How Often Is My Credit Report Updated

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it’s important to also know that most lenders report changes in account status, such as payments you’ve made or whether you’ve fallen behind, on a monthly basis. If you make a payment on one of your accounts, it’s possible that the payment won’t appear on your credit report for up to 30 days.

Checking Your Credit Report

Experts recommend that consumers request a credit report at least once a year from each of the three major bureaus to check for inaccurate information and evidence of identity theft. If you stagger your requests , you are pulling a credit report more frequently to check for errors and evidence of identity theft. People with negative information in their credit file also want to check that it has been removed after 7 years from the delinquency date or 10 years after bankruptcy. It is also a good idea to check your credit report before applying for a substantial loan, like purchasing a house or car, so you are not delayed if it contains incorrect information.

Below are some common errors to look for in a credit report:

- Accounts that are not yours. Perhaps they belong to a family member living at your address or even to a stranger with the same name. Unrecognized accounts could also provide evidence of identity theft

- Incorrect information such as late payments when bills were paid on time or multiple collection agency notations for a single debt and

- Negative information remaining after the seven-year drop-off period.

Some errors you might find on your credit report include:

|

What Is A Credit Report And Why Is It Important

A credit report is a collection of personal and financial information. These reports are available from three major credit reporting bureaus: Equifax, Experian and TransUnion.

The details in your credit report are used to generate your credit scores, including FICO scores and VantageScores. These scores tell lenders and other entities how responsible you are when it comes to borrowing money and paying your bills.

Read Also: Is 796 A Good Credit Score

Frequently Asked Questions About Credit Report

How often is a credit report updated?

Credit reports can be updated daily or weekly but typically, information is updated on a monthly basis.

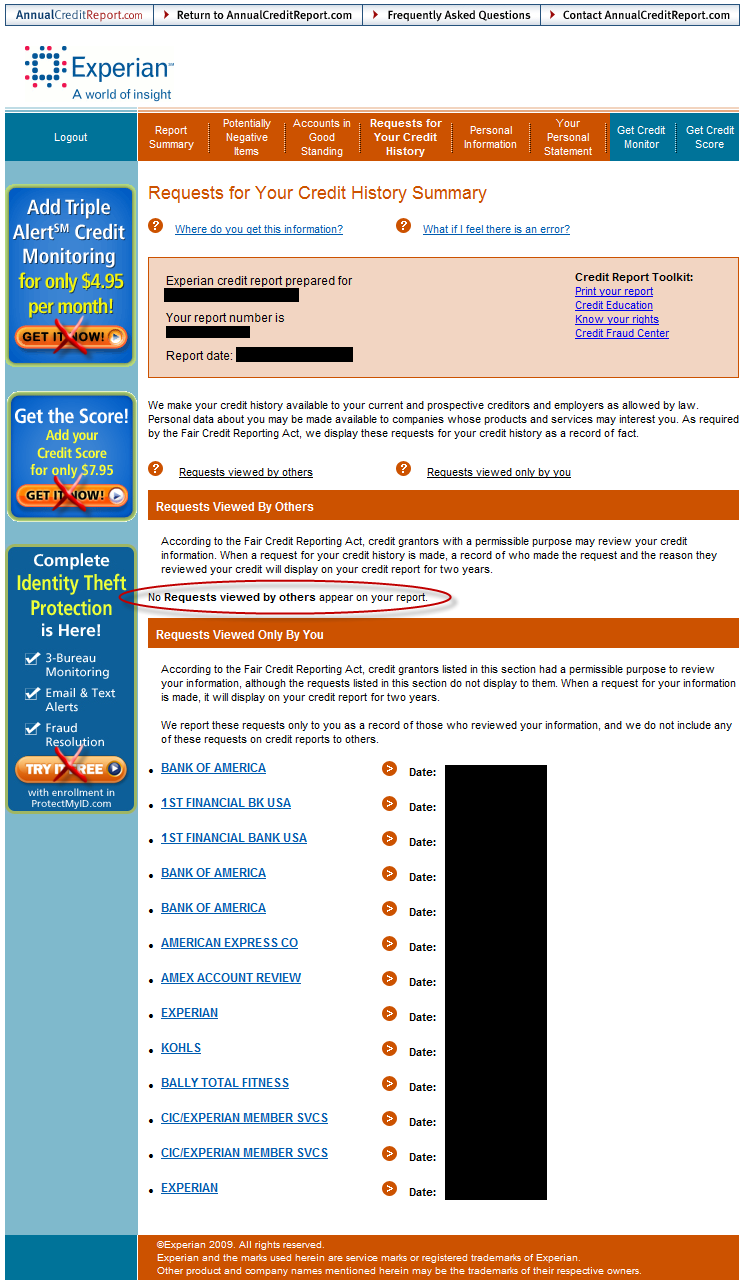

Who can see my credit report?

Lenders, creditors and entities with a permissible purpose, such as a prospective employer or insurance company, can access your credit reports.

Are all inquiries hard inquiries?

No. There are also soft inquiries which dont show up on your credit report or affect your credit score. For example, you can check your own credit as often as you like without triggering a hard pull.

Can I get my credit report for free if Ive been denied credit?

Yes. If youre denied credit for any reason, you can request a free copy of your credit report from the credit bureau that furnished your information to the creditor.

Im married. Do spouses share a credit report?

No. Married couples each have individual credit reports. But jointly owned credit accounts can show up on both your credit histories.

How long does information stay on my credit report?

Positive credit history can stay on your report forever. Negative information, such as late payments, can linger for up to seven years. Some bankruptcy filings can stay on your credit up to 10 years.

Do bank accounts show up on my credit report?

Does saving money help my credit score?

Will rent payments show up on my credit report?

Only if your landlord reports those payments to the credit bureaus.

Can I freeze my credit report?

How To Get Your Free Credit Report Information

You can get free credit report information in two ways:

-

You’re entitled to a free report directly from the three credit bureaus by using AnnualCreditReport.com. Reports had been available annually, but in response to the pandemic the site will offer free weekly updates through the end of 2022.

-

Some personal finance websites, including NerdWallet, offer free credit report information. NerdWallet’s credit report includes a credit score, providing your VantageScore 3.0 using TransUnion data, and updates weekly.

See your free credit reportKnow what’s happening with your free credit report and know when and why your score changes.Get started

Read Also: How To Request A Copy Of My Credit Report

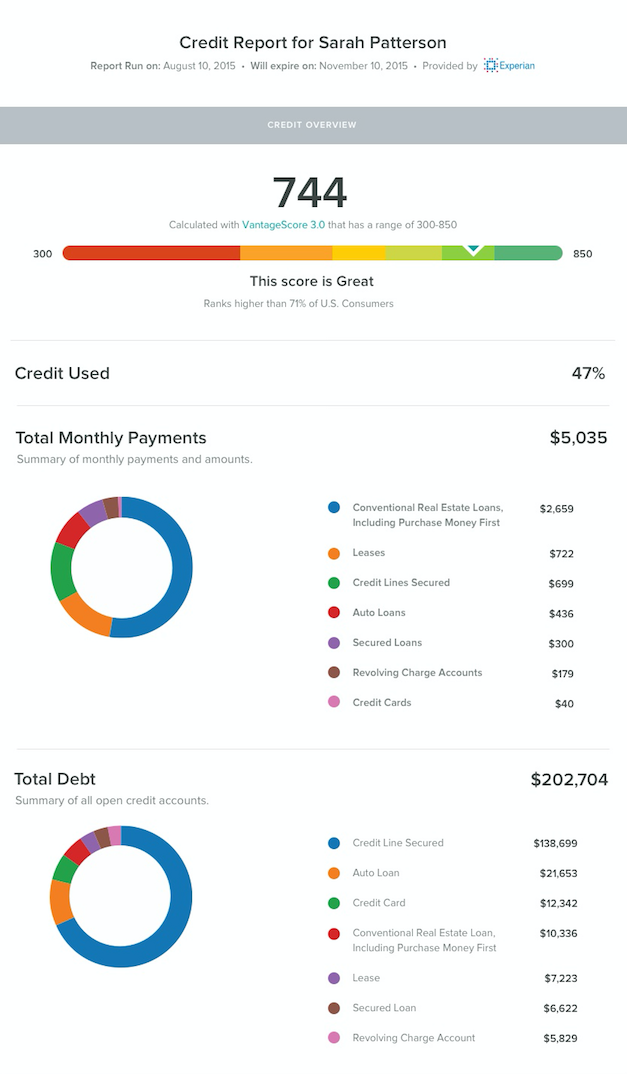

Who Generates Credit Scores

Credit scores dont just appear out of thin air. Theyre calculated using the information in your credit report. The FICO score, originally developed by the Fair Isaac Corporation, is the most popular. This score ranges from 300 to 850, with 850 considered to be the perfect score. The VantageScore is another credit-scoring model.

While the FICO and VantageScore models use different algorithms to generate credit scores, they both rely on for information. Understanding how to read your credit report is the first step to better credit health.

How To Get Your Credit Report

You have the right to get a free copy of your credit report every year from the three nationwide credit bureaus: TransUnion, Equifax, and Experian. Some financial advisors suggest staggering your requests over a 12-month period to help keep an eye on your reports and make sure they have accurate information. The best way to get your free credit report is to

- go to AnnualCreditReport.com or

Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

And everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Recommended Reading: What Is A 640 Credit Score

How To Get Your Credit Score

Unlike your free annual credit report, there is no free annual credit score. Some companies you do business with might give you free credit scores. Other companies may give you a free credit score if you sign up for their paid credit monitoring service. This kind of service checks your credit report for you. Sometimes its not always clear that youll be charged for the credit monitoring. So if you see an offer for free credit scores, check closely to see if youre being charged for credit monitoring.

TIP: Before you pay to get your credit score, ask yourself if you need to see it. Your credit score is based on whats in your credit history if you know your credit history is good, your credit score will be good. It might be interesting to know your score, but you can decide if you want to pay to get it. For more on credit scores, see the article .

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

Don’t Miss: What Credit Card Is Good For A 600 Credit Score

Why Is A Credit Report Important

Your credit reports are what your credit scores are based on. You have three reports, one for each of the three major credit bureaus Equifax, Experian, and TransUnion. While these reports are more or less the same, some lenders only report information to one or two of the bureaus instead of all three, so there can be some variation.

Your credit score is a three-digit number thats based on the information in your credit reports. Think of it like a grade of your financial responsibility. Lenders use your credit reports and scores when deciding whether they want to work with you. A good credit score and a report without any concerning information will get you the best interest rates and increase your odds of getting approved. Conversely, a bad credit score and a report with several black marks is more likely to get you denied. If lenders do work with you, theyll probably charge you higher interest rates to hedge their bets.

An increasing number of companies, apart from banks and financial institutions, are also starting to look at credit reports as a way of measuring a persons responsibility. Some employers pull credit reports on prospective employees, especially if that employee will be working in a role managing company or customer funds. Some landlords look at credit reports for prospective tenants before approving them, and even some cell phone and cable providers run a quick credit check when you sign up for their services.

North American Credit Services

Category: Credit 1. Remove North American Credit Services from Credit Report North American Credit Services, Inc. is a debt collection agency located in Chattanooga, Tennessee. They specialize in the collection of healthcare View customer complaints of North American Credit Services, BBB helps resolve disputes with the services or products

Also Check: How To Check My Business Credit Score

Negative Information If Any

The negative information section will list accounts that havent been paid as agreed, collections and public records such as bankruptcies. Negative information generally stays on your credit report for seven years, with the exception of Chapter 7 bankruptcies, which stay on your report for 10 years.

In this section, youll want to make sure any negative information is accurate. If you see incorrect accounts or collections or if something is being listed after it was supposed to have dropped off, dispute the entries immediately to have them removed from your report.

How To Do Balance Transfer In Citibank Credit Card

Category: Credit 1. How to transfer your credit card balance Citi.com Know your existing credit cards interest rates, balances, and balance transfer limits · Weigh your available offers against your existing cards offers · Select How do I transfer money from a credit card to my bank account?. How

Don’t Miss: Is 550 A Bad Credit Score

Consumer Financial Protection Bureau

For additional protection, consumers can opt out of unsolicited inquiries. An inquiry means that someone looked at your credit report. This could be a creditor you have asked for a loan, or an unsolicited offer of credit such as those you may receive in the mail for credit cards. This is known as prescreening. Creditors may view numerous inquiries as negative since they could mean that you are overextending yourself. If you do not want to receive unsolicited credit offers based on your credit report, contact the credit bureaus individually or call the Opt Out line at 1-888-567-8688 to remove your name from the three major credit bureaus with one call.

Use This Checklist As You Review Your Credit Report For Inaccuracies Old Information And Other Entries That Shouldn’t Be There

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports during the COVID-19 pandemic. Go to AnnualCreditReport.com to get your free reports.

At least once per year, you should get your credit report from each of the three nationwide credit reporting agencies and check each report for errors or for outdated or incomplete information.

Here’s a checklist to guide your review.

Read Also: What Is The Best Credit Score You Can Have

Open And Closed Accounts

Open and closed accounts will both appear on your credit report, with the exception of negative, closed accounts that are older than seven years. Those accounts have passed the credit reporting time limit. Accounts that were closed in good standing remain on your credit report about 10 years after the account has been closed, or whatever period the credit bureau has specified.

Is It Free To Request My Credit Report

Sometimes, yes. If you have applied for any bank or financial institutions credit monitoring service, for example, you can usually get a credit report free within 30 days of receiving a standardized letter notifying you of using such services.

Credit reports will usually be managed by either the Credit Bureau Singapore or other credit bureau businesses, which could include credit reporting agencies. In most cases, you can request your report either online here or by visiting one of Singapores many 62 SingPost branches in person. Other methods of requesting your report include:

You might even be able to access your free credit report within a longer time period if you request it by mail, or in person by visiting CBS directly on site at their Shenton Way office.

Under some circumstances, you can also request a free credit file or report of your finances via the My Credit Monitor service. This will issue you with a free version of your credit report notifying you of any significant changes that may have recently been made. If you are required to pay, take note that each credit report is usually worth approximately $6 including GST charges.

Also Check: How High Does Your Credit Score Go

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

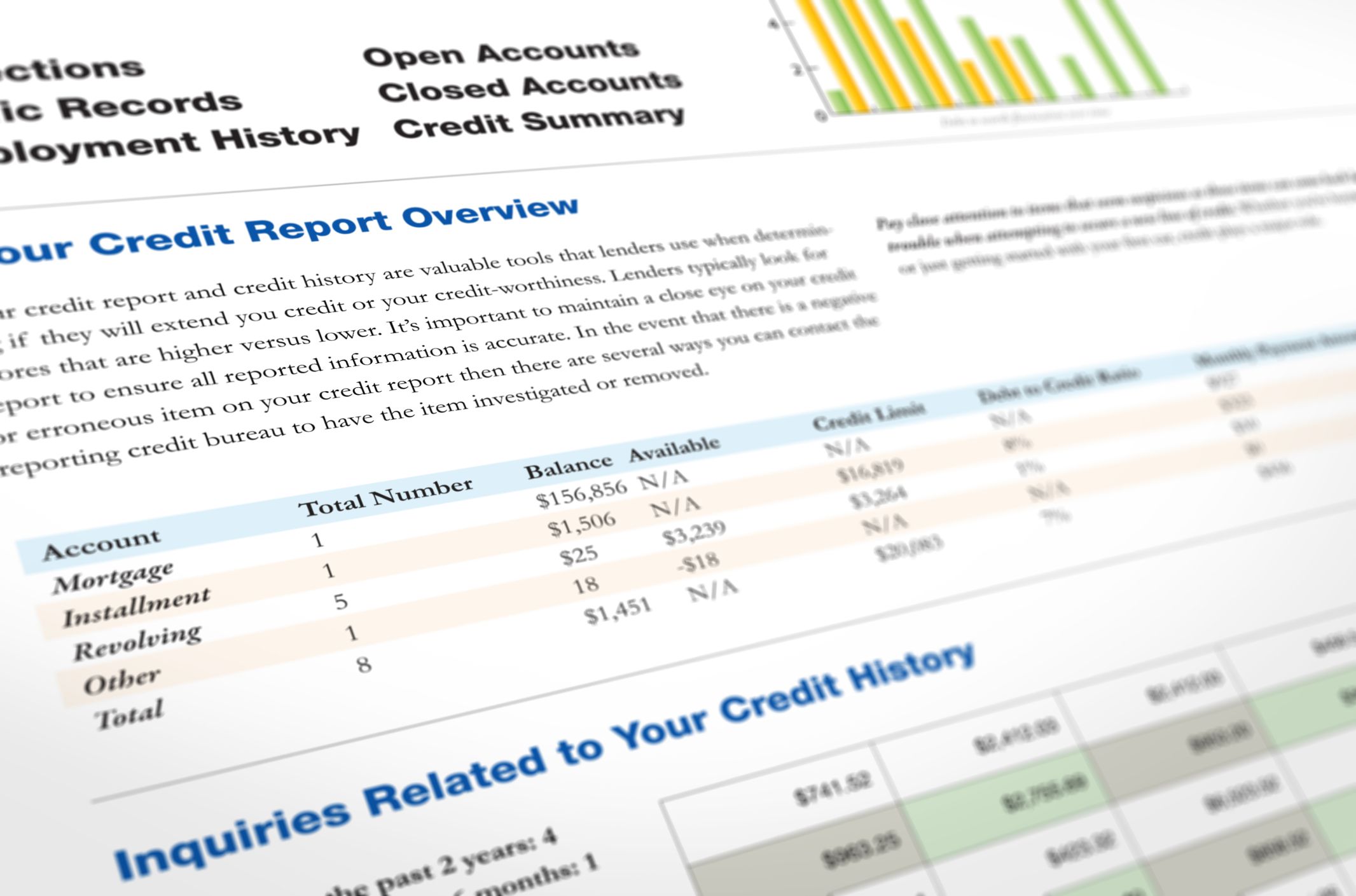

What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Bankruptcies

- Collections accounts

Also Check: How To Get Hard Inquiry On Credit Report

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Where Can I Check My Credit Scores And Reports

There are a number of places where you can check your credit reports and scores. Just be aware that some of those places may charge you for the information. To check your credit scores or reports, you could:

- Sign up for a service like .

- Check what options are available from the credit bureaus or .

Monitoring your credit can help you understand where you stand. But itâs important to note that decisions about loan applications or credit cards are ultimately up to each lender. And because there are multiple scores and reports out there, what you see in reports and scores youâre given might not be exactly the same as what lenders use to judge creditworthiness.

Read Also: What Is Coaf On My Credit Report

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.