Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

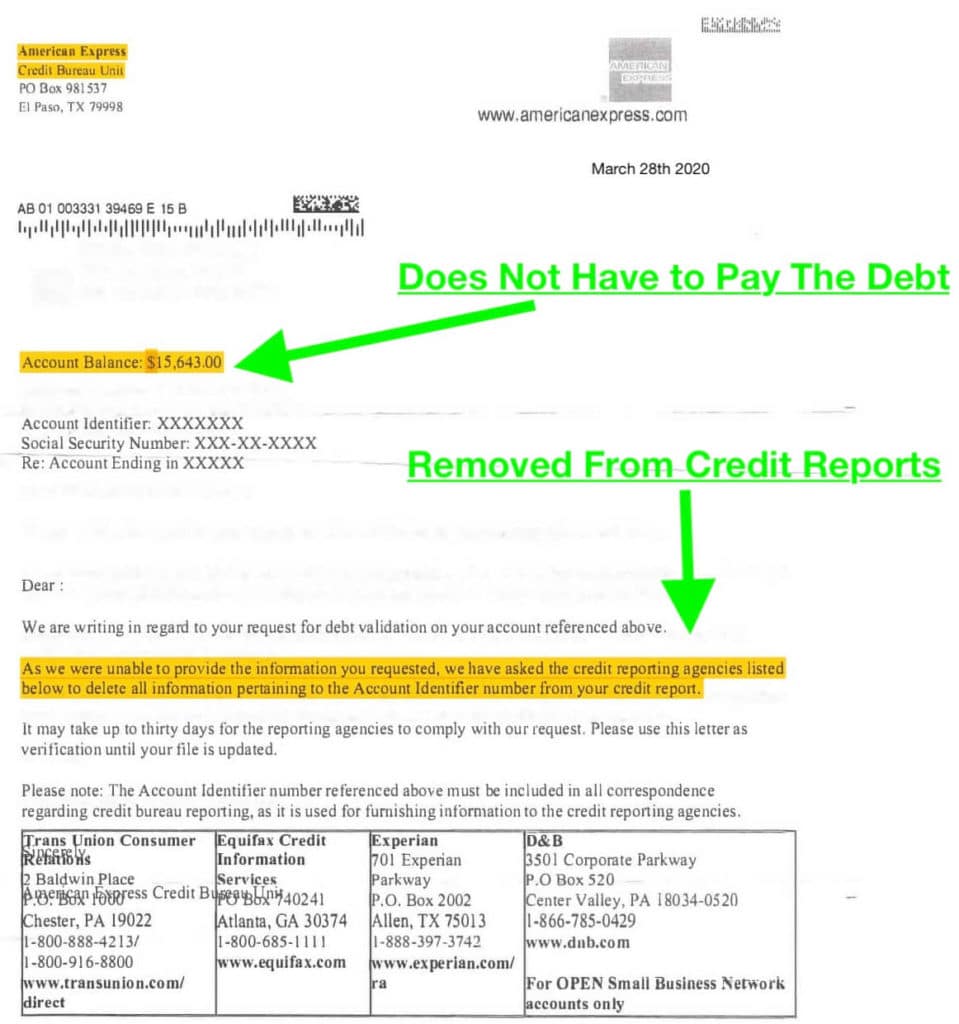

Have Any Debts Validated

When a debt collector contacts you, send them a letter asking them to validate the debt. Request that they confirm the original creditors name, the owing amount, and whether its still collectible and falls within the statute of limitations of your province or territory. If a debt is outside the statute of limitations, it can no longer be collected.

The Quirks Of Credit Scoring

In the above scenario, Person B would most likely be better off than Person A, at least in the eyes of creditors and lenders. A recent negative item happens to have a much greater impact on your score than older ones. It’s just the way credit scoring works.

A good analogy is thinking of good credit as a marathon and bad credit as a sprint. Building a strong credit history is a long process. Bad credit can happen in the blink of an eye.

Whether caused by financial missteps, an unexpected job loss, divorce, or medical bills due to illness or injury, derogatory marks will let their impact be known once they hit your credit report.

A derogatory mark, or “black mark,” is a long-lasting negative record on your credit report. Even just one can hinder your ability to obtain credit or get approved for a loan. Multiple ones will make you seem riskier in the eyes of lenders for years to come.

Missed payments are just a blemish compared to some of the more severe derogatory marks. Failing to meet your credit obligations can lead to:

- Short sales or deed-in-lieu of foreclosure

- Vehicle repossession

Any time that your credit accounts are not paid as agreed, you can bet that the instance will make it onto your credit report. Finally, derogatory marks can remain on your file for as long as seven to ten years.

Recommended Reading: How Long Does Credit Score Take To Update

Tips To Overcome Derogatory Credit

Your credit score benefits from having positive information, so your score may start improving long before the derogatory items are removed from your credit report if you’re paying other accounts on time.

Your recent credit history affects your credit more than old derogatory credit items, so having open accounts with on-time payments will help improve your credit score.

You may not be able to have excellent credit until the derogatory items are completely removed from your credit report. However, with good credit, you’ll still be able to qualify for many credit cards and loans.

Rebuilding Your Credit After Derogatory Marks

A derogatory mark is a negative item on one of your credit reports, which is often the result of falling behind on bills. While rebuilding your credit can take time, you donât have to sit around and wait.

Taking an active approach to rebuilding your credit through responsible credit usage over time, like consistently making on-time payments, can help.

You can also monitor your progress as youâre rebuilding credit. One way to monitor your credit is with . CreditWise gives you free access to your TransUnion® credit report and weekly VantageScore 3.0 credit scoreâwithout hurting your score. CreditWise is free and available to everyoneâeven if you donât have a Capital One account.

You can also get free copies of your credit reports from the three major credit bureaus. Visit AnnualCreditReport.com or call 877-322-8228 to learn more.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The information contained herein is shared for educational purposes only, and it does not provide a comprehensive list of all financial operations considerations or best practices.

Also Check: How Long Do Late Payments Stay On Your Credit Score

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Don’t Miss: What Is The Highest Credit Score You Can Have

How Do I Remove Derogatory Remarks From My Credit Report

Okay, youve decided enough is enough and you want to fix your credit and remove the derogatory remark from your credit. But how do you do that?

Well, I am here to help. I wont guarantee any of these methods work for you, but they are methods you can try.

The first thing to do is to get a copy of your credit report. The Fair Credit Reporting Act is a federal law that protects the information that credit card companies collect. You should review your credit report periodically to be sure it contains accurate information. You can request a free credit report every 12 months from each of the national credit bureaus .

Next, youll want to dispute the issue. This will only work if the remark is incorrect or unfounded.

You dont even have to dispute the entire issue. You can dispute the problem with the major credit bureaus to correct your name, the amount, or even a wrong date.

If the entire issue is wrong, then you definitely want to dispute it to get it off your record. But, you may also want to dispute it to make sure the amount owed or other specifics are correct.

If the derogatory remark is accurate but you still want to try to get it removed, there are options for that as well. The next couple of options may be a long shot, but they might work.

You can try something called a pay for delete letter. You see, a debt collector agency gets paid a portion of any money they collect from you. They might be willing to remove the derogatory remark for a certain amount of cash.

File A Dispute With The Credit Bureaus

Unfortunately, if you were responsible for the incident, theres not much you can do. However, if you find an error or sign of identity theft on your credit report, you can file a dispute with the bureau that holds it . This can be done easily by completing the proper forms and mailing or faxing them to the bureau.

While you may have to fill out different forms or details with Equifax and TransUnion, the basic dispute process is similar and typically goes something like this:

- Once the bureau receives your forms, they will review your claim, as well as your personal and financial information to confirm your identity.

- For the dispute to be taken seriously, be sure to provide any proof you have that shows that the incident was not your fault

- Next, one of their agents will investigate your case, which could involve contacting the business or lender that you claim has reported the error.

- If the error was the bureaus responsibility or your identity was stolen, the matter will be resolved internally .

- If your dispute is acceptable, the bureau will inform you of the results, then update the appropriate documents.

How To File A Dispute With TransUnion?

You can initiate a dispute with TransUnion online, by phone or by mail.

TransUnion Consumer Relations Department

P.O. Box 338, LCD1

TransUnion Centre de relations au consommateur

CP 1433 Succ. St-Martin

Laval, QC, H7V 3P7

How To File A Dispute With Equifax Canada?

Equifax Canada Co.

Box 190 Jean Talon Station

Montreal, Quebec

H1S 2Z2

Don’t Miss: How To Delete Closed Accounts On Credit Report

Write A Goodwill Letter

If you did miss a payment but later made the transaction, you can ask your creditor to remove that derogatory mark using a goodwill letter.

Also known as a forgiveness removal letter, itâs a letter you write where you ask for the creditor to remove a negative mark from your credit reports.

Goodwill letters still work today.

You can find out how to write a goodwill letter with templates included right here.

How To Dispute Inaccurate Information

The last thing you want is for inaccurate information to hurt your credit score. Thats why its so important to regularly check your credit report and dispute anything that looks wrong.

You can on disputing credit report errors, but its typically a simple process that can be completed online. Below is the website and other contact information for each of the major credit bureaus.

Read Also: Does Free Credit Report Hurt Your Score

Learn What Derogatory Marks Are Their Causes And How To Rebuild Credit After Getting One

You may or may not have heard of derogatory marks in your credit reports. So, what are they? A derogatory mark or remark in your credit report is a negative item, such as a late payment or foreclosure. If a derogatory mark is listed in your credit reports, it can hurt your and may affect your chances of qualifying for things like credit cards, loans and mortgages. While most derogatory marks can stay on your credit reports for up to seven to 10 years, depending on the type of mark, their impact generally diminishes over time.

Consistent responsible credit usage, such as on-time payments, could help you rebuild your credit, though. You can also review your credit reports for errors and dispute any incorrectly reported derogatory marks, which might improve your credit. Read on for more information about what derogatory marks are and how to rebuild credit after receiving one.

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, its important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it youre using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a persons creditworthiness. FICOs scoring has five categories, each with a percentage value indicating how much weight they place on each:

Read Also: Target Credit Card Application Status

Also Check: Does Checking Credit Karma Lower Your Score

Why You Should Not Pay A Collection Agency

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. … Any action on your credit report can negatively impact your credit score – even paying back loans. If you have an outstanding loan that’s a year or two old, it’s better for your credit report to avoid paying it.

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

Read Also: Is 722 A Good Credit Score

How To Dispute Accurate Information In Your Credit Report

Accurate items in your record can’t be removed before the term set by law expires, which is seven years for most negative items. For example, if you truly missed payments on your credit card, your dispute to remove that information will be denied. However, the information will automatically fall off your credit report seven years from the time you missed the payments.

If you do have valid negative items on record, here are some things that might help:

Why Is A Good Credit Score Important

First, letâs do a quick refresh on why credit is important â and why a good credit score can save you money.

At some point, you are going to want to borrow money for a car loan or mortgage.

Because a credit score is an indicator of trust, the better your credit score, the better interest rates you can qualify for, which means youâll be paying less in interest. And overall, saving you money.

Derogatory marks, which lower your score, can hinder this.

Recommended Reading: When Does Chase Sapphire Report To Credit Bureaus

Dispute Credit Report Errors

Keep up to date on your credit status by ordering a free credit report at annualcreditreport.com. Check it thoroughly to see if you notice anything that appears suspicious, such as a delinquent charge you donât recall making on your credit card.

You can dispute any errors you find by mailing a letter to the credit reporting agency. Include your contact information and identify the specific nature of the error. Include copies of paperwork, such as signed receipts, that document your case, as well as dates, amounts, and other relevant information. State your reason for disputing the item and the information you want to have corrected.

The reporting agencies must investigate your dispute and forward your documents to the company that reported the information. If you are found to be in the right, that company will have to contact all the credit reporting agencies with the correct information so it can be updated.

How Can I Raise My Credit Score By 100 Points In 30 Days

How to improve your credit score by 100 points in 30 days

You May Like: When Does Navy Federal Report To Credit Bureau

Strategy : Create A Budget To Avoid Overspending

Do you have a budget? If so, are you sticking to it?

By making a budget and tracking your money, not only will you make better decisions about where your money goes youâll lower your credit utilization and avoid getting in high-interest bad debt by overspending.

If you are currently in bad debt â and paying high interest â create a plan TODAY to get out of it.

Disputing A Derogatory Mark On Your Own

Perhaps the best reason to dispute negative items on your own is that its free. Of course, youll have to do a lot of research to find the most effective methods, but if you are living paycheck to paycheck, this is your best option.

After all, putting yourself further into debt isnt going to do your credit score any good. But youll need to be careful that you dont make any mistakes that could actually end up hurting your credit score even more.

For example, paying an old collection may actually renew the period it stays on your credit reports, depending on your states statute of limitations.

You also dont want to offer too much information in your dispute letter. Its the credit bureaus job to verify the accuracy and fullness of each item. Check out our resources on dispute letters to get started on the process.

You May Like: How To Put Fraud Alert On Credit Report