Why Are My Transunion And Equifax Credit Scores Different

When you log into your Credit Karma account, you can access your free credit reports and scores from both TransUnion and Equifax. Theyll likely be slightly different, and its possible they could be very different.

Multiple factors could account for why your scores are different.

- Like all credit-reporting agencies, TransUnion and Equifax use proprietary scoring models. And while credit scores are typically based on the same or similar factors including your payment history and number of accounts in good standing each credit-scoring model can weigh those factors differently.

- The credit bureaus may have different information. Not every credit-reporting company will have every bit of information about you. Some lenders may report information to all three big credit bureaus, while others might report to only one or two. And a lender may report updates to different bureaus at different times. So, its possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

- You may be seeing scores from different dates. A credit score is a snapshot of your credit profile at a specific point in time. Since credit scores can change over time, its important to compare scores from the same time period when comparing them across credit bureaus.

What factors determine my credit scores?

The Main Three Credit Bureaus

Data maintained by Experian, TransUnion and Equifax is used to calculate credit scores. Credit bureaus gather information about your credit accounts, including credit cards, loans and lines of credit. They record your payment history, balances, available credit, late payments, accounts in collections and bankruptcies.

Credit reports also include identifying information such as your name, Social Security Number, current and former addresses, and current and past employers that have been reported to the bureaus by the creditors. They dont include financial information unrelated to debt, such as your income or bank account balance. In the case of Experian, to help protect you from identity theft, they do not list your actual SSN on your personal credit report.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: How Do You Increase Your Credit Rating

Similarities Between Fico And Vantage Score

Both FICO and VantageScore have the same straightforward goal: To predict the likelihood that a consumer will default on a debt sometime in the next 24 months.

And that’s why you shouldn’t get too worried about the differences. Every one of your credit scores should be in the same general range, but they’ll never be identical.

Different lenders use different scores. Because you cant predict which score they will choose, it may not matter which score you rely onFICO or VantageScore. There are many other scoring models and no practical way for you to keep track of or access all of them.

You don’t have just one credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Why Is Knowing Both Equifax And Transunion Score Necessary

Is TransUnion more important than Equifax? I wouldnt say so. Same question goes for is Equifax more important than Transunion.

Which credit score matters more Transunion or Equifax?

Since they can vary so much, if youre applying for credit sometime soon , you might wonder if knowing but your Transunion vs Equifax score is necessary or would it be considered overkill. Personally, it would be good to know both your Equifax and Transunion score.

So to answer the question, Transunion or Equifax which is better

At least you should check both Transunion and Equifax credit reports periodically, in case you need to check with the particular credit card bureau to fix something between the landlord and tenant. For me, I check about every 6 months or more frequently, when I apply for a new credit card .

If youre not applying for credit any time soon, its still nice to know because knowing your credit score is like a vanity metric LOL. This is somewhat reminiscent of the days when you want to get as high a grade as possible in school, right?

Getting an 800+ credit score is not hard to do and its nice to have.

Its also good to check your credit score for both credit bureaus because when you close a credit card that you have applied for recently you will want to double check and make sure the account is closed. This happened recently to me.

Had I not done that I would be charged $120.

You May Like: How To Improve Credit Rating Nz

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

What Is A Transunion Credit Score

Asked by: Ms. Lea Renner Sr.

The credit score you see if you’re signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780.

Recommended Reading: What Is Considered A High Credit Score

Understand Your Credit Scores

Each credit monitoring service uses a unique scoring system and, to some extent, different credit information to make decisions.

Knowing how different credit agencies such as Equifax and TransUnion operate and how they calculate your credit score can help you know where you stand so you can begin to build credit effectively.

Why Your Equifax Credit Score Is Lower Than Transunion Fico Score

The three main credit reporting companies areEquifax,TransUnion, andExperian. Each one receives slightly different information from creditors.

Because of this, you might often ask yourself, “why is my Equifax score lower than TransUnion”? Or conversely, you may ask, “Why does TransUnion differ from Equifax?”

People are obsessed with their credit scores for good reason. If you have a good credit score, the better potential creditors view your financial trustworthiness.

Whether you are applying for a credit card, car loan or mortgage, jobs, and even rentals, your interest rate and terms will be far better with a good or excellent credit score.

Let’s take a look at credit scores and credit scoring models, and then look more deeply into the credit reporting agencies or credit bureaus.

Read Also: How Is Credit Score Determined

Which Credit Score Is Better Fico Or Transunion

It’s considered to be one of the more balanced bureaus since it assigns weight fairly evenly across the standard risk categories. TransUnion ranges from a low of 300 to a high of 850. … FICO scoring is more holistic, which allows more Americans to qualify for loans and mortgages than most traditional bureaus’ scores.

Is 893 A Good Credit Score

An 893 credit score is excellent. Before you can do anything to increase your 893 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and don’t count towards your score.

Recommended Reading: What Does Charged Off Account Mean On My Credit Report

Why Do Bureaus Have Different Credit Scores

Aside from TransUnion and Equifax, the third major credit bureau is Experian. The big three maintain databases containing information on more than 220 million American consumers.

The companies sell the information to lenders, banks, debt collectors, and other entities that wish to review your creditworthiness and financial history during any application process. But your credit reports arent necessarily the same at all the credit bureaus.

When it comes to the difference between TransUnion and Equifax, the important thing to remember is that the companies generally rely on the same factors to come up with credit scores. Still, those factors are evaluated using different credit-scoring models.

Of course, there might also be slight variations in the data used to generate the scores because the major credit bureaus dont necessarily get the same information from lenders and creditors.

Its also worth noting that some lenders and creditors focus exclusively on scores that emphasize the information relevant to a particular industry, while others choose to blend your TransUnion or Equifax credit score with the scores from Experian.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Read Also: Does Collections Report To Credit

Transunion Vs Equifax: Why Your Scores May Differ

The main reason your TransUnion and Equifax scores may look different from one another is that the companies use different algorithms to compute your score.

On the other hand, some credit bureaus may collect information that the others dont. For example, Equifax is known to report longer credit histories for borrowers than TransUnion or Experian. Additionally, TransUnion may report your employment history and personal information to determine your creditworthiness, while Equifax and Experian may only report the name of your employer.

What Do The Credit Bureaus Do

Credit bureaus, or credit reporting agencies, collect information from a variety of sources using your Social Security number, credit file, and other identifying information. They use this information to compile credit reports and calculate credit scores, which are different.

- : Your credit report contains information about when credit accounts were opened, their balances, credit limits, and payment history, as well as information on bankruptcies and debt collections. Credit scores are calculated from the information in your credit reports.

- : Credit bureaus each calculate their own . This can be confusing because most lenders use credit scores compiled by one of two outside companies â FICO® and VantageScore â which come up with different credit scores using their own models based on the credit bureausâ reports.

Generally speaking, credit scores are calculated using five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. However, these are defined and weighted somewhat differently depending on the company thatâs compiling your score.

Itâs helpful to know the difference between how TransUnion and Equifax calculate credit scores, in order to better understand the numbers that appear on their credit reports.

Also Check: Is 671 A Good Credit Score

Why Is My Transunion Score Higher Than Fico

For example, lenders can choose to report to one, two or all three agencies. Because of this, the information in your reports can vary, which is partly why your scores can differ too. There are also many scoring models, and they may weigh certain information in your reports more heavily than other factors.

How Do I Build A Good Credit History

A credit reporting agency needs a track record of how youve managed credit before it can calculate a credit score. Typically, six months’ worth of activity will provide enough information to generate a score. Your score is dynamic and may rise or fall over time, based on how consistently and promptly you pay your bills. Establishing a good credit history takes time. Each creditor has different.requirements for issuing credit. If you are declined credit, contact the lender to determine the reasons why.

Don’t Miss: Why Does Credit Score Go Down

Who Are The Credit Reporting Agencies Understanding Where Your Credit Scores Come From

When you borrow money, your creditor will generally report your payment history to one or all of the three credit bureaus. Once you have at least six months of credit history, your data is subjected to scoring models by either FICO or VantageScore. These three credit bureaus then generate a credit score.

Payment history is the single biggest factor with credit scores, weighted at 35% of your score. If you skip or make late payments your credit history takes a ding. Enough of these dings and your credit score drops. A credit card company will always report late payments!

The second factor is credit utilization. This factor represents 30%of your score. Utilization looks at how much of your revolving debt you are using versus your credit limit.

Revolving debt includes loans like credit cards or home equity loans. The more of your credit limit you are using, the higher the ratio and the lower your credit score.

Age of credit is 15% of your score. You need at least 6 months of credit usage to have a credit report. The older your credit, the better your score. By having credit cards or other personal loans for years improves your score.

The last factor is application history . Every application for a credit card or a loan results in credit inquiries or a “pull.” Hard pulls, or the release of the full report, temporarily lowers your credit score. Soft pulls do not affect your credit score.

Why Is Knowing About Credit Bureaus Important

Learning about how credit bureaus work can actually help you better understand your overall credit. While the bureaus are often lumped together, they are actually separate companies competing for the same business from consumers. So how do credit bureaus work, where they get your information, and how should you go about handling any inaccuracies you may find on your report.

Given the importance of your credit score and how it impacts your everyday life, any chance to improve your credit score should be welcome.

Also Check: Does Child Support Show Up On Your Credit Report

Key Differences Between Fico And Vantage Score

The differences between the FICO score and Vantage Score are relatively minor:

- VantageScore is designed to keep track of new or infrequent credit users. This can be an advantage for young adults, or to anyone who for any reason has dropped off the consumer radar for a time.

- When you apply for a new loan, the lender checks your credit rating. Consumer protection law requires that multiple applications are treated as one query so that you don’t get dinged multiple times for comparison shopping. Because the two rivals handle these queries a little differently, VantageScore may ding you a little more than FICO will.

- Both compile a credit score at the moment it is requested. The FICO system relies on current information as it is reported to the credit bureaus. The VantageScore system incorporates information on your spending behavior over the past two years.

What Is The Difference Between Fico Score And Vantagescore

Two companies dominate credit scoring. The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of 300 to 850.

FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well.

You May Like: How To Get Your Free Credit Report From Transunion

Why Does Transunion And Equifax Different

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, it’s possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

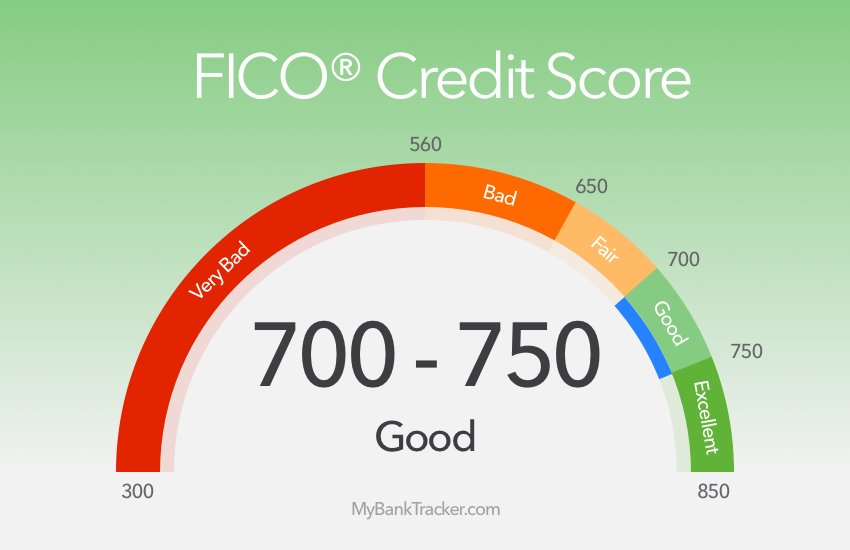

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

Read Also: What Is The Highest Your Credit Score Can Be

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

Equifax Credit Score Calculation

Atlanta-based Equifax was founded in 1899. It operates in 11 countries, including the United States, where it monitors data on more than 222 million consumers.

It uses a proprietary credit scoring formula, which is similar to FICOâs. However, its scoring range is slightly different from FICOâs range, starting at 280 and topping out at the same 850 figure. Under the Equifax model, a good credit score ranges between 660 and 724.

Another difference is that Equifax classifies your accounts as either âopenâ or âclosed,â instead of grouping all accounts together as other credit bureaus do, so an open account may be weighted differently than an account you closed three years ago. It also employs an 81-month credit history instead of the standard seven-year history the others use.

Don’t Miss: How Often Does Your Credit Score Update