How Credit Scores Are Determined

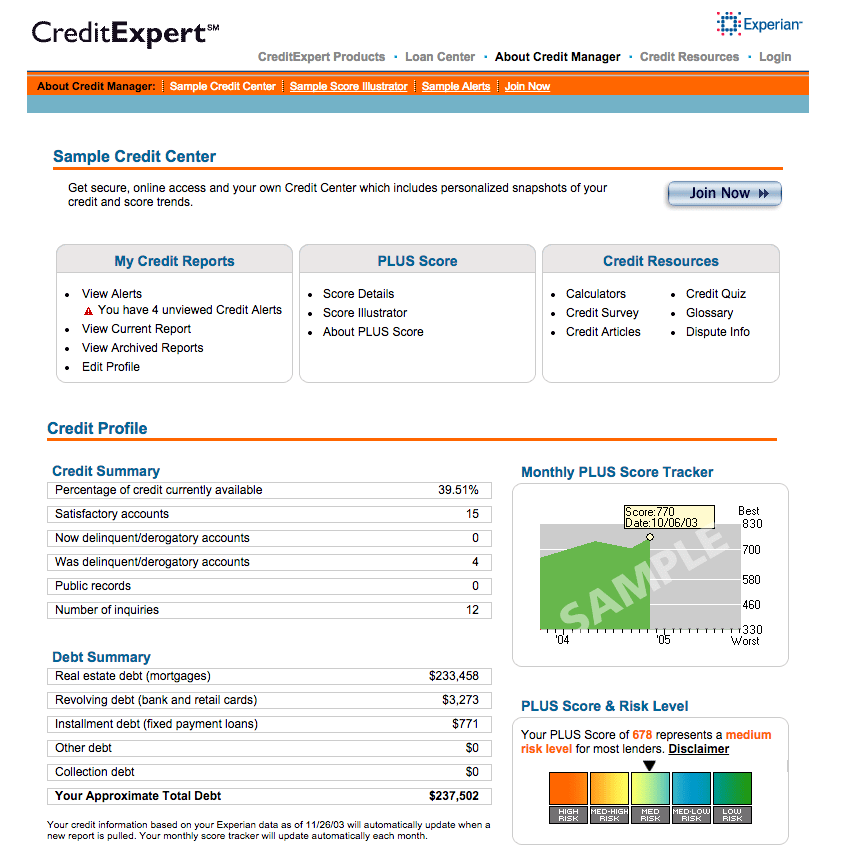

Information found in your credit report is used to determine your credit scores, which might include the following:

- Your history of debt payments

- Hard inquiries6 on your credit score from new credit applications

- The amount of debt you currently have on your credit accounts

- The age of your credit accounts

- The amount and type of loan accounts you have open

- The percentage of available credit you’ve utilized

- If and when you had a foreclosure, declared bankruptcy, or had debt sent to collections

It’s common to see varying credit scores when you look at different sources. Credit Karma and other services might display different credit scores, like TransUnion VantageScore, which is different from the TransUnion FICO score that’s used for your Apple Card application. Your credit report and the timing of when your credit score is updated can affect your credit score.

For information about credit scores from TransUnion, please click here.

How Some Pos Loans Could Decrease Your Credit Score

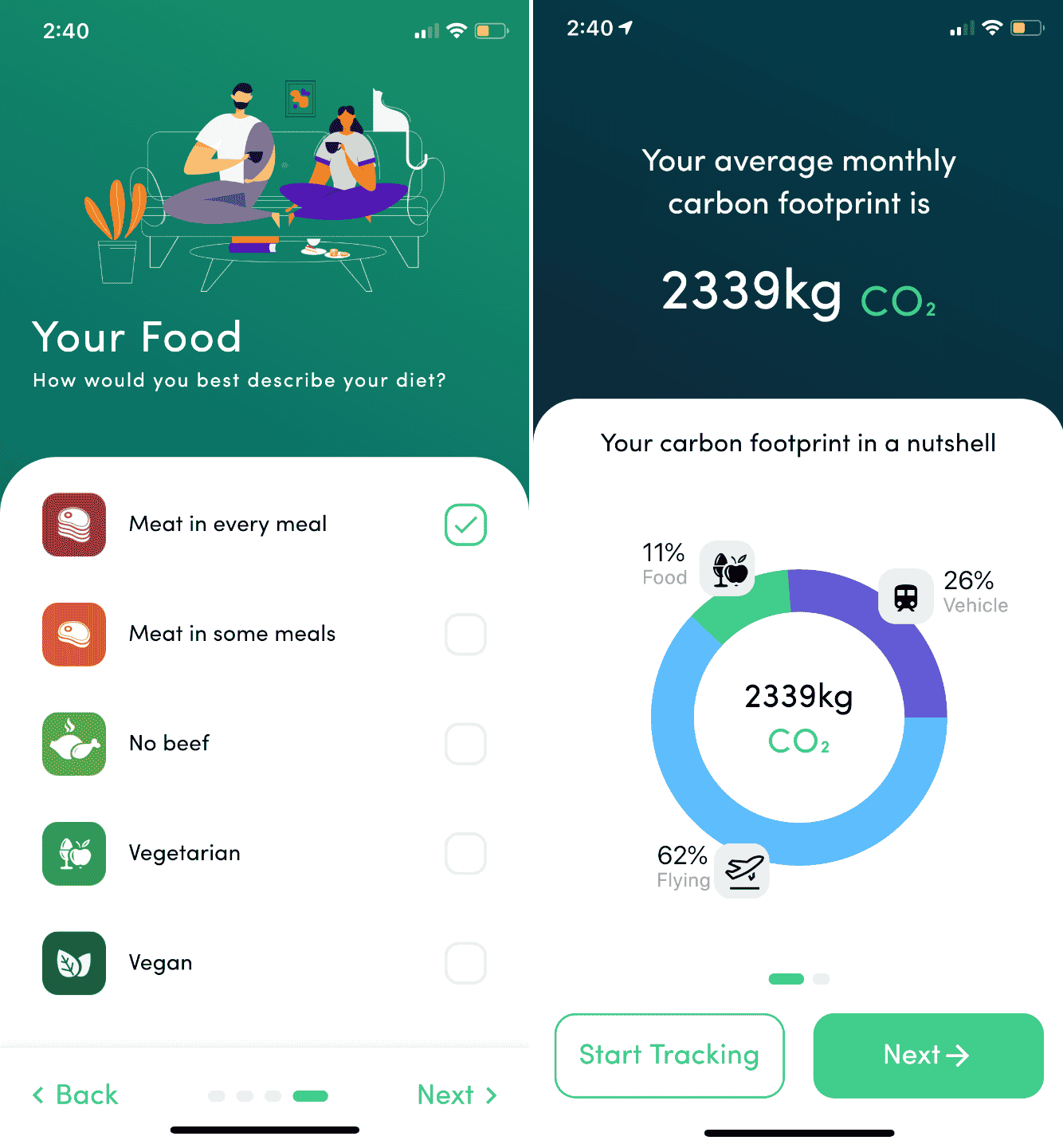

Depending on your loan provider, taking out a POS loan can either increase, decrease or have no impact at all on your credit score. Some of the most popular POS loan providers AfterPay, Affirm and Klarna report some loans to the credit bureaus while others don’t.

“If reported, a missed payment can be noted on your credit report for up to seven years and will negatively impact your credit score,” says Rod Griffin, the senior director consumer education and advocacy at Experian. “At the same time, if a ‘buy now pay later’ lender reports account information to credit reporting agencies like Experian, and you are managing the debt responsibly, these services can be a helpful way to build credit.”

Affirm is one BNPL provider that does report information to Experian on some loans. It doesn’t report loans with a 0% APR and four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR.

For other Affirm loans, the entire loan history is reported to Experian. This means that both positive and negative payment history will be reported to only Experian and not other credit bureaus. Your payment history, the amount of credit you’ve used, the length of time you’ve had the credit and any late payments will all be reported to Experian.

If you default on your Affirm loan or make late payments, you risk decreasing your credit score. But your credit score could take a hit even if you’re paying your POS loan on time.

Conditions That Might Cause Your Application To Be Declined

When assessing your ability to pay back debt, Goldman Sachs1 looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application.

If you’re behind on debt obligations4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank .

- You have two or more non-medical debt collections that are recently past due.

If you have negative public records

- A tax lien was placed on your assets .

- A judgement was passed against you .

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income .

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low ,5 Goldman Sachs might not be able to approve your Apple Card application.

Don’t Miss: How Often Do Credit Cards Report To Credit Bureaus

What You Can Do If Your Application Is Approved With Insufficient Credit Or It’s Declined

If your application is declined, a message with an explanation is sent to the primary email address associated with the Apple ID you used to apply for Apple Card. The message might show your credit score. If information provided by a credit bureau contributed to your application being declined, you can request a free copy of your credit report from that credit bureau using the instructions in the email you receive.

If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

Will Acceptance Now Collections Sue Me Or Garnish My Wages

Its possible, but if you work with a law firm like Lexington Law, you have nothing to worry about. They will help you dispute the collection account with the credit bureaus and possibly remove it from your credit report. Its also quite possible that you will never hear from or have to deal with Acceptance Now Collections again.

Read Also: Does Carecredit Affect Credit Score

Directorate Of Digital Innovation

The Directorate of Digital Innovation focuses on accelerating innovation across the Agency’s mission activities. It is the Agency’s newest directorate. The Langley, Virginia-based office’s mission is to streamline and integrate digital and cybersecurity capabilities into the CIA’s espionage, counterintelligence, all-source analysis, open-source intelligence collection, and covert action operations. It provides operations personnel with tools and techniques to use in cyber operations. It works with information technology infrastructure and practices cyber tradecraft. This means retrofitting the CIA for cyberwarfare. DDI officers help accelerate the integration of innovative methods and tools to enhance the CIA’s cyber and digital capabilities on a global scale and ultimately help safeguard the United States. They also apply technical expertise to exploit clandestine and publicly available information using specialized methodologies and digital tools to plan, initiate and support the technical and human-based operations of the CIA. Before the establishment of the new digital directorate, offensive cyber operations were undertaken by the CIA’s Information Operations Center. Little is known about how the office specifically functions or if it deploys offensive cyber capabilities.

United States Census Bureau

| Preceding agency |

|---|

| .gov |

The United States Census Bureau , officially the Bureau of the Census, is a principal agency of the U.S. Federal Statistical System, responsible for producing data about the Americanpeople and economy. The Census Bureau is part of the U.S. Department of Commerce and its director is appointed by the President of the United States.

The Census Bureau’s primary mission is conducting the U.S. census every ten years, which allocates the seats of the U.S. House of Representatives to the states based on their population. The bureau’s various censuses and surveys help allocate over $675 billion in federal funds every year and it assists states, local communities, and businesses make informed decisions. The information provided by the census informs decisions on where to build and maintain schools, hospitals, transportation infrastructure, and police and fire departments.

In addition to the decennial census, the Census Bureau continually conducts over 130 surveys and programs a year, including the American Community Survey, the U.S. Economic Census, and the Current Population Survey. Furthermore, economic and foreign trade indicators released by the federal government typically contain data produced by the Census Bureau.

Read Also: What Is The Most Accurate Credit Score App

Census Regions And Divisions

The United States Census Bureau defines four statistical regions, with nine divisions. The Census Bureau regions are “widely used…for data collection and analysis”. The Census Bureau definition is pervasive.

Regional divisions used by the United States Census Bureau:

- Division 1: New England

- Division 2: Mid-Atlantic

Re: Finally Starting To Fix My Credit

Well it would still be open, but they very well may start reporting it monthly and actively pursuing collections, calls, etc. You did not list balances, only offer to pay for delete if you have the money to do so, settlements are least likely to be removed from bureaus. The GW to Kay Jewelers has been long enough that they might go ahead and remove it. The one you speak of that was charged off 2 years ago may remain for awhile as it is relatively viewed as new. I don’t know the SOL in your state.

You May Like: How To Get My Free Annual Credit Report

Copyright Policy/termination Of User Privileges For Infringement And Contact Information For Suspected Copyright Infringement/dmca Notices

We will terminate the privileges of any user who uses the Site to unlawfully transmit copyrighted material without a license, express consent, valid defense or fair use exemption to do so. In particular, users who submit user content to the Site, whether articles, images, stories, software or other copyrightable material must ensure that the content they upload does not infringe the copyrights of third parties.

If You believe that Your copyright has been infringed through the use of PC, please contact Our designated agent at: You may also contact Our customer service department at: or mail at:

Can I Remove Acceptancenow From My Credit Report

Its possible that youll be able to remove AcceptanceNOW from your credit report. Your odds depend on whether the debt is legitimate or a mistake.

If the debt is a mistake: If AcceptanceNOW is trying to collect an illegitimate debt , your chances of getting it removed from your credit report are pretty good. The same goes if the debt is more than 7 years old , at which point its supposed to automatically fall off your report.

You can dispute the item on your credit report and get it removed by sending a to AcceptanceNOW and the three major credit bureaus .

If the debt is legitimate: Unfortunately, if the debt is real and its less than 7 years old, removing AcceptanceNOW from your credit report will be very difficult.

Your best move at this point is to simply pay the debt. Newer credit scoring models ignore paid-off collection accounts, which means paying off your collection will boost your credit score even if you cant remove the item.

However, when you pay, there are two negotiation strategies you can try as a last-ditch attempt to remove AcceptanceNOW from your credit report:

If all else fails, remember that collection accounts only stay on your credit report for 7 years. Like all negative marks, AcceptanceNOW will fall off your credit eventually.

Learn more about how AcceptanceNOW impacts your credit score:

Read Also: How Long Hard Inquiries Stay On Credit Report

Early Cold War 19531966

The CIA was involved in anti-Communist activities in Burma, Congo, Guatemala, and Laos. Operations in Laos continued well into the 1970s.

There have been suggestions that the Soviet attempt to put missiles into Cuba came, indirectly, when they realized how badly they had been compromised by a USUK defector in place, Oleg Penkovsky. One of the most significant operations ever undertaken by the CIA was directed at Zaïre in support of general-turned-dictator Mobutu Sese Seko.

Need A Bnpl Loan That Won’t Impact Your Credit Score

Each BNPL loan handles credit checks and reporting to credit bureaus differently.

Although AfterPay does not consider itself a POS provider, AfterPay performs no credit check at all, making it a solid option for people who have poor or bad credit and have a hard time securing a loan otherwise . It doesn’t report loans to the credit bureaus.

Klarna also does not report information to the credit bureaus on its POS loans, according to Klarna. Klarna will perform a soft credit check, which won’t affect your credit score, if you’re taking out a ‘Pay in 4’ loan or a ‘Pay in 30 days’ loan. Additionally, if a consumer applies for a branded open line-of-credit product offered by Klarna’s partner bank, a hard inquiry may be conducted.

Your score won’t be affected if you take out an Affirm loan that charges 0% APR and has four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR. If you take out a longer loan with interest, the loan will be reported to Experian.

Before you take out any BNPL loan make sure you’re clear on the terms and conditions, so you understand the interest rate and repayment schedule.

Also Check: How Long Do Credit Inquiries Stay On My Report

Requirements To Get Apple Card

To get Apple Card, you must meet these requirements:

- Be 18 years or older, depending on where you live.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that isn’t a P.O. Box. You can also use a military address.

- with your Apple ID.3

- If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

- You might need to verify your identity with a Driver license or State-issued Photo ID.

Make A Point To Regularly Review Your Credit Report

Everyone should make a point to get into a habit of regularly reviewing their , especially if you’re opening new financial products, whether that’s a POS loan or a new credit card.

Due to the pandemic, each of the three credit bureaus Experian, Equifax and TransUnion now offer one free credit report weekly. Just go to annualcreditreport.com, a website authorized by federal law, to request your credit report from one of the bureaus. If you have an Affirm loan, you’ll want to request your Experian credit report.

There are also a number of free services that allow you to keep track of your credit score. Most credit card companies allow you to check your score on their apps or website. You can also use a free credit monitoring program like or Experian free credit monitoring.

While signing up for a POS loan won’t necessarily improve your credit score, there are a few quick ways to improve it. *Experian Boost, for example, is a free service that offers consumers the ability to connect their utility and streaming accounts to their Experian credit report. This means that if you’re timely about paying off your internet, water or Netflix® bill, you could see your FICO® score improve.

Read Also: When Does Opensky Report To Credit Bureaus

Finally Starting To Fix My Credit

Hey guys and gals ive posted here before but didnt start my credit repair process like i should have if i did my credit would have been repaired by now more than likely..

going to post items on my report and what im planning on doing to/with them if yall see anything needs changing let me know any advice is appreciated. also i just purchased a “609 credit repair” program and im out the 45$ now but wont be using it after reading things on here. id rather the problem be resolved not show back up on a credit report when im trying to buy a house.

Opened: 3/16 High Balance: $4,199.00 Current Balance: $2,141.00

Currently Open No delequincies

Opened: 4/17 High Balance: $23,482 Current: $22,186

Currently Open No Delequincies

American Honda Finance

Opened: 8/12 High Balance: $6,379.00 Closed Paid in full GW sent 7/25 by fax to executives

Closed: 11/14 Paid In Full

Lates: 12/13 1/14 4-7/14

Capital One CC

Opened: 8/10 No Info on file about amount or Balance. Just says Paid, Paying as agreed, was past due 90 days.

Closed: 8/11 Paid

Opened: 7/12 High Balance: $836.00

Closed: 12/15 Charged off $836.00

Lates: 1-2/14 5-7/14

Midland Funding For Credit One Card

Opened: 11/14 $894.00

Current Status Collection Lists As Negative On Report Each Month

Kay Jewlers

Opened: 11/08 High Balance: $180.00

Closed: 9/11 Paid Charge Off Account Closed By Credit Grantor GW Emails sent to Signet Executives 7/25

Lates: 3-5/11

Opened: 2/13 High Balance: $23,533 Balance: $18,030

Closed: 2/13

What Happened To Acceptance Now

Acceptance Now has is now doing business under the name Acima Credit. The AcceptanceNow has partnered with a large variety of furniture, appliance and other retailers to make it easy to get the best, high quality brands and pay as you go. You can shop with confidence knowing that no credit is needed and flexible payment plans are available.

AcceptanceNOW® is a company that partners with name brand retailers to provide customers access to the products they want and need but are unable to get from the retail store. AcceptanceNOW® allows customers to shop with confidence because no credit is required and only a low monthly payment is needed.

You May Like: What Credit Score Do You Need For Care Credit Dental

How Do I Remove Acceptance Now Collections From My Credit Report

Removing Acceptance Now Collections from your credit report may be possible if any information on the account is incorrect, error’d, or fraudulent, and is not fixed in an appropriate amount of time. According to a study by the U.S. PIRGs, 79% of credit reports contain mistakes or serious errors. We specialize in going after these types of accounts for our clients.

Dni Takes Over Cia Top

The Intelligence Reform and Terrorism Prevention Act of 2004 created the office of the Director of National Intelligence , who took over some of the government and intelligence community -wide functions that had previously been the CIA’s. The DNI manages the United States Intelligence Community and in so doing it manages the intelligence cycle. Among the functions that moved to the DNI were the preparation of estimates reflecting the consolidated opinion of the 16 IC agencies, and preparation of briefings for the president. On July 30, 2008, President Bush issued Executive Order 13470 amending Executive Order 12333 to strengthen the role of the DNI.

Previously, the Director of Central Intelligence oversaw the Intelligence Community, serving as the president’s principal intelligence advisor, additionally serving as head of the CIA. The DCI’s title now is “Director of the Central Intelligence Agency” , serving as head of the CIA.

Don’t Miss: What Credit Score Do They Use To Buy A House