Search Or Browse Our Credit Dispute Faqs Below

As you use this website, we and our third-party providers collect your internet and other electronic network activity information via cookies and other technologies. We use this personal information to enhance user experience, analyze performance and traffic on our website, and to provide targeted advertising. If you would like to opt out from the use of non-essential third-party cookies, please select the Restrict All option. To learn more about how we use cookies, see our .

Please note that:

Ways To Dispute An Error On Your Credit Report

If you believe an error has been made on your credit report, you should start by contacting the credit bureau that issued it.

You can usually contact a by phone, mail or an online portal.

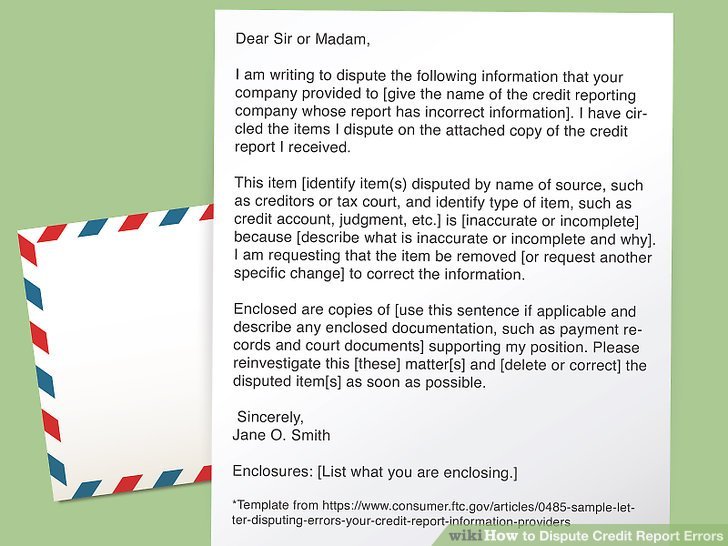

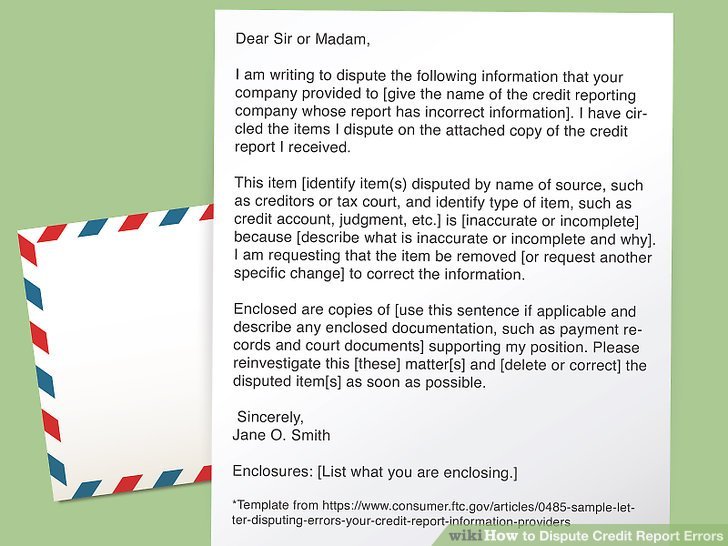

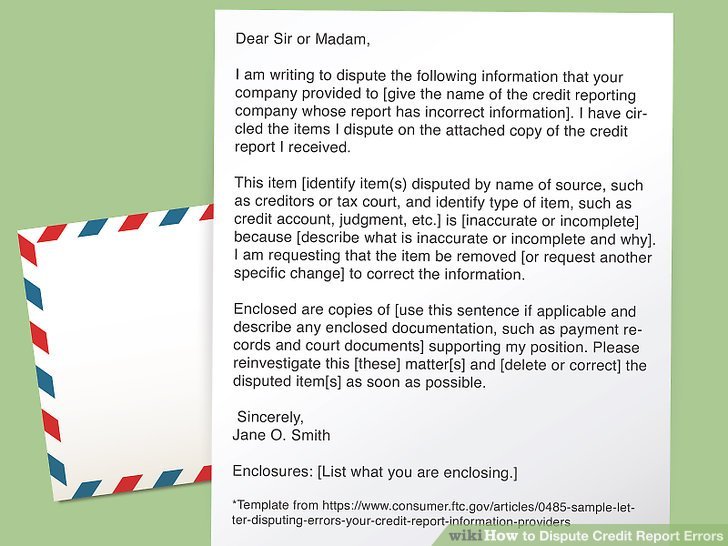

If you want to contact the credit bureau by mail, you can send a detailed letter outlining the error and why its a mistake via certified mail and request a return receipt.

You should include a copy of your credit report with the letter, highlight the error and provide copies of any documentation you have to support your claim.

Documentation can include a canceled check, a statement that proves an account has been paid off, police reports, FTC Identity Theft Reports or any type of correspondence related to your claim. In addition, make sure you clearly list your contact information including your name, mailing address and phone number in your letter.

If you would prefer to start the claim process by phone, you can call the credit bureaus dispute line, and theyll walk you through the steps for filing it.

Its typically easiest and fastest to dispute an error online, where you can upload any documentation that supports your claim. No matter how you contact them, it takes credit bureaus approximately 30 to 45 days to complete their investigations.

How Disputing Impacts Credit

Filing a dispute with one or all of the credit bureaus has no direct impact on your credit scores. But once the dispute process is completed, any changes to your credit reports could lead to changes in your credit scores.

Whether your score goes up, down or remains the same depends on what you’re disputing and the outcome of the dispute. Removal of mistakenly reported negative information, such as late payments or unpaid collections accounts, could lead to credit score improvements. On the other hand, corrections to your personal information, while important to maintaining accurate credit tracking, have no impact on credit scores.

Read Also: How To Get Navient Off Credit Report

Make Sure Your Disputes Are Legitimate

Be sure you dont do anything to make the credit bureaus think your credit report disputes are frivolous. Dont dispute everything on your credit report and do not send all your disputes at once. If you dispute the same item more than once, you should give a different reason for each dispute so the credit bureau doesnt think youre sending duplicates. The credit bureau has the right to reject your dispute if you don’t have solid evidence.

Error Detected Now What

Alas, your good word isnt good enough on its own. You will need the best available evidence. Been divorced five years, but your ex is still on your report? Present a copy of your divorce decree.

Payments made on time were recorded as late? Bank statements are your friend.

In short, you need documentation. Whatever is relevant applies: Loan documents, credit card statements, marriage licenses, divorce decrees, birth or death records, bank statements.

Investigators will be delighted to have help. Demonstrate that you are organized, reliable, and circumspect. Help them help you. Youve spotted an error, and you can back up your claim with the hard evidence of a paper trail .

Recommended Reading: When Late Payment Report To Credit

How To Fix Credit Report Errors

Fixing credit report errors is a two-step process: communicate with credit bureaus and then give them the correct information.

It sure sounds easy, doesnt it? Well, it is, but it can be a process. If youre going to try and correct an error on your credit report, these are the steps you may want to take.

Its also important that your credit report doesnt short-change your history. Dont see that gas credit card you paid off last year? Make a note to get it added. An accurate and complete credit report is important.

Check All Three Credit Reports For Errors

Through the end of 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Don’t Miss: Who Uses Transunion Credit Report

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

Also Check: Is 850 A Good Credit Score

How To Check With The Data Furnisher

When you file a dispute, the Federal Trade Commission suggests also informing the company that provided the data to the credit bureaus, such as a bank, lender or card issuer, in writing. These sources of information are known as furnishers. Notifying the data furnisher may cause them to proactively stop reporting the inaccurate information to the credit bureau, although that’s not guaranteed.

Send the letter to the company using the address it listed on your credit report. If there is no address listed, ask the company for one.

The FTC notes on its website: “If the provider continues to report the item you disputed to a credit reporting company, it must let the credit reporting company know about your dispute. And if you are correct that is, if the information you dispute is found to be inaccurate or incomplete the information provider must tell the credit reporting company to update or delete the item.”

What Steps Can I Take If I Do Not Agree With The Dispute Investigation Results

If you still believe that the information on your credit report is not accurate following your review of the investigation results from the credit reporting company, you have several options:

- You may contact the creditor that reported the information to the credit reporting company and dispute it directly with them. If you wish to obtain documentation or written verification concerning your accounts, please contact your creditors directly.

- You may provide additional information or documents to the credit reporting company relating to your dispute.

- You may request a brief statement be added to your report. Your statement should be specific to your dispute of credit information.

- You may file a complaint about the credit reporting company, or the business reporting the item, with the Consumer Financial Protection Bureau or your State’s Attorney General’s office.

Also Check: Are There Any Real Free Credit Report Sites

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

Whats The Best Way To File A Dispute

If you see incorrect information on your credit report, it is possible to dispute it and have it permanently removed.

To do this, send a written request for verification to the credit bureau and send it via certified mail with return receipt. Sending a certified dispute letter ensures you know the agency received your request and you have a paper trail with a date to begin the countdown for removal.

Make sure you send separate dispute letters to each credit bureau reporting the information, even if it is the same.

Each credit reporting agency is a separate entity. They also generally do not share information with each other. Therefore, even if the data is removed from one credit report, it may stay on your other credit reports until you submit another request.

Don’t Miss: Does Closing A Credit Card Hurt Your Score

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack in 2020, which was finalized in 2022, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year for seven years.

Read Also: What Is The Minimum Credit Score To Buy A Car

Wait For The Credit Bureau Response To Your Dispute

The credit bureau may respond to your dispute by immediately deleting the information in question. However, the company does have the right to reinsert previously deleted items if those items are later verified. If that happens, the credit bureau has to notify you, in writing, that the item has been put back on your credit report.

Any data you provided about the inaccuracy of the information will be forwarded to the original company that provided the information, which is then required to investigate and respond back to the credit bureau.

Once the investigation is complete, the credit bureau will provide you with the results, along with a free copy of your credit report if the dispute resulted in a change. You can then request that the credit bureau send a correction notice to any company that accessed your credit report within the past six months.

If there is inaccurate information in one credit bureau’s version of your credit report, it’s likely that the information will be inaccurate on the other two bureaus’ reports as well. You should check all three credit reports to be sure that the information in each is complete and accurate.

Sometimes the credit bureau responds that the error you disputed was verified by the creditor. This can happen when there’s an error within the creditor’s systems and it was not uncovered in the investigation. If this happens, you can bypass the credit bureau and dispute the error directly with the creditor.

Send Dispute Letters To Each Agency

Make sure you send separate dispute letters to each agency that has the information, even if its exactly the same. The credit reporting agencies dont share information or communicate with one another. Even if you have the data removed from one report, it may stay on the other reports until you submit another request.

Also Check: Does Requesting A Credit Line Increase Affect Credit Score

Your Legal Rights To Dispute Credit Reports

Because inaccurate credit reports can potentially harm you financially, its worth knowing all your dispute-related rights under the Fair Credit Reporting Act , the federal statute that regulates credit reporting and safeguards consumers. The law stipulates your right to:

- One free annual credit report that contains all information on file at the time of your request from each of the three credit bureaus.

- Know who received your credit report in the past year .

- Dispute a report with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the information supplier are legally obligated to investigate your dispute.

- Another free credit report should an application for a loan, credit card, etc., be denied because of information in your credit report. Should you choose to dispute the credit report, you must do so within 60 days of that denial.

- Add your own explanatory note to your credit report if your dispute is not resolved to your satisfaction.8

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also , but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

Read Also: What Is Your Credit Score

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

How Does The Dispute Process Work

File a dispute for free

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, you have two options to submit a dispute form and required documents: electronically or by postal mail.

Results

After your dispute is processed, we will notify you with the results and outcome of the investigation. If you submitted your documents electronically, you will receive the results by email. If you printed and mailed in your dispute information, your results will be mailed to you.

Please note that you will need to contact Trans Union of Canada, Inc. directly to correct inaccuracies found on your TransUnion Canada credit file.

Recommended Reading: What Can A 800 Credit Score Get You

How You Can Check Your Credit Reports

You can get a free copy of your credit report from each major credit reporting agency every 12 months at AnnualCreditReport.com.

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports, so that you can manage your credit during the COVID-19 crisis.

What If You Disagree With The Credit Bureau’s Investigation

If you tell the information provider that you dispute an item, a notice of your dispute must be included anytime the information provider reports the item to a credit bureau while that dispute is being investigated.

Finally, if the investigation does not produce the results you feel are correct, and inaccurate information in your credit report is causing you harm, you may consider hiring a lawyer to help resolve your dispute as a last resort.

The secret to success is to be vigilant and tenacious when it comes to reviewing, repairing, and correcting the record regarding your credit reports.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Also Check: Why Did My Credit Score Go Up