What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

Your credit history is important. It tells businesses how you pay your bills. Those businesses then decide if they want to give you a credit card, a job, an apartment, a loan, or insurance.

Find out what is in your report. Be sure the information is correct. Fix anything that is not correct.

Different Credit Bureaus Available In India

a credit bureau is a credit agency that collates your information and shares it with lenders and creditors in the form of a CIBIL score that is helpful in checking your creditworthiness.

below are some leading credit bureaus of the country

1 . transunion CIBIL score

it is a complete credit bureau that reports the analysis for organisations as well as individuals. the credit score ranges from 300 to 850 720 or above is an excellent score. in the case of any entity or company, the credit score is known as a performance score. transunion cibil members include all the major financial institutes, lenders, nbfcs, and banks, etc.

2. equifax credit score checker

equifax gives portfolio scores and risk scores along with credit scores that usually range from 1 to 999 for individuals. working as an approved credit rating agency since 2010, equifax provides different reports like portfolio management, industry diagnosis, credit fraud, or risk management report in the case of companies.

What Happens When You Open A Checking And Savings Account

Opening a checking and savings account requires that you have proof of a few things: your age , your identification and your current address. But you don’t have to worry about where your credit score stands.

According to Experian, one of the three main credit bureaus, banks and credit unions don’t check your credit score when opening these two bank accounts. They may instead run a ChexSystems report.

A ChexSystems report shows banks a potential customer’s past activity with deposit accounts. It shows any unpaid negative balances , frequent overdraft fees, bounced checks and suspected fraud.

Access a free copy of your ChexSystems report once every 12 months by going to the consumer reporting agency’s website or by calling 800-428-9623. Note that your ChexSystems report has no direct impact on your credit score.

You May Like: Is 667 A Good Credit Score

How To Get A Credit Report

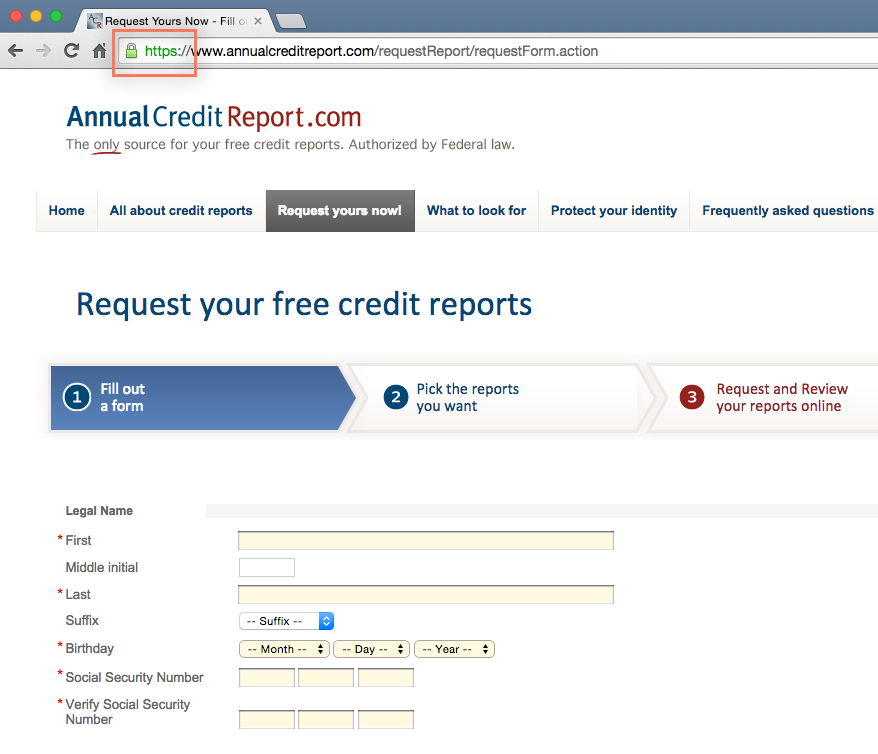

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

Why Would A Potential Employer Look At Your Credit

More than half of employers conduct background checks during the hiring process only, and the No. 1 reason is to protect their employees and customers, says the 2018 HR.com report.

For security purposes, the credit report can be used to verify someone’s identity, background and education, to prevent theft or embezzlement and to see the candidate’s previous employers . For employers, it is a big picture snapshot of how a potential candidate handles their responsibilities.

“Credit reports indicate whether or not you’re responsible,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “And, they also indicate if you’re in financial distress. These are attributes that are important to employers. For example, would you want to hire someone in your accounting department who can’t manage their own obligations?”

If an employer is running a credit check on you, it is most likely only after they already made a decision to hire you, and it is usually the last thing they check. Since pulling credit checks cost employers both time and money , credit checks aren’t necessarily used to weed out a big pool of potential applicants and not all applicants will have their credit checked.

Employers are more likely to run a credit check for candidates applying for financial roles within a company or any position that requires handling of money .

Also Check: When Does Credit Karma Update Score

Extra Or Missing Details

There are three major credit reporting agencies in the United States: Experian, TransUnion, and Equifax. Each credit reporting agency may receive information about your credit obligations from companies to which you owe money .

Collectively, these companies are formally referred to as data furnishers because they furnish information to the credit bureaus. There are some 11,000 of these companies in the United States.

Not all creditors become data furnishers with the three credit bureaus. Some companies you pay each month like most utility companies dont report your account activity to the credit bureaus at all unless your account goes to collections. Other companies may furnish information about your accounts to one or two credit reporting agencies, but not all three.

For this reason, you can wind up with three credit reports that contain similar but still somewhat different information.

Because your credit reports can each contain different information, its important to keep an eye on all three of them. If you only check your Experian credit report, for example, you may miss out on critical details that appear on your Equifax or TransUnion report.

Furthermore, if you check one credit report and a lender checks a report from a different credit bureau, the accounts and details the two of you are reviewing are not likely to match, including any credit scores.

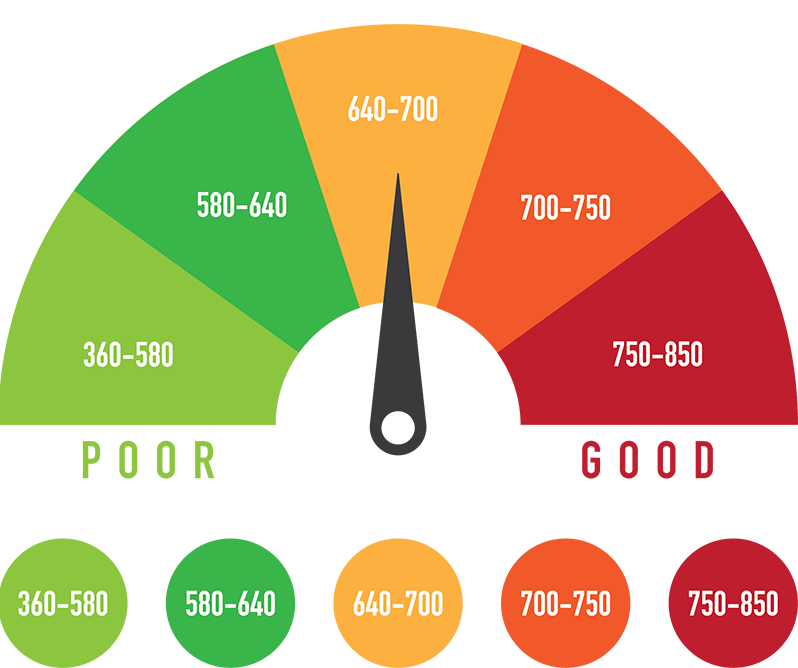

What Is Considered A Good Credit Score

Your credit report provides a detailed credit history, while your credit score gives a quick read on how well you manage credit. Using data from your credit report, credit scoring models create numerical scores ranging from 300 to 850. The exact algorithms used to calculate these scores are not public knowledge, but the factors that affect your credit score are widely known. FICO, whose scores are used in most consumer lending decisions, breaks down the factors as follows:

- Payment history: Paying on time every time creates a solid base for your credit score.

- Amounts owed: The less of your available revolving credit you’re using, the better. Progress on paying off loans is also considered in this factor.

- Length of credit history: Having long-standing accounts shows stability.

- : A diverse mix of revolving credit cards and installment loans shows you can manage multiple types of credit.

- New credit: While opening new credit isn’t bad per se, frequent credit applications can make you appear as more of a credit risk.

How does your credit score stack up? Here are FICO credit score ranges and how they might play out when you’re applying for credit:

| How Your FICO® Scores Stack Up With Lenders |

|---|

| 800 – 850 |

|

Read Also: What Credit Score Is Needed For An American Express Card

How Do I Run A Credit Check Without Hurting My Credit

Some places may charge you to check or monitor your credit. But you donât have to pay to use . You can use it to access your TransUnion credit report and weekly VantageScore 3.0 credit score for free anytimeâwithout negatively impacting your score.

You can even see the potential impacts of financial decisions on your credit score before you make them, with the CreditWise Simulator.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Also Check: Is 756 A Good Credit Score

Additional Credit Report Items

Credit rating requests from potential lenders also show up in your credit report. Credit reporting companies also keep a record of your current and earlier employment, your addresses, along with personal identifying information. Your date of birth, Social Security number and even arrests, if applicable, will always be in your credit report, says USAGov.

What About Paid Credit Scores

It only makes sense to think that paid credit scores should provide you a more accurate look at how your situation appears to banks and other creditors. Can you get a more accurate score if you pay one of the credit bureaus for your score? Maybe.

Other credit scores from Equifax and TransUnion might not be the scores used by lenders, either. So paying for these scores might not be your best option especially since they might not be much more accurate than the free scores you can get off other sites.

Now, of course, attention turns to the FICO score. FICO says that 90% of the top 100 banks use the FICO score when making decisions. However, what you see when you head over to myFICO.com and pay for your FICO score might not be the same thing that financial institutions see when they pull your credit. This is because FICO is selling you a consumer credit score.

This is a different credit score than the different scores that FICO sells to lenders and others. Indeed, FICO has a number of different versions of its score that it sells. There are tweaks made to scores for mortgage purposes, for car loan purposes, and for other types of loans. It isnt one score fits all loans. There are custom and proprietary scores sold to lenders, and the exact formulas arent realsed.

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.

Disclosure

Don’t Miss: What Is My Vantage Credit Score

Why Is It Important To Maintain A Good Credit Score

listed down some of the important reasons due to which you must maintain a good credit score:

improves your eligibility for loans: a good credit score improves your eligibility to get a loan faster. a good credit score means that you pay the bills or outstanding amount timely that leaves a good impression of yours on the banks or other financial institutions where you have applied for a loan.

quicker loan approvals: applicants with a good credit score and long credit history are offered pre-approved loans. moreover, the loan that you have applied for gets approved quickly and processing time is zero.

lower interest rate: with a good credit score, you can enjoy the benefit of a lower rate of interest on the loan amount that you have applied for.

you are offered credit cards with attractive benefits and rewards if you have a healthy credit score.

higher : a good credit score not only gets you the best of credit cards with attractive benefits or lower rate of interest on the loan you have applied for but also you are eligible for getting a higher loan amount. a good credit score means that you are capable of handling the credit in the best possible manner, therefore, banks or financial institutions will consider offering you a credit card with a higher limit.

Recommended Reading: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Account Not Showing On Your Credit Report Here’s Why

When you’re reviewing your , you may notice that some of your financial accounts don’t show up. In some situations, you may see accounts on your credit report from one bureau but not on the other two. There may be accounts that dont appear on any of your credit reports from any of the major credit bureaus.

There are a few explanations for this, and it’s all based on how credit reporting works.

Recommended Reading: What Credit Score Is Needed To Buy A New Car

Should I Check My Score Elsewhere Before Taking Out A Loan

The credit score your bank provides will help you track your personal credit well-being. When it rises, you’ll know you’re going in the right direction, even if it’s not a score that you’re familiar with or that a lender typically uses.

Still, since lenders use credit scores to determine qualification and to set terms such as interest rates, it’s a good idea to check your credit scores with the most common scoring models to take some of the guesswork out of your planning:

Repairing And Managing Credit

A low credit score can translate into higher loan and credit card interest rates. It can also inhibit your ability to secure insurance, school loans, rental housing, utilities and even elective medical procedures.

If you have credit problems, work to repair your credit on your own or use a credit-counseling agency. Ask several agencies about services, fees and repayment plans before signing a contract. Beware any that ask you to pay up front or promise a quick fix it may take years to repair credit legitimately.

If you find errors on your credit report, correct them as soon as possible. To dispute an error, contact the financial institution that reported it or go directly to the credit agency. Provide all necessary details in writing. They then have 30 days to investigate, submit any corrections needed to credit agencies, and provide a written response. Learn more about disputing information reported by TD Bank

To protect your credit in the future, create a budget and pay bills on time, every time. Consider fees, interest rates and monthly payments before obtaining new credit. The sooner you begin to re-establish good credit, the sooner you’ll improve your credit score.

You May Like: Is 628 A Good Credit Score

Can I Get A Free Credit Score From My Bank

It used to be that if you wanted to see your credit score, you would have to fork over some cash, for either a monthly subscription service or a one-time look. However, since 2013, FICO has allowed lenders to make the previously difficult-to-obtain scores available to consumers for free through its FICO Score Open Access program. FICO announced in December 2018 that more than 300 million people could get their credit scores for free through the program. More than 170 financial institutions and eight of the top 10 credit card issuers participate in Open Access.

Among the participating companies are Bank of America, Citibank, Discover, HSBC, Key Bank, Merrick Bank, Navy Federal Credit Union, PenFed Credit Union, Sallie Mae, SunTrust, Union Bank, and Wells Fargo.

Who Can Access Your Credit Report Or Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

With lots of personal data available online, you might suspect that your credit history is accessible to anyone with a slight aptitude for Google search. Although you arent the only person who can see your credit scores and reports, you can feel secure in knowing that this financial information is given only to those who legitimately need it.

That said, your credit can be checked in many situations when you apply for a loan or credit card, a job, utilities, student loans and more. Monitoring your own credit helps you watch out for trouble and build your profile.

Don’t Miss: How Does A Credit Card Settlement Affect Your Credit Score

You Can Get It For Free Thanks To The Fico Score Open Access Program

One easy way to get your credit score may be from your bank. Your is a numeric valuation that lenders use, along with your , to evaluate the risk of offering you a loan or providing credit to you.

You can get a free credit report from each of the three big credit agencies: Equifax, Experian, and TransUnion. With the exception of Experian, you will be charged a fee if you want to see your actual credit score. The good news is that you may be able to get your score for free from a bank or credit card issuer. Heres how to check your credit score.