consumers to improve their credit scores. The way Experian Boost works is simple: Connect your bank account to Experian Boost so it can identify your utility, telecom and streaming service payment history. Once you verify the data and confirm you want it added to your Experian credit file, you’ll get an updated FICO® score delivered to you in real time.

Visit Experian to read more and register. By signing up, you will receive a free credit report and FICO score instantly.

Benefits From A Good Range Credit Score

If you have a good credit score, it may mean that you have a relatively short credit history but have managed your credit well. Alternatively, it may mean that you have a longer credit history with a few mistakes, such as occasional late or missed payments, or high credit usage rates. Lenders see people with scores like yours as good prospects for business. Most lenders are willing to extend credit to borrowers with good credit scores, although they may not offer the best interest rates, and card issuers may not offer the most rewarding loyalty bonuses.

Consumers with 670 credit scores have an average of 4.2 credit card accounts.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Read Also: What Should My Credit Score Be To Buy A House

Does Filing Bankruptcy Help Your Credit

For a while, bankruptcy hurts credit ratings, but so does amassing debt. In reality, for many people, bankruptcy is the only way to get out of debt and improve their credit score.

Your bankruptcy credit score will be lower. High credit scores are affected more than low scores. The sliding scale system will deduct as many points as needed to demonstrate that you have bad credit. If you already have bad credit, your bankruptcy credit score may barely reduce.

Take heart, after bankruptcy, you should be able to concentrate on improving your bankruptcy credit score 12 to 18 months after the filing. If the correct actions are taken, most people will experience some improvement after one year.

Fair Credit Vs Good Credit

Having fair credit generally puts you near the middle of credit score ranges. As scores improve, the numbers go up. Good credit scores are a step above fair scores. A good credit score with FICO falls within 670 and 739, while VantageScoreâs good range is from 661 to 780.

The better your credit, the better a candidate you may be for things like credit cards. But thatâs just the start. Having strong in a number areas:

- A higher credit score may improve your chances of qualifying for a credit card that best fits your situationâwhether youâre looking for a good rewards program or a low APR.

- Mortgages and other loans: Strong credit can also help you qualify for mortgages, auto loans and more.

- Interest rates: If you qualify for a loan or credit card, the lender may use your credit score when setting your interest rate or credit limit. Generally, a higher credit score may help you get better terms.

- Rental applications: Landlords may pull your credit report to help them decide whether you qualify for an apartment lease.

- Employment applications: With your written permission, employers may pull your credit reports during a background check.

- Insurance premiums: Depending on state laws, insurers may consider your credit history when determining premiums.

- Deposits: Cellphone providers and utility companies may decide to waive security deposits for people with strong credit.

Read Also: Is 666 A Good Credit Score

Personal Loans With A 670 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

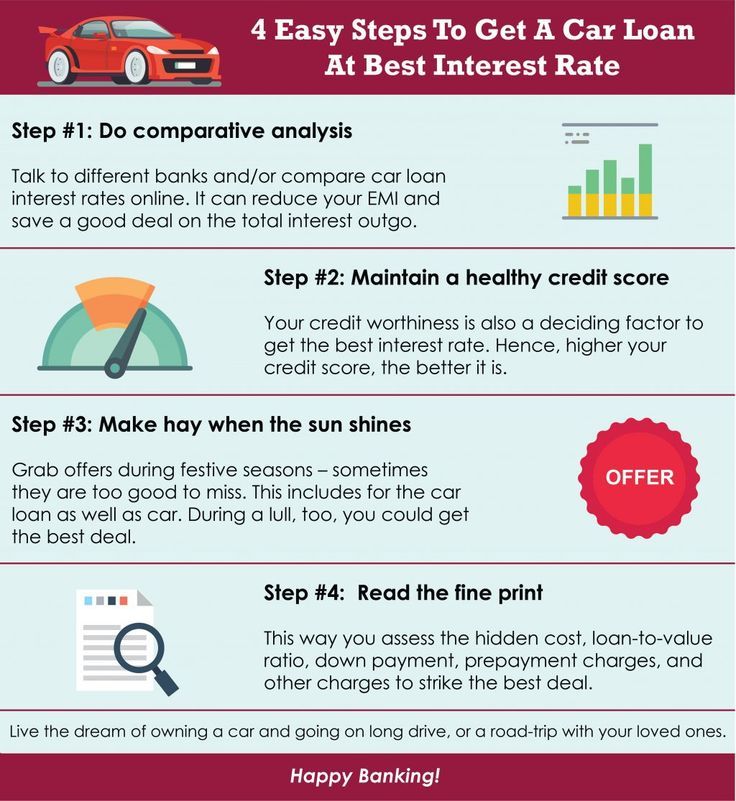

Can I Get An Auto Loan With A 670 Credit Score

If you have a 670 credit score, you will likely qualify for a relatively cheap auto loan. This is because there is less risk for the car lender, which means you get better rates. Taking out an auto loan with a 670 credit score shouldn’t be difficult. The best rates for auto loans are usually available to people with good-to-excellent credit, but what counts as “good” credit can vary from lender to lender. In addition to the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores. As you research the best credit card for your needs, pay attention to the score required. Since each application can temporarily nip a few points off your score, you want to make sure you’re likely to be approved. However, you should find plenty of choices of credit cards for a 670 score.

Also Check: What Happens When Credit Score Dropped During Underwriting

How Your 670 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

Can You Get A Mortgage With A 670 Credit Score In 2022

If your credit score is a 670 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s. Therefore, if you have a 670 or higher credit score, you should not be short on options.

The types of programs that are available to borrowers with a 670 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans. With a 670 score, you may potentially be eligible for several different types of mortgage programs.

You May Like: How To Increase Mortgage Credit Score

Learn More About Your Credit Score

A 670 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian. Read more about score ranges and what a good credit score is.

Lower Your Credit Utilization Rate

Your credit utilization rate is the percentage of your available credit that youre using. For example, if you have a single credit card with a limit of $1,000 and you owe $500, you have a credit utilization rate of 50%.

Generally speaking, the lower your credit utilization rate, the better for your scores. A good rule of thumb is to keep your credit utilization rate below 30% and even lower than that, if possible. A 50% rate is an example of a high credit utilization rate that could negatively affect your credit.

You can decrease your credit utilization rate by paying off debt . You can also lower your credit utilization rate by increasing the amount of credit available to you. One way to do that is by reaching out to your lender to ask for a higher credit limit or opening a new loan or credit line though you probably wont want to open too many too often, as that could have a negative impact on your credit as well.

Also Check: How Do You Freeze Your Credit Report

Monitor Your Credit To Boost Your Score

The last thing you want is for identity theft to throw a wrench in your plans if youre on the road to a better credit score. Its a good idea to use a credit monitoring service to keep tabs on your credit reports while you build positive credit habits.

A credit monitoring service alerts you whenever a new item appears on your credit report. This can help you track positive items that help you raise your score and stop identity theft before it can damage your score.

MoneyLion offers a credit tracking service that will allow you to view and track your score through the MoneyLion app without damaging your credit. It comes with the MoneyLion membership, which also offers a proven program for improving your credit with a credit builder loan of up to $1,000 and 0% APR Instacash advances.

What Is A Credit Score Anyway

Whenever you finance a purchase, you’re using credit rather than paying for it outright. This includes everything from your favorite store credit card to your car loan. Your credit score, which reflects the information on your credit report, directly impacts your ability to take out new credit.

Before lenders start handing over cash, they want to feel confident that the borrower can be trusted to repay the loan as promised. A stronger score basically tells lenders that you’re good for it, making you more likely to get approved.

Your credit score also affects the interest rates available to you . Higher rates equal higher costs.

Recommended Reading: Does Being A Loan Guarantor Affect Your Credit Rating

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Building Your Credit Score Of 670 In The Long Run

Once youve completed the steps above , its time to settle in for the long game. Review your knowledge of how to build your credit over time. Your 670 score provides a solid base to start from, and if you cultivate good, sustainable habits, its sure to improve even further.

To build your credit, be sure to:

- Add positive information to your credit reports by using your credit cards to make moderate-sized purchases and by paying off your credit cards in full every month. If you dont have any active credit accounts, you can apply for some weve listed several options that make sense given your credit score of 670 below.

- Take steps to get out of debt, especially high-interest debt. Having an active loan isnt a bad thing, but you should avoid credit card debt if at all possible.

- Add some of your regular bill payments to your credit reports using Experian Boost or a third-party service that lets you get credit for your monthly rental payments, such as PayYourRent or eCredable.

Boost your credit for FREE with the bills you’re already paying

5.0/5

No credit card required. Results may vary, see website for details.

Boost your credit for FREE with the bills you’re already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost

- Daily Experian credit monitoring and alerts

Don’t Miss: Is 760 A Good Credit Score

Fha Loan With 670 Credit Score

FHA loans only require that you have a 580 credit score, so with a 670 FICO, you can definitely meet the credit score requirements. With a 670 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

What Affects Your Credit Scores

So you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says make up a typical credit score:

- Payment history: How well youâve done making payments on time. Late or missed payments can reduce your credit scores.

- Debt: How much current unpaid debt you have across all your accounts. This can include credit card debt, car loans and many other types of debt.

- Reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans you have and what types of loans they are, such as revolving credit accounts or installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open and have used credit. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve recently applied for new credit. The effect on your scores might be minor, but a lot of new hard inquiries could still give a negative impression to lenders when they perform credit checks.

How Does FICO View Those Credit Factors?

How Does VantageScore View Those Credit Factors?

What Information Do Credit Scores Not Consider?

FICO’s and VantageScoreâs scoring models donât consider:

You May Like: How To Remove Collections From A Credit Report

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Credit Score: Good Or Bad

At a glance

670 is a good credit score. Scores in this range are high enough to get most types of credit, but you wont qualify for the best interest rates. Well explain what financing you can get with a score of 670 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or instantly boost your credit score for FREE with Experian Boost.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Also Check: How Long Will Judgement Stay On Credit Report