Credit Score Personal Loan Options

While this credit score range isnt the lowest on the totem pole, it is still below average. While you should be able to secure a personal loan, your interest rates and terms will definitely be less than favorable. Interests will often vary anywhere from sixteen to eighteen percent, with most leaning towards the higher end of that range. If youd like to secure a lower rate, a cosigner is a good option while you work to build your credit. Guide on poor credit loans

Raising Your 640 Credit Score

Your FICO credit score is good, and you have a high chance of qualifying for a broad array of credit facilities. But if you can boost your score and reach the best credit score ranges, ten you might qualify for better interest rates so you can save even more money in interest. Here are a few tips for raising your credit score.

Get a secured credit card: getting a secured credit card can help increase your FICO score, even when youre not eligible for conventional credit cards. If the lender reports credit activity to the various credit because in the country, then you should make a deposit equal to your total spending limit. Any time you utilize the secured card, the events will be entered in your reports.

Consider getting a credit-builder loan: these specialty loans are meant to help boost your credit score, by showing your ability to pay on time. Once you take out this loan facility, the credit union puts the cash borrowed in an interest-generating account. It is a reasonable savings strategy, but the main benefit is that the credit unions will report those payments, which helps to boost your credit score.

Personal Loans With A 640 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Also Check: Syncb Amazon Credit Inquiry

Type Of Loan According To Minimum Credit Score

USDA Loans

This government-backed loan insured by the U.S. Department of Agriculture doesnt actually have a minimum credit score. However, to qualify for a loan, you must be buying property in a rural area.

With a 640 credit score, you will find yourself in a more favorable position to get approved for a USDA loan, and the application process is relatively smoother.

FHA Loans

Mortgages insured by the Federal Housing Administration are mostly meant for first-time home buyers. But even those who have had mortgages before are still welcome to apply.

The minimum credit score required for an FHA loan is only 500, but if you have at least a 580 credit score, its all the better because you will be asked to make a down payment of only 3.5 percent.

Conventional Loans

If you have a credit score of 620 at least, you might be eligible for a conventional loan.

Sometimes called traditional loans, conventional loans are the complete opposite of government-backed loans. But because the federal government does not insure them, you might be asked to pay for private mortgage insurance.

VA Loans

When it comes to interest rates, they say that VA loans offer the best. But you can only qualify for this if you have served in the countrys military.

You will also need a credit score of at least 640 to be eligible.

Mortgage Rates For Fair Credit

The average credit score it takes to buy a house can vary widely depending on where youre looking. With that said, it can be more challenging to get a mortgage with good terms if your credit is in the fair range.

There are several types of mortgages out there, some of which are meant specifically for those who may not qualify for a conventional loan. These loans, which are made by private lenders but are backed by the government, may allow a smaller down payment than youd need with a conventional loan.

Common types of government-backed loans include

- FHA loans

- VA loans

- USDA loans

These options can be easier to get than a conventional loan, but they arent for everyone. If you have fair credit and plan to apply for a conventional loan, you may find it difficult to qualify without having to pay high interest rates and fees.

Its important to shop around to understand your options and what competitive rates look like in your area. As with auto loans, you have a window of time when multiple inquiries are only counted as one for your credit scores. While that shopping window can be longer, keeping multiple inquiries to a period of 14 days is the safest bet.

Read Also: Does Speedy Cash Report To Credit Bureaus

Avoid A Card With An Annual Fee If You Can

If a card has a particularly large annual fee, in combination with a low credit limit, it will effectively reduce that credit limit. It will also increase the likelihood youll be carrying a balance and making interest payments.

Some of the cards weve included on our list do have annual fees, though all are below $100. Its best to avoid these if you can, but if not, just be aware that it will raise the cost of improving your credit score.

What Are The Best 640 Credit Score Car Loan Interest Rates

Beauty is in the eye of the beholder… I hope we didnt lose you there.

What we are trying to say is, its all relative to you and your circumstance, credit score, time restraints, and budget

In a general sense, the absolute best car loan interest rates, like the 1 to 2 percent APRs, will go to people in the 750 to 800 range. Not even people with a 700 FICO score get those advertised percentages.

So, you can curb your expectations right there.

We can realistically guesstimate where your interest rate will land – you can not get an accurate estimate without getting an actual quote.

Also, know that lenders give borrowers with less than excellent credit higher rates.

Why? Because statistics show that customers with fair credit are higher risk Its more probable that they will default on their loans.

The credit reports of 42% of Americans with a FICO® Score of 640 include late payments of 30 days past due. – Experian

Now That we got those expectations, facts and FIYs out the way. Here are some average automobile loan rates:

Don’t Miss: Speedy Cash Extension

Can I Get A Car / Auto Loan W/ A 640 Credit Score

Trying to qualify for an auto loan with a 640 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 640 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

What Does A 640 Credit Score Get You

| Item |

|---|

| 88% |

As you can see, most people who are at least 35 years old have a credit score of 650 or higher. And even younger folks nearly have a majority. This just goes to show that people with 650 credit scores come in all shapes and sizes, with diverse backgrounds and differing financial obligations.

As a result, the grades for each component of your credit score, which you can find on the Credit Analysis page of your free WalletHub account, might not exactly match those of another individual with a 650 score. But the sample scorecard below will give you a pretty good idea of what a 650 score is made of.

Sample Scorecard 640 Credit Score:

- Payment History: C = 98% on-time payments

- B = 10% – 29% utilization

- Debt Load: A = Debt-to-income ratio below 0.28

- Account Age: B = Average tradeline is 7 or 8 years old

- Account Diversity: C = 2 account types or 5 – 9 total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

These are by no means the only credit-score grades capable of producing a score of 650, nor will they necessarily result in that exact rating. However, this is representative of the type of scorecard someone with a 640 credit score can expect: plenty As and Bs, but no failing grades to be found.

Also Check: Does Affirm Show Up On Credit Report

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

The Process Of Restoring The Credit Rating To At Least 640

IPASS, for example, is a credit repair firm that can:

- Examine the credit report: Review your credit report to discover any harmful information that could lower your score by 640 points.

- Negative Items in Dispute: Make your customized template and then send letters of disagreement to Bureaus inquiring them to remove any items that are not sure to be removed from Your list . ).

- Removal of damaging items: Repair services like IPASS can continue to contest items for you until they affect creditworthiness.

- Improve Your Score Once negative things begin to disappear from the credit file, youll notice an astounding increase in your score. This could mean more favorable terms for your auto, home or personal loan.

IPASS, an industry leader, can help you navigate this procedure. Call them at 369-258-147 or speak with them online today.

Also Check: Do Authorized Users Build Credit Capital One

Credit Score Is 640 A Good Credit Score Or Bad

My credit score is 640! What do I do?

Having a 640 credit score isnt a good score. Youll need a score of 700 or higher to obtain good credit. However, a 640 score isnt bad either. In fact, its a fair credit score. It doesnt matter if your 640 credit score good or bad, you still need to have your finances organized so you can improve it.

Fear not. Having a low credit score isnt a bad thing if you dont have too much credit history. But this is something you need to fix if youre if you want to obtain affordable rates. While the score isnt bad, you might get locked out of getting approval for loans and the best interest rates.

As a result, youll be able to obtain a loan or credit card with a 640 credit score. But having a bit of credit improvement will help save you money and give you more options. With some credit improvement, youll have more options and more able to obtain more money.

Here, well show you what youre eligible to apply with your current credit score, the types of people who have A 640 credit score, and the procedure that gives you more options and help you save more money.

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Also Check: Does Paypal Credit Report To Credit Bureaus

Upstart: Best For Short Credit History

Overview: While Upstart evaluates your credit score to determine your , its not the companys only method. It will also consider your education and job history, which might be helpful if youre struggling to qualify for a personal loan based on your credit score.

Why Upstart is the best for short credit history: You can apply for a personal loan even with little credit on your report, and Upstarts minimum credit score is 580.

Perks: You can borrow as little as $1,000, and theres no penalty for paying your loan off early.

What to watch out for: If you dont qualify for a loan on your own, you might have to look elsewhere, since Upstart doesnt allow co-signers.

| Lender |

|---|

Pay All Your Bills On

A late payment here, a collection there, may seem fairly harmless at the time especially if youre having a cash crunch. But those are the stuff of fair and poor credit, and you need to avoid them at all costs.

One advantage you have with bad credit is that it becomes less important as time goes on. The sooner you begin paying your bills on time, the older the derogatory information will become, and the higher your credit score will be. So start now paying all your bills on time all the time.

Dont forget landlords and utility companies either. They will report to the credit bureaus if you have unpaid balances.

Recommended Reading: How To Remove Repossession From Credit Report

Top Auto Refinance Rates

Say you have a credit score of 640 or 649. You can qualify to refinance with this score!

If you had a lower credit score when you took out your car loan or if you financed your car through a dealer and didnt get a great deal, you could save money by refinancing.

Do not apply for a refinance car loan if your credit score is lower than it was when you got your original loan.

Refinancing may be able to lower your monthly payment and put that extra saved interest right into your pocket.

If you refinance with a longer term you could lower your monthly payment considerably. You will pay more in interest and you may end up owing more than your car is worth.

Refinance rates are usually the same as rates for a loan taken at the time of sale, so the figures quoted above will apply.

on AutoCreditExpress.com

How Long Does It Take To Repair A 640 Credit Score And What Kind Of Interest Rates Can You Expect

Weve been talking a lot about specific credit scores lately, how many people have a certain FICO score and what is good credit. A 640 credit score is one of those scores that seems to catch a lot of people.

I dont know if the FICO system gets stuck around 640 or if its just an easy, even number but I hear from a lot of people with a 640 FICO.

Let me answer a few of the most common questions first and then well go into detail on what this credit score means to you.

- A low credit score may not be your fault if you just dont have much credit history but its still something youll want to fix if you want affordable rates

- A 640 FICO isnt bad credit but it will lock you out of getting the best interest rates or even approved for a loan at all

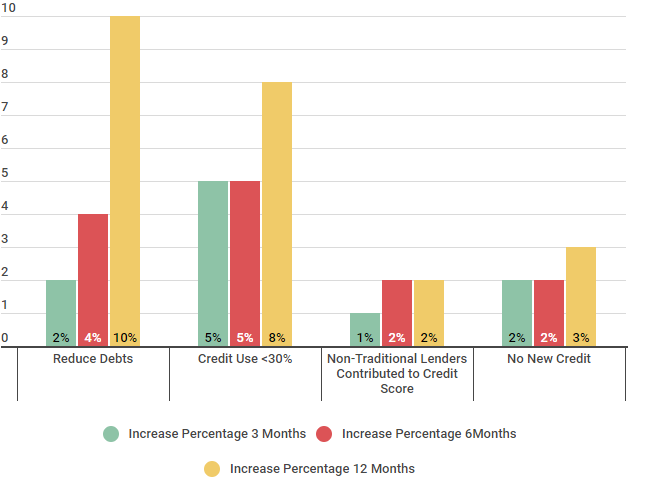

- From talking with borrowers, it takes between six- to 18-months to increase a credit score the 40 points to become a prime borrower

Read Also: Mprcc On Credit Report