Negotiate Pay For Delete

If youre trying to remove a legitimate negative mark, your options are more limited. Youll need to contact your data furnisher and negotiate with them to remove the item.

If youre trying to delete information associated with a debt you havent yet paid, then you may be able to get your creditor or debt collection agency to remove it in exchange for payment. This method is known as pay for delete.

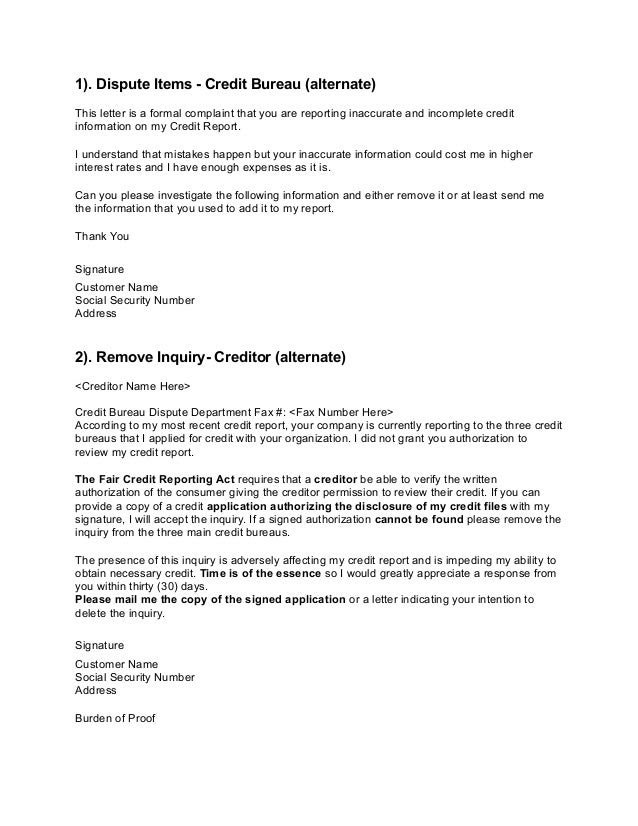

To negotiate pay for delete, use our free template to write a letter.

Pay for Delete Letter to Collector

Use this pay for delete letter template to ask a debt collection agency to remove a collection account from your credit report. Pay for delete works best on old debts in collection, so this is the scenario the strategy is most suited to.

Send your letter it to your creditor or debt collector . Watch for their reply, as they might write back with a counter-offer of some type.

You dont need to negotiate pay for delete for medical collection accounts

Starting from July 1, 2022, all paid medical bills in collections will automatically be removed from consumer credit reports. This means that you can delete medical collections yourself before 7 years have passed just by paying themtheres no negotiation required.

What Else Can Donotpay Do For You

Helping you write credit disputes and clean your credit report is just one of the many things that DoNotPay can do for you. If you needhelp canceling subscriptions or services, writing financial aid appeal letters, or helping with bills, let us help.

DoNotPay is here to answer questions and solve problems.

How Long Do Credit Bureaus Have To Process A Credit Report Dispute

Again, the answer lies in how you obtained your last credit report. If you went through AnnualCreditReport.com to get your free yearly report, the credit bureaus have 45 days to process disputes. The same is true if you sent supporting documentation separate from the initial dispute. In all other situations, the credit bureaus have only 30 days.

You May Like: Does Hsn Report To Credit Bureaus

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How To Dispute A Charge

The Fair Credit Reporting Act gives you numerous rights when it comes to the information on your credit reports. For example, you have the right to dispute an item on a credit report with which you disagree.

Disputing a charge-off is actually a simple process. The credit bureaus give you three potential ways to submit a dispute: via mail, online, or over the phone.

Also Check: Is Kornerstone Credit Legit

What You Can’t Change Or Remove

You can’t change or remove any information on your credit report that is correct even if it’s negative information.

For example:

- All payments you’ve made during the last two years on credit cards, loans or bills, whether you paid on time or not.

- Payments of $150 or more that are overdue by 60 days or more these stay on your report for five years, even after you’ve paid them off.

- All applications for credit cards, store cards, home loans, personal loans and business loans these stay on your report for five years.

For a full list, see what’s in your credit report.

Avoid credit repair companies that claim they can clean up this sort of thing or fix your debt. They may not be able to do what they say. They may also charge you high fees for things you can do by yourself for free.

Paying a credit repair company is unlikely to improve your credit score.

How To Dispute An Eviction On Credit Report

You can submit a dispute with the credit bureaus if theres some eviction-related information on your credit report that you believe isnt supposed to be mentioned. Youll have to submit a dispute to each credit bureau separately.

To do this, you can send a letter to the respective credit bureaus, including your complete information, proof of your claim, and an explanation of why you believe the information is disputed.

It must include requests to remove the information from your credit records. In addition, submit copies of documents provided by the courtcivil judges expungement records, debt settlement receipts, and eviction suitattached with the letter.

Recommended Reading: Does Opensky Report To Credit Bureaus

Read Also: Tax Id Credit Score

What Is The Credit Repair Organizations Act

dispute negative information found on your credit reports. But in the past, some of these companies would overstate what they could do for consumers to drum up business.

The Credit Repair Organizations Act is a federal law that became effective on April 1, 1997, in response to a number of consumers who had suffered from credit repair scams. In effect, the law ensures that credit repair service companies:

- Are prohibited from taking any payment from a consumer until they fully complete the services they promise.

- Are required to provide consumers with a written contract stating all the services to be provided as well as the terms and conditions of payment. Under the law, consumers have three days to withdraw from the contract.

- Are forbidden to ask or suggest that you mislead credit reporting companies about your credit accounts or alter your identity to change your credit history.

- Cannot knowingly make deceptive or false claims concerning the services they are capable of offering.

- Cannot ask you to sign anything that states that you are forfeiting your rights under the CROA. Any waiver that you sign cannot be enforced.

The CROA adds transparency and due diligence to the credit repair process, making it less likely that consumers will be taken advantage of. However, regulators have still found wrongdoing among credit repair companies.

How To Remove Negative Items From Your Credit Report By Yourself

At a glance

You dont need to hire a credit repair expert to erase bad credit. With a little guidance, you can remove negative marks from your credit report on your own.

Speak with our credit specialists today and start your path towards a better credit score.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Stains on your credit report can take a serious toll on your life by making it difficult to secure new loans, get good interest rates, or even land an apartment or get a job.

Many people with damaged credit turn to credit repair professionals for help. That isnt a bad idea, but the truth is, theres nothing a credit repair company can do for you that you cant do for yourself. Read on to learn how to repair your credit on your own.

Read Also: Syncb Ntwk

Errors By The Credit Provider

A credit provider may have reported information wrongly. For example, they:

- incorrectly listed that a payment of $150 or more was overdue by 60 days or more

- did not notify you about an unpaid debt

- listed a default while you were in dispute about it

- didn’t show that they had agreed to put a payment plan in place or change the contract terms

- created an account by mistake or as a result of identity theft

To fix this kind of error:

- Contact the credit provider and ask them to get the incorrect listing removed.

- If the credit provider agrees it’s wrong, they’ll ask the credit reporting agency to remove it from your credit report.

If you can’t reach an agreement, contact the Australian Financial Complaints Authority to make a complaint and get free, independent dispute resolution.

If you’re struggling to get something fixed, you can contact a free financial counsellor for help.

What Is An Eviction In Legal Terms

While the situations above describe reasons for a tenants removal from the property, eviction from a technical standpoint entails the landlord suing a renter for refusal to leave.

A few places allow landlords to employ self-help eviction tactics, like changing the locks on the property, but this is illegal in most places. If your landlord does this to you, make sure you check to see if this is legal. Otherwise, its time to contact the authorities.

Instead of locking you out, the landlord must usually go through the court system to file a lawsuit against you and obtain a writ of possession.

A law enforcement officer then posts the eviction notice on the property, giving a specific deadline of when it must be vacated. If the tenant is still there on the posted date, the law enforcement officer will physically remove the tenant and their belongings.

Recommended Reading: How Often Does Bank Of America Report To Credit Bureaus

Can You Pay To Have Your Credit Fixed

If your credit file has information you feel is incorrect, credit repair companies may offer to dispute the information with the credit reporting agencies on your behalf. Credit repair companies typically charge a monthly fee for work performed in the previous month or a flat fee for each item they get removed from your reports. However, Experian does not charge consumers or require any special form to dispute information, so this is something you can do on your own at no cost.

If you’re on a monthly subscription, the cost is typically around $75 per month but can vary by company. The same goes for paying a fee for each deletion, but that option typically runs $50 each or more.

That said, it’s important to keep in mind that credit repair isn’t a cure-alland in many cases it crosses the line into unethical or even illegal measures by attempting to remove information that’s been accurately reported to the credit bureaus. While these companies may try to dispute every piece of negative information on your reports, it’s unlikely that information reported accurately by your lenders will be removed.

And again, credit repair companies can’t do anything that you can’t do on your own for free. As a result, it’s a good idea to consider working to fix your credit first before you pay for a credit repair service to do it for you.

Why Pursue Credit Repair

Credit repair is critical to saving money on loans and credit cards, but that’s not the only reason to repair your credit. A better credit scorecomplemented by a pristine credit report, which can be viewed by a potential employer if youve given them permissioncan also help your cause when you’re trying to land a new job.

Likewise, if you dream of starting your own business or you want the security of knowing you can borrow money or increase your credit limit if you need to, you should repair your credit sooner rather than later.

Don’t Miss: What Credit Bureau Does Affirm Use

Build Up Your Positive Credit History

Adding positive credit activity to your credit report can be just as effective as erasing bad credit. Even with a very bad credit score, you can try the following approaches to start rebuilding your credit:

- Get a secured credit card: Unlike an unsecured credit card, secured cards are low-risk for credit card companies, so they usually come with little to no credit score requirements. This means you can get one even with a tarnished credit history.

- Get a : These loans are specifically designed for people with bad credit. As you make payments over time, your positive payment history will counteract any derogatory items on your credit report.

- Become an : If someone with a spotless payment history adds you to their credit card account as an authorized user, your credit file could quickly fill up with positive information as their entire account history is added to your credit reports.

- Get credit for rent or utilities: You can counteract the negative marks in your credit report by adding your on-time rent and utility payments. All you need to do is sign up for a rent-reporting service or bill-reporting service like Experian Boost.

What To Do If You Disagree With The Outcome Of Your Dispute

If you don’t agree with the results of your dispute, here are some additional steps you can take:

- Contact the information source. Your best next step is to contact the entity that originally provided the disputed information to Experian and offer proof their information is incorrect. The source may be the lender or financial institution that issued you a loan or credit, but it could also be a collection agency or government office. Contact information for each source appears on your credit report, and you can use it to reach out to them.

- Add a statement of dispute to your credit report. A statement of dispute lets you explain why you believe the information in your credit report is incomplete or inaccurate. Your statement will appear on your Experian credit report whenever it’s accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select Add a Statement from the menu of dispute reasons.

- Dispute again with relevant information. If you have additional relevant information to substantiate your claim, you can submit a new dispute. If you’re filing the dispute online, follow the steps listed above for using the Dispute Center, and use the upload link to provide your supporting documentation.

Don’t Miss: Does Paypal Credit Show Up On Credit Report

What Does It Mean To Repair Your Credit

A low makes it difficult to qualify for mortgages, auto loans, personal loans and credit cards. Even if you qualify, you may have to pay a higher interest rate than someone with a better score. The term credit repair refers to a set of steps that can be used to increase your credit score, making it easier to qualify for loans and credit cards with favorable terms.

The , part of the Consumer Credit Protection Act, gives you the right to work directly with credit bureaus to challenge inaccurate items on your report. If your score needs a boost, you can try to repair your credit yourself, or you can have a reputable credit repair company manage disputes on your behalf.

The Pros Know The Ins And Outs Of The Industry

It can be tricky to repair your credit yourself if you dont know your rights under the various consumer protection laws. Credit repair professionals understand the ins and outs of the Fair Debt Collection Practices Act, Fair Credit Reporting Act and Fair Credit Billing Act, giving them insight into the best way to improve your score within the shortest possible time frame. Their knowledge of these laws also helps them avoid some of the mistakes made by amateurs, improving your chances of having negative items removed from your credit reports.

Recommended Reading: When Does Capital One Report To Credit

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Keep Your Credit Utilization Ratio Below 30%

Your is measured by comparing your credit card balances to your overall credit card limit. Lenders use this ratio to evaluate how well you manage your finances. A ratio of less than 30% and greater than 0% is generally considered good.

For example, lets say you have two cards with individual credit limits of $2,000 and $500 of unpaid balances on one card. Your credit utilization ratio would be 12.5%. In this case, total your debt owed and then divide that by your total credit limit .

Also Check: What If My Credit Score Changes Before Closing

Your Rights With Landlords And Eviction Notices

Many states require the landlord to send an eviction notice alerting the tenant of the issue that may trigger an eviction. Then the tenant has a short period of time before the eviction process is in full effect â typically anywhere from three days to one month â to resolve it. During this phase of the legal process, the tenant should seek legal advice if thereâs an interest in challenging the eviction.

If the tenant canât catch up on rent payments or otherwise fix the problem, the landlord files the eviction paperwork in housing court. The housing court then provides a hearing date to both the landlord and tenant.

At the eviction lawsuit hearing, the landlord and tenant can present their cases and provide supporting documentation, including the original lease, correspondence between the landlord and tenant, etc.

If the landlord wins the eviction lawsuit, the renter will receive a court order to move out. The deadline to move out varies by state but is usually anywhere from a couple of days to a few weeks.