Option 2 Apply For A New Credit Card

Applying for a new credit card is also a tactic that could reduce your credit utilization ratio. By adding a new line of credit, youre essentially boosting your overall credit line, which can help if youre unable to quickly pay down existing credit card debt.

Before you apply, determine the following:

- What type of credit card you need. If you have poor or fair credit, youll want to consider a card meant to help you build a good credit history, such as a secured card. Secured cards require a deposit in the amount of your credit limit, and protect the issuer in case you default on the debt. On the other hand, if you have good credit or better, you could choose to apply for a card that earns rewards or offers an introductory APR period.

- If you prequalify for any cards. Some issuers such as American Express, Capital One, Chase and Discover allow consumers to check if they prequalify. While prequalification doesnt guarantee youll be approved once you apply, it does indicate a better chance.

How much will this action impact your credit score?

Much like requesting a credit limit increase, the amount that getting a new card can improve your credit score depends on the credit limit youre granted on the new card. The lower it brings your utilization, the better for your score.

Consider the following examples:

Ways Buying A Car Can Impact Your Credit

Whether buying a car negatively or positively impacts your credit will depend on how reliably you make your loan payments. When you first get an auto loan, you may see a slight dip in your credit scores because youre taking on a hefty new debt. However, as you begin making on-time payments on the loan, your credit score should bounce back.

Buying a car can help your credit if:

- You make all of your payments on time. Because payment history is the biggest factor in your credit score, making payments on time and in full should improve your credit score over time.

- It improves your . Lenders like to see a mix of revolving credit and installment credit in your credit history. Successfully managing a wide variety of credit accounts helps prove that youre creditworthy. If you currently have only revolving credit accounts, credit cards for instance, adding installment credit in the form of an auto loan could help boost your credit score.

However, buying a car could end up hurting your credit if:

Also Check: How To Clean The Inside Of Your Car

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: What Raises Your Credit Score

How Do You Build Or Establish Credit

As previously mentioned, payment history can significantly impact your credit score. If you have a thin credit file meaning you have few or no credit accounts and only a brief credit history then there may not be enough information in your credit report to calculate a credit score or it may be lower than you’d like.

If this is the case, you’ll need to take steps to establish a longer credit history before you can focus on improving your credit score.

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can raise your payment history going forward.

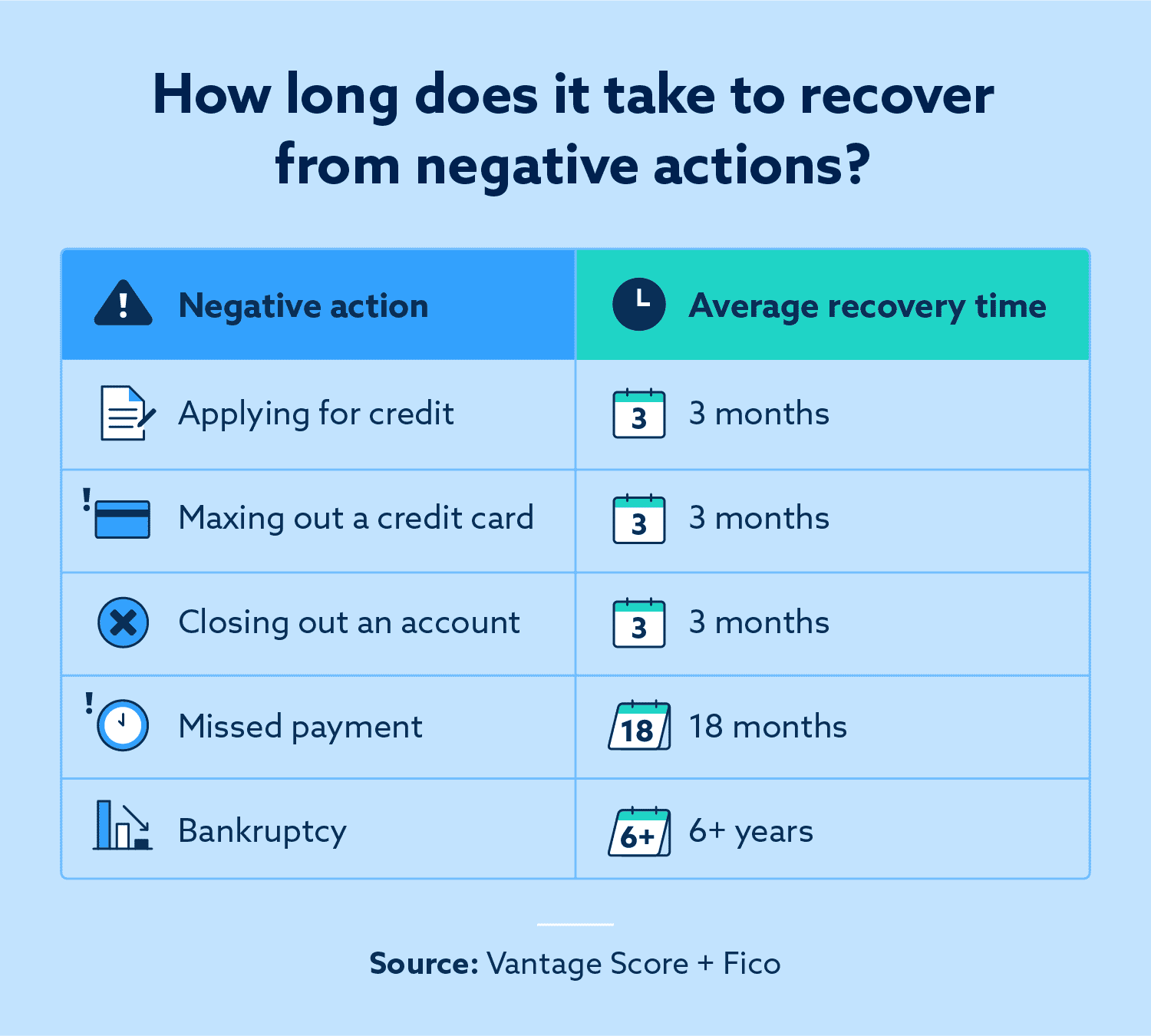

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Read Also: When Does Chapter 13 Bankruptcy Fall Off Credit Report

Get The Best Deal On A Car Loan

Before you sign on the dotted line for a car loan, be sure to compare multiple offers to get the best possible deal. Make sure to consider how much of a down payment you plan to offer, the interest rate you can qualify for, and what your target amount is for affordable monthly payments.

Having a manageable monthly payment can go a long way toward easing your stress over having a new debt to pay off. Not only do you want an affordable payment, but you also dont want your loan terms to last long. Consider reviewing the tips and tricks in this article and comparing potential car loans before applying for a new loan.

View Article Sources

Request Increased Credit Limits

Similar to becoming an authorized user, a credit limit increase is another way to lower your credit utilization ratio and, therefore, improve your credit. If you have a credit card already, you can call your card issuer to request an increase. These requests arent always approved, so here are some tips that may help with an approval:

- Request the increase with a bank you have history with

- Make sure you dont have missed or late payments

- Show that youre making additional income

- Show improvements in your credit score

Impact: High. Again, your credit utilization ratio is a major part of your credit score, so this is a very influential factor.

Potential speed for results: Fast. As long as you dont increase your credit usage before the next update to your credit report, this may have an effect pretty quickly.

You May Like: Why Do You Need A Credit Report

It May Take Time But An Auto Loan Can Raise Your Credit Score

You may see a quick credit score drop when you initially take out an auto loan. This is normal. As the life of your loan progresses, your on-time monthly payments could raise your score and start you on the track of building credit and developing a high FICO Score.

Want more personal finance tips and tricks delivered straight to your inbox?.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 to $300.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Read Also: What Is 11 Sprint On Credit Report

How Long Does It Take To Rebuild My Credit Score

There is no fixed time for rebuilding your score. Naturally, the lower your score, the longer it will take. A credit score of 750 is seen as the minimum required in order to have a good chance of qualifying for loans and avoiding rejection.

On average, it takes 4-12 months to reach a stage where you can become loan-eligible. If your score is between 650 and 700, it will take a few months to reach 750. If your score is less than 650, it will take more time.

There is no overnight quick fix for improving your score. Just like your health report, it takes some patience, changes in habits, and self-discipline to see results. Once you achieve a good score, the rewards are life-long.

Add To Your Credit Mix

An additional credit account in good standing may help your credit, particularly if it is a type of credit you don’t already have.

If you have only credit cards, consider getting a loan a can be a low-cost option. Check that the loan you’re considering adding reports to all three credit bureaus.

If you have only loans or have few credit cards, a new credit card may help. In addition to improving credit mix, it can reduce your overall credit utilization by providing more available credit.

Impact: Varies. Opening a loan account is likeliest to help someone with only credit cards and vice versa. And there’s more potential gain for people with few accounts or short credit histories.

Time commitment: Medium. Consider whether the time spent researching providers and applying is worth the potential lift to your score. Weigh what you’d pay in interest and fees, too, if you’re getting a loan or card strictly to improve your credit.

How fast it could work: Fast. As soon as the new account’s activity is reported to the credit bureaus, it can start to benefit you.

Someone with a low score is better positioned to quickly make gains than someone with a strong credit history. Paying bills on time and using less of your available credit limit on cards can raise your credit in as little as 30 days.

Someone with

Also Check: How To Check Credit Score Without Hurting It

Can You Have A 700 Credit Score With Collections

There is no easy answer when it comes to credit scores and collections. It is possible to have a 700 credit score with collections, but it is not guaranteed. Each situation is unique and will be evaluated on its own merits. However, generally speaking, collections can have a negative impact on credit scores. Therefore, it is important to work with a professional to understand all of the factors involved in your specific case.

In most cases, you can have a credit score of 700 or higher with a collection notice on your credit report, but this is not common. Over 50 different scoring models can be used by creditors, insurance companies, and rental agencies, according to the website. Each region has its own set of FICO scores. The credit scoring versions 3.0 and 4.0 have been improved, and paid collections have been calculated differently. Payments are generally positive, as shown by the results of the paid collections test in the FICO 9 version. Higher grades receive more coverage, as VantageScore places a higher emphasis on the upper end of the spectrum. Young borrowers can never have the same credit as an old borrower.

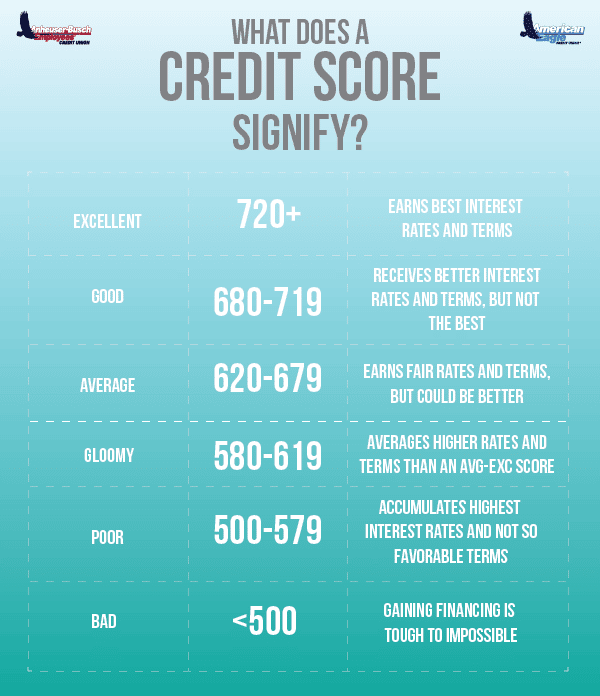

What Is A Good Credit Score

The nations three large credit rating agencies collect personal-finance data from numerous sources and weigh them using a formula to arrive at a number, called a FICO score, which comes on a scale of 300 to 850.

Any score above 750 tells the business world youre an excellent risk and you can borrow money at the most favorable interest rates.

Numbers between 650 and 750 are a gray area youll probably offered loans and credit, but probably not at the best rates.

Fall below 650 and you might find it difficult getting a loan or a credit line at an easily affordable rate.

The three credit-rating bureaus Experian, TransUnion and Equifax use their own methods for calculating scores, with results that arent identical, but are usually similar.

Key metrics are whether you are delinquent paying debts, the amount you owe, your payment history, the types of credit you have and the length of time in your credit history.

Rod Griffin, director of consumer education and advocacy with Experian, said the first step in improving your score is learning what the negatives are and taking steps to change them.

Resolving those negative issues will result in the most rapid improvement, Griffin said. Will that result in a 100-point change in a month? Thats unlikely but not impossible. If you have poor scores to start with, its a bit more plausible than for a person with high scores.

Don’t Miss: How To Fix Missed Payments On Credit Report

How Does A Car Loan Impact Your Credit

Before we can discuss how to raise your credit score by getting a car loan, we need to understand how exactly a car loan impacts your credit in the first place. There are actually several different ways that bringing a new loan onto your credit report can change your overall number.

First, youll be diversifying your credit mix. Your credit score takes several factors into account, including loans like student loans, car loans, credit card debt, and more. Having several different types of loans on your credit report and paying them back successfully can help prove to creditors that you are a safe bet when it comes to loaning money.

Youll also be adding a new line of credit to your account. Though you may experience a small dip in your credit score at first, you will soon see that your score increases as you continue to make your payments on time.

Understand Credit Score Factors

Before you can learn how to build credit, the best thing you can do is understand the factors that comprise your credit score. Understanding how credit scores work allows you to avoid harming your score and know which factors to focus on. Most companies looking at your credit report use the FICO® scoring model, which uses the following five factors. Each one is weighted differently:

- Payment history : How frequently you make your payments in full and on time

- The ratio of the total amount you owe compared to your max credit limit

- The average age of your lines of credit

- How many forms of revolving and installment credit you have

- New credit : How often you apply for new lines of credit

Impact: High. Knowing how your score is weighted lets you focus on the most important factors, like payment history and credit utilization, first.

Potential speed for results: Average to fast. This is the foundation for boosting your score and will help you incorporate the other tips faster.

Read Also: Which Credit Score Is Used For Home Loans

Ask To Have Negative Entries That Are Paid Off Removed From Your Credit Report

You may have a series of late payments on your credit report, or perhaps an old collection account that’s since been paid off still shows up. If this is the case, ask to have them removed.

This step may take more time and effort on your end, but it could be worth it. Triggs suggests speaking to the collections agency, debt buyer or original creditor to remove a paid-off account from your credit report.

“You’d most likely have better results using this method with collection agencies or debt buyers versus the original creditor,” he says.

Try to convince them to not only show the account as paid, but to remove the account altogether, which could have a much bigger impact on your credit score. “Having even a paid collection account or paid charge-off on your credit report could deter creditors in issuing you future credit at all,” Triggs says.

Establishing A Credit History And Good Credit Scores Takes Time But There Are Steps You Can Take That May Help

Building credit can be important to your financial health, but it doesnât happen overnight. And even once youâve built your way to better scores, youâll need to show responsible credit use to maintain them.

So how long does it take to build a credit history? The short answer is that it depends on several factors. But thereâs information that can help give you a better idea of the timing.

You May Like: Does Requesting A Credit Report Hurt Score

Option 3 Pay Your Card Off With A Personal Loan

A quick way to zero out your credit card debt and boost your credit utilization ratio could be achieved by paying it off with the proceeds from a debt consolidation or personal loan. Personal loans are issued by banks, credit unions and online lenders.

Using a personal loan to pay off high-interest credit card debt has the benefit of giving you a set monthly payment and a set repayment time period. It also reduces your credit utilization, because a personal loan is considered installment credit rather than revolving credit and doesnt count toward your utilization rate.

Plus, having a personal loan as well as a credit card can improve your credit mix, which accounts for 10% of your credit score.

The interest rate for a personal loan typically ranges from 5% to 36%. Note that some lenders may charge fees for example, an origination fee when you take out the loan, or a prepayment fee if you pay the loan off early.

How much will this action impact your credit score?

Applying for a personal loan does generate a hard inquiry, which typically decreases your score anywhere from 5 to 10 points. However, the inquiry will fall off your credit reports in two years and once the loan funds have been used to pay off all or most of your credit card balance, having a decreased utilization rate should improve your credit score significantly.