The Disadvantages Of Debt Settlement

Long-forgotten past due bills often come back to haunt many couples because credit cards, loans and low-cost insurance plans are hard to obtain if you have bad credit. You can deal with your delinquent debts by entering into a settlement with your creditors. Settling a debt and having it removed from your credit report, however, are two entirely different things.

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

Look For Inconsistencies And File A Dispute

Filing a dispute for inconsistencies relating to your settled accounts can help remove it from your credit report. Be sure to check your credit report regularly to spot any inaccuracy. Under federal law, you can dispute any incorrect information on your credit report for free. File a dispute with the major credit bureaus .

Steps for filing a dispute:

- Send a detailed dispute letter explaining the reason for the dispute and identifying the points you believe are incorrect.

- Include a copy of your credit report with the incorrect items highlighted.

- If youre sending the dispute letter by mail, make sure to ask for a return receipt so youll have proof that the credit reporting company received your letter.

- If it proves that your claim is true, it will notify the credit bureaus so that they can remove the incorrect information.

- Youll be informed about the result of their investigation via mail.

Recommended Reading: Is 825 A Good Credit Score

Debt Collection Is Costly

Debt collection is costly for lenders and financial institutions, which is why they are likely to be inclined towards settlements. If they choose to sue you for debt payment, the process will be costly and lengthy. Most people seek to work with debt settlement companies to negotiate effectively while settling debts with creditors or debt collection agencies.

How Bad Does A Debt Relief Program Affect Your Credit

In general, a program of debt settlement will cause your credit score to drop by about half as many points as a bankruptcy. Since the post-settlement drop is typically less, its measurably easier to begin rebuilding your credit after debt settlement than after bankruptcy.

How many points does debt relief hurt your credit?

Does Debt Settlement Hurt Your Credit? Debt settlement affects your credit for up to 7 years, lowering your credit score by as much as 100 points initially and then having less of an effect as time goes on.

What qualifies you for debt relief?

As noted above, to qualify for a debt relief program, you must be able to make a monthly payment into a settlement fund, which will be used to settle with your creditors. For many consumers, this monthly payment will be lower than the total monthly payments on their credit cards.

Don’t Miss: Does First Premier Credit Card Report Credit Bureaus

Tips For Credit Rebuilding

Ironically, the only way to fix your credit score is to start borrowing money again. If you are in a consumer proposal, think carefully about the purpose of this process, and how to avoid new problems with your credit. Even though it feels good to be offered new credit, or be accepted for a new card, be sure not to overextend your ability to make regular payments. Go slowly. You do not need to borrow large amounts to rebuild your credit. Making all your payments on time is the key. In addition, pay attention to the interest rates and fees charged on credit products you apply for as there are some lenders who may not have your best interests in mind.

Here are some tips for rebuilding your credit.

Are There Alternatives To Settling A Debt

Before you jump into settling your debt, there are other options that might not have as much of a negative impact on your credit. If you dont want settled in full recorded on your credit report, consider:

- Renegotiating: Renegotiate terms, like a longer payment period and lower monthly payments, with your lender, creditor or debt collector.

- Applying for a deferment or forbearance: Talk to your lender to see if you qualify for a deferment or forbearance. Both options allow you to temporarily postpone payments.

- Loan forgiveness: You may qualify for student loan forgiveness if you can prove financial hardship to your lender.

- Debt consolidation: Combining your debt into one loan with one monthly payment may result in a lower interest rate and make your debt easier to pay off.

- Nonprofit credit counseling: Find a nonprofit counselor to help you figure out how to handle your debt and give you advice on repayment strategies. Look for counselors accredited by the National Foundation for Credit Counseling or the Financial Counseling Association of America.

Bankruptcy is another option but it should be a last resort. Chapter 7 bankruptcy can reduce or wipe out your debt, but it can also have a long-lasting negative impact on your credit report, and you may have to give up some of your possessions.

Also Check: What Can You Do With 800 Credit Score

Cant I Just Pay Off My Medical Bills With A Credit Card

Before choosing to use a credit card to pay your medical bill, make sure you have a plan for repaying the debt after its charged. The last thing you want to do is add to the pain of medical debt by racking up interest on a credit card.

And if you are struggling with how to pay off your medical debt, consider moving it to a 0% balance transfer credit card. The Chase Slate® Credit Card offers a low introductory balance transfer offer: $0 fee during the first 60 days of account opening and 0% intro APR for the first 15 months from account opening .

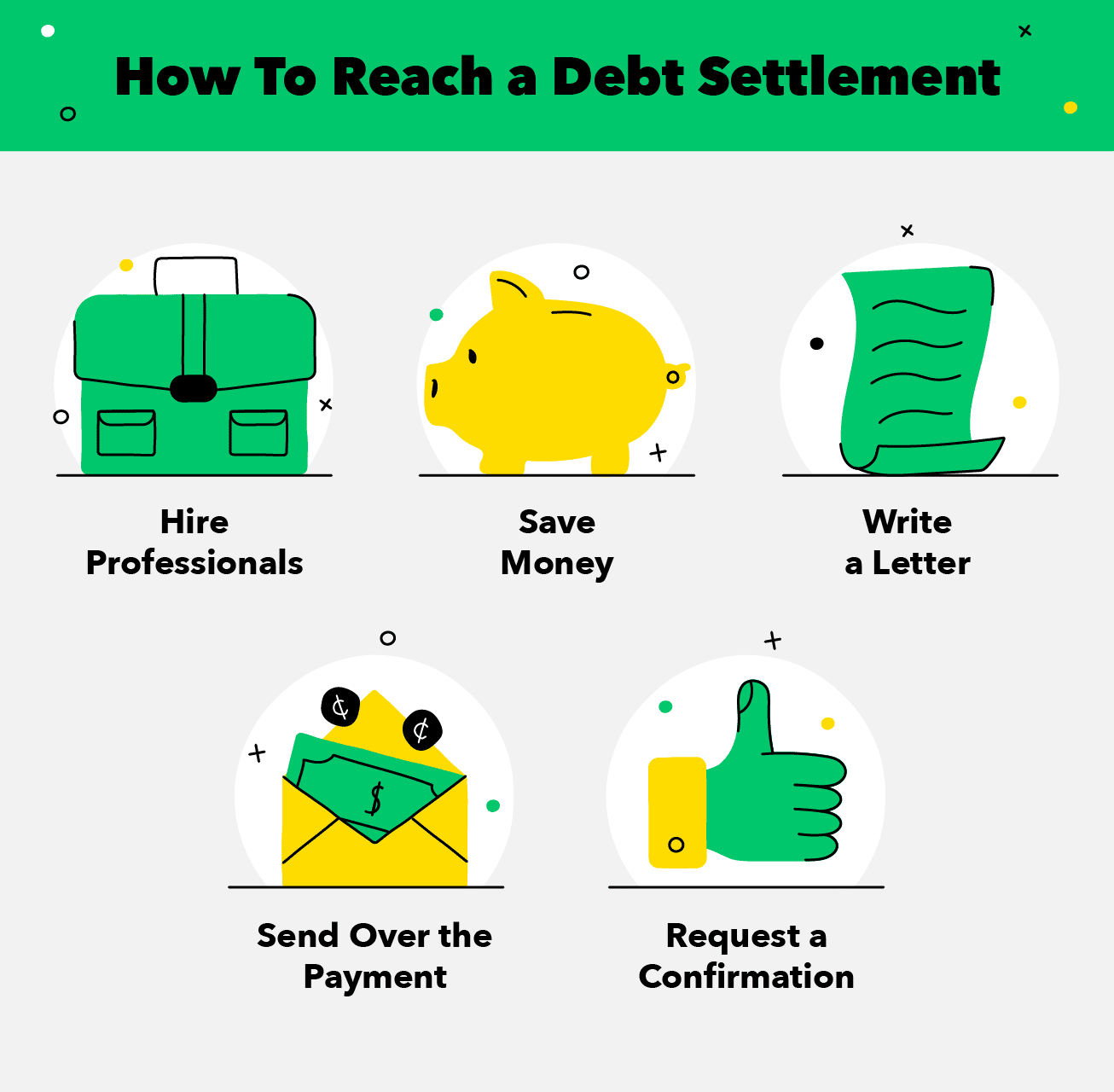

Debt Settlement For Effective Relief

Debt settlement is widely advised for effective debt relief. Unfortunately, it can leave a negative mark on your credit report, affecting your ability to undertake a loan or obtain credit for several years.

Even if you manage to settle your debt in good standing, it will remain a fixture on your credit report for seven years. If you are not careful and mindful about managing your settlement payments, it can remain on your report for even longer.

So, your ability to settle or pay off the amount depends entirely on your financial condition and capabilities.

You May Like: How To Remove A Delinquency From Your Credit Report

Debt Settlement Strategies And Risks

Ironically, consumers who enroll in a debt settlement program because they cant manage their debt burdensbut who have still been making payments, even sporadic oneshave less negotiating power than those who have made no payments. So their first step must be to stop making payments altogether. Credit scores can suffer during the debt settlement process, particularly at the beginning, says Sean Fox, co-president of Freedom Debt Relief. As the consumer begins to make payments on settled debt, credit scores typically will recover over time.

Becoming delinquent on debt and settling the debt for less than you owe can have a severe impact on your credit scorelikely sending it into the mid-500s, which is considered poor. The higher your score before you fall behind, the larger the drop. Late payments may remain on your for up to seven years.

Making no payments also means accumulating late fees and interest, which add to your balance and will make it harder to pay off your debt if you cant settle. Consumers can expect harassing debt collection phone calls once they become delinquent. Creditors might also decide to sue consumers for debts above $5,000debts that are worth their trouble, in other wordswhich can result in wage garnishment. The more money you have available to settle, the sooner you can resolve the debt. The longer your debt goes unpaid, the greater the risk of being sued, Detweiler says.

Debt Settlement Vs Credit Counseling

Credit counseling is a free or inexpensive service provided by nonprofits and government agencies. Interestingly, these services are often partly funded by credit card companies. By enrolling in a debt management plan with a , you may receive an interest rate reduction on your balances and a waiver of penalty fees.

Those concessions may or may not be sufficient to help you pay down your debt considerably faster, and you may or may not be able to afford the new required monthly payments. In addition, you may not qualify for an interest rate reduction, even if you have a significant financial hardship.

However, because you wont have to default on your debt, your credit score may suffer less. Also, credit counseling may offer additional financial assistance that can help you avoid similar problems in the future, such as budget development and financial counseling, and referrals to low-cost services and assistance programs to help you reduce your expenses.

So how do you know which to choose if you dont want to pursue bankruptcy? Credit counseling is usually better to pursue before considering contracting a debt settlement company. Credit counselors can help you determine the best course of action which may include debt settlement, but in a way that benefits you and not necessarily a debt settlement company that is interested more in you as a client than your credit health.

Read Also: Is 773 A Good Credit Score

It May Be The Best Option But Your Score Will Sufferlearn How Much

Debt settlement typically has a negative impact on your . How negative depends on many factors: the current condition of your credit, the reporting practices of your , the size of the debts being settled, whether your other debts are in good standing, how much less than the original balance the debt is settled for, and a multitude of other variables.

Rebuilding Your Credit Score After Debt Settlement

For seven years, your settled accounts are reflected on your credit report. This means that for those seven years, your settled accounts will affect your creditworthiness. Lenders usually look at your recent payment history. There is a high probability that you will be affected for a couple of months or even years after settling your debts. However, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little.

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement. Some needed years before they could get a new or loan. It varies case by case and it is difficult to determine the exact timeframe required to improve your credit score. The time it takes to repair your credit score will depend primarily on your credit history.

Read Also: How To Remove Santander From Credit Report

How Long Will It Take For Credit Scores To Improve After Debt Settlement

After debt settlement, it’s important to remember that it will remain on your credit report for seven years. However, you can begin improving your credit score right away. You can do that by adding positive history to your credit report. That includes paying your bills on time, paying off other past debts, and keeping your credit utilization low.

How To Remove A Charge

A charge-off stays on your credit report for seven years after the date the account in question first went delinquent. There is nothing you can do to get a legitimate charge-off entry removed from your credit report.

If a charge-off is reported inaccurately, or if it fails to fall off your credit report after seven years, you can file a dispute with Experian or one of the other national credit bureaus to have it removed from your credit reports.

You May Like: How To Get Your Credit Report Mailed

Why Consider Opting For A Consumer Proposal

If you have the capacity to make partial payments towards your debts, opting for a consumer proposal is an advantageous option for a number of reasons. It not only helps you avoid bankruptcy but can also relieve you of a significant proportion of your debt without interest. In addition, it consolidates your debts into one reasonable and affordable monthly payment, the terms of which can be negotiated with the guidance of a federally Licensed Insolvency Trustee. Moreover, there is no loss of assets in a consumer proposal,so assets like home equity investments, and secondary motor vehicles can be retainedwhile stopping collection calls and legal action from creditors. Proposals filed by Licensed Insolvency Trustees are the only debt settlement plans sanctioned by the Government of Canada. The Office of the Superintendent of Bankruptcy is the section of the Government of Canada that regulates the bankruptcy and consumer proposal processes in Canada.

It is important to remember that filing a consumer proposal is a positive step, and the effect on your credit rating will be temporary. Questions about consumer proposal or how does a consumer proposal affect your credit score? A Licensed Insolvency Trustee can answer your questions and help you explore your options. Contact a Trustee today for a free consultation.

You May Like: What Does Filing For Bankruptcy Do To Your Credit Score

How Long Does It Take To Rebuild Credit After Debt Settlement

Fixing your credit after a debt settlement takes time. However, if you use a professional for the debt settlement process, you might see your score go up faster than you expected. Exactly how much time depends on a few factors, including what condition your credit was in before the settlement, how quickly you paid off the debt, and sometimes, who negotiated it. If you have an otherwise strong credit history and other loans currently in good standing, your score may begin improving within a few months.

On the other hand, if you have poor credit or a thin credit file, it could take much longer to see improvement.

Good news: Debt settlement has a better outcome for your credit than acharge-off or going to collections. So while you wait for that settlement to eventually drop off your credit report, here are some other ways you can work on improving your credit in the meantime:

Read Also: Which Credit Score Is Most Important

Schedule Your Free Debt Analysis

Potential clients speak with a certified debt specialist regarding their financial situation.

The debt specialist evaluates the callers financial situation and suggests the optimal debt relief strategy.

Clients choosing to enroll in our debt relief program are then guided through the enrollment process.

How To Remove A Settled Student Loan Account

It can be challenging to remove settled loans and credit card debt from your credit history, particularly without clear direction. There are a few steps you should take that will make the process of fixing your credit easier.

The first things to do when trying to remove a settled student loan from your credit report are:

-

Get your free credit report

-

Dispute any inaccurate information

Also Check: Is 632 A Good Credit Score

Myth No : I Have To Pay Upfront For Debt Settlement And The Settlement Company Controls My Money

The truth: Not anymore.

Debt settlement companies that market their services are banned from collecting advance fees from consumers before settling or reducing a consumers credit card or other unsecured debt, according to a Federal Trade Commission rule that took effect in October 2010.

The rule also specifies that the consumers money set aside to pay debts be maintained in an account at an insured financial institution that the consumer owns the funds and any interest accrued that the debt settlement company does not own, control or have any affiliation with the company administering the account and that the provider does not exchange any referral fees with the company administering the account, the FTC says.

Also, consumers can withdraw from the debt relief service at any time without penalty and receive all unearned provider fees and savings within seven business days.

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Recommended Reading: Is 737 A Good Credit Score

Send A Goodwill Letter To The Lender

If you feel like going directly to a credit bureau isnt the right attack, then you can send the lender a goodwill letter directly.

This letter is a polite way to ask if a lender will remove the settled account from your credit history.

This differs from a dispute because you are asking nicely to have the settled account removed and not stating any inaccuracies.

Sending a goodwill letter is ideal for people that defaulted on a loan due to personal injuries or illnesses.

Keep in mind that creditors will look at the history of the account and try to see if you made any attempts to get caught up after one of these circumstances.

They may use this information to make a decision on your account.

At this point, you can offer to make the full payment or try to find a middle ground.

With the lender by settling on an amount that is less than whats owed.

After finding a way to pay in full or at least some, the lender should remove the account from your credit report.

Keep in mind the negative effects of the account will be removed since it is considered to be paid, but the ragged payment history will still be available on your account.