Factors That Affect Creditworthiness

- When you apply for credit, lenders look at your , which includes information such as open loans and lines of credit, balances, credit limits, payment history, credit inquiries and public records.

- Creditors may consider a version of your , which is basically a grade for the contents of your credit report, ranging from 300 to 850. You should aim for a score of at least 700, which is good credit.

- Income In some cases, high income can compensate for a bad credit score. If youre making lots of money, your ability to borrow and pay back larger amounts increases, unless you already owe a lot. One comparison lenders usually make is the ratio of your income to your debt. The better that ratio, the better positioned you are for making payments on new debt.

- Assets Assets are any valuable property you own, such as houses, cars or stocks. If your assets have a lot of value, lenders know you can use them to settle debts.

- Debts How much you owe affects how much you can borrow. Not only will debt bring down your credit score in many cases, but it also makes creditors doubt how capable you are of paying them back.

- Liabilities Liabilities are amounts of money that you will be obligated to pay in the future. They are not necessarily debts, but they are any agreements that will reduce the amount of money you have later on.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Improving Your 5 Cs: Conditions

Conditions are the least likely of the 5 Cs to be controllable. Many conditions such as macroeconomic, global, political, or broad financial conditions may not pertain specifically to a borrower. Instead, they may be conditions that all borrowers may face.

A borrower may be able to control some conditions. Ensure you have a strong, solid reason for incurring debt and be able to support how your current financial position supports it. Businesses, for example, may need to demonstrate strong prospects and healthy financial projections.

Recommended Reading: What Is A Hard Inquiry On Your Credit Report

How Your Credit Report Is Maintained

TransUnion, Equifax and Experian are the three bureaus that maintain credit reports. They issue credit reports to creditors, insurers and others businesses as permitted under law.

When you apply for any new line of credit – for example, a new credit card – the creditor requests a copy of credit report from one or more of the credit bureaus. The creditor will evaluate your credit report, a credit score, or other information you provide to determine your credit worthiness, as well as your interest rate. If you’re approved, that new card – called a tradeline, will be included in your credit report and updated about every 30 days.

Tens of thousands of credit grantors – retailers, credit card issuers, banks, finance companies, credit unions, etc. – send updates to each of the credit reporting bureaus, usually once a month. These updates include information about how their customers use and pay their accounts.

Put Your Best Foot Forward

Securing credit often involves a lot of scrutiny. For lenders, though, checking your credit isn’t about being invasive or judgmental: They just want to reduce their financial risk by verifying that your credit history and finances match up with requirements for the loan or credit card they’re offering. Understanding what lenders are looking for, then checking your credit score and and looking for ways to put your best foot forward can help you secure the loan you wantand maybe help you breathe a little easier during the approval process.

Don’t Miss: What Makes You Have A Bad Credit Rating

What Can I Do To Improve My Credit Score

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

Improve Your Credit Score

Because your credit score is calculated from the information on your credit report, there are several ways consumers can improve their score. Here are a few tips:

- Regularly check your credit report for inaccuracies and contact the credit bureaus to correct errors. Learn more in this Officeâs publications entitled and The Credit Handbook.

- Pay your bills on time. Signing up for automatic payments on the lenderâs website or through your bank will help prevent late or forgotten payments. Also, pay more than the minimum due if you are able.

- Talk to your creditors about a temporary payment plan if you think you will have trouble making payments. Many creditors are willing to work with borrowers to keep accounts current.

- Be careful not to apply for too much credit at one time. Taking on a new car loan and mortgage at the same time may negatively affect your credit score. Opening lots of new credit cards to take advantage of promotions or discounts will also hurt your credit score.

- You may correct errors on your credit report for free. There are several non-profit organizations that offer free credit counseling. You may contact two of these organizations as follows:

Lutheran Social Services Financial Counseling424 West Superior Street, Suite 600Duluth, MN 55802

Also Check: Is 757 A Good Credit Score

How To Improve Your Credit Before Applying

Before applying with a lender, start by checking your credit score and report. This will give you a better idea of what types of loans and credit cards you might qualify for. You can access your Experian FICO® Score and for free at any time, or sign up for free credit monitoring with alerts that let you know when changes have been made to your credit file.

Unless your credit score is already top-tier, there’s always room for improvement. And moving from “good” to “very good” credit, for example, may open the doors to lower interest rates, more favorable terms or simply a better chance of approval. Although there’s no quick fix for your credit, there are steps you can take to bring your credit score up. Here are a handful of tips to consider:

The same advice holds if you don’t have much of a credit historyor your credit file is “thin” . It may take time to build the credit score you aspire to, so start working on it now. Building good credit from scratch may take multiple steps. You may need to begin with a secured credit card or start with a . Over time, as long as you manage your credit responsibly and continue to make all payments on time, your positive credit history will populate your credit report and build up your score.

Improving Your 5 Cs: Capacity

You can improve your capacity by increasing your salary or wages or decreasing debt. A lender will likely want to see a history of stable income. Although switching jobs may result in higher pay, the lender may want to ensure your job security is stable and your pay will continue to be consistent.

Lenders may consider incorporating freelance, gig, or other supplemental income. However, income must often be stable and recurring for maximum consideration and benefit. Securing more stable income streams may improve your capacity.

Regarding debt, paying down balances will continue to improve your capacity. Refinancing debt to lower interest rates or lower monthly payments may temporarily alleviate pressure your debt-to-income metrics, though these new loans may cost more in the long run. Be mindful that lenders may often be more interested in monthly payment obligations as opposed to full debt balances. So, paying off an entire loan and eliminating that monthly obligation will improve your capacity.

You May Like: What Does Transunion Credit Report Show

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Improving Your 5 Cs: Collateral

You may improve your collateral by simply entering into a specific type of loan agreement. A lender will often place a lien on specific types of assets to ensure that they have the right to recover losses in the event of your default. This collateral agreement may be a requirement for your loan.

Some other types of loans may require external collateral. For example, private, personal loans may require placing your car as collateral. For these types of loans, ensure you have assets you can post, and remember that the bank is only entitled to these assets if you default.

Also Check: What Is The Ideal Credit Score To Buy A House

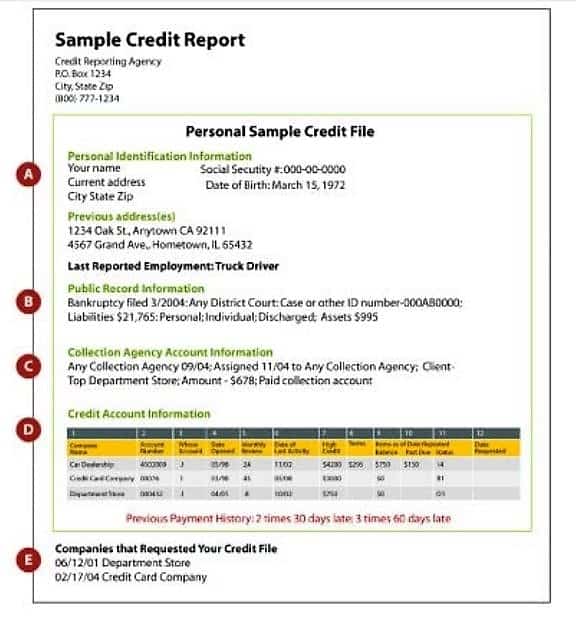

What Lenders Look At On Your Credit Report

Your credit report provides a detailed record of how you manage credit. For lenders who are just getting to know you, a credit report tells a lot about your experience with various kinds of credit. The best way to visualize what your credit report says is to check it yourself. You can access your credit report for free from all three credit bureaus at AnnualCreditReport.com or get a free Experian credit report anytime. You can also read up on what a typical Experian credit report contains. A few highlights:

- Personal information, including any names associated with your credit, current and past addresses and date of birth

- Current and past employers that have been listed on past credit applications

- Open loans and revolving credit accounts with credit limits, dates of late payments and current status

- Collection accounts, both open and resolved

- Bankruptcies, which are the only public record listed on your credit report

- , including those from prospective lenders and credit card issuers

Lenders don’t necessarily expect to see a flawless credit report. But a history of late payments, accounts in collections or a flurry of recent credit inquiries can raise red flags, lower credit scores, and may disqualify you from getting the best rates and terms or from being approved at all.

What Is Creditworthiness

Creditworthiness, simply put, is how worthy or deserving one is of credit. If a lender is confident that the borrower will honor her debt obligation in a timely fashion, the borrower is deemed creditworthy. If a borrower were to evaluate their creditworthiness on her own, it would result in a conflict of interest. Therefore, sophisticated financial intermediaries perform assessments on individuals, corporates, and sovereign governments to determine the associated risk and probability of repayment.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

Why Is Credit Important

And your credit history can play an important role in whether lenders will approve you for a loan or credit card, as well as what interest rate youâll be charged on the money you borrow.

But banks and lending institutions arenât the only ones that might consider your credit history. Landlords, insurance companies and even employers are just a few examples of the types of entities that may make decisions based on your credit.

Because credit can play such a huge role in shaping your overall financial profile, itâs important to develop good credit habits. The Consumer Financial Protection Bureau has some helpful tips that can help you build and maintain good credit scores over time.

You can also monitor your credit with . Itâs free to sign up, and you donât have to be a Capital One customer. And using it wonât hurt your credit scores. You can also visit AnnualCreditReport.com to learn about how to get free copies of your credit reports.

When Youre Buying A Home Your Credit Matters

If you are in the market to buy a home, lenders will use your credit scores to decide whether theyre willing to lend to you and at what interest rate.

Dont apply for any more credit than you absolutely need. If you can, avoid applying for new accounts or adding significantly to your debt. Your credit score may decline if you have too many new account requests or too much new debt. However, when you request your own credit report, those requests will not hurt your score. And when you shop for a mortgage with multiple lenders, the additional credit checks wont hurt your credit so long as they happen within a short window of time, roughly 45 days.

Remember that everyone, regardless of credit score, has the right to shop around for the best mortgage for their financial situation. Checking your credit history, fixing any errors, and knowing your credit scores will put you in the best possible shape for getting a mortgage.

Weve got a lot of information on our site already to help you get started.

- Visit “Buying a House” to help you navigate the process all the way to closing.

- Check out Ask CFPB, our database of common financial questions.

- Ask us questions. Well feature some of the most frequently-asked questions on our blog this spring.

Read Also: What Credit Score For Best Buy Card

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lenders decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used.

- Excellent: 800850

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit that you take out.

A persons credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers scores, especially when deciding whether to change an interest rate or on a credit card.

What Is A Credit Score?

What Is The Purpose Of Credit Risk Analysis

The main purpose of credit risk analysis is to quantify the level of credit risk that the borrower presents to the lender. It involves assigning measurable numbers to the estimated probability of default of the borrower.

Credit risk analysis is a form of analysis performed by a credit analyst on potential borrowers to determine their ability to meet debt obligations. The main goal of credit analysis is to determine the of potential borrowers and their ability to honor their debt obligations.

If the borrower presents an acceptable level of default risk, the analyst can recommend the approval of the credit application at the agreed terms. The outcome of the credit risk analysis determines the risk rating that the borrower will be assigned and their ability to access credit.

Recommended Reading: How Long Before Something Falls Off Your Credit Report