Good Range Credit Scores By Income

People who make more money are statistically more likely to have a higher credit score. For example, those who make $75,000 to $99,999 per year are more likely to have a score in the 700s. But it is possible to have a high score even if you don’t make a lot of money, or to have a low score even if you do. It all depends on spending within your means.

Forty percent of consumers have credit scores that are lower than 737.

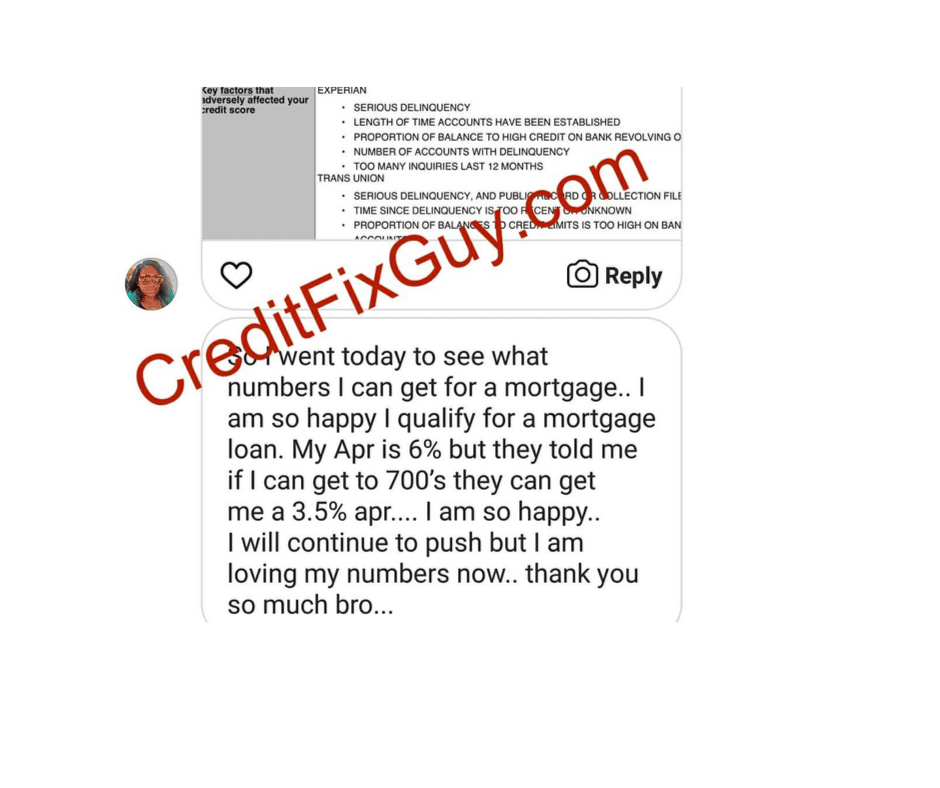

What Is A Good Credit Score To Avail Of A Home Loan

To avail of a home loan you need to ensure that you have a CIBIL score of at least 650 or above. Since a housing loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest.

You can maintain a good CIBIL score by following these simple steps:

- Pay your EMIs on time to create a proper track record

- Avoid having a credit card that you dont use cancel dormant credit cards

- Manage your credit cards carefully by setting payment reminders or limiting your use to one credit card

- Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

- Dont make too many loan applications in a short span of time

- Choose lengthy loan tenors with care and try to make part-prepayments when you can

Ways To Raise Your Credit Score Quickly

If youre looking to catapult your already-good 737 to even greater heights very quickly, that may be difficult. Nonetheless, you can try the following methods to raise your credit score extremely fast:

1. Dispute errors on your credit report

Order your report from AnnualCreditReport.com and scour it for errors. If you spot any, send in a dispute letter to the bureau that published the errors.

If you manage to get any derogatory marks removed, youll definitely boost your score beyond 737 almost immediately.

2. Get credit for paying rent and utility bills on time

Your rent and utility bill payments generally wont be reported to the three credit bureaus . But now there are some services that will allow you to do just that. Provided you pay on time and in full each month, this is probably the easiest way to add some quick points to your 737 score.

- Try Experian Boost: A free service you can use to boost your credit for making certain types of payments like utility bills .

- Try rent and bill reporting services: Paid services like PayYourRent will report your rent payments to all three credit bureaus and others will report your utility payments to one or two of them. Before signing up for these services, check to make sure your landlord or property management company isnt already reporting your rent and utilities.

Also Check: Does Afterpay Show On Credit Report

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

What Is The Fastest Way To Build Credit

The fastest way to build credit is to take on credit. Opening up a credit card or getting your name on another individual’s credit card, such as a parent, is a good starting point to build credit history. From there, paying your bills on time and consistently checking your credit report for inaccuracies will allow you to build a good credit history.

Also Check: How To Remove Address From Credit Report

How Your 737 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Don’t Miss: Does A Judgement Show Up On Your Credit Report

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues you should always contact a local attorney for legal advice regardless of your use of any other service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

Read Also: How To Print Free Credit Report

Charge No More Than You Can Easily Repay When The Bill Comes In

This really gets to the mechanics of paying off your balance each month. If you have room in your budget to pay $500 per month toward your credit card bill, then thats as much as you should charge on it. It makes it less likely youll need to carry a balance.

Remember, using a credit card responsibly does not mean maxing out your available credit every month!

Is Your Credit Score Holding You Back Gardner Realty

If you have a credit score of 737, you might be asking yourself, is 737 a good credit score? luckily, the answer is yes: Mortgage, auto, and personal loans are relatively easy to get with a 737 credit score. What exactly is a credit score and why is it important? Find out more about your credit score and learn steps you can take to improve your credit.

A 737 credit score is considered good. While this may sound tedious, it will be beneficial to try . A credit score is a number that lenders use to help . Is 737 a good credit score?

Mortgage, auto, and personal loans are relatively easy to get with a 737 credit score. Fico scores range from 300 to 850. A 737 fico® score is considered good. What exactly is a credit score and why is it important?

Read Also: Does It Affect Your Credit Rating To Apply For Cards

S To Improve Your 737 Credit Score

Improving your 737 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Read Also: Is Fico Score Different From Credit Score

Factors That Can Affect The Calculation Of Your Credit Scores

There are five main factors that can affect the calculation of credit scores. If youre interested in improving your credit, understanding what these factors are can help you create a plan to build healthy credit habits.

1. Payment History

How you manage your payments is one important factor used during the calculation of your credit scores. This includes how many accounts you have open as well as all the positive and negative information about these accounts. For example, if you make payments on time or late, how often you make late payments, how late the payments were, how much you owe, and whether or not any accounts are delinquent.

2. Outstanding Debt

Sometimes referred to as a , many credit scoring models take into account how high your balance is compared to your total available credit limit. Specifically when it comes to revolving credit, for examples credit cards and lines of credit.

3. Length Of Credit History

Your credit file includes how old your credit accounts are and will influence the calculation of your credit scores. The importance of this factor will differ depending on the scoring models, but generally speaking, how long your oldest and newest accounts have been open is important.

4. Public Records

Public records include bankruptcies, collection issues, liens, lawsuits, etc. Having these types of public records on your credit report may have a negative effect on your credit scores.

5. Inquires

Additional Reading

Credit Score: Good Or Bad

At a glance

737 is a good credit score. Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest rates. Well explain what financing you can get with a score of 737 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or instantly boost your credit score for FREE with Experian Boost.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Also Check: What Is The Lowest Credit Score To Buy A Car

How To Read Your Credit Report

Your credit reports contain both personal information and financial information. Your credit reports illustrate who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. A credit report is the report card of your credit life and understanding how to read it can help you take control of your credit and be prepared for any of your future credit needs.

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Don’t Miss: Does Adding A Credit Card Improve Your Credit Score

What Credit Score Should You Have

A is a number that helps lenders evaluate a person’s credit report and estimate their credit risk. The most common credit score is the FICO score.

A person’s FICO score is provided to lenders by the three major credit reporting agenciesExperian, TransUnion, and Equifaxto help lenders evaluate the risks of extending credit or loaning money to people.

Frequent Credit Card Use Is Required To Take Full Advantage Of Rewards

Depending on the rewards offered, earning them can be a bit complicated. It may be easy in the first year, due to a generous sign-on bonus. But the ongoing rewards arent always so easy.

Take travel rewards, for example. If a travel rewards card offers two points for every $1 you spend, youll have to spend $1,000 per month to earn 2,000 points. In one years time, you can earn 24,000 points spending at that level, equal to $240 in travel purchases.

But the critical connection is being able to spend at that level every month. If you dont normally use a credit card, you may not accumulate a meaningful number of points.

Don’t Miss: How To Repair Credit Score

Watch Out For The Balance Transfer Trap

A 0% introductory APR is an outstanding benefit to have, but only if you use it the right way. And the right way is to pay off any balance transferred before the 0% APR introductory term ends.

To do otherwise is to put yourself in a potential trap.

Heres why

- Balance transfer fees. Credit cards routinely charge an upfront fee of between 3%-5% of the balance transferred. If you transfer $10,000, that will be $300 to $500, paid up front.

- The 0% introductory APR could convince you to keep the balance outstandingafter all, it wont be costing you any money.

- The 0% introductory APR will end, and then youll be subject to the regular interest rate. Its possible that rate will be higher than the one youre paying on the card you transferred the balance from.

If you wont be able to pay the balance in full within the introductory term you might want to avoid a balance transfer entirely. In that situation, itll just be moving debt from one credit line to anotherwith an interest rate reprieve in the middle.