File A Dispute By Phone

. You ‘ll often receive faster feedback and a faster resolution over the phone if you have time. If there is a large call volume, you may waste time waiting on hold or in a lengthy queue. You can call Wells Fargo customer service at 869-3557 to address a dispute by phone.

If you don’t have time to wait on the phone, filing a dispute online can be a more convenient method of disputing your Wells Fargo credit report.

Report The Debt Collector To Authorities

What if the debt collector cant verify the debt?

The debt collector isnt allowed to collect payments if they fail to respond to your dispute. They cant collect payments for a debt that doesnt exist. If they try to, you can report them to the CFPB, the Better Business Bureau, or your states Attorney General.

Dont forget to check your credit report for any negative marks related to the debt in question. Youre entitled to one free credit report per year from each of the national credit reporting bureaus.

File a dispute with the credit bureaus so that they can investigate and remove the negative item if they prove that your claim is true. Send a copy of the debt verification letter you sent to the debt collector along with the return receipt as proof that it was delivered.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Don’t Miss: Comenity Bank Credit Score

Which Credit Report Errors Should You Dispute

The most concerning errors are those that could hurt your scores or suggest identity theft. Those include:

-

Wrong account status .

-

Negative information that’s too old to be reported most derogatory marks on your credit must be removed after seven years.

-

An ex-spouse incorrectly listed on a loan or credit card.

-

Wrong account numbers or accounts that arent yours.

-

Inaccurate credit limits or loan balances.

-

Accounts you don’t recognize.

If you suspect your identity has been stolen, follow the steps to report identity theft.

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

Recommended Reading: Locked Out Of My Experian Account

What Should I Do If I Find Information That Is Inaccurate On My Credit Report

Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. You may submit your dispute to the business who provided the information to the credit reporting company and/or to the credit reporting company who included the information on your credit report.

The Federal Trade Commission’s website has information about how to dispute errors on credit reports, and the Consumer Financial Protection Bureau’s website provides additional guidance about disputing information on credit reports.

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Read Also: Can Someone Check Your Credit Without Permission

Video: What You Should Know About Credit Disputes

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Dispute The Errors With The Credit Bureaus

When you find evidence of fraudulent activity, you need to dispute the errors with each of the three credit reporting agencies: Experian, Equifax, and TransUnion. You should contact each one and submit evidence, such as your police report or a letter from the lender acknowledging the occurrence of identity theft. Once the credit reporting bureau has that information, they can remove the accounts from your credit history.

If your credit score took a hit due to thieves defaulting on your loans, getting them removed can help improve your score. It can take weeks or even months for your score to fully recover, but it will eventually be restored to its previous level.

Read Also: How Does Leasing A Car Affect Credit Score

Why Use Donotpay To Dispute Your Wells Fargo Credit Report

| Fast | You don’t have to spend hours trying to solve the issue. |

| Easy | You don’t have to struggle to fill out tedious forms or keep track of all the steps involved in solving your problem. |

| Successful | You can rest assured knowing we’ll make the best case for you. |

DoNotPay is the easiest and most convenient method of disputing your credit report. We use proven tactics to ensure your success and help you get results faster. DoNotPay can help you with the following:

- Paid Off Debts

Complain To The Bureaus Bosses

If your dispute fails, you can always try again. But nothing is likely to change unless you provide new and stronger evidence. For example, maybe you have a confirmation email for a payment that your credit report says you missed. Such evidence isnt always available, though. Theres not much you can do to really prove it wasnt you who opened a particular account listed under your name, for instance.

So if youre dissatisfied with the credit bureaus handling of your dispute, you can escalate your case to the FTC, the Consumer Financial Protection Bureau or your states Attorney Generals office. And if a credit-report error is serious enough, you may want to hire an attorney that specializes in such matters.

Recommended Reading: How Long Does An Eviction Stay On Your Credit

Getting Your Credit Score Together

AnnualCreditReport.comMistakes you may find on your credit report

- Youre mistakenly identified as someone with a name similar to yours.

- A credit account was never included in your report, weakening your perceived credit worthiness.

- Your loan or credit card payments were applied to the wrong account.

- A legitimate credit account or debt has been reported and recorded multiple times.

- Your name is still linked to your ex-partners accounts and debts.

- Identity thieves have used your name and credit file to open accounts and take out loans you knew nothing about and its unlikely they have been making payments on those loans.

3 steps to disputing an errorStep 1: File a dispute with each of the major credit bureaus.

Mail your Equifax dispute to the following address:

Equifax Information Services LLC

Chester, PA 19016

Step 2: Contact the creditorStep 3: Follow up in 30 days

What Happens After You Dispute Information On Your Credit Report

Tip

If you suspect that the error on your report is a result of identity theft, visit IdentityTheft.gov, the federal governments one-stop resource to help you report and recover from identity theft.

If the furnisher corrects your information after your dispute, it must notify all of the credit reporting companies it sent the inaccurate information to, so they can update their reports with the correct information.

If the furnisher determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

You May Like: What Is Syncb Ntwk

Through Our Transunion Service Center Where You Can:

- Manage or fix any inaccuracies on your credit report

- Place Fraud Alerts to protect your identity

- Control who can access your credit information with Credit Freeze

Are you applying for credit or has a lender referred you here to lift a freeze on your TransUnion credit report? Youre in the right place.

- Add a note to your report around any COVID-19 or other financial considerations

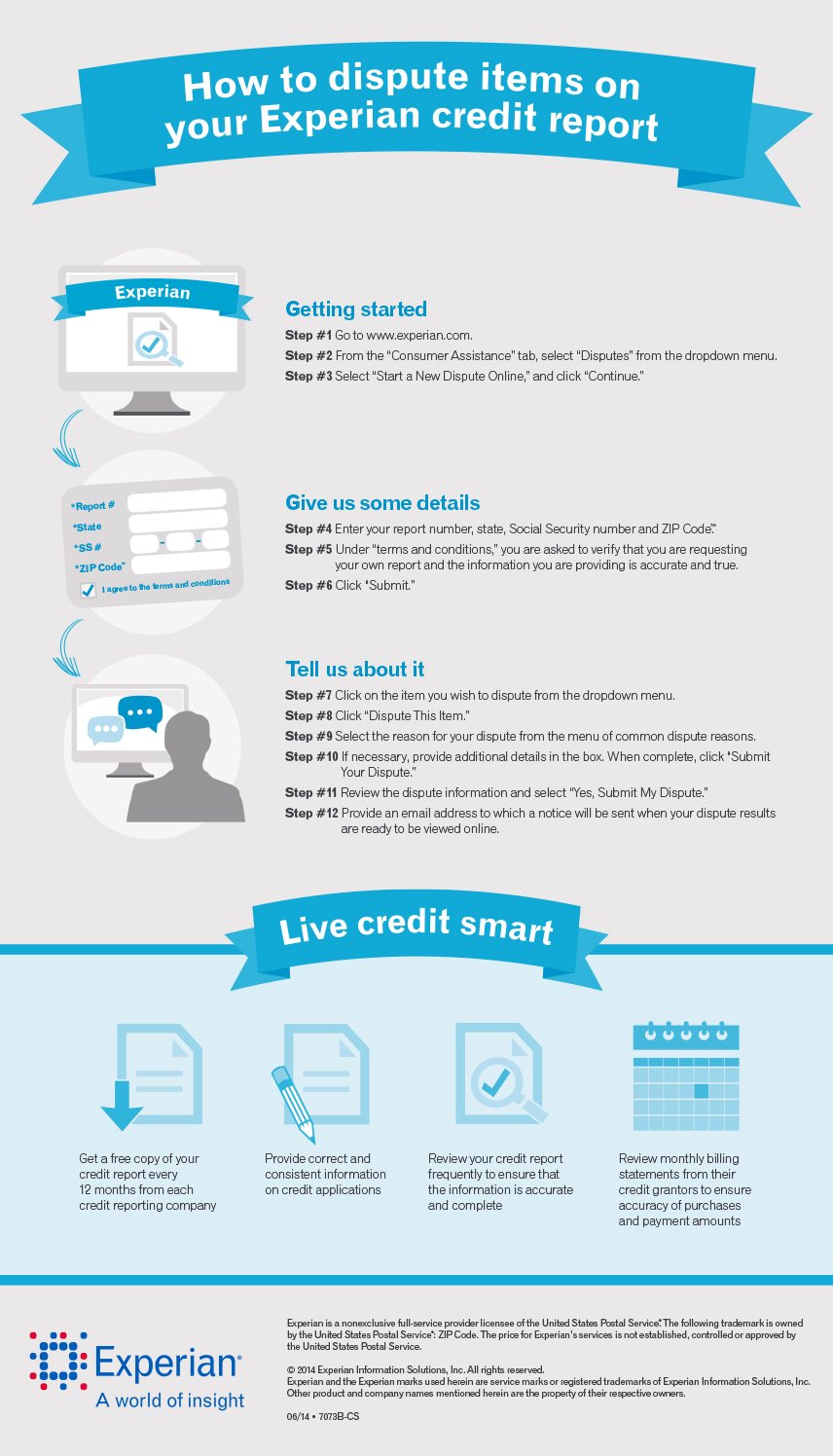

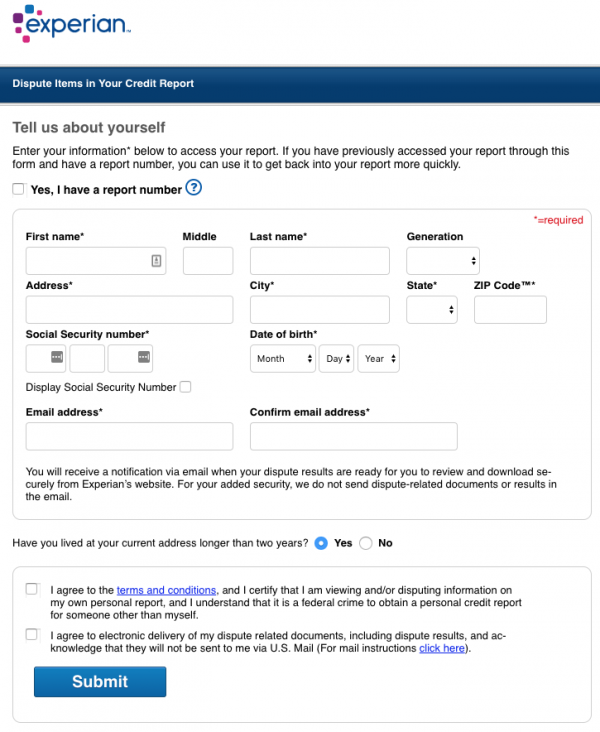

How Do I Submit My Dispute

To submit a dispute to a credit reporting company, contact the credit reporting company who has the inaccurate information on your credit report. You may submit a dispute with each of the credit reporting companies over the internet or by mail.

Online:

- P.O. Box 2000

- Chester, PA 19016

You may also submit documents in support of your dispute. Documents may be uploaded for online disputes or submitted by mail. When mailing documents, please only submit copies of documents and not originals. Documents will not be returned to you following the investigation.

To submit a dispute with a business:

- Contact the business directly. The contact information for that business should be included on your credit report or monthly billing statement.

The Federal Trade Commission’s website has more information on correcting your credit report, and the Consumer Financial Protection Bureau’s website also provides additional information on disputing information on your credit report as well.

Recommended Reading: Aargon Payment

File A Dispute Online

If you have Wells Fargo online banking, you can sign in to file a dispute for one or more transactions online. File a dispute in seven simple steps:

Filing a dispute using Wells Fargo online banking allows you to file the dispute and respond at your convenience. It is one of the easiest methods, but it can take up to 10 days for Wells Fargo to respond with a resolution.

Unfortunately, there is no guarantee that Wells Fargo decides the dispute in your favor, and disputes are limited to transactions. DoNotPay helps you conveniently file a trackable Wells Fargo credit report dispute for errors, collections, and transactions with a higher chance of success.

What Is A Charge

The term charge-off can be confusing. It does not describe, as some people believe, a debt that you no longer owe.

Instead, when you miss payments and default on a debt obligation, the creditor may write off the debt as a loss for tax purposes. This is called a profit and loss charge-off.

At this point, your creditor may report the status of your account as charged-off to the credit bureaus, which, in turn, will likely add the charge-off notations to your credit reports. Thats typically not good for your credit scores or for future financing applications.

Your original creditor may even opt to sell or consign your debt to a third-party debt collector or debt buyer. Once this occurs, both the original account and the new collection account may appear on your credit reports.

Of course, even though charged-off accounts and collections can appear on credit reports, data furnishers must follow the rules set forth in the FCRA. One important rule is that for a charge-off to remain on your credit reports, the reporting needs represent accurate information.

Also Check: Can I Check My Credit Score With Itin Number

How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that aren’t negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you weren’t already delinquent.

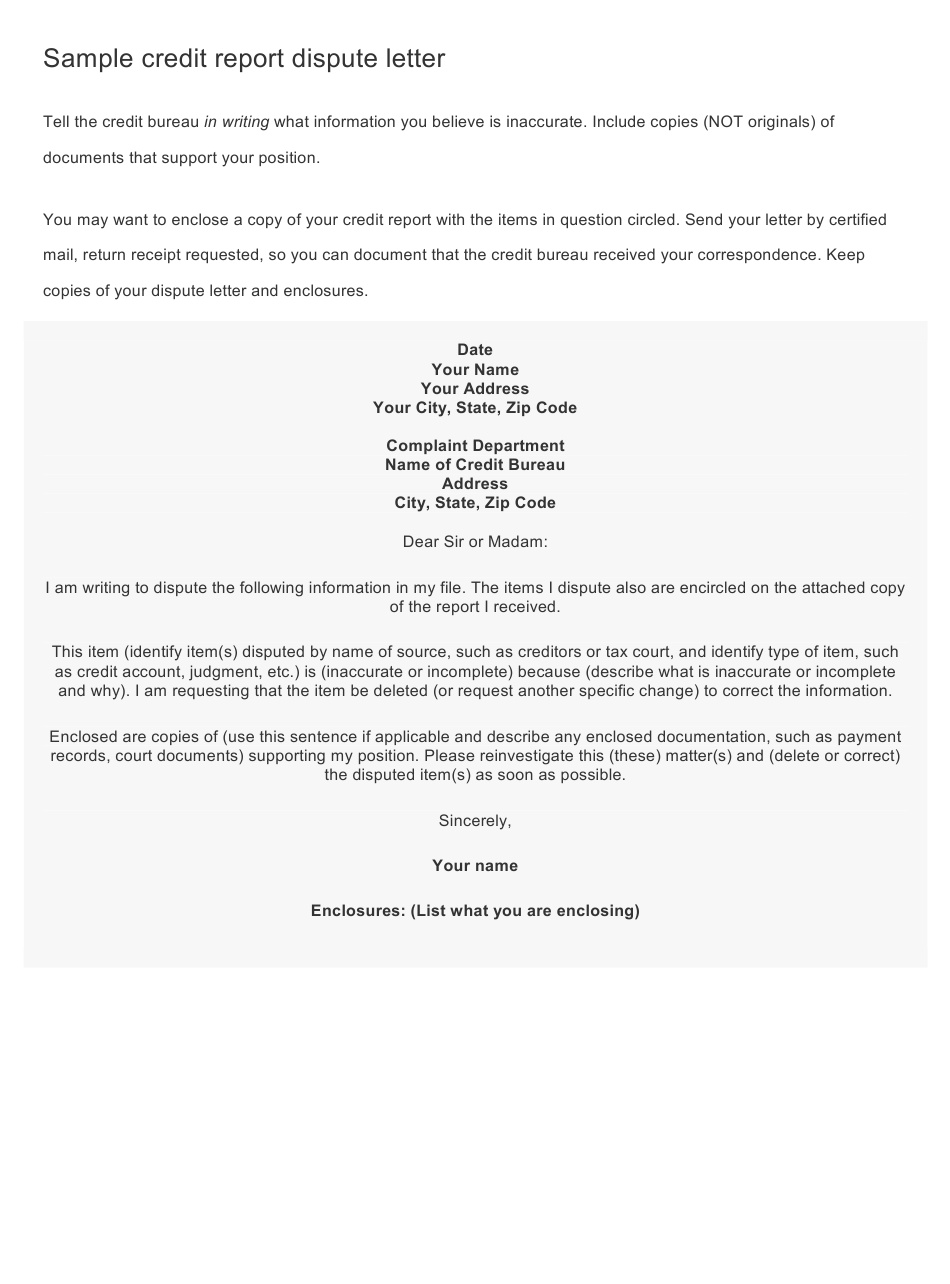

Understand How Credit Report Errors Happen And Correct Them With A Dispute Letter

When a contains errors, it is often because the report is incomplete or contains information about someone else. This typically happens because:

- Your does not reflect all credit accounts.

- The person applied for credit under different names .

- Someone made a clerical error in reading or entering name or address information from a handwritten application.

- The person gave an inaccurate Social Security number, or the number was misread by the lender.

- Loan or credit card payments were inadvertently applied to the wrong account.

If you feel your contains errors, or is missing accounts, learn more about how to file a dispute on a below.

You May Like: Corelogic Credco Security Freeze

Send A Letter To The Credit Bureau

Once you identify an error on your credit reports, the Consumer Financial Protection Bureau recommends that you contact the credit bureaus that produced the reports with the error. Equifax, Experian and TransUnion, the three major credit bureaus, let you dispute inaccuracies on their respective consumer credit reports online or by mail.

Give your contact information and, in writing, explain what the error is and why its wrong. Youll find sample letters to dispute credit report information with the credit bureau on the CFPB website. Be sure to include supporting documentation, such as a copy of an email verifying the status of the account thats reported incorrectly. The CFPB also recommends that you keep copies of any letters or documentation that you send, and suggests that if you send it by mail, use certified mail with a return receipt.

Consider Contacting A Data Furnisher

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

Recommended Reading: 550 Credit Score Car Loan

How To Dispute Or Remove A Charge

It can be tough to earn great credit scores when there are negative items on your credit reports. One such item is the so-called charged-off account or, informally, a charge-off.

If you have a charge-off on your credit reports, its only natural to wonder if theres a legitimate way to have it removed. In many cases, youll need to be patient when it comes to charge-offs. The Fair Credit Reporting Act allows legitimate charge-offs to remain on your credit reports for up to seven years.

But, if a charge-off is incorrect or contains questionable information, it may be possible to get it removed from your report much sooner.