Keep Old Or Unused Accounts Open

You might think that you should close your old accounts, like your beginners credit card from back in the day, but doing so will reduce your total available credit. This drop will raise your utilization rate and hurt your credit score.

Instead of closing your old accounts, use them occasionally so that your creditors keep them open.

Takeaway: Try to keep your credit utilization rate low

- Your credit utilization is the amount you owe on your revolving credit accounts relative to the total amount of available credit you have.

- Your credit utilization rate can be calculated for each individual account or across all of your revolving accounts. Both contribute to your score.

- In many credit scoring models, the ideal credit utilization rate is between 1% and 10%. If thats not a realistic goal, try to keep it below 30%.

- To lower your credit utilization rate, try to increase your credit limits, curtail your spending, and avoid closing old and unused accounts.

Article Sources

Request A Credit Limit Increase

Another good way to lower your credit utilization ratio is to request a credit limit increase from your credit card issuer. By increasing your credit limit, youll have more available credit on your account, which will automatically lower your credit utilization ratio. Just be careful that you dont turn your new credit into new debt!

How To Calculate Your Credit Utilization

Your credit utilization ratio is calculated using a very simple formula:

To calculate your credit utilization rate, all you need to do is follow these steps:

Also Check: What Is The Government Credit Report Website

How Do I Determine My Credit Utilization Ratio

Figuring out your credit utilization ratio is simple with a little math. Heres how to figure it out:

- Add up all of the balances on your credit cards.

- Add up the credit limits on all of your credit cards.

- Divide your total balances by your total limit to find your ratio.

For instance, if you have $3,000 limit on all of your credit cards and you have a balance of $1,500, your credit utilization ratio is 50%.

What Is Revolving Utilization

Revolving utilization, also known as credit utilization or your debt-to-limit ratio, relates only to revolving credit and isnt a factor with installment loans. Utilization refers to how much of your credit balance youre using at a given time.

Heres how to determine your individual and overall credit utilization:

If you have a credit card with a $1,000 credit limit and a balance of $500, your utilization rate is 50%, for example. For the same card, if you have a balance of $100, your utilization rate is 10%.

When it comes to your credit score, revolving utilization is typically calculated in total. For example:

- You have one card with a limit of $1,000 and a balance of $500.

- You have a second card with a limit of $4,000 and a balance of $400.

- You have a third card with a limit of $3,000 and a balance of $600.

- Your total credit limit across all three cards is $8,000.

- Your total utilization across all three cards is $1,500.

- Your revolving utilization is around 19%.

Read Also: Is 798 A Good Credit Score

The Bottom Line Of Credit Utilization

When it all comes down to it, hereâs what you need to know about your credit utilization ratio: the lower it is, the better your score. And if you want to ace your credit utilization ratio, you can take those five easy steps to becoming an expert at managing it.

But remember: Building your credit score is a balancing act, and your score wonât climb overnight. Itâs all about being aware of your credit activity, practicing good borrowing habits, and patience.

If you follow the credit utilization ratio best practices, youâre well on your way to having a stellar credit score!

Article Sources:

Time Your Payments Right

Find out when your card issuer reports information to the credit bureaus and pay attention to the date you make your card payments each month. If your balance is high when your issuer sends your account information to the credit bureaus, such as a few days before the end of the billing cycle, then the credit utilization used in your credit score will also be high.

Make sure your balance is low by your account statement closing date . Check a recent copy of your billing statement to gauge your next account statement closing date.

Recommended Reading: Is 570 A Good Credit Score

Keep Tabs On How Much Youre Charging On Each Card

This first piece of advice is the most obvious one.

If your credit utilization ratio essentially comes down to the relationship between your outstanding balances on your card and your total available credit limit, then the first step is to keep your balances low!

Now, we know that reining in spending is not an easy thing to do. But start by simply monitoring your different accounts on a regular basis. That way youâll know when youâre getting into dangerous territory before you put your next purchase on your cardânot when itâs the end of the month and itâs too late to doing anything about your utilization.

Even though your credit utilization ratio is calculated by aggregating your total balances and your total credit limit, itâs important to be aware of your credit utilization ratio on each individual account you have open. Some scoring models can penalize you for having a high credit utilization ratio on any one card. So as a best practice, keep your outstanding balance low on all your cards at all times.

And finally, if you have more than one credit card account to your name but tend to only use one card, start spreading out your charges among all your cards. Doing so will help you avoid a high utilization ratio on just one card.

Whats The Best Credit Utilization Percentage

You may have seen experts say you should keep your credit utilization under 30%. And while that advice is okay, its not perfect.

Lower utilization is generally better, with the slight exception that 1% is better than 0%. But each credit-scoring formula may treat utilization a little bit differently, and the resulting impact can vary from credit file to credit file based on various other factors at play.

You May Like: How To Check Experian Credit Report

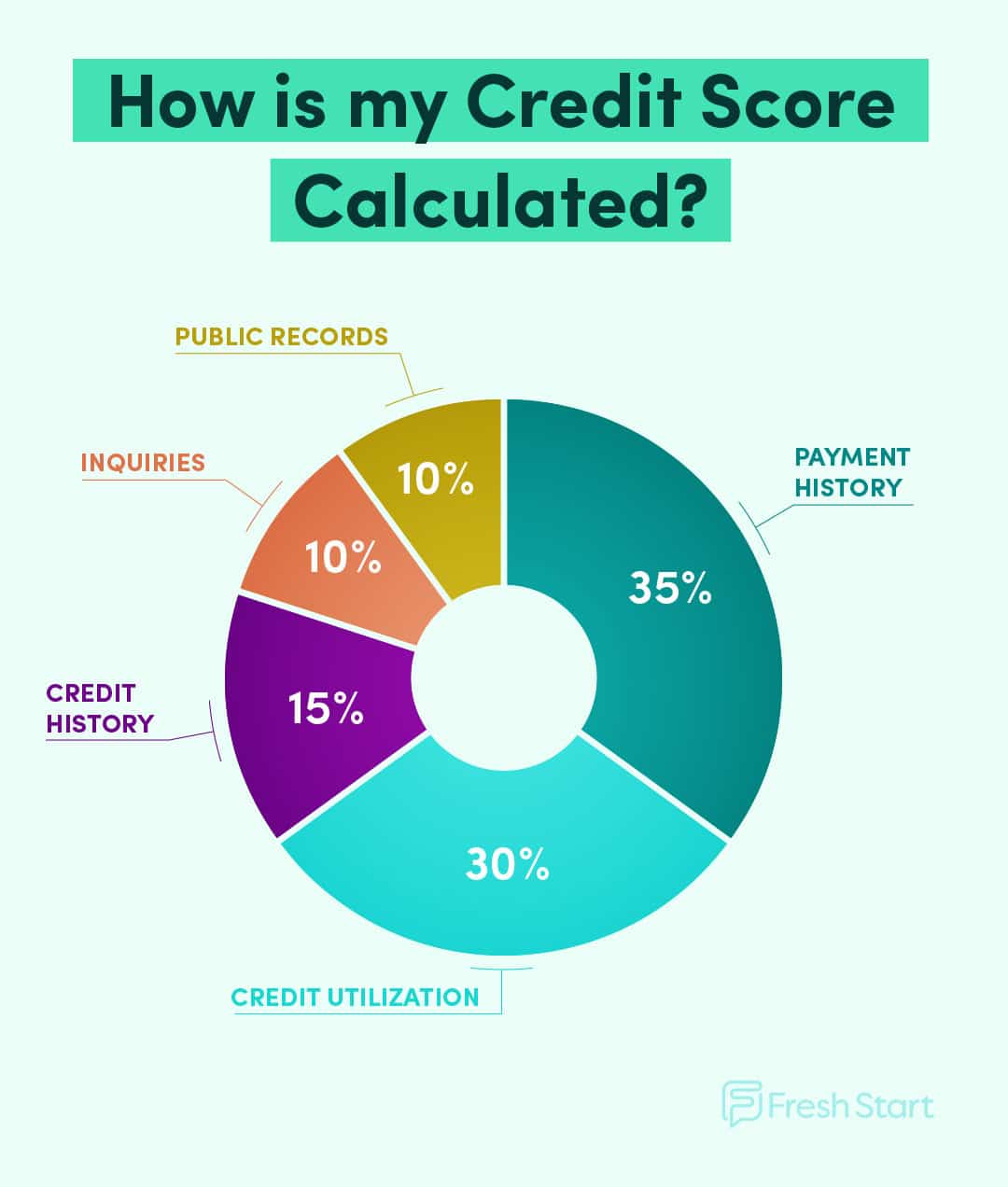

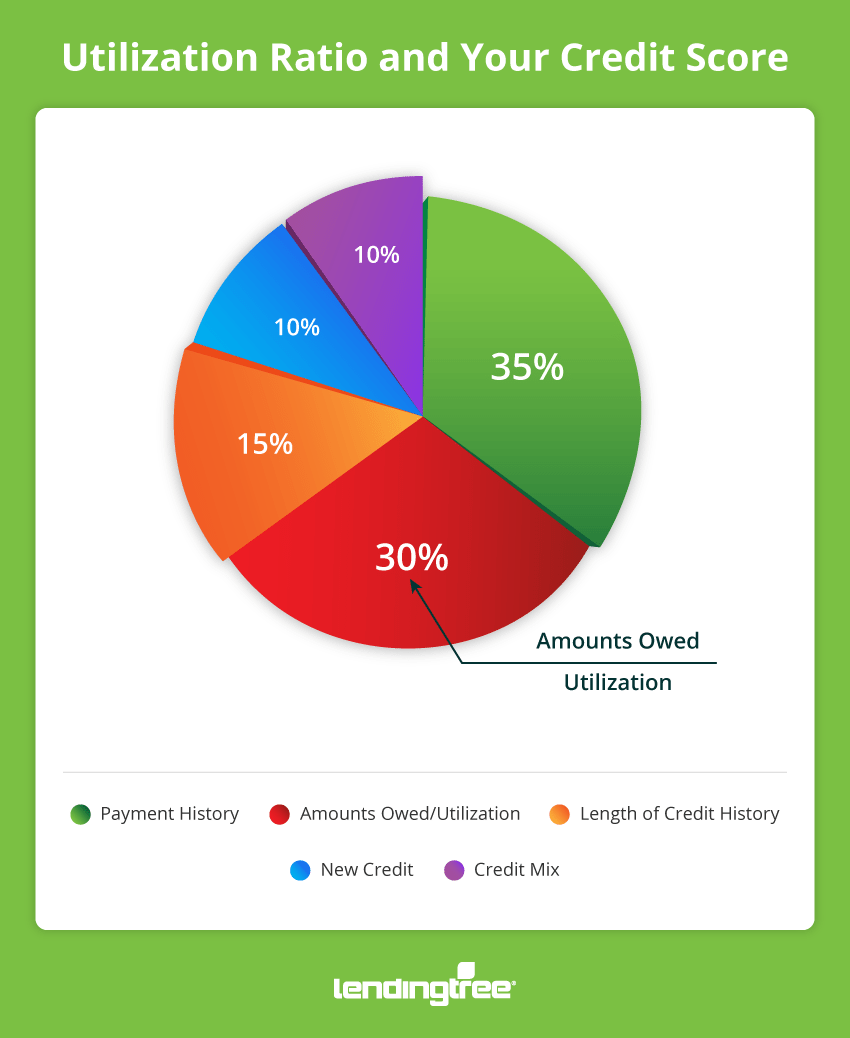

How Does Revolving Utilization Impact Your Credit Score

Your revolving utilization weighs heavily on credit score as its included in the amounts owed factor in the FICO credit-scoring model. Amounts owed accounts for 30% of your FICO score, making it the second-most-important factor.

A high credit utilization ratio generally accepted as anything over 30%, though FICO has no fixed percentage can cause your . Conversely, the lower your revolving utilization, the more positively itll impact your .

Pay Down And Pay Off Credit Cards

This is the most obvious strategy. You dont necessarily have to pay off all your credit card debt, but paying it down substantially can make a major difference. Be careful not to assume that every payment you make will automatically translate into a higher credit score. Paying down $1,000 in plastic probably wont have much of an effect if you have $30,000 in total credit card debt.

Recommended Reading: What Is The Best Way To Improve Your Credit Score

Why Is Using My Card’s Capacity Bad

The purpose of a credit score is to gauge the likelihood that you will repay the money you borrow. Certain factors make people more likely to default on credit obligations. One of those factors is high credit card and loan balances.

Higher balances are more difficult to afford and could indicate that you’re overextended. High utilization lowers your credit score and signals to prospective lenders an increased risk that you will fall behind on payments.

Be Careful About Closing Accounts

This advice doesnt apply to the average consumer. But for those of you in the credit card rewards game its important to remember that closing an account will result in less overall credit. While this seems obvious, its important to take that into account when thinking about your overall credit utilization ratio.

For travel hackers, signing up for a card for its sign up bonus and then cancelling that account a year later when the annual fee kicks in, can be a good way to snag free flights. However, if you do this too much or forget about your overall credit utilization ratio, you could end up negatively affecting your credit score. For example, if you cancel a card but forget that that means your overall limit is $1,000 less, you could end up hitting a higher credit utilization ratio by accident. Cancelling cards can also reduce the overall average age of your accounts, which can also negatively affect your score.

On the flip side, a still active credit account that you dont actually use can boost your score. So make sure before cancelling an account that it wont significantly hurt your overall credit utilization ratio. Coughing up an annual fee might be more cost effective, long term, than damaging your credit score, particularly if some big purchasesay a homeis on the horizon.

Also Check: What Is A Good Credit Score For A Mortgage

Ways To Improve Your Credit Scores

There are a few things you can do to improve your credit:

- Monitor your credit: Stay updated on your credit scores and reports so you can identify any potential problems early on. Doing so will also help you understand why your credit dipped and how to course-correct.

- Develop a budget: Designing a budget tailored to your lifestyle and sticking to it will help keep your spending in check and prevent you from racking up more debt than you can handle. You can use an app like Mint or Personal Capital to track your spending and set expense categories.

- Minimize debt: If you can afford it, pay off your debts as quickly as possible. The sooner they are paid off, the less of a negative impact they will have on your credit score. Additionally, avoid using credit if you cant pay off the balance at the end of the billing cycle.

- Pay your bills on time: Payment history makes up a significant percentage of your credit score calculations. Always pay your balances in full and on time at the end of each billing cycle. If youre having trouble remembering when to pay, set up automatic payments. But make sure you have money in your bank account to avoid an overdraft.

What Is A Credit Report

Think of your credit report like your financial health history. Its a statement that includes detailed information about your current credit situation and past credit history. All of this information is voluntarily submitted by banks, , debt collectors, and credit card issuers to one or more of the three major credit reporting bureaus: Equifax, Experian, and TransUnion. This recorded information is then used by lenders, potential landlords, and even future bosses to determine if they want to lend you money, offer a line of credit, approve your rental application, and more.

Whether you apply for a new credit card, loan, or mortgage, a lender will look at your credit report to gauge the likelihood that you will repay your debts as agreed going forward, says Rod Griffin, senior director of public education and advocacy for Experian. Lenders use the information in your credit report when deciding whether to extend credit and determining the interest rate and terms of the offer.

Read Also: How Can You Improve Your Credit Score

How Lenders View Your Credit Utilization Ratio

Different industries and individual lenders have different ways of evaluating your credit. While some may look strictly your overall credit score, others may look more closely at specific components.

Your credit utilization ratio can be one of those components. For example, lets say that you have a credit score of 685, which is generally within a lenders range of acceptable scores. However you have a credit utilization ratio of 77 percent, and that particular lender has a limit of 65 percent. You may be declined for the loanor the loan amount reduced-because you exceed the lenders credit utilization ratio limit.

This is not an unusual situation. As an example, though you may have a good credit score overall, if you have a history of making late payments on car loans, an auto lender might assign you a subprime interest rate, or even restrict the terms of the loan.

In general, however, you should assume that a high credit utilization ratio will always be an obstacle. It is used by lenders as a critical predictor of default. According to their reasoning, a high credit utilization ratio indicates either a pattern of excessive credit usage, or that you are getting dangerously close to default since you will soon have no additional credit available.

For this reason, you should be purposeful about keeping a relatively low credit utilization ratio, even apart from the impact that it may have on your credit score.

How To Lower Your Credit Utilization Rate

Pay off your debts. The best way to lower your utilization rate is to pay off your balances. Getting that balance down to $0 should always be a cardholders goal, says Schulz. This is a win-win, since, in addition to decreasing your credit utilization ratio, you wont be subject to interest charges from carrying a balance from month to month.

Request a credit line increase. Adding available credit can lower your utilization and can be easier than paying down balances, says Schulz. But you dont necessarily need to open a new credit card to do this. One handy alternative is to simply reach out to your current credit card companies and request a limit increase on your existing accounts.

Just remember to not just go out and spend that newly available credit. Otherwise, youll just make your financial situation worse, Schulz adds.

While increasing your credit limit can help get the job done, keep in mind that it may result in a hard inquiry on your credit file. Again, a single inquiry is generally no big deal, but multiple inquiries could drag your score down.

Keep credit accounts open. Because closing a credit card account will lower your available credit , its best to keep old accounts open whenever possible.

Additionally, to avoid having an issuer close your account due to inactivity, be sure to make small charges on the account on a regular basis.

You May Like: How To Get Rid Of Derogatory Remarks On Credit Report

What Options Do I Have To Lower My Credit Utilization Rate After The Credit Limit On My Credit Card Or Heloc Has Been Changed

Unexpectedly having your credit limit lowered can be a jarring experience, but fortunately, there are steps you can take to minimize the impact on your credit standing.

If your credit limit is lowered and none of the remedies above prove fruitful, try not to despair. As long as you continue to pay your bills on time, your credit scores will likely reflect your good borrowing habits. If youve recently experienced a job loss or other income reduction and are having trouble keeping up with your debts, reach out to your lender or creditor to discuss various repayment options any sort of communication is better than none.

How Can I Improve My Credit Utilization

If you want to improve your credit utilization, first pay down your debts to at least under the 30% mark. Other ways include utilizing more credit by asking for a higher limit or opening a new card, or you can keep a card with the balance fully paid open but not use it. However, the best way to improve your credit utilization is to pay off your debt on time.

You May Like: How Does Your Credit Score Go Down

Where To Get A Copy Of Your Credit Report

Typically, you can request a free credit report from each of the three major credit bureaus every 12 months through Annualcreditreport.com. All three major credit reporting agencies currently offer free weekly online credit reports through December 2023 because of the COVID-19 pandemic. Equifax is also offering everyone in the U.S. six free credit reports per year through 2023 through its website.

Once youve requested your report, your request should be processed and you should receive your report within 15 days. This can take less time if you request your report online, or you may experience delays if the credit reporting agency needs more information to verify your identity.

Pro tip: You dont have to request all three reports at the same time in fact, you may want to spread out these requests so that youre able to monitor your credit report throughout the year.

You can still get a copy of your credit report once youve already requested your three free copiesalthough youll likely have to pay a fee. The good news: A credit reporting company isnt allowed to charge you more than $13.50 for a credit report.

You may also be able to request an additional free report if