Pay Down Your Credit Card Balances

Paying down credit card balances is an actionable way to potentially raise credit scores. FICO bases 30% of your score on factors pertaining to the amount of money you owe to creditors on your credit report. Your has a big influence over this credit score category.

When you lower your credit card balances, your scores are likely to benefit. But youll have to wait until the next time your card issuer updates your account with the credit bureaus to find out if your strategy worked. At the worst, paying down credit card debt can save money in interest fees. So, its a low-risk move, even if you dont see the improvement you hope for when you recalculate your credit scores.

How To Check A Credit Report

Under federal law, consumers are entitled to one free copy of their credit report every 12 months from each of the main credit reporting agencies, TransUnion, Experian, and Equifax.

AnnualCreditReport.com is the only authorized website for free credit reports, according to the Federal Trade Commission.

Consumers can also call 1-877-322-8228 and provide their name, address, Social Security number, and date of birth to verify their identity.

If you want to check your credit history more than once a year, you can ask one or all three credit reporting bureaus, for a small charge, for another copy.

Why check your credit report periodically? Mainly:

;; To make sure the information is accurate and up to date before you apply for a car or home loan, buy insurance, or apply for a job.;; To help guard against identity theft.

Recommended: How To Read A Credit Report

Who Is Responsible For Credit Scores

Technically, the service youre using to monitor your credit updates your credit score, but there are a lot of players in this process.

If you don’t already have a credit monitoring service then you should check out some of Credible’s vetted partners. Let them do the heavy lifting and alert you when there are any potential problems.

Remember, your creditors are the ones that report your account activity, such as your payment history, balance and other information, to the credit bureaus. The bureaus then update your credit report with the most current information.

Then the credit monitoring service youre using, whether its Credible, one of the credit bureaus, your bank or credit union, or another company, uses a credit scoring system to recalculate your credit score based on the new information.

There are many different credit scoring companies out there, but the most popular ones are FICO and VantageScore. Each model considers data differently, so you may see different scores, depending on where you look.

Its also important to note that credit monitoring services typically dont update your credit score every time your creditors send updates to the credit bureaus. Instead, they may choose to recalculate weekly, monthly, or sometimes even quarterly.

You May Like: Why Is There Aargon Agency On My Credit Report

How And When Are Credit Scores And Reports Updated

Normally, you can expect your credit score and credit report to be updated about once a month. Sometimes it can even take days. However, it will depend on the lender and the credit bureau youre with, as some organizations may operate on a slightly different timeline.

Will a debt consolidation loan look bad on your credit report? Read this.

Generally, your credit score wont change Credit report and credit scores are usually updated when credit card companies and other lenders report new information to the credit bureaus. Most often, lenders will work with one of the two main Canadian bureaus. These bureaus will then share a borrowers credit-related information at the request of each lender.

How Quickly Can You Earn A Higher Credit Score

Lets talk about what most people really want to know when they ask the question, How often do credit scores update?

Youve been working hard to improve your credit scores. How long will it take for your credit improvement efforts to pay off?

There are many variables that can affect the answer to that question. To keep the answer as simple as possible, Ill just say the following. Its often possible to earn a higher credit score in 30 days or less.;

Its important to understand that the accounts on your credit reports dont update in real time. The credit card balances on your credit reports, for example, wont move up or down as you make charges or pay your bill. Instead, your credit card company will update the credit bureaus once a month with your new account details, as they appear on your statement.

You have hundreds of credit scores, not just one. The credit scoring model a lender uses to evaluate your credit report has a big affect on the credit score you receive.

Read Also: How To Get Credit Report Without Social Security Number

Your Score Can Change When Your Credit Report Is Updated

Credit scores are calculated by performing complex statistical analysis on data compiled in your credit reports at the national credit bureausExperian, TransUnion and Equifax. The bureaus update your to reflect new information about your credit usage, including:

- Payments you’ve made

- Changes in your credit card balances

- Your total outstanding debt

- New credit applications you’ve made or new loan or credit accounts you’ve opened

- If you use Experian Boost, your credit scores based on Experian data can also reflect your utility and cellphone payments.

The receive information about your activity in reports from the credit card issuers, lenders and potentially other companies with whom you have financial relationships.

When Do Credit Reports Update

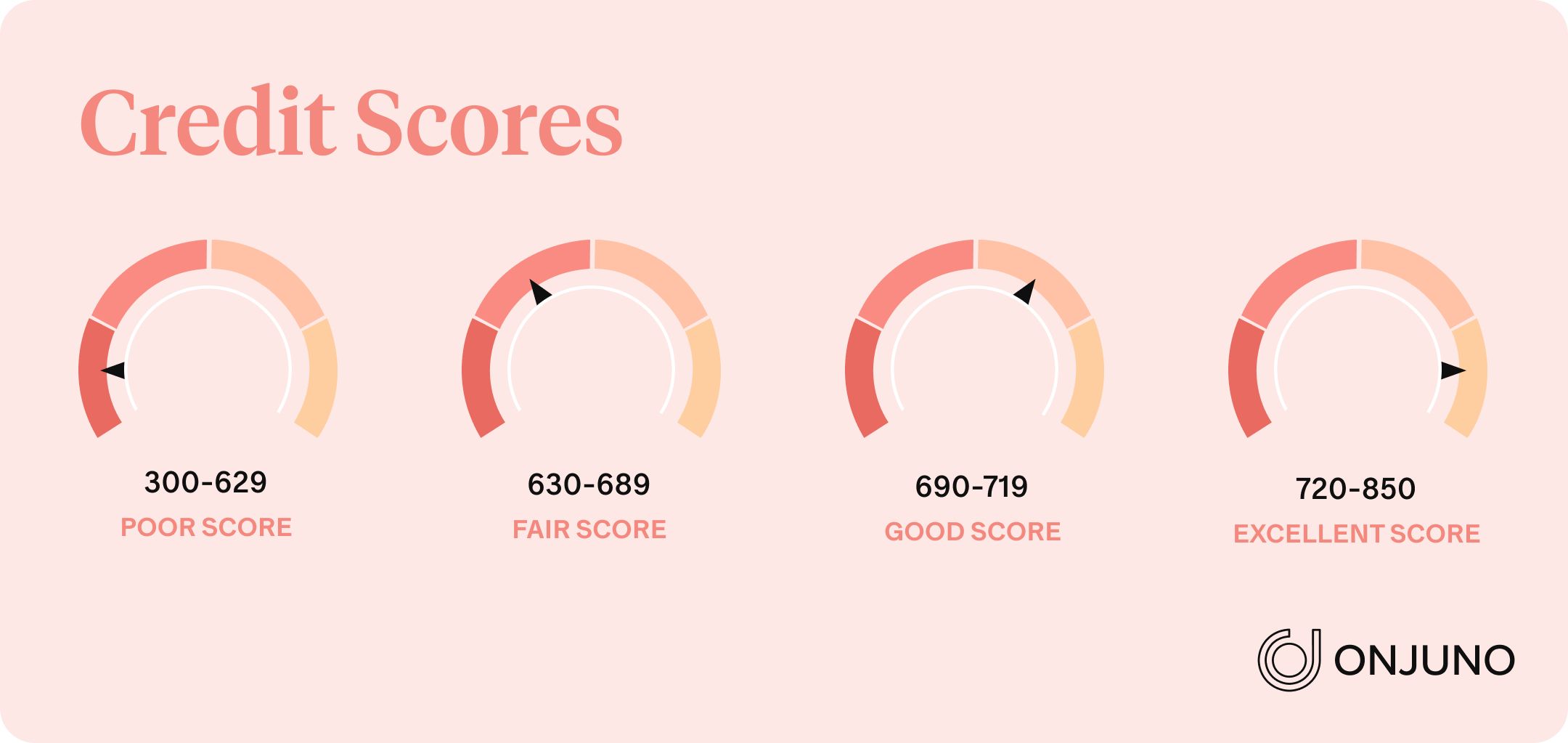

Whenever consumers take some sort of action relating to their credit, their score, usually a number between 300 and 850, will fluctuate.

For instance, if they apply for a loan or miss a credit card payment, their score could change.

There is no set date for a credit score update because a lender or creditor may send information to the three main credit bureaus at different times: Experian one day, Equifax five days after that, and TransUnion a week later.

An update, though, will occur at least every 45 days.

Rather than constantly checking for updates, it might be better to focus on long-term goals like paying off debt, making sure payments are sent on time, and ensuring that scores are going in an upward direction.

Recommended: Which Credit Bureau Is Used Most?

You May Like: How Bad Is A 524 Credit Score

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

How Much Does Your Fico Score Change Over Time

The change depends entirely whats going on in your life. If youre in a comfortable position and are not buying on credit, applying for loans or mortgages, your FICO score may not change much at all. If youre looking to buy a new car with a loan or get a mortgage, your score may change more significantly.

Lenders are not obliged to report all of your transactions to FICO but most do. Its in their interest to keep the data as accurate as possible as they use it to assess your creditworthiness. You may find smaller changes do not affect your score at all and thats normal.

Recommended Reading: Speedy Cash Credit Check

How Credit Updates Work

The businesses you have accounts withcredit card issuers and lenderssend your updated account information to the at different times throughout the month based on their own schedule. Information in your account updates includes your current balance, payment status, and credit limit. New inquiries to your credit stemming from any applications youve submitted are also reported to the credit bureaus. After receiving updates, credit bureaus compile that information and adjust your credit report accordingly.

You can dispute inaccurate or incomplete information to remove it from your credit report. If you dispute an item, the results of a dispute will update as soon as the credit bureau completes the investigation. This credit bureau has 30 days to complete its investigation and, in some cases, may have an extra 15 days to investigate.

When Do Creditors Report To Credit Bureaus

Most creditors send information like a large purchase, opening a new credit card, applying for a mortgage, making a late payment, etc., to the bureaus once a month.;

But not all creditors report to all bureaus, and they might report at different times during the day. Some credit card companies that handle millions of accounts may only send over information in batches, once or twice a month. ;

Thats one reason why moving the needle from poor to excellent credit wont happen overnight. Your score can move a bit in one day, but it can take a while to make a real change for the better.;

Recommended Reading: 739 Credit Score Good Or Bad

How Often Is My Credit Score Updated

Wondering why your credit score seems different every time you check it? Credit scores can change frequently, reflecting updates to your credit files at the three national credit bureaus. Here’s what you need to know about how and why credit scores rarely remain stagnant.

What Is A Credit Score

A is a financial instrument lenders use to determine whether you are a creditworthy individual or not. In Canada, credit scores can range from 300-900. The number you have reflects how good or bad your credit profile is. Generally, the higher you score, the less risky of a borrower youll seem, and vice versa.

Moreover, the higher your credit score, the better chance you have when it comes to getting approved for a loan, and the better interest rate you will get on that loan. Generally, anything above 650 will qualify you for a standard loan but dont worry, there are plenty of loan options for people out there with a low score as well. Those with a low credit score can apply with alternative lenders, they often have more lenient requirements than banks. However, it can be more expensive as they typically charge higher rates and fees than banks.

Want to know the minimum credit score required for mortgage approval? Read this.

Recommended Reading: Can You Have A Credit Score Without A Social Security Number

How Often Do Credit Scores And Credit Reports Update

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Working to improve poor credit is largely a waiting game. You;may;be disappointed at how slowly improvement seems to occur and impatient about seeing results.

To understand how often and why credit scores change, it helps to know how often credit reports, the source of the data that is used to calculate scores, are updated with fresh information.

How Long Does It Take Your Credit Score To Improve

Thomas J. Brock is a Chartered Financial Analyst and a Certified Public Accountant with 20 years of corporate finance, accounting, and financial planning experience managing large investments including a $4 billion insurance carrier’s investment operations.

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

Don’t Miss: Syncb/ppc Closed

How Often Is A Credit Report Updated

Until your credit report is updated your score will not change. Chances are each of your lenders will update your specific report with the credit bureau about every 30 days. Heres how it works:

- At the end of your billing cycle, your lender sends you your statement detailing how much your spending was for the previous month. Before your grace period ends, you send a payment to the lender .

- The creditor then posts your payment and sets your account up for reporting noting that the payment was made, along with updated balance information for your account.

- Most of us have multiple lenders, so each likely will cause updates to your report multiple different times during the month. They dont all report at the same time, and they dont report every day, so while information in your credit report could change throughout the month as your lenders update their account information, its hard to know exactly when the changes will populate your report.

- Additionally, your credit report is being updated continuously with other changes, such as old late payments being removed, new accounts youve applied for being added, inquiries appearing in response to your applications for new credit, and so on.

In the words of Rod Griffin, senior director for consumer education at Experian, Your credit report is a continuously evolving document, so its important to check it regularly.

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to;estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

How Do You Dispute A Credit Karma Score

If you spot an error on your TransUnion credit report, you can use feature to dispute the error. To find that option, scroll to the bottom of the erroneous account snapshot and click the button labeled Dispute an Error. Youll then need to fill out a form about your dispute. Once you submit the form, TransUnion will review the disputegenerally within 30 daysand notify you about any resulting changes to your credit report.

Have you tried using our Direct Dispute feature? . This should help! Feel free to reach out to us if you have any difficulty.

Do Not Close Old Accounts

This might sound odd to some but getting rid of your old accounts can harm your score. Doing so can damage the length of your credit history while also reducing the amount of credit available to you as fewer accounts mean a raise in your overall utilization, often to a point that may negatively impact your score.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

You’ve Settled A Legal Dispute

If you’re involved with a legal dispute around money owed, the judgment can land on your credit report if the judge doesn’t rule in your favor. Negative public records such as bankruptcy filings, tax liens, or civil judgments can drastically drop your credit score and stay on your report for up to 10 years.

If you’re working to improve or repair your credit, focus on making smart financial decisions every month rather than worrying about how often your credit score is updated. Practice responsible credit by making payments on time, spending within your means, and keeping your credit utilization low.

Responsible credit management will be reported to the bureaus and logged on your credit report, which in turn can improve your score in the long run.;;reports to all three credit bureaus each month to ensure card members always have the most up-to-date information reflected on their credit report.

This material is for informational purposes only and is not intended to replace the advice of a qualified tax advisor, attorney or financial advisor. Readers should consult with their own tax advisor, attorney or financial advisor with regard to their personal situations.

The Four Most Important Words Are Debt

This is the single most important personal statistic you can know. DTI is simply how much of your gross income is needed to pay your debts. Ideally, you want it to be as low as possible, but this being the real world, I usually recommend no more than 30 percent.

If you want to figure out your DTI ratio, Debt.com has a handy;Debt-To-Income Ratio Calculator;that can do it for you.

Recommended Reading: Aargon Agency

How Often Should You Check Your Credit Score

The simple answer is that you can check your credit score whenever you want. And, your credit score wont take a hit just because you cant stand not knowing.;

Besides, there are times when checking your score more often is a good idea:

- If youre worried your credit information has been compromised

- To protect yourself from identity theft

- When opening a new credit card

- When applying for a mortgage or a personal loan

- When youve been working on improving your credit score

For most people, checking credit scores annually is adequate. Thats not to say that checking your credit score more often, say every three months, is not also a solid plan. Doing so will actually give you a better idea of what goes into raising or lowering your score and credit history over time.;;

While day-to-day progress is informative, it will only give you half the picture whereas checking less often helps you identify trends and is a better indicator of your credit history.;