How Much Will Credit Score Increase After Bankruptcy Falls Off

Your credit score will increase by 50 to 150 points after a bankruptcy is removed from your credit report. The removal of bankruptcy can dramatically increase your credit score because bankruptcy is the most negative item that can appear on your credit report. The amount of points your credit score will increase depends on other items you have on your credit report.

If you have other negative items bringing down your credit score, you might not see a huge increase. But if nothing else is affecting your credit score, the removal of bankruptcy will likely result in a huge increase in your credit score.

If, after filing for bankruptcy, you open new accounts, make all of your payments on time, you should see a substantial increase in your credit score once the bankruptcy is removed from your credit report.

Many people have reported that their credit score has increased by 50 to 150 points after the bankruptcy fell of their credit report. That said, some saw a 50 point increase, others saw a 91 point increase, and others experienced a 150 point increase. So, your point increase will vary depending on the information in your credit report.

If, after filing for bankruptcy, you opened new credit cards, racked up a lot of new debt, and missed payments on your account, you will be hurting your credit score and the removal of a bankruptcy would have little to no impact on your credit score because the new derogatory information will drag your credit score down.

How Long Does Inactive Debt Affect Your Credit Score

Bankruptcy is the scarlet letter on your credit report that can cause lenders to avoid you like the plague. Fortunately, bankruptcy does not stay on your credit report forever. The Fair Credit Reporting Act dictates that bankruptcy stays on your credit report for 10 years after your file. While that is a long time, bankruptcy does not automatically disqualify you from obtaining credit while you wait for it to come off your credit report.

Turning Your Financial Picture Around

Before you start thinking about when you might be able to get that next or line of credit again, its important to make sure you correct whatever behaviors got you into trouble in the first place.

First and foremost, and most people dont realize this, before getting back into the credit game or applying for anything, make sure your financial habits are fixed, said Exantus. Whatever you did that required filing bankruptcies, you now need to establish good financial habits. That includes things like paying yourself first, saving money, creating an emergency fund. All of these things are so directly tied to credit and the ability to manage credit and money.

Read Also: Does Student Debt Affect Credit Score

Chapter 13 Bankruptcy And Your Credit

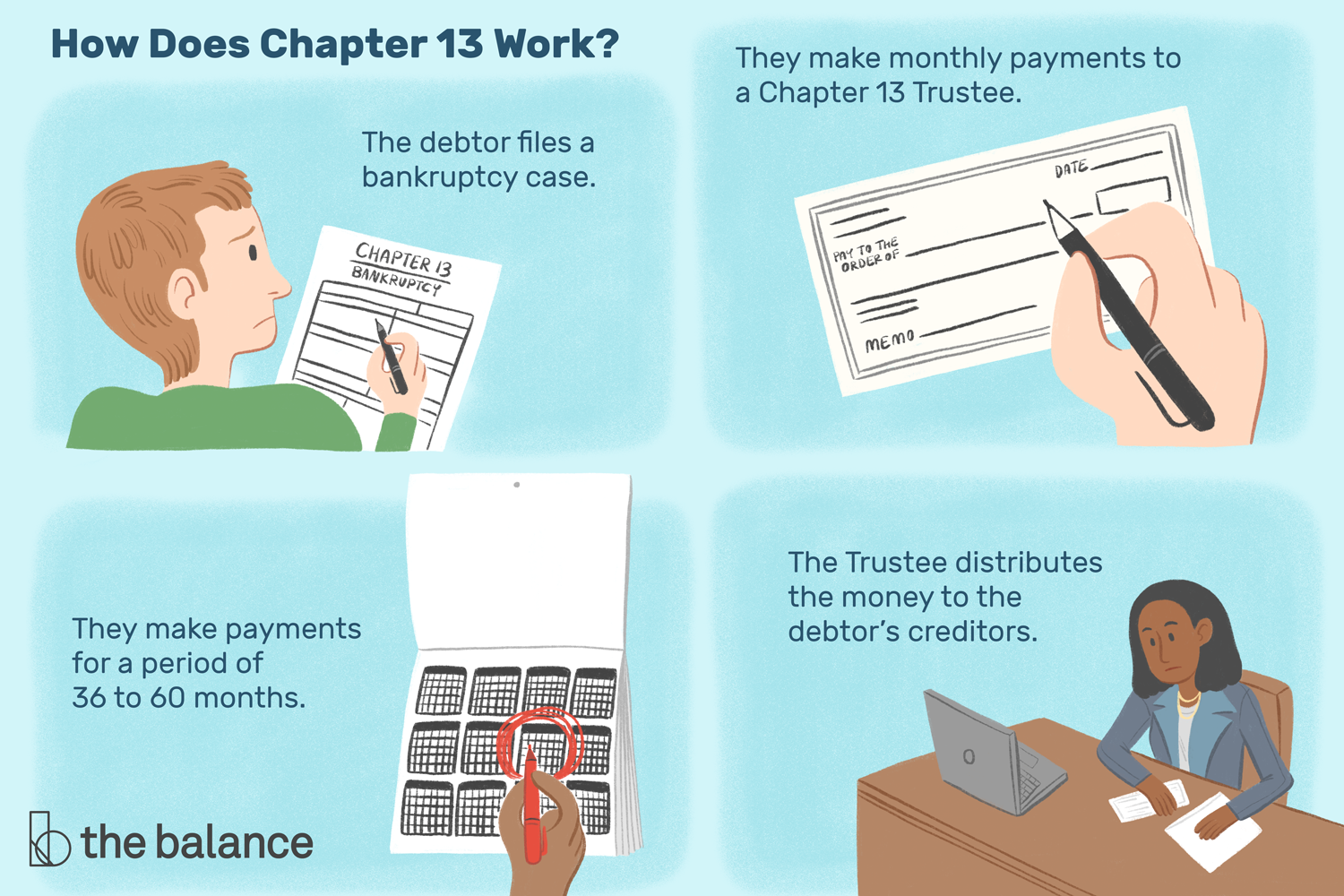

Filing for bankruptcy in any form will have an adverse impact on your credit rating for as long as it appears on your credit report. However, filing under Chapter 13 if you have the ability to reorganize your finances may cause less damage than filing under Chapter 7 and allow you to regroup faster. This is because Chapter 13 provides a greater opportunity for you to pay your debts. Instead of exempting or liquidating your assets, as you would under Chapter 7, you will make monthly payments that will be distributed to creditors. Unless your Chapter 13 plan does not include paying unsecured debts, a future lender will be less concerned about the bankruptcy on your record and the risk that a potential loan will not be paid back.

On the other hand, filing for Chapter 13 instead of Chapter 7 probably will not greatly affect your credit score. Most people who are filing for bankruptcy have experienced significant financial difficulties for a long time, so they probably do not have a strong credit score. It may be so low already that filing for any type of bankruptcy will not have a significant impact. If it is not very low, it will drop sharply regardless of which chapter you use.

The and debtor education courses required of all filers may provide useful information about rebuilding credit.

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Dont Miss: How Long After Filing Bankruptcy Can You Buy A Home

Also Check: Is 618 A Good Credit Score

How To Remove Bankruptcy From Your Credit Report

As frustrating as it is, theres nothing you can do to get a bankruptcy off your credit report early unless its a credit reporting error. The normal methods of removing negative items from your credit report arent applicable to bankruptcies.

All negative items on your credit report, including bankruptcies, will eventually be removed , but you cant speed up the process.8

The rare exception is if the bankruptcy is an error. If theres a bankruptcy on your credit report that you never actually filed, you can file a dispute with the credit bureaus that are reporting it to have it removed. If the bureau confirms that the bankruptcy is a mistake, they will remove it from your reports.

If you did actually file for bankruptcy, then dont worry. Even though you cant get it removed early, there are things you can do to mitigate the damage it has on your credit and finances.

The best thing you can do is make sure that you consistently make on-time payments for all of your bills from now on. Payment history is the biggest factor influencing your credit score, accounting for 35% of your FICO score.

Here are some other steps you can take to improve your credit over time:

- Try to keep your as low as possible.

- Apply for a secured credit card or .

- Consider asking a family member with good credit to either cosign a loan for you or add you as an on one of their credit card accounts.

Q: I Am Having Trouble Renting An Apartment Because Of A Dismissed Chapter 13 Bankruptcy Can It Be Removed From Credit Reports Since I Did Not Continue With It And The Debt Has Since Been Paid In Full

A: A discharged bankruptcy means you have satisfied the debts included in the Chapter 13 BK and that creditors will not further pursue you for payment. In addition, discharged debts listed on your credit report must be listed as discharged. This will either lower or eliminate your overall debt making you are better credit risk.

When a Chapter 13 has been dismissed, creditors can immediately pursue you for payment again in addition to initiate or continue with court litigation for payment which causes potential new creditors to deny you.

Even if you pay the debt, potential creditors are still going to look at a dismissed bankruptcy more negatively than a discharged bankruptcy. Unfortunately, when you attempt to get new credit with a dismissed bankruptcy its going to be more difficult.

Most creditors, lenders and rental companies want to see a discharged bankruptcy. Its great that you paid the debt but ironically theres no benefit to your credit profile for doing so.

Once a bankruptcy is filed it is almost impossible to un-ring the bell. But because a discharged Chapter 13 stays on your credit report for 7 years and dismissed Chapter 13 stays on your credit report for 10 years I suggest several strategies:

To Credit Bureaus:

Any case, civil or otherwise, which is dismissed no longer exists in the eye of the law and a case filed may never have actually been adjudicated. Therefore, you have no right to maintain information which the government has deemed nonexistent.

Don’t Miss: Is 815 A Good Credit Score

Review Your Credit Reports

Monitoring your credit report is a good practice because it can help you catch and fix credit reporting errors. After going through bankruptcy, you should review your credit reports from all three credit bureausExperian, Equifax and Transunion. Due to Covid-19, you can view your credit reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to see if all accounts that were discharged after completing bankruptcy are listed on your account with a zero balance and indicate that theyve been discharged because of it. Also, make sure that each account listed belongs to you and shows the correct payment status and open and closed dates.

If you spot an error while reviewing your credit reports, dispute it with each credit bureau that includes it by sending a dispute letter by mail, filing an online dispute or contacting the reporting agency by phone.

Checking A Credit Report For Accuracy

Its prudent to review your credit report from time to time, even if you arent considering bankruptcy. One way to check is by taking advantage of the free copy from each of the three major credit bureausExperian, TransUnion, and Equifaxthat youre entitled to once per year at no cost. The website for ordering your credit reports is www.annualcreditreport.com.

Its important to review all three carefully because not all creditors report to all three agencies. A few months after filing your bankruptcy, each of your creditors should notate that the account was included in bankruptcy. If not, its a good idea to have that corrected because any line item that appears open but unpaid could lead a potential lender to believe that youre still responsible for paying that debt.

Your credit report should also identify whether your Chapter 7 bankruptcy case was discharged or dismissed. A successful bankruptcy that leads to a discharge has a different effect on a potential lenders decision to grant you credit than if the bankruptcy had been dismissed, leaving your account liability intact.

Its a good idea to address any errors you see as soon possible. You can do this by disputing the item, either through the credit bureaus website or by sending a letter directly.

Read Also: What Information Is On A Soft Pull Credit Report

Reporting Debts As Discharged In Bankruptcy

While it might be daunting to think about a bankruptcy filing showing up on your for ten years, it might not be as bad as you think. A bankruptcy discharge can help you clean up debt much faster than youd be able to do yourself.

For instance, instead of a delinquent or unpaid debt lingering on your report for years, it will show as being discharged as part of your bankruptcy. In fact, creditors wont be able to report your debt in a variety of ways that could cause your credit to suffer, such as allowing the obligation to show as:

- currently owed or active

- having a balance due, or

- converted to a new type of debt .

Such reporting labels are often the reason creditors deny applicants credit. In some cases, applicants must pay off such debt as a condition of loan approval. Instead, when you pull your report, each qualifying debt should be reported as:

- having a zero balance, and

- discharged, included in bankruptcy, or similar language.

Unfortunately, some creditors dont update information to the credit reporting agencies. This tactic could be a way to get you to pay up, even though you no longer legally owe the debt. If your credit report shows an improperly labeled discharged debt, youll want to take steps to correct the problem.

Chapter 13 Bankruptcy And Your Credit Score

As addressed earlier, Chapter 13 bankruptcy wont hurt your credit score quite as much as Chapter 7. That being said, if your credit score is higher, then Chapter 13 will most certainly bring it down. Filing for Chapter 13 has to be a well-thought-out decision. If your credit is already bad, then it doesnt matter. If your credit is decent, then it might.

As a baseline, if your credit score is around 650 or better, the Chapter 13 is likely to drop it into the 550 range. But if youre missing payments and your credit score is down to around 600 , it may be time to consider it.

You May Like: Does Getting A Credit Report Hurt Score

Early Removal Of A Bankruptcy From Your Credit Report

When you file for bankruptcy, it will appear on your credit history. Chapter 7 bankruptcy cases stay on your credit report for 10 years and Chapter 13 cases stay on for seven years. After this time passes, the bankruptcy should disappear from your credit report automatically.

Creditors are required by law to only report accurate information to credit bureaus. This requirement protects consumers from having any inaccurate information on their reports that would unfairly harm their credit. But this also prevents information from being removed when it is correct. So when you have a bankruptcy case on your credit report and itâs accurate, it canât be removed early.

That said, if the bankruptcy entry has incorrect information or has been wrongly entered, you have the right to dispute it. The Fair Credit Reporting Act gives you the legal right to dispute inaccuracies and errors on your credit report. If you challenge an entry and the agency that reported the entry canât defend it, then theyâre required to remove it.

How Bankruptcy Is Removed From A Credit Report

Oct 7, 2021Bankruptcy

When people file Chapter 7 and 13 bankruptcies, theyre usually focused on filling out all of the necessary paperwork and after all is said and done, on rebuilding their credit. They rarely think much about when and how the bankruptcy falls off their credit report. Its been almost 10 years since I filed Chapter 7. What do I need to do to get it removed from my credit on the 10-year anniversary?

In the above situation, usually the debtor doesnt need to do anything to have their Chapter 7 bankruptcy removed from their credit report. Why? Because, Chapter 7 and 13 bankruptcies and all of the included or discharged debts are deleted automatically after a specified period of time passes.

Also Check: How Many Times Has Trump Filed For Bankrupsy

Recommended Reading: How Close Is Credit Sesame Score To Fico

What Is Secure Debt In Athens Georgia

New secured debt has a similar effect. Our Athens bankruptcy lawyers have professional partnerships with lenders who work with bad credit borrowers. So, buying a car or even a house shortly after bankruptcy is a real possibility. Your buying choices might be limited, and you might pay a higher interest rate than other borrowers, but the bank will say yes.

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

Don’t Miss: How To Dispute A Missed Payment On Credit Report

Can A Bankruptcy Come Off My Credit Report Early

A legitimate bankruptcy record cannot be removed from your credit report, but a bankruptcy can come off your report if it is inaccurately entered or otherwise incorrect.

The FCRA makes provisions for challenging anything on your credit report that is incorrect, has remained on your credit report beyond the maximum time allowed, or cannot be substantiated by the creditor who reported it.

In the case of bankruptcies especially because they remain on the credit report for so many years its not uncommon for errors to creep in.Some of the most common errors we find include:

- Debts that were discharged in the bankruptcy are still showing a balance.

- Individual accounts included in the bankruptcy are still appearing on the report after seven years. In both Chapter 7 and Chapter 13 bankruptcies, the individual affected accounts can only impact your report for seven years starting from original delinquency date, not the filing date of the bankruptcy in which they were discharged.

- The bankruptcy is still showing up on a report more than 10 years after the filing date.

- Any sort of material error in how the bankruptcy was reported, from the spelling of names to accurate addresses, phone numbers, dates, etc.

If any of these or other errors appear on your credit report, you have the right to challenge those errors. The reporting agency must remove them if the reporting agency cannot substantiate the item.

Dont Miss: How To File For Bankruptcy In Massachusetts

What If Your Bankruptcy Has Been Discharged But Is Still Showing Up On Your Credit Report

Credit bureaus are required to stop showing a bankruptcy seven years after the filing date for Chapter 13 and 10 years after the filing date for Chapter 7. If you notice that your bankruptcy hasn’t been removed from the public records area of your credit reports, you should treat this like any other reporting error and dispute it with the credit bureaus. The credit bureaus are required to respond within 30 days.

As for the accounts included in your bankruptcy? They wont be erased at your filing day, either, according to the three major credit bureaus Experian, Equifax and TransUnion. You can expect closed accounts with delinquencies to be deleted from your credit history about seven years after the account went delinquent and was never brought current. Closed accounts without a negative payment history can stay on your reports for up to 10 years.

Don’t Miss: What Is The Lowest Credit Score