Should I Report Rent Payments To Credit Bureau

rent paymentsreportspaymentsrent payments reported

Reported rent can help or hurt youAll three bureaus will list any reported rent payments on your reports. While you can guarantee that reported rent will show up on your report, it may not always affect your .

how do I report a payment to the credit bureau? You canât directly add things to your , even if theyâre bills you actually pay each month. Instead, you must depend on your creditors and lenders to send updates to the based on your account history. There are three major in the U.S.: Equifax, Experian, and TransUnion.

Just so, when can Landlord report to credit?

Large Landlords Can Report DirectlyThe three major , Experian, Equifax and TransUnion, allow high-volume landlords to report their rental payments directly to the each month. However, you need to generate a high number of payment records to begin reporting.

Does rent a center report to credit bureaus?

No. Rent-A-Center does not report your information to the three main , Equifax, Experian, and TransUnion. After all, youâre not shopping with when you come to Rent-A-Center. A rentâto-own agreement is more like a lease, not a loan, and doesnât accrue interest.

What Software Does Rent A Center Use

To support the new site, RAC decided to use SAP Hybris as its e-commerce platform. However, the company needed to find the right underlying technology to run Hybris. As we began looking at technologies, we realized performance, security, and high availability would be absolutely critical, Jayaraman says.

One: Data Furnisher Setup

Your first step is submitting an application to the credit bureau to become a data furnisher. We will help you complete the following requirements to verify your companys:

- Identity: one copy of a valid form of ID for property owner or manager

- Ownership: one copy of an acceptable form of proof of ownership for each property to be rented

- Contract: one copy of standard rental contract used by property owner and/or manager

- signed Service and Support Agreement with Datalinx

If you have questions about any of these requirements for setting up your company as a data furnisher, dont worry. Your Datalinx rep will be on hand to help.

You May Like: Credit Wise Is Not Accurate

Add Rent To Credit Reports

In a welcome new development, the major credit agencies now accept rent payment history from Landlords. That history gets included on a Tenants consumer credit report.

For Tenants, this is a game-changer. Tenants want their rent payments reported. Their positive payment history improves their credit records, giving them access to attractive amenities and money-saving financing rates.

Landlords benefit too. Landlords and Property Managers know how heavily regulated the rental industry is. When Tenants default on their rent, Landlords must go through a long and costly legal process to remove the Tenants and capture missed payments. Late payment fees are prohibited or limited and often ineffective as a deterrent.

But Landlords who report rent payments to credit agencies see a higher incidence of on-time rent payments. This means less time spent chasing down Tenants, collecting late fees or filing evictions.

How To Get The New Acima Leasepay Card

Customers can now pre-register now for the new Acima LeasePay card.

Starting this summer, consumers will be able to use the Acima LeasePay card at participating merchants across Acimaâs mobile app, marketplace and web browser extension.

While Acima says that customers donât need to have a good credit score in order to be approved for a lease, the website states that eligibility requirements include a 3-month income history, monthly income of $1,000 or more and a checking account for at least 90 days in positive standing . Consider applying if you have low or no credit but a source of income.

There is also a welcome offer for consumers: Get instant approval for a lease transaction by applying through the mobile app and, if eligible, receive access to up to $4,000 through the Acima LeasePay card. This $4,000 limit can be used to complete lease transactions at participating Acima merchants for any qualified goods in the U.S.

Once approved, customers can instantly access their Acima LeasePay card directly through the mobile app so lease transactions are quicker than ever. While there is only the virtual card option at the moment, Acima plans to issue a physical payments card in the future.

The Acima LeasePay card is currently not available in MN, NJ, WI or WY.

Also Check: When Do Companies Report To Credit Bureaus

You May Like: Sync Ppc On Credit Report

What Is A Rent Reporting Service

Individuals cant report their own rental payments and landlords seldom do. Instead, independent reporting agencies gather information and report it to the credit bureaus on your behalf.

Another benefit of using a rent reporting agency is for securing a future rental property. All landlords much prefer candidates with a history of on-time rental payments, and this is an easy way to document your success.

In fact, Experian RentBureau and TransUnion SmartMove are designed specifically for landlords performing background checks during the application process.

You May Like: Is Speedy Net Loan Legit

How To Get Credit For The Rent You Pay

There are two ways to build your credit with CreditBoost you can report your ongoing rent payments and/or your past on-time rent payments. Both options have the potential to build your credit health without having to open a new line of credit.

- Ongoing rent payment reporting: Report the rent youre currently paying to potentially see a steady improvement in credit and establish proof of long-term financial trustworthiness.

- Past payment reporting: Increase your credit score by reporting your past on-time rent payments from up to two years back. This can be helpful if you have little to no credit and need to build up your credit history.

Don’t Miss: Unlock Transunion Credit Report

Learn More About Credit

Your credit score may be used in many scenarios – auto loans, mortgages, credit card applications, and more – so it is important to build and maintain credit. To learn more about building credit with on-time rental payments, visit Experian.com or ask your property management company. To learn how to obtain a copy of your credit report or how to manage your credit score, Experian has resources for you.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is A Good Business Credit Score

Can Rent A Center Break Into Your Home

Most likely, the police will not want to get involved in what is a civil matter. So Rent a Center will have to sue. Then, once they win, assuming they do, Rent a Center can get the Sheriff to go into your house and repossess your stuff. However, the contract may already give them permission to have the Sheriff come in.

Leasing From A Retail Store

Some electronics and home improvement stores offer lease-to-own contracts for new items. If you want to pay for something this way, a store may check your credit report and require you to have a bank account or credit card. If it accepts your application, youll probably get a 12 month lease. Youll connect your debit or credit card to your lease, and the store will automatically take regular payments. Your payments cover the cash price of the item plus the cost of lease services. If you pay for 12 months, you might wind up paying twice as much as the items retail price. You might be able to change to a shorter pay-off term, but your total payments will still be more than the retail price.

Also Check: Mprcc On Credit Report

How Do Rent Payments Appear On My Credit Report

Rent payments are considered alternative credit data, which are non-traditional forms of credit that can determine your creditworthiness. Although these payments wont show up on your main FICO® credit score, this is a great way to build credit if you currently have little to none on your report.

Popular scoring models FICO 9, FICO XD, and VantageScore consider rent payments and other utilities when determining whether or not someone is a reliable borrower. In order to contribute to those credit scores, youll need to utilize a rent reporting platform to start building your credit health as a renter.

How To Choose A Rent

First, check to see if your property manager already works with a service. If not, here are questions you should ask rent-reporting service providers before choosing one:

-

What would my total costs be for a year of service, including any setup fees or fees for reporting previous rental history?

-

How do you protect my personal data?

-

Which of the major credit bureaus do you report to?

-

Do you provide free access to credit scores, and if so, which score?

-

How soon should I expect the information to appear on my credit report?

-

How can I cancel the service?

-

What happens if I have a dispute with my landlord or break my lease? In some states, renters have a right to withhold payment if the landlord fails to keep the unit repaired and habitable. Find out whether rent withheld during a dispute is reported as nonpayment or a negative mark.

Don’t Miss: Chase Sapphire Required Credit Score

Does Aarons Do A Credit Check

As part of our digital approval processes, Aarons will check credit history and creditworthiness and rely upon customer reports and information obtained from third-parties in considering your application. Aarons minimum in-store lease requirements include a verified source of income, residence and 3 references.

Aaron Aaron Rental Center

In fact, these places do not report good or bad payment dates. If someone or a store tells you something else, you are lying. The only way to report a credit score is to steal property and make a decision against yourself. The ones that allow you to use it are a credit report to use as rental property. You have not registered with the Credit Bureau.

Renting a center usually offers better quality products than Aaron Its potential stems from the fact that Aaron & # x27s was a franchise and was also given RAC Cooperative. They are very much involved in doing business with new things. Ask both stores if they have any unused items. This is a room that moves slowly. Both companies will be ready to step back and you will be able to get good deals along the way. You are tired of using furniture and when you buy used furniture you insist on cleaning it professionally. I can talk about mistakes, but I wont.

I would suggest visiting the two stores and finding the item of your choice in both stores and then comparing. Pay attention to contract length, pre-sale options, insurance, and any club fees. Do the calculations and calculations, you can order both even after seeing the total cost.

Rent A Center Or Aarons Better

You May Like: How Does A Landlord Report To Credit Bureau

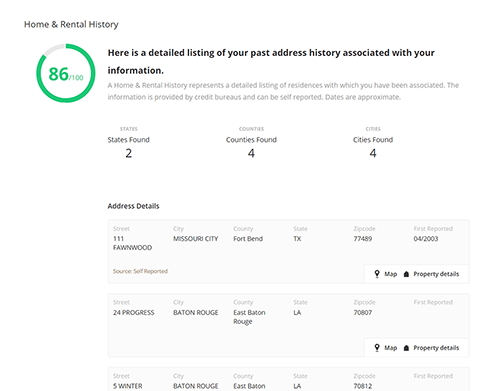

How Can I Check My Rental History

You can check your rental history report for free once a year, thanks to the Fair Credit Reporting Act. To get your rental history, go online to find a list of rental history report providers. From there, you can reach out to the rental history report agency of your choice and ask them for a copy of the report.

Can Rent A Center Bring The Police To Your House

Additionally, can Rent A Center call the cops? They can not place a warrant on you. However, they can call the police who can write up a report, do an investigation and ask the State Attorney to file charges. But Rent-A-Center will sue for the remaining amount/item and additional fees youve now racked up.

You May Like: Speedy Cash Collection Agency

Appliances Of Rent A Centre

RAC offers new, used branded furniture, appliances, computers and electronics from brands, such as Ashley Furniture, Sony, Whirlpool Corporation, Dell and HP. Customers can return the item at any time, for any reason, free of charge and may have the option to re-rent the item and take payments where they left off. Delivery, download, service and repair are also included in the rental price. Customers can also improve things while hiring – payments will change accordingly.

What Happens If You Break Something From Rent

On the off chance that your thing quits working and needs an off-site fix, Rent-A-Center will give a practically identical loaner at no extra charge while we fix the first thing. Here and their items break from an assembling imperfection. On the off chance that that occurs, and youre exceptional on your installments, well fix or supplant the thing immediately.

Also Check: Dispute Verizon On Credit Report

The Benefits Of Paying Rent Online

Paying rent online has many benefits beyond building credit!

- Avoid late fees with automatic rent payment

- Track your rent payment online

- Paying rent online makes sharing rent with roommates much more convenient

- No annoying checks! That means no dealing with envelopes and stamps, or the landlord saying it didnt arrive on time

- Paying rent online is better for the environment. Save a trip to the post office!

Can You Get Out Of Your Rent

There are two ways that you can get out of your rent-to-own contract. First, you can return your item to Rent-A-Center to pause payments. Our related research explains how to pause and reinstate a lease at Rent-A-Center. Alternatively, if you can afford it, you can pay the remaining balance of the item. If you pay off the item in full, you will be freed from the lease agreement. Rent-A-Center even offers an Early Purchase Discount.

You could also get out of your current contract by starting a new contract. Rent-A-Center allows you to upgrade your merchandise whenever you would like to, and then they adjust the payments accordingly. Of course, getting out of one contract by opening up another isnt ideal, and it will likely result in you owing more money for the upgrade.

Read Also: Aargon Agency Collections

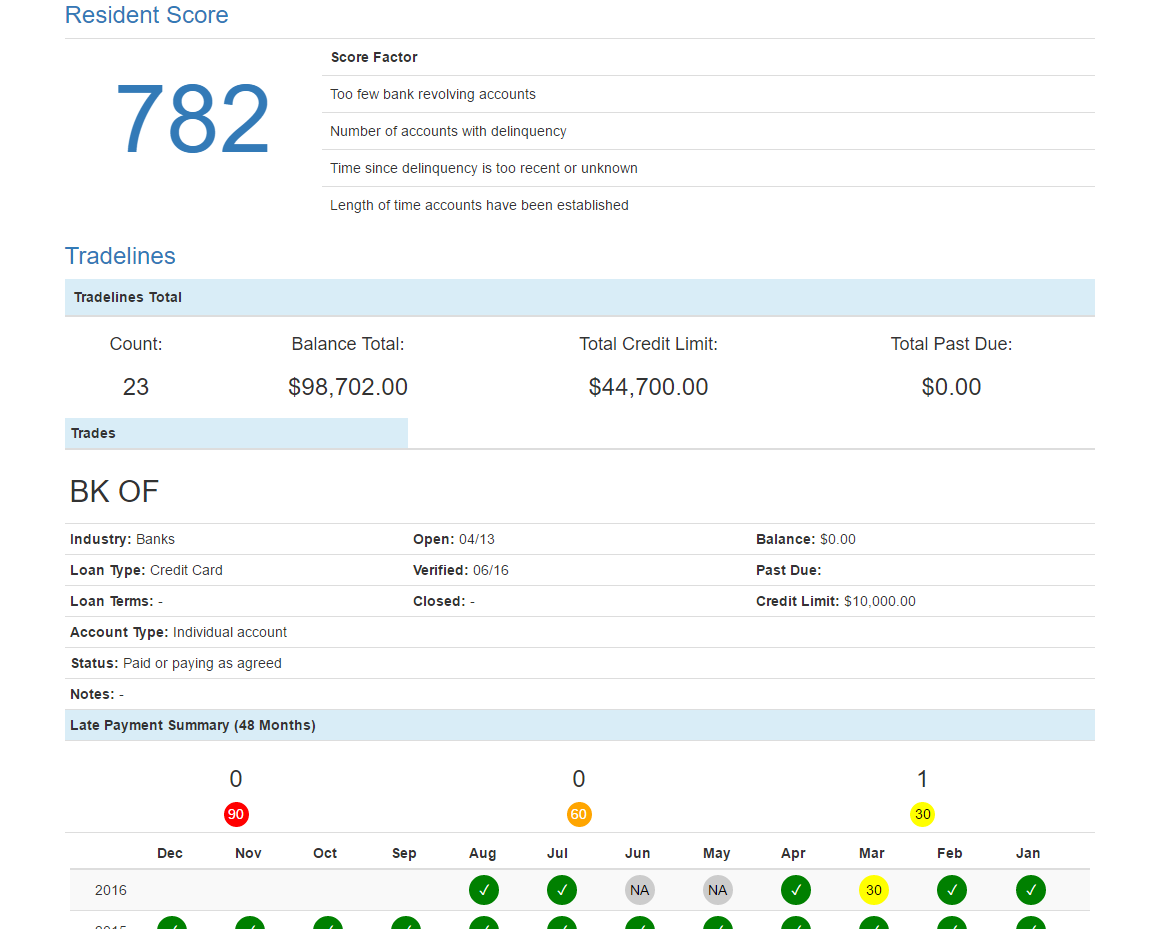

The Importance Of Credit

Buying a first homefor many, it is one of lifes biggest milestones. However, without a strong credit record, renters dreams of home ownership may be left unfulfilled.

As people build credit, they can gain better access to mortgages, as well as qualify for lower fees and interest rates on credit cards and other lines of credit. These advantages open the door to new opportunities and make it easier to accumulate wealth.

Building good credit takes time, consistency, a mixture of credit accounts and solid financial habits. For example, paying monthly bills on time regularly usually increases a persons credit score. Many renters pay their bills on time every month and get credit for it. But historically,

Tenants have not received credit for their largest monthly payment of all. Typically, 30% to 40% of a Tenants income goes toward paying rent to their Landlord.

Beware: Selling Rented Merchandise

There are some people who try to take advantage of rent-to-own services by renting brand new merchandise and then selling it elsewhere to make quick cash. This is an illegal practice Rent-A-Center can and will take these people to court for it, and the court may charge these people with theft. As long as you communicate with your Rent-A-Center and dont do anything illegal, you dont need to worry about going to court or jail. Rent-A-Center generally wont call the police or press charges.

Also Check: 1-877-795-9819

The Benefits Of Having A Good Credit Score

Having a credit score higher than 629 can make it easier to qualify for lower interest rates on different types of loans, a mortgage, and credit cards. Plus, youll have an easier time getting approved for an apartment down the line.

Exploring various ways to build your credit can make it easier to not only improve a low credit score, but get as much value as possible from all of your monthly bills. In the past, only homeowners were able to build credit through their monthly mortgage payments, but the same is now possible for renters to prove their credit worthiness.

Having a good credit score affects many areas of life, from necessities like housing and transportation to opportunities for leisure and travel. The quicker you begin reporting your on-time rent payments to a credit bureau like TransUnion, the easier itll be to have a stellar credit history.

Is It Smart To Rent

When it comes to rent-to-own homes, the cons outweigh the pros. If you want to make a smart decision for your future, its simple: Avoid a rent-to-own situation, even if it means you have to wait to move. Trust usits worth it to buy a house the smart way. If you need time to clean up your finances, thats okay.

You May Like: Who Does Aargon Agency Collect For

States Pushing For Changes

Rent-to-own transactions could become more common in credit reporting, as states move to treat such matters under the same laws that govern credit sales, in order to protect consumers from potentially predatory pricing and fee practices. According to the FTC, courts in a few states have ruled that rent-to-own transactions are indeed credit sales, including New Jersey, Minnesota and Wisconsin. However, they are not currently deemed credit transactions under federal laws, including the Truth-in-Lending Act or the Consumer Leasing Act.