Equifax Vs Experian Vs Dun & Bradstreet

An Equifax small business credit report is the most expensive of the three options see a sample report here. The Equifax business credit report includes more scores than the Dun & Bradstreet Credit Evaluator Plus basic report though D& B offers pricier reports with more information. However, the Equifax and Experian CreditScore report includes similar metrics.

Experian includes two scores that are similar to what youll find with Equifax. Its reports include a financial stability risk rating from 1-5, with lower ratings meaning lower risk, and a business credit score between 1 and 100, with higher scores meaning lower risk. A payment trend summary shows how the businesss payments are trending over time. See a sample Experian business credit report.

Dun & Bradstreet offers a credit report for $61.99 that shows these key metrics:

- Paydex score: A dollar-weighted indicator of how a business has paid its bills. Scores are from 1-100 and the higher score signals lower risk.

- A dollar value recommendation based on an analysis of similar companies.

Opportunity To Check For Errors

Your business may at some point depend on outside financing possibly a loan from a bank or a line of credit from a supplier. When you apply for financing, its likely that a lender will check your business credit report as well as your personal credit report. Its a good idea to make sure that information is accurate, before you apply for credit.

If there are any errors, youll need to contact your credit reporting agency and open an investigation into the error.

How to dispute Equifax errors

To start the dispute process, log into your member center account and use one of the options available to contact Equifax. Youll need to purchase an Equifax report in order to register for an account. Equifax will provide you with a Research Request Form to fill out and return. It will verify the information with the reporting entity and youll receive the results 45-60 days later.

How Can I Check My Equifax Business Credit Score

To check your Equifax credit score, youll make your way to their website and submit a form to Equifax. A representative from their team will contact you directly to gather information about your business. From there you will receive access to your credit report in a portal. This will include your company profile, credit summary, public records, risk scores, and payment trends. You are also able to check a credit report of a company you plan to do business with to ensure they are reliable.

Read Also: How Long Does A Bankruptcy Stay On My Credit Report

Equifax As A Business Growth Tool

Equifax is one of the largest credit reporting services for small companies on the market. If your score isnt quite where youd like it to be, check out our guide to improving your business credit score. If Equifax gives you a high score, it opens up a world of financial possibilities for your business.

Know how to get Equifax business credit report and if your business credit score is high, you probably know what you need to do to take advantage of those opportunities.

A Few Key Considerations You Should Make When Choosing A Business Credit Card For Bad Credit:

- Whats the APR for purchases?

- Is there a penalty APR if I pay late?

- Whats the annual fee?

- How much working capital do I need?

- Would a no-personal-guarantee business credit card be a better option for my needs?

- How can this card potentially impact my personal and business credit if Id like to qualify for better financing down the road?

Because business credit cards for bad credit are very limited, Navs pick here is a personal credit card with a flexible credit score requirement:

Recommended Reading: Does Business Line Of Credit Show On Credit Report

Equifax Business Credit Report Components

Your Equifax business credit report generally contains the following information:

Other information can be included on your report, too, depending on how you do business and the suppliers, lenders, associates and partners your company has. The report serves to provide a detailed analysis of your business financesas such, various information may be needed if its relevant to your business credit.

How To Establish And Build Business Credit

Building good business credit is similar to building personal credit. But, as weve mentioned, there are a few key differences.

common mistake is assuming that as long as you pay your bills on time, your business credit is fine, Detweiler says. That may be true, but not always. Many lenders and vendors dont report to commercial agencies, which means you may not have a business credit , even after years in business.

This could lead to a history of on-time payments that goes unreflected.

Here are some important steps you can take to ensure youre actually building business credit.

Recommended Reading: How Long Are Late Payments On Your Credit Report

Why You Should Check And Monitor Business Credit Reports

Lenders, suppliers, prospective business partnersanyone, reallycan check your business credit report. Unlike consumer reports, there is no restriction on who can access your business credit report. According to the Federal Reserve 2019 Small Business Credit Survey, 54% of business owners said they relied either on business credit or a combination of business and personal credit when applying for financing.

Increasing Your Credit Score For An Existing Business

If youve been in a business for a few years and just recently found out that your business credit scores are low, you can take some steps to rectify this as well.

1. Check Your Credit Report

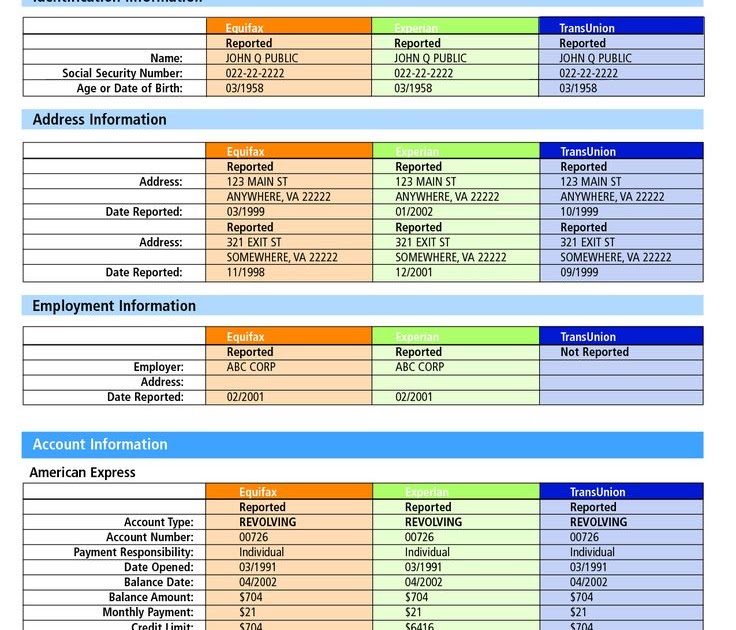

You cant fix bad credit without knowing what is on your credit report. You should purchase a copy of your businesss credit report from all three credit reporting agencies .

Review the information carefully and dispute any mistakes you see. It is not uncommon for credit reports to have some errors.

It can also help to submit any missing or outdated information. This can be done by contacting the individual agencies.

2. Make Early Payments

On-time payments are good, but early payments are even better.

Whatever you do, dont make late payments as they will reflect poorly on your scores and make it look like you are in financial distress.

3. Request Trade References

References can help. Ask a business associate to submit information to D& B about your financial status with them. This will increase your D& B PAYDEX score.

Considering a small business loan? Check out these guides:

Working Capital Loans | Inventory Loans | Grants vs. Loans

Just as your personal credit score can affect your personal financial stability, a business credit score reveals much about how well your business manages its money.

Keep in mind that there are some other factors a lender might take into consideration when deciding whether or not to extend you a loan:

You May Like: How To Fix Discrepancies On Credit Report

Bank Of America Business Advantage Unlimited Cash Rewards Mastercard Credit Card

The Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card offers a host of extras on top of their See Terms for 9 billing cycles on purchases introductory APR and$0.00 annual fee. You can earn 1.5% cash back for every $1 spent on all purchases. and there are flexible rewards options, too. Earn even more with a Bank of America business checking account.

Where To Check Your Business Credit Score

There are four main business credit scores and reporting agencies. Dun & Bradstreet Credit Score for Businesses is most commonly employed in a credit check. There are also the Experian Business Payment and the Equifax Business Credit Scores. These are typically used by banks and lenders when assessing credit applications.

Finally, there is the FICO LiquidCredit Small Business Scoring Service. Unlike the above examples, FICO is not a credit bureau. It instead uses information from Dun & Bradstreet, Equifax, and Experian to generate a credit score. That score is then commonly used when making approval decisions on Small Business Administration loans.

These four credit reporting agencies can all hold different information on the same company and, as a result, there can be variation in these business credit scores. They also use different credit ranking scales, meaning what is considered a good score by one reporting agency may not be by another.

You May Like: How Long Do Hard Inquiries Affect Your Credit Score

How Is A Business Credit Score Calculated

A business credit score considers many of the same factors as a personal credit score, such as payment history and amount of debt used. However business credit scores use different scoring models.

For two main types of business credit scores, Dun & Bradstreet PAYDEX Score and Experian Intelliscore Plus, scores range from 1 to 100, and the closer to 100, the better. Consumer FICO scores, on the other hand, are ranked 300 to 850, with 800 and above being consider excellent credit.

Business credit scoring models weigh different factors when calculating scores, but you can anticipate that your payment history, age of accounts and amount of debt will be considered. If you carry a balance on The Blue Business® Plus Credit Card from American Express, that will be factored into your business credit score. And if you miss a payment on your Ink Business Cash® Credit Card, that can negatively impact your score.

How A Business Credit Card Can Build Business Credit

Whenever anyone applies for a credit card, theres always a key question they ask how will it impact my credit? That question is doubly complicated when it comes to business credit cards, as business credit cards can impact both your personal and business credit scores.You can read our article here on which credit card issuers report to the consumer credit bureaus, and how that reporting can impact your personal credit scores.

Major business credit bureaus include Dun & Bradstreet, Experian and Equifax. The Small Business Financial Exchange, though it doesnt designate itself as a commercial credit bureau, shares business financial account information with a number of business credit bureaus, and so often your business credit card account data is shared with the SBFE, which then shares it with its Certified Vendors who can include it in business credit reports they sell.

Getting a card from credit card issuers that report can help ensure youre building your business credit profile with all major bureaus. However, it also means that if you default, pay late or have other negative information on the card account, it can have a negative impact on your business credit score. Below are some quick tips that may help improve business credit with your business credit card.

Don’t Miss: Is 700 A Good Credit Score To Buy A House

The Best Capital One Business Credit Cards

The Spark line of business credit cards from Capital One has long been a favorite of business owners looking for quick approvals that serve a wide variety of personal credit scores. Capital One has one of the best all-purpose travel rewards cards as well, meaning its line of cards can be a great fit for business owners looking for cash back or miles and those who travel often but arent loyal to a specific airline or hotel chain. Capital One also has business credit cards that operate on both Mastercard and Visa payment networks, which provides some flexibility if you have a preference.

Equifax Business Credit Reports Provide The In

- Company Profile key firmographic information such as company name, address, and phone numbers

- Public Records Secretary of State business registration, judgments, liens, or bankruptcies reported for the business

- Risk Scores Equifax Business Credit Risk Score and Equifax Business Failure Score

- Payment Trend and Payment Index a 12-month payment trend and comparison to the industry norm

- Additional Company Information alternate business names, owner and guarantor names, and business and credit grantor comments

- Equifax Business Risk Scores can help you identify potential risk of late payments and business failure:

- Business Credit Risk Score predicts the likelihood of a business incurring a 90 days severe delinquency or charge-off over the next 12 months.

You May Like: What Is A Fair Credit Score

More Than One Annual Credit Report

You could be eligible for an additional credit report under the Fair Credit Reporting Act during any 12-month period if you meet one of the following requirements:

- You are unemployed and intend to apply for employment within 60 days

- You receive public welfare assistance

- You believe your credit report contains inaccurate information due to fraud.

You are also entitled to a free copy of your credit report if you meet these requirements:

- You have been the subject of adverse action, such as denial of credit or insurance, within the past 60 days.

- You have placed a fraud alert on your credit reports.

If any of these situations apply to you, you can request your additional free copy of your Equifax credit report:

- On our automated phone line: 685-1111. Hours are 7:30 a.m. 1:30 a.m. ET.

If you’re sending your request by mail, please be sure to include your name, Social Security number, current and previous addresses, and date of birth. For your protection, you will also need to verify your identity through an acceptable form of identification. Find out more about acceptable forms of identification.

Business Credit Reporting Agencies

There are a number of national commercial credit reporting agencies. A few include:

- Dun & Bradstreet

In addition, the Small Business Financial Exchange is a nonprofit trade association that collects small-business data and makes it available through certified vendors that currently include Dun & Bradstreet, LexisNexis, Equifax, and Experian. It is not a credit bureau, and business owners cannot request or review data on their business directly from SBFE, but are directed to contact the certified vendors.

Only a couple of national credit reporting agencies directly provide business owners with a copy of their free credit report.

Don’t Miss: Do Mortgage Inquiries Affect Credit Score

Small Business Loan Amounts

The amount you can borrow will depend on the loan type, as well as qualifications such as your credit scores and/or business revenues. Here are some general guidelines for maximum loan amounts for a typical small business. Medium to large businesses with more employees and revenues may qualify for larger amounts. And, of course, every lender is different in terms of how much they will lend.

- Business Credit Cards: $75,000

- Vendor terms: $50,000

Does Personal Credit Still Matter For Business

Certain business credit scores will take both business and personal credit reports into account.

Your personal and business credit reports are kept in separate databases. They do not impact each other, Detweiler says. However, there are a few business credit cards and financing options that may report to both commercial and personal credit. And there are some credit scores, such as the FICO® SBSS, that include data from both personal and business credit.

Experian also has a credit score that can take both into account. So its important for business owners to understand, monitor and build both, she says.

You May Like: Does Consolidating Debt Help Credit Score

What Factors Determine Your Score

The factors that determine a business credit score vary depending on the agency doing the calculations.

Of course, many factors are used by all three reporting agencies, but some place a higher value on different factors.

Some of these factors will look familiar since they are also used for your personal credit reports.

Whats A Business Credit Score

If youre familiar with personal credit scores, then youll recognize business credit scores as a similar concept.

As a quick refresh, your personal credit score is a three-digit number that helps lenders decide whether to offer you credit, and on what terms.

The way they see it, the higher your credit scores are, the higher your likelihood to pay off debt on time. This comes into play when applying for credit cards or loans, and is determined using information from your personal credit reports.

A business credit score performs the same function for your business as a personal score does for your own finances. Lenders and creditors look to minimize risk when giving out loans, so they look for information on whether a business is likely to repay the loan.

Business credit reporting agencies collect information on your businesss financial history and can use it to put together an assessment of your risk level for lenders this serves as your business credit score.

The higher your score, the likelier you appear to lenders to be able to repay your debts. And that means it might be easier for you to get approved for loans and qualify for lower insurance premiums.

Also Check: How To Check Your Real Credit Score

Improving Your Business Credit Score

So lets say your business credit score isnt where you want it to be. It happens, especially if you havent been building business credit for long.

Fortunately, just as with personal credit, you can take certain steps to improve your business credit score. For example, the following practices can help:

With all of these, youll want to make regular timely payments. Keep in mind that these practices wont fix your credit score overnight. But with time, you should see improvement.