How To Improve Credit Score In 6 Months

If you recently discovered how low your credit score is, you may feel there is a sense of urgency to get the score back to good and excellent standing. It is possible to start seeing an improvement in your credit score in six months. How fast and how much the score improves depends significantly upon the score you began at and what was causing the low score in the first place.

Understand what affects your credit score, such as missed payments, late payments, using more than 30 percent of available credit, no credit history, and applying for multiple lines of credit in a short time. Once you know what is causing your score to be low, create a plan to target those items. Whether making payments on time or removing inaccurate information, you will start seeing an improved credit score as quickly as a couple of months and an even better score in six months.

Does Paying Off Collections Boost My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

Verify The Contents Of Your Credit Reports

Review each of these reports thoroughly, verifying the following details are correct on each:

- Details on payments made on time

- Debt payment history

- Balances due of accounts open currently

- Number of closed accounts

- Personally identifiable information is identical across all reports complete name, address, SSN, date of birth, etc.

Recommended Reading: How Often Is My Credit Score Updated

Consider New Credit Accounts

Depending on what forms of credit you already have going, opening up a new credit account could help you bring your score back up. For example, opening a new credit card can improve your credit utilization and give you the chance to build a history of timely payments.

However, keep in mind that applying for a credit card can result in a hard inquiry on your credit report. This can knock your score down a few points. You also have to consider how youd use the account. You dont want to end up with a large credit card balance and additional payments youre not ready to take on.

If you have poor credit, be aware that you might not be able to qualify for a traditional credit card. You may have to choose a secured credit card instead, which. Ultimately, this option could be helpful, but isnt the best for everyone.

How To Increase Credit Score Faster Than Six Months

On average most people working to improve their credit scores start seeing significant increases within six months. It is possible to see your credit score improve faster, but that depends on what is causing your low score in the first place. Simple tasks to do to help raise your credit score more quickly than six months include:

- Dispute inaccurate items and have them removed

- Get added to someone else’s credit card

- Stop applying for new credit

- Start paying bills on time

- Make a large payment to pay down credit card debt

- Ask for a credit line increase

- Pay off collections and have them removed

Read Also: What Do Credit Rating Agencies Do

How To Prevent Your Credit From Becoming Stagnant

If you are trying to improve your credit but are noticing it is remaining stagnant, or even if you’re not sure where to start and feel that you need guidance, it might be time to hire the help of one of the three best credit repair services.

Some credit repair service companies include Novae Money, Lexington Law, and Ovation by LendingTree. Even if you have a credit score stuck at 750, it is possible to bring that score up in a short period.

The company not only provide a personal finance manager and access to credit & debt collection attorneys when buying their premium package but also provide an affiliate program where you can earn a $100 commission every time you refer them someone that is in the market for credit repair services Namely, you’d be earning some money while repairing your credit, as well as providing others the opportunity to start improving or repairing their scores too.

The first time you register, you’ll be charged a $150 one-time fee + your package monthly cost. That is to say, you’ll be paying $150 + $89 = $239 the first time you register, then $89/month. However, you can save some money by having a free month when you refer a friend*

- No guarantee it will be effective

- No credit counseling

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

Don’t Miss: How Do You Improve Your Credit Score

Start Simple: Pay Your Bills

The first step you can take toward repairing your credit is paying your bills on time. And, bring past-due accounts up-to-date. If youve struggled with paying bills on time in the past, then you need to get a system in place for staying on top of them if you want to rebuild your credit. For example, some of the things you can do include:

- Creating a monthly budget and tracking your spending

- Setting up direct deposit so you can get paid up to 2 days earlier

- Creating bill due date alerts through an online bank account so you know when bills are due

- Scheduling automatic payments from your checking account

- Setting up automatic savings deposits to help build an emergency cushion for unexpected expenses

Those are all simple ways to keep up with your bills and build a positive payment history. In some cases, you might be in a tougher financial situation. Figure out whats within your means and makes the most sense for your money obligations.

How Quickly Does Your Credit Score Update

Unlike a lot of financial metrics, your credit score doesnt tick away silently in the background, changing without your knowledge. Instead, its recalculated each time you or a business requests it. If you request it often, itll update more frequently. Most popular free credit score websites request this information every month that way, you get a new score update every 30 days.

It also depends on how often the companies you do business with report your information. For example, if your credit card company doesnt report your payments until the end of the month, you wont see the impact of your payments on your credit score until then, even if you pay it off at the beginning of the month.

Don’t Miss: What Is A Middle Credit Score

What Lowers My Credit Score

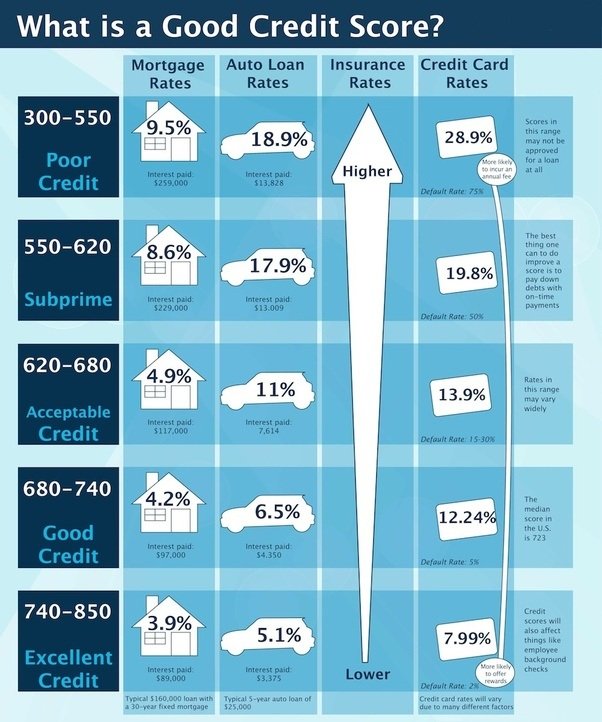

FICO credit scores are based on specific guidelines that are each weighted and contribute to an overall credit rating of 100%.

|

Type of rating |

|

|

New credit |

Based on this breakdown, there are many reasons why your credit score is lower than before. These are some of the major factors that can quickly impact your credit score.

- No credit history or, alternatively, too much credit: If you don’t have a well-rounded credit history, it is difficult for lenders to assess your payment behaviors because there is no real way to determine if or how you will make payments for this debt.

- Too many new accounts: If you show too many new accounts, it can mean financial instability and signify that you may not be ready to take on another financial burden.

- Missed payments: It reflects poorly upon your credit if you fail to make regular, timely payments on your account.

- If you have a lot of outstanding debt, it can quickly lower your credit.

- Bankruptcy: Bankruptcy on your credit report is a major red flag to lenders because it shows that you were unable to pay your debt previously. It causes concern that you may have difficulties in paying this loan, as well.

How Long Does It Take For Your Credit Score To Recover After Taking A Hit

In order to understand how long it might take you personally to improve your credit, it can be helpful to look at one FICO study of the average amount of time it takes to recover your credit score back to its original number after a negative mark on your credit report.

This study was only done for mortgage payments, but its likely that itd be similar for other types of negative marks, such as paying your student loans late or having a car repossessed if you dont pay your auto loan.

| Starting credit score of 680 | Starting credit score of 720 | Starting credit score of 780 |

|---|---|---|

| 30-day late payment | ||

| 7-10 years | ||

| Note: Figures are approximations. |

In general, the longer you forgo a payment you owe, the longer itll take to recover. And the higher your credit score was to begin, the longer it will take to recover. Know that there are things you can do to prevent this from happening and to build credit in the meantime.

Read Also: Do Insurance Companies Report To Credit Bureaus

Pay Credit Card Balances Strategically

The portion of your credit limits you’re using at any given time is called your . A good guideline: Use less than 30% of your limit on any card, and lower is better. The highest scorers use less than 7%.

You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that’s what is used in calculating your score. A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low.

Impact: Highly influential. Your credit utilization is the second-biggest factor in your credit score the biggest factor is paying on time.

Time commitment: Low to medium. Set calendar reminders to log in and make payments. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount.

How fast it could work: Fast. As soon as your credit card reports a lower balance to the credit bureaus, that lower utilization will be used in calculating your score.

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to raise your credit score, avoid applying for new credit for a while.

Read Also: Does Car Loan Affect Credit Score

How Long Do Derogatory Marks Stay On Your Credit Report

Your score is determined by the three credit bureaus , but its up to your lenders to contact them to report information about you. It can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debtor decreased your balances. These are all positive influences on your score, but there may be a slight lag in timing due to the reporting process.

In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years. Unfortunately, the more harmful events are often the ones that stick around the longest, so its best to know what actions will be the biggest burdens:

| Event | |

|---|---|

| Chapter 7 bankruptcy | 10 years |

This may seem ominous, but heres the good news: recency bias is alive and well in the credit scoring world. Even if theyre still present, the old items that appear on your report have less weight than your newer ones.

What Can Delay An Increase In Your Credit Score

Your credit score wont instantly increase every time you do something good for your credit. Credit scores are calculated based on the information in your credit reports, and credit reports are usually only updated when creditors report new information .

This means that itll usually take at least a month to see the results of any positive steps you take to boost your credit score.

Read Also: How Do You Get A Credit Score

How Long Does It Take To Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you have no credit, working your way up to a good credit score can feel impossibly slow.

Building a credit score from scratch can take anywhere from a month or two to six months, depending on the type of credit score you are looking at. The two main credit scoring systems vary on how soon they’ll show a score. You can establish a VantageScore within a month or two of having a credit line. Your FICO score the score used in most credit decisions takes at least six months to generate.

How Long Does It Take To Improve Credit Score

The answer depends on the conditions of your debt and overall payment history. If your FICO score took a hit when you opened a new credit card or maxed one out that can usually be resolved within a few months.

But if youve made a habit of missing payments, you may be looking at a couple of years of making steady payments to get your credit score back on track. No matter where youre at on that scale, theres a lot you can do to improve your credit score quickly.

Don’t Miss: How To Read Experian Credit Report

Apply For A Secured Loan Or A Credit

Another great first step for establishing credit is to get a secured credit-builder loan. It works like this: youll deposit a few hundred dollars into a secured loan savings account, which acts as collateral on a loan from the lender.

Youll then make scheduled payments which are reported to the credit bureaus until the amount you owe is paid back. The deposit is then released back to you after the account is closed. Secured loan groups like Kikoff and Self may be worth considering. After youve proven that you can pay back the loan, your FICO score may improve and credit card issuers can be quick to offer credit.

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that you use at any given time. After payment history, its the second most important factor in FICO Score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, then a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there, you can work on whittling that down to 10% or less, which is considered ideal for raising your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online youll just need to update your annual household income. Its possible to be approved for a higher limit in less than a minute. You can also request a credit limit increase over the phone.

Don’t Miss: How To Get Free Credit Report From Transunion

Protect Your Credit Score With Solosuit

When you owe a debt and fall behind on your payments, your credit score will probably take a hit. However, it is not uncommon for inaccurate and fraudulent debt information to find its way onto your credit report.

If you are a victim of identity theft, or if your creditor has transferred your debt to a collections agency who has reported inaccurate information to the credit bureaus, you

When a debt collector initially reaches out to claim you owe them, you should respond with a Debt Validation Letter within 30 days. This forces the collector to validate the debt, and if they cannot, they will most likely back off.

If they continue to report inaccurate information, you can file a dispute explaining that you never received a proper debt validation. Experian will reach out to the collectors and remove the information as soon as they find out that the reported debt is invalid.

Learn more about how a Debt Validation Letter can help you in this video: