How Can Credit Scores Affect Mortgage Interest Rates

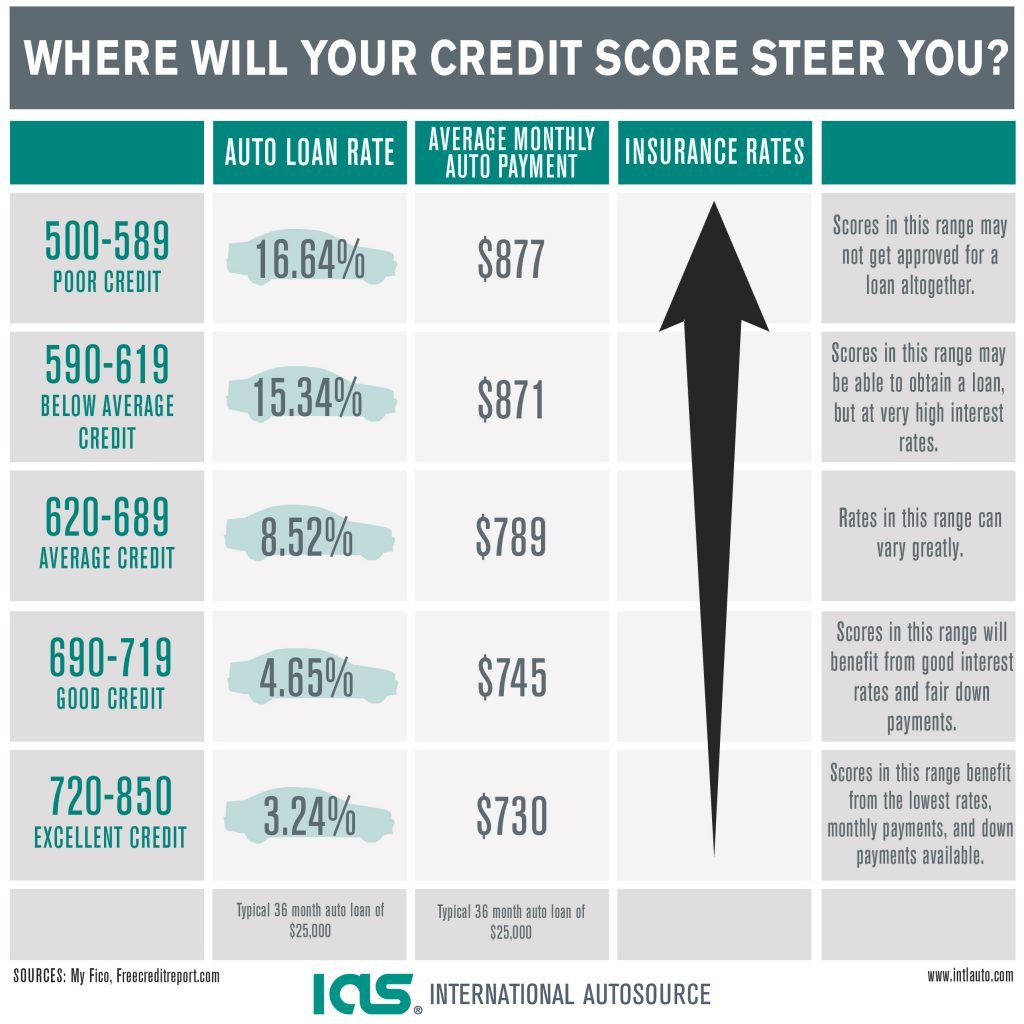

The CFPB points out that your credit scores are a key ingredient in the mortgage qualification process and that higher credit scores generally help you qualify for lower interest rates. To see the potential impact of credit scores on mortgage interest rates, it helps to look at this example:

Letâs say two borrowers apply for a 30-year fixed mortgage for $200,000. Borrower A has a credit score in the 620 to 639 range, while Borrower B has a score between 760 and 850. According to FICOâs home mortgage rate comparison tool, the borrowersâ potential mortgage rates could differ by about 1.5%.

While that may not sound like much, according to the results of that tool, the borrower with the lower credit scoreâBorrower Aâpays $173 more every month. And that extra $173 every month adds up over time.

What Is A Typical Credit Score For A Mortgage

Typically, a lot of mortgage lenders like your credit score to be as high as possible because it shows them you have been good with credit in the past. But, there isnt a typical credit score for a mortgage. Because of this, there isnt a minimum credit score for a mortgage. Its possible to get a mortgage whatever your credit score. There are specialist lenders who will consider your mortgage application even if you dont have a typically good credit score.

Often, mortgages appropriate for people who dont have a high credit score arent available directly to you as a borrower. Theyre only available from specialist lenders via specialist mortgage brokers who have relationships with the lenders. We can help with that. Our brokers are all specialists who can help you get a mortgage even if you have a bad credit score.

What Is An Insured Mortgage Anyway

You may be wondering what an insured mortgage is in the first place. Often referred to as a CMHC mortgage, it applies to any mortgage where the borrower contributes a downpayment of less than 20%, down to the minimum downpayment of 5% of a home’s purchase price.

The ‘insurance’ refers to mortgage default insurance, which protects the lender against default should the mortgagor fail to pay the mortgage as agreed. CMHC is the leading provider of mortgage default insurance in Canada, alongside two other providers: Genworth Financial and Canada Guaranty. For more information, check out our guide to mortgage default insurance.

Also Check: Paypal Credit Report

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Also Check: Does Qvc Report To Credit Bureaus

Is There A Minimum Credit Score For A Mortgage

There isnt a minimum credit score needed to get a mortgage. This is quite a common assumption but getting a mortgage is possible with any credit score. Of course, a low credit score can make it difficult but a mortgage is still very much possible.

Your credit score is used by lenders as part of their mortgage assessment. If you have a low credit score, but otherwise have a strong application, then your mortgage chances shouldnt be affected too much.

A good credit score can give lenders the impression that youre a reliable borrower and are more likely to repay your mortgage on time. That being said, each lender has its own unique scoring system to calculate what a good credit score is. This means that the same credit score may be considered good by one lender, but average or bad for another.

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

You May Like: Can You Dispute A Repossession

How Do I Start My Mortgage Application

The application for a mortgage is similar to what happens in the pre-qualifying process and virtually identical to what is needed in the pre-approval process.

The basics for the mortgage application process are the same as its two siblings name, current address, household income and expenses the lenders just dig a little deeper knowing you are now ready to sign a contract.

You will need paperwork to back up things like:

- Employment history. Have recent paycheck stubs , W-2s and federal tax returns for the last two years. If you own a business, have your 1099s or profit and loss statement.

- Youll need bank statements and paper statements for IRAs, stocks, bonds, CDs or any other securities.

- Real estate holdings. If you own a home, and a second home or rental property, have documents that verify addresses and current market value If you have mortgages out on the property, provide paperwork that includes the lenders name and address the loan number, how much you still owe and what your monthly payment would be.

- This obviously is an important area, particularly in verifying. List credit cards, mortgages, auto, student or personal loans with the names and address of the creditors, the account numbers, balance on the account and minimum monthly payment. If you make alimony or child support payments, list those.

Related Articles:

What Credit Score Is Needed For A Mortgage Faqs

What credit score do you need to buy a house in 2022?

Can I buy a home with a 630 credit score?

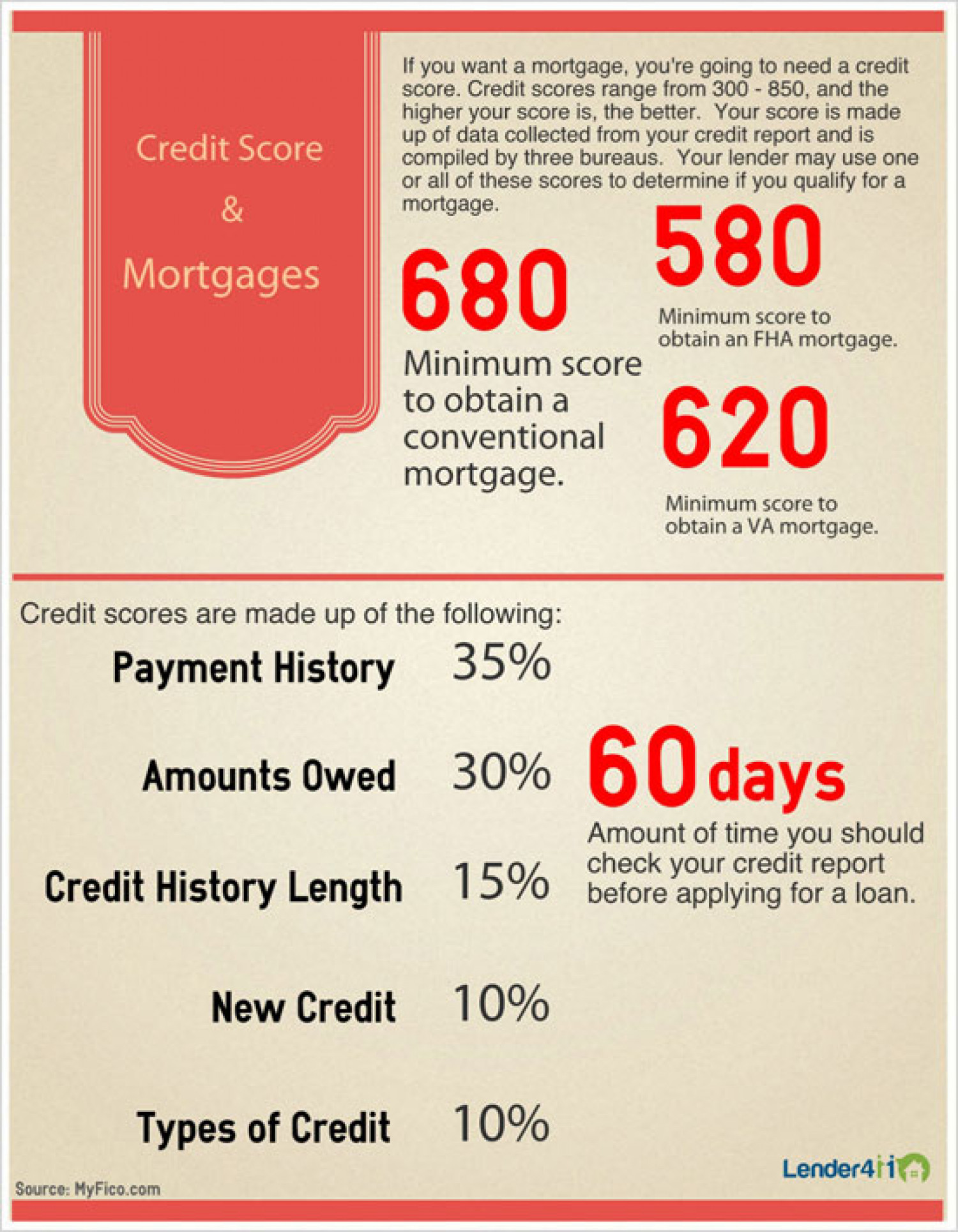

You can qualify for a mortgage with a 630 credit score. The minimum credit score for a conventional loan is 620 for FHA loans, its 580 and for VA loans, the minimum is typically set by the lender. However, the higher you can get your score before you apply for a mortgage loan, the greater your chances of approval and of getting competitive mortgage rates. In addition to meeting minimum credit score requirements, youll also need to meet other eligibility criteria, including sufficient income to make your monthly payments, proof of employment, and having a qualifying debt-to-income ratio.

Is 670 a good credit score?

A credit score of 670 is considered good, based on the FICO score model that is used by mortgage lenders. But the higher your score, the greater your chances of qualifying for a loan and receiving competitive interest rates.

If you have a lower credit score than you think youll need to qualify for a mortgage, talk to a lender anyway. They can tell you exactly what you need to do to raise your score. The process may take several months, or even years, depending on your finances and credit improvement plan. But getting insights from a professional will let you know youre on the right track.

Recommended Reading: Is 586 A Bad Credit Score

Is 715 A Good Credit Score

A 715 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Sources

Save A Larger Down Payment

Lenders look at more than just your credit score when considering your mortgage application. They also consider factors like your income, your debt levels, and the size of your down payment. In Canada, the minimum down payment amount is 5% of the homeâs purchase price. If your credit is less than ideal, your lender may require a higher down payment, since it is riskier to lend to you.

Consider saving a 20-25% down payment for a bad credit mortgage. Not only does this larger down payment signal that you are financially stable enough to own a home, but it also lowers your monthly mortgage payment. It also means you wonât have to pay for mortgage default insurance, which is required for anyone getting a mortgage in Canada with a down payment of less than 20%. Mortgage default insurance protects your lender in the event you default on your loan.

The table below illustrates the benefit of saving a larger down payment at a mortgage rate of 2.54%.

| 5% Down Payment |

*For a $500,000 home amortized over 25 years.

Read Also: Is Carmax Pre Approval A Hard Inquiry

How Credit Plays A Role In Getting A Mortgage

Most people Googling how to buy a home soon find out that credit score plays a big role in getting a mortgage.

Your credit score shows lenders how to rate you as a borrower. Lenders want evidence that you pay bills and repay loans. A history of using credit plus a good credit score give a lender reassurance that youll repay the large sum of money theyre handing you.

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

Recommended Reading: Suncoast Credit Union Truecar

Checking Your Credit Report

A potential lender will look at your credit report before approving you for a mortgage. Before you start shopping around for a mortgage, order a copy of your credit report. Make sure it doesnt contain any errors.

If you dont have a good credit score, the mortgage lender may:

- refuse to approve your mortgage

- only consider your application if you have a large down payment

- require that someone co-sign with you on the mortgage

- require that you get mortgage loan insurance even if you have a down payment of 20% or more

What Is Fico Score And Why Is It Important

FICO is one of the main credit scoring companies in the U.S., and most major creditors use one of FICOs credit scores when making a lending decision. If you apply for a mortgage, auto loan, personal loan, or credit card, theres a good chance that the creditor will check your .

FICO creates different types of credit scores. Its base FICO Scores, created for multiple types of lenders, range from 300 to 850. It also offers industry-specific scores for auto lenders and credit card issuers that range from 250 to 900. In either case, a poor score is often a score below 580, while having a good score means your score is in the high 600s, at least.

You wont necessarily know which type of FICO Score a lender will use when reviewing your credit. But thats okay because you can take similar actions to improve all of your FICO Scores. So, dont get led astray by the myths and misconceptionshere are 10 ways to actually raise your FICO Scores:

Recommended Reading: Reverse Mortgage Manufactured Home

Read Also: Comenity Bank Late Payment Forgiveness

Whats A Good Credit Score To Buy A House

Generally speaking, youll need a credit score of at least 620 in order to secure a loan to buy a house. Thats the minimum credit score requirement most lenders have for a conventional loan. With that said, its still possible to get a loan with a lower credit score, including a score in the 500s. How?

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

Also Check: Print My Credit Report

What Is The Minimum Credit Score Required For A Mortgage In Canada

There are many things you need to have in place before getting a mortgage in Canada. One of the most important is to have a good credit score. But what constitutes a good credit score? After all, there are many different mortgage lenders out there, and each one has its lending criteria that they follow. This article will let you know what credit score you’ll need to qualify and what else you need to consider before starting your mortgage application.

What Credit Score Do I Need For A Conventional Loan

Lenders issuing conventional mortgages have considerable leeway in determining credit score requirements for their applicants. Lenders may set credit score cutoffs differently according to local or regional market conditions, and they may also set credit score requirements in accordance with their business strategies. For example, some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO® Score scale range of 300 to 850, while others may specialize in subprime mortgages aimed at applicants who have lower credit scores. Many lenders offer a catalog of mortgage products designed for applicants with a range of credit.

All that considered, the minimum FICO® Score required to qualify for a conventional mortgage is typically about 620.

Read Also: How To Check Credit Score On Usaa

Can I Get A Mortgage With A Fair Credit Score

Yes! You can get a mortgage with a fair credit rating. Generally, mortgage lenders like you to have a high credit rating, but they all have different lending criteria. If youre thinking of getting a mortgage and want a clear view of how mortgage lenders will see you, the best thing to do is create an account with checkmyfile. Checkmyfile shows you data from four of the major UK credit reference agencies Experian, Equifax, TransUnion and Crediva.

When you apply for a mortgage, a mortgage lender will do a thorough check on you and be able to see your credit history. Checkmyfile lets you see what they will see, so youll know exactly how your credit appears and what kind of score you have. Once you have a clear view of your credit history and how each of the major credit reference agencies have rated you, youll know how likely most lenders will be to offer you a mortgage.

Read more about checkmyfile in our Guide: Checkmyfile Explained.