Pay More Than Monthly Minimums

If youve maxed out your credit card in the past, now is the time to take control of the situation. Make more than the minimum payment due each month, says Lisa Torelli-Sauer, editor at Sensible Digs, a website specializing in budgeting home investments. Even if its only a few dollars more than the minimum payment, it will show the credit reporting agencies you are making a greater effort to pay down your debt and will improve your score.

Bring Proof Of Payments

The first hoop will be documentationlots and lots of documentation. Youll need to show verification of your income for the last 1224 months, as well as a steady payment history for at least four regular monthly expenses. These expenses may include:

- Utility bills not included in your rent payments

- Phone, cell phone or cable bills

- Insurance premium payments

- Childcare or school tuition payments

The more evidence you can provide of your on-time payment history, the higher your chances of qualifying for your mortgage.

Check Your Credit Report For Errors

The first step to increase your credit score before buying a house is to know where you are starting. Go straight to the source for an accurate credit report. Each of the credit reporting bureaus are required to give you a credit report one time per year at no charge. All you have to do is contact them. The credit reporting agencies are:

You May Like: How To Remove Inquiries From Credit Report Sample Letter

Where To Check Your Score

You can usually check your credit scoreon any credit card issuerâs app or website, through your bank or other institutions where you borrow money. You can check your scores for free once a year on AnnualCreditReport.com. However, the credit bureaus have allowed a free weekly check of your credit score through 2022 due to the Covid-19 pandemic.

Fha Loans Dont Require Traditional Credit

Building credit takes time. If youre ready to buy a home but you lack a credit score, waiting until youve built up a worthwhile credit history could feel slow and frustrating especially in markets where house prices are rising fast.

The better, faster solution is to seek out mortgage loans meant for borrowers with little or no credit to their name. The FHA mortgage is one such option.

As the Federal Housing Administration states on its website: The lack of a credit history, or the borrowers decision to not use credit, may not be used as the basis for rejecting the loan application.

Instead of turning away borrowers who have not had a chance to build a credit history , the FHA instructs loan officers to look at all aspects of a mortgage application.

This is good for first-time home buyers because FHA loans allow for a low down payment of just 3.5%, which can help a household with good income but less-than-optimal savings move from renting into homeownership.

Don’t Miss: How To Report Credit Card Theft To Police

How Can I Check My Credit Score

You can request a free copy of your credit report once every 12 months directly from Equifax, Experian, and TransUnion. You can also use online credit monitoring services or your credit card provider.

Make sure you know if you’re looking at your VantageScore or FICO score, since your lender could be looking at just one.

You wonât improve your credit score overnight

If you plan to buy a house, start working on your credit as soon as you can.

You might see small changes to your credit score in as little as a few weeks. But generally, it will take several months to see a big improvement.

What Credit Score Is Good Enough To Buy A House

Inside This Article

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products however our opinions are our own.

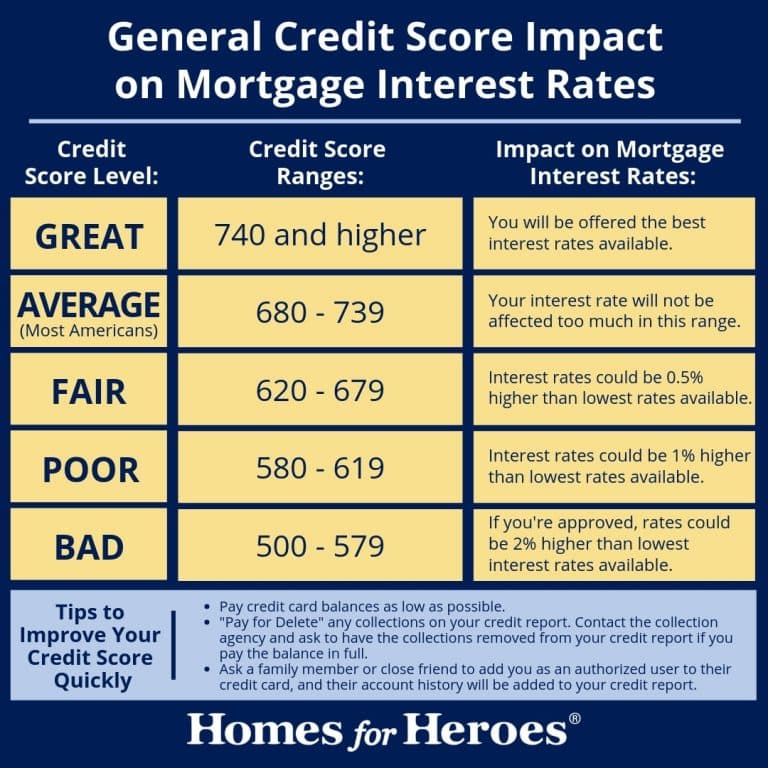

In order to buy a house, most mortgage lenders would like you to have a minimum credit score of 620. While some lenders might approve you for a home loan in the 500s the ideal credit score needed for a home loan is between 620 to 740. The higher your credit score the better interest rates and loan terms you will get.

is also one of the best credit repair companies that fixes your credit by removing negative information from your report. They work on FICO score as well as other scoring medals. It has an A rating at Better Business Bureau.

You May Like: Is 588 A Good Credit Score

Can You Buy A House With Credit Card Debt

You sure can. Theres no rule that you have to get rid of all of your credit card debt before purchasing a home. That said, you may scare off a mortgage lender if you have too much credit card debt.

Why? Its because your credit utilization ratio the percentage of your available credit you use is a key factor lenders consider. Maxing out your credit cards or getting too close to your total credit limit could signal to a lender that youre overextended financially.

For this reason, you should pay down your credit cards as much as possible prior to applying for a mortgage. And once you apply for a mortgage, dont put any large expenses on your credit card before closing on the loan. Otherwise, a lender could raise your interest rate or deny your loan.

Conventional Loans With No Credit

Unlike the FHA mortgage program, conventional loans are not known for their relaxed credit standards.

But what many borrowers dont know is that Fannie Mae and Freddie Mac the agencies that set the rules for most conventional loans may be willing to approve borrowers with no credit score.

However, youll have to meet additional requirements.

For instance, youll likely need to make a larger down payment at least 5% or 10% down. The home youre buying has to be a single-family property youll use as your primary residence.

And the maximum loan amount is $ Fannie and Freddies higher loan limits in high-cost areas dont apply.

In addition, your lender will likely want to see a 12-month history of rent payments.

These loans need to be manually underwritten. Manual underwriting means the borrower cant be approved by a lenders computerized underwriting system.

What this means for you is that not all lenders will do conventional loans with no credit score. Youll need to shop around for one that does.

You May Like: How To Check Credit Score Without Social Security Number

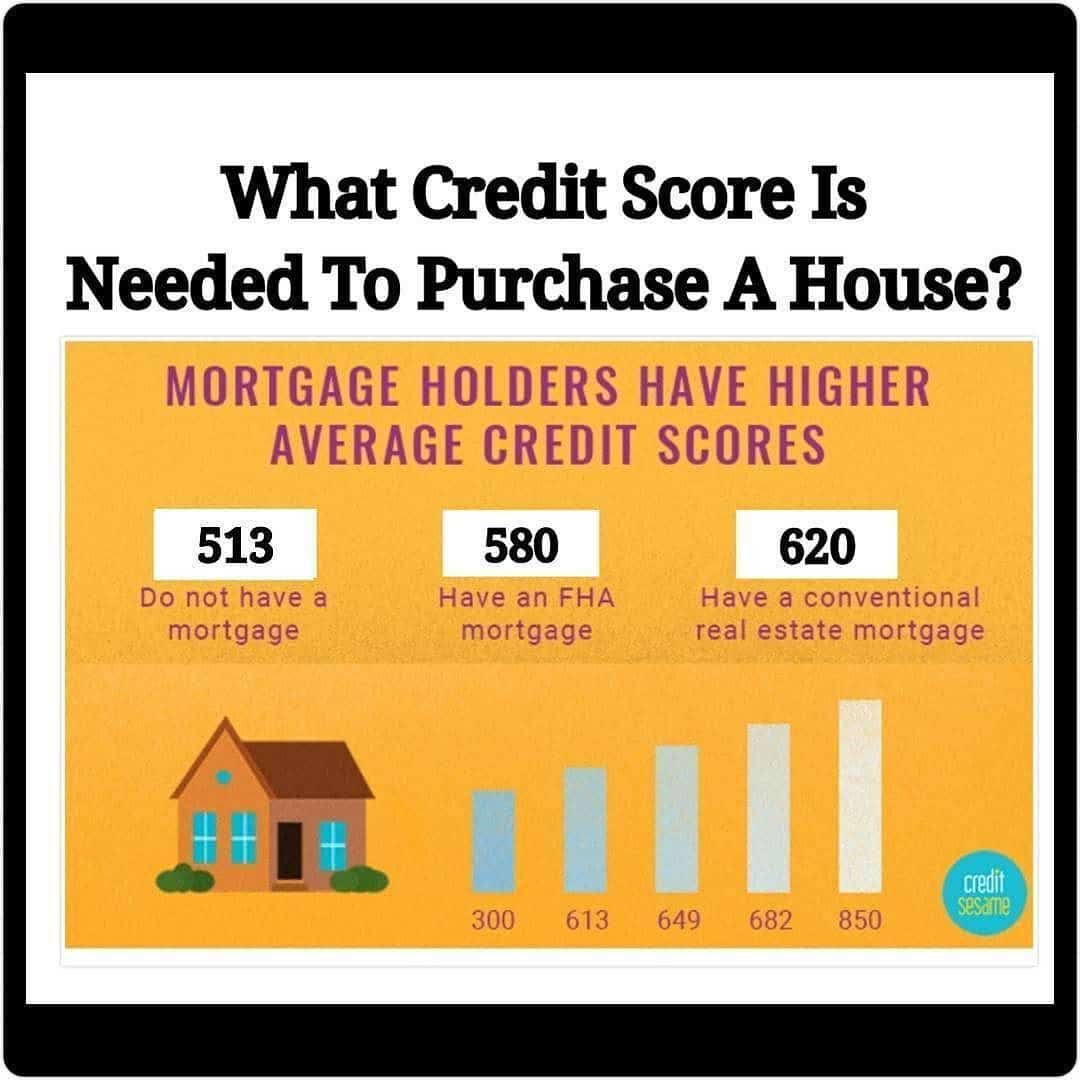

Fha Loan: 500 Credit Score

FHA loans have the lowest credit score requirements of any major home loan program. Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you need to put only 3.5% down.

Those with lower credit scores may still qualify for an FHA loan. But theyd need to put at least 10% down and its more difficult to find a willing lender.

Another appealing quality of an FHA loan is that, unlike conventional loans, FHA-backed mortgages dont carry risk-based pricing. This is also known as loan-level pricing adjustments . Risk-based pricing is a fee assessed to loan applications with lower credit scores or other less-than-ideal traits.

There may be some interest rate hits for lower-credit FHA borrowers, but they tend to be significantly less than the rate increases on conventional loans. For FHA-backed loans, this means poor credit scores dont necessarily require higher interest rates.

Keep in mind, though, that FHA requires both an upfront and annual mortgage insurance premium which will add to the overall cost of your loan.

You May Like: Will Disputing Items On Credit Report Lower My Score

Can I Get A Mortgage With A Low Credit Score

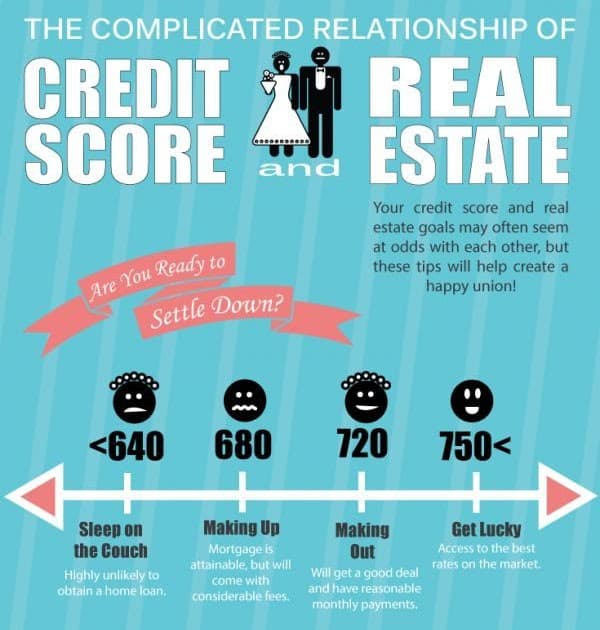

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as your DTI ratio, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

Recommended Reading: What Credit Score Do You Need For A Home Loan

What Factors Determine Your Credit Score

Payment History 35%: How well you pay your bills on time has the biggest impact on your credit score. If you have multiple 30-day late payments or 60,90 or 120 late payments you will see a huge drop in your credit score. However, if youve made your payments on time for years, youll see a much higher credit score.

Utilization Rate 30%: The next largest factor is how much you are using your available credit. Are your credit cards maxed out? Do you run high balances on them? Once you keep a balance of 30% of your credit limit or higher on your cards, your score begins to decrease.

How long youve been making debt payments also has an effect on your credit score. This is why its never a good idea to close a credit card or other credit account if youve had it for a long time. Closing the account will lower your average age of accounts and negatively impact your credit.

Your credit mix is the types of credit you have. In order to get the most out of your credit score, youll want to have a mixture of revolving accounts, like credit cards, and installment loans, like car payments.

New Credit 10%: Finally you need to keep an eye on how much new credit you open at one time. If you go on a credit spree opening a bunch of new accounts, this can cause your scores to drop. Obtaining a lot of new credit can be a red flag to lenders that you may be desperate or unable to make ends meet.

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively build your credit score or maintain it to give yourself the best chance of qualifying for a mortgage.

One of the most common scores used by mortgage lenders to determine creditworthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your , such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

- Types of credit

The higher your score, the easier itll be to qualify for a lower interest rate on a great mortgage.

Recommended Reading: What Is A Good Credit Score

What State Has The Highest Average Mortgage Balance

Washington, D.C., Credit Karma members had the highest average mortgage balance at $452,712. But Washington, D.C., isnt a state.

That makes California, with an average mortgage balance of $427,781, the state with the highest average mortgage balance among Credit Karma members. The state with the lowest average mortgage balance among Credit Karma members is West Virginia at $132,334.

Why Your Credit Score Matters To Lenders

Your credit score helps lenders determine your ability or inability to repay the mortgage . Lenders also examine your debt-to-income ratio , the percentage of monthly debt obligations relative to how much income you bring in.

To illustrate, if you earn $4,000 per month, and have $1,250 in credit card, loans, housing and other payments, your DTI ratio would be 31 percent. The ideal ratio is less than 36 percent, though some lenders will accept more with a higher down payment.

You May Like: Is 773 A Good Credit Score

Other Mortgage Options For No Credit Or Low Credit

When you have no credit or less than stellar credit, lenders will often try talking you into an FHA loan. But dont fall for it. An FHA loan is a total rip-offits way more expensive than a conventional mortgage.

FHA loans were designed by the government to make purchasing a home easier for first-time home buyers or folks who cant easily qualify for a conventional mortgage.

Lets take a closer look at the pros and cons:

What You Need To Know

- Your credit score is a number ranging from 300 to 850 that represents your creditworthiness

- A higher credit score means youre more likely to qualify for a mortgage and get a low mortgage interest rate

- If you have a lower credit score, you may still qualify for a Federal Housing Administration or a Department of Veterans Affairs loan

You May Like: Is 650 A Good Credit Score To Buy A House

How Can I Improve My Credit Score Before Buying A House

If you have some time before applying for a mortgage, you can try to improve your credit score:

- Donât apply for new credit. Avoid taking out a new credit card or car loan in the months before you buy a house. New credit lines can ding your credit score.

- Pay down your debt. The amount you owe makes up a big part of your credit score. Pay off credit cards and existing loans, and you may see a score improvement.

- Check your credit report. Your credit report could have inaccuracies that hurt your credit. Get a copy of your report from each bureau, and dispute any information that looks wrong.

Checking your credit is just the first of many steps for first-time home buyers.

Next, youâll want to learn how mortgage loan applications work and start shopping around for lenders. Before you start looking at houses, you should have a mortgage pre-approval letter in hand. That way, youâll be ready to make an offer when you find the perfect house.

Then youâll need a great real estate agent. Your agent will guide you along the whole buying process.

ð¡ Need a realtor? Try Clever Real Estateâs free agent matching service. Match with top local buyerâs agents nationwide, qualify for cash back after closing! Learn more.

Overview Of Credit Scores And Mortgages For All Credit Karma Members With A Mortgage

As of Aug. 13, 2022, there were more than 29 million Credit Karma members with mortgages. Among this set, the average VantageScore 3.0 credit score is 705 and the median is 725. Users had an average mortgage balance of $231,194, with an average next monthly payment of $1,632.

In 2020, the average score for this group was 717. This might indicate a general decline of credit health across all consumers over the last two years.

Looking for more info on mortgage debt in the United States? Check out our article on average mortgage debt in America.

Read Also: How To Up Your Credit Score

Minimum Credit Score To Buy A House By Loan Type

The minimum credit score requirement varies depending on the type of home loan you get and who insures the loan. Eligibility requirements are looser for mortgages backed by government agencies, including the Department of Veterans Affairs, Department of Agriculture and the Federal Housing Administration. The minimum credit score for conventional loans and jumbo loans is often higher because these arent insured by the government.

Bottom Line On Credit Score Needed To Buy A Home

Theres no universal credit score youll need to buy a house, as score requirements differ based on the type of loan youre applying for. At a bare minimum, youd want a score around 620, unless youre going for a FHA. And, as a general rule, the higher your score is, the easier it will be to qualify for a mortgage. Thats why its essential to improve your credit score for better mortgage rate offers from lenders.

Don’t Miss: What Is A 700 Credit Score

What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

What Kind Of Credit Report And Score Do Lenders Use

There are several versions of your credit score, depending on who issues the score and the lending industry .

To offset their risk and ensure that theyre getting the most accurate picture of a mortgage borrower, most lenders will use whats called a tri-merge credit report showing credit details from multiple credit bureaus.

Alternatively, they may use a residential mortgage credit report, which may include other details about your financial life, such as rental history or public records. These reports reveal the borrowers credit details from multiple bureausTransUnion, Experian, or Equifaxor all three.

In many cases, the credit score you see as a consumerpossibly through your bank or credit card companyis different from what a potential mortgage lender would see.

Recommended Reading: Is 736 A Good Credit Score