How To Get Credit For The Rent You Pay:

If you regularly pay your rent on time and in full, you can have your good payment history reported to credit bureaus to help raise your credit score through a rent-reporting service. Know that any rent-reporting services will require a fee for the service, which is usually paid on a monthly basis.

When you sign up with a rent-reporting service, you will actually pay your rent directly through the service. The rent-reporting service will then transfer your rent, minus service fees, to your landlord. They will report each positive payment to the credit bureaus.

What Factors Must I Consider Before Signing Up With Any Rent

Its an excellent idea to sign up for rapid rent reporting of your credit because of several factors, including

Every on-time payment boosts your score.

Digging deep in its system helps explore multiple benefits

However, its challenging to get the exemplary service for reporting rent payments to the credit bureaus because of the same multiple businesses. Here we discussed a few FAQs that help you to make the right decision.

Related: What Happens When You Dont Pay Your Credit Card Bill

Q: How quickly can my landlord sign up, and will he provide all the required information?

Different services come with unique requirements in some cases, a phone call or an email is enough, while some demand a copy of the lease or drivers license. Further, the landlord must sign up and maintain the account with the service. Individual landlords dont sign up for a new service to potentially support your credit score.

Q: What does the Cost of this Service Per Year?

Payment options also vary for the services as some require initial deposits while others are based on monthly charges or contracts. Excitingly, sign up for a service like MoCaFi is the best method to report rent payments to the rent bureau for free as it favors free reporting to Equifax if you have installed its phone application.

Q: Is Rent History Included in the Service?It depends on the tracking method of the service and may check past payment history.

Q: The Service Report to Which Credit Bureaus?

Does Paying Rent Late Affect Your Credit History

Making a late rent payment only affects your credit history if you or your landlord reports rent payments. Rental history reports that show missed late payments will severely impact your credit score. For some tenants, this is a reason to avoid rent reporting. However, this can be a red flag to landlords.

Read Also: R9 Credit Score

Rent Reporting Benefits Landlords And Tenants

Landlords, Property Managers and Tenants can report rent payments and rental history data to Landlord Credit Bureau through FrontLobby.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Bby Cbna

Does Applying For An Apartment Or Home Hurt My Credit

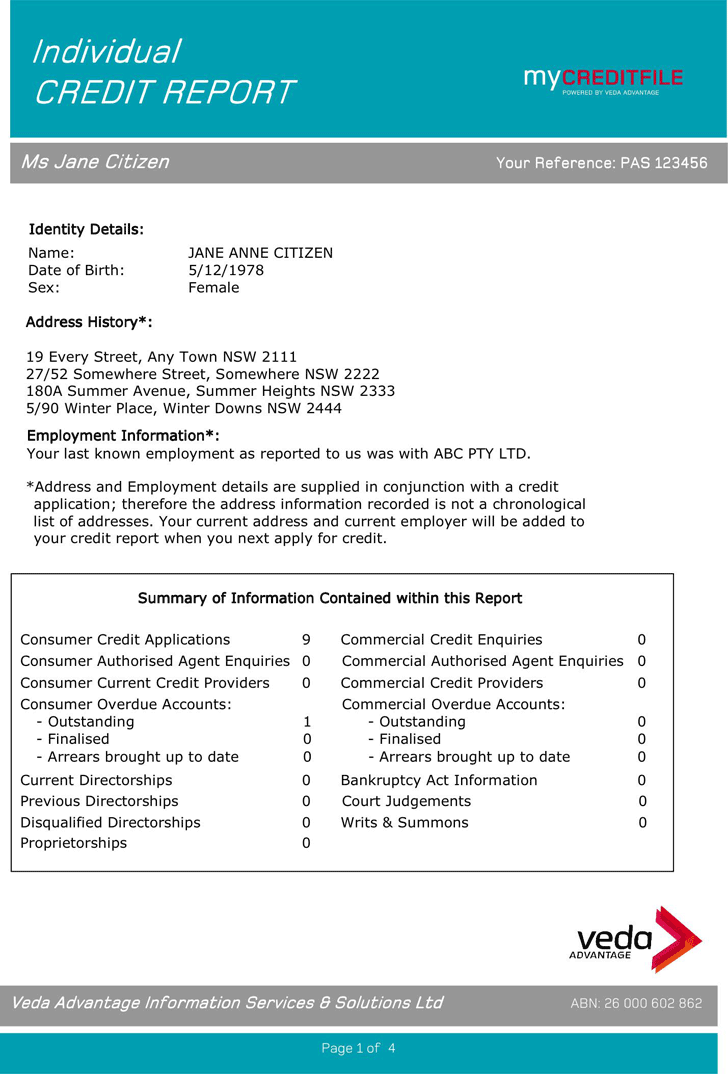

When you apply for a new apartment, the landlord requests a copy of your credit report. This request initiates a hard inquiry credit pull that does affect your credit score. The good news is that a single hard inquiry doesnt impact it much and will no longer affect your credit after 12 months. Your credit score will take a hit if too many hard credit inquiry requests come in over a short period of time.

Fico And Vantagescore Scoring Models For Rent Payment Information

FICO and VantageScore are the commonly used scoring models in the United States. They consider information, such as payment history, new credit, length of credit history, the amount owed, and types of credit to score individuals.

Below are how these two credit-scoring models handle your rent payment history:

- FICO 8, which the most used version of the FICO model, does not include your rent payment history when calculating your credit scores.

- Latest versions of the FICO model, including FICO 9 and FICO 10, incorporates your rent payment information in calculating your credit scores

- VantageScore, an alternative to the FICO scoring model, includes your rent payment information in calculating your credit scores.

Also Check: How Do Evictions Show Up On Credit Reports

Use A Credit Card To Pay Your Rent

While your rent payments wont be listed as a separate tradeline on your credit report, using your credit card for your rent still can boost your credit score. Check to see whether your landlord accepts credit card payments, and note any service fees that might be charged for using a credit card. If youre using a rewards credit card to pay your rent, you can earn points or cash back on your rent payments.

When you use a credit card to pay your rent, make sure to pay off your full balance just as if you were paying rent. Thats the best way to stay out of debt, improve your credit score, and get the full benefit of making timely rent payments.

Our Goal Is To Share Information And Products That Are Truly Helpful To Renters

If you click on a link or buy a product from one of the partners on our site, we get paid a little bit for making the introduction. This means we might feature certain partners sooner, more frequently, or more prominently in our articles, but well always make sure you have a good set of options. This is how we are able to provide you with the content and features for free. Our partners cannot pay us to guarantee favorable reviews of their products or services and our opinions and advice are our own based on research and input from renters like you. Here is a list of our partners.

Recommended Reading: Does Affirm Report To Credit

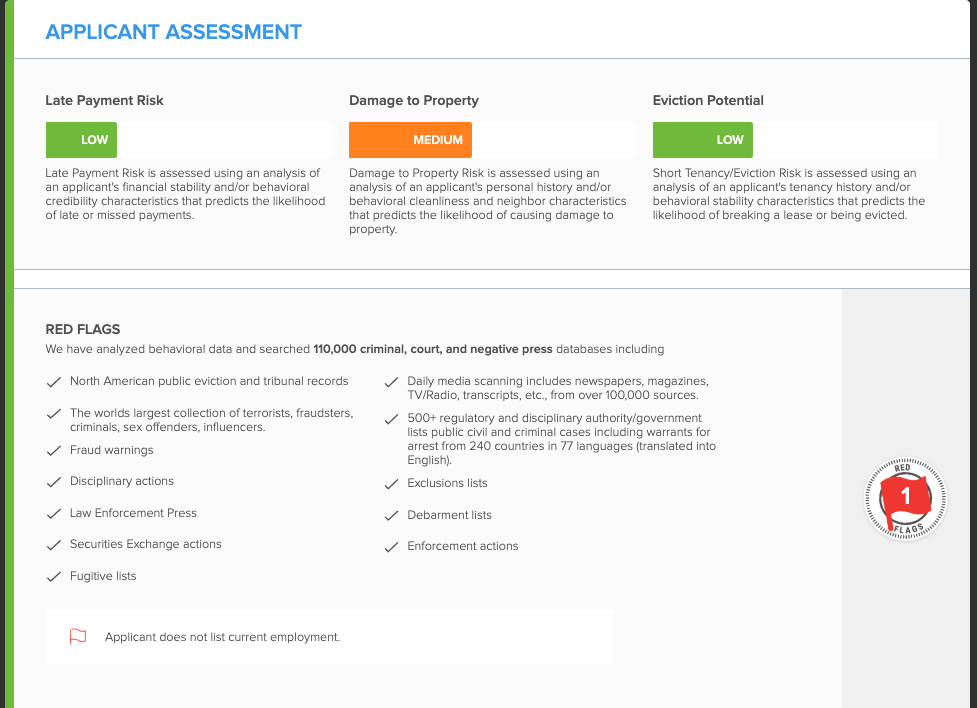

Landlord Credit Check: What To Expect

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Because many landlords check applicants’ credit, your credit history could make a big difference in your next apartment search.

For would-be renters, the credit-check process may seem mysterious. If you’re wondering what landlords scrutinize when they check your credit, here’s an insider’s look, along with strategies for landing a place to live.

How To Report Rent Payments To The Credit Bureaus

Reporting your rent payments to a credit bureau is fairly simple. You can either have your landlord manually report your rent for you, or you can do it yourself using a rent reporting platform like *. Most renters prefer to report their rent payments to a credit bureau themselves since they have more control over the process. But its important to note that your landlord will need to set up an account in order for you to take advantage of this tool.

helps you contribute to your FICO 9, FICO XD, and VantageScore by reporting your on-time rent payments. Your payments go directly to TransUnion, one of the three major credit bureaus, to make it easier to build your credit health.

Heres how to start reporting your on-time rent using CreditBoost: :

Create an account or log in to your tenant dashboard today to get the process started.

You May Like: How Can I Get Eviction Off My Record

Tenants Are Staying Off The Roads

That same NMHC survey reveals that over 40% of tenants say they telecommute, at least some of the time. That trend may impact landlords. Tenants are around more, so landlord-provided utility costs could go up. There also may be an uptick in noise complaints, because working adults will be around while little kids are hopping around to their favorite morning cartoons.

At the same time, where a unit provides good space to work, being situated close to public transit might not rate as high on the list of tenant preferences, giving an advantage to landlords in the suburbs.

How To Choose A Rent

First, check to see if your property manager already works with a service. If not, here are questions you should ask rent-reporting service providers before choosing one:

-

What would my total costs be for a year of service, including any setup fees or fees for reporting previous rental history?

-

How do you protect my personal data?

-

Which of the major credit bureaus do you report to?

-

Do you provide free access to credit scores, and if so, which score?

-

How soon should I expect the information to appear on my credit report?

-

How can I cancel the service?

-

What happens if I have a dispute with my landlord or break my lease? In some states, renters have a right to withhold payment if the landlord fails to keep the unit repaired and habitable. Find out whether rent withheld during a dispute is reported as nonpayment or a negative mark.

You May Like: Will Paypal Credit Affect Credit Score

The Negative: Reporting Late Payments

If you do rental payment reporting and a tenant pays late or doesnt pay at all, this information will make it onto their credit report in various ways. You might get upset that a tenant keeps paying late and want to report a tenant to the credit bureau.

Most tenants will not want this to happen, so the knowledge that you report to credit bureaus monthly can help to keep tenants focused on making their payments on time. You may want to remind tenants that consistently paying late in the ways of this can affect them.

Even if late payments may not actually lower their credit score, every late payment issue will show up in the full report. If they plan to rent again in the future, this could be a problem for them. Ensuring that they know this can help encourage tenants to be more reliable while also protecting you and their future landlords.

Six Vital Reasons Landlords Should Report Rent Payments To Credit Bureaus

The most common reason landlords report rent payments is to encourage tenants to pay rent on time. However, rent reporting has more benefits for landlords. For example, being a rent reporter, a landlord helps attract responsible tenants, fill vacancies faster, and provide a better service for tenants.

Lets look in more detail at these reasons to use rent payments to build a tenants credit.

Also Check: What If My Credit Score Changes Before Closing

Where Rentreporters Falls Short

Because the company reports only to TransUnion and Equifax, its reach is limited. The company says it also plans to add a customer portal, but for now, clients receive status updates via emails or by calling the company.

Also note that the companys user satisfaction guarantee about your initial score bump has a time limit. Once RentReporters adds rent payments to your credit report and emails your new score, you have only 48 hours to cancel the service and get a refund. RentReporters then removes the rental history, which in turn shifts your credit score back to what it would have been without the service.

Read RentReporters educational materials and advice with the understanding that it wants you to buy its services. It sometimes overemphasizes the role of rent reporting in a broader credit-building strategy.

What Are The Best Rent Payment Services For Reporting Your Rent Payments

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products however our opinions are our own.

There are several rent payment service providers that you can choose from. Below is a list of some of the best rent payment providers. Read about each one and see which provider fits your needs.

Also Check: Speedy Cash Open 24 Hours

Use A Rent Reporting Platform

Renters can sign up to have their rent payments reported through a third-party reporting platform. Because rent reporting usually benefits a renter the most, it can make sense to use a platform where renters are the ones responsible for signing up and paying any associated fees.

Platforms like report rent payments on a monthly basis to TransUnion, and renters can choose to report their past rent payments and/or current payments to the bureau. An added bonus for renters is that only on-time payments are reported, so their score wont necessarily be hurt if they slip up and submit a late payment.

Services You Can Use To Report Rent Payments

Theres not a direct way for you to report rent payments to credit bureaus yourself. Instead, you can use one of the many reporting services which send information about your monthly payments to credit bureaus. Before signing up for a reporting service, make sure you know how much youll pay and which credit bureaus the service reports to.

Recommended Reading: Kroll Factual Data Complaints

What If I Cant Fix My Credit Score

Its important to keep in mind that your credit score isnt the only thing that mortgage lenders look at. If you are not able to improve your credit score and dont want to consider a private mortgage lender, you can consider other options. Making a large down payment can make it easier to be approved for a bad credit mortgage. If you can find a co-signer, their credit score will be considered as well. This is helpful if they have a strong credit score or more income.

If you are over 55 years old, you are eligible forreverse mortgages. Reverse mortgages have no income or credit score requirements, and there are also nomortgage paymentsrequired either. This is particularly useful for seniors as a source of income during retirement.

Renting instead of buyinga home might also be a temporary solution in the meantime. If there is a particular property that you would like to purchase, but cannot afford to do so currently,rent-to-own homeprograms allow you to rent the home for a period of a few years, with a portion of your rent payments going towards your eventual down payment on the house. This allows you to save up money until you canafford a mortgage.

Recommended Reading: How Much Is Mortgage On 1 Million

How Landlords Can Report Rent Payments To Credit Bureaus

FrontLobby is a turnkey, user-friendly platform designed specially for Landlords. It makes rent reporting payments both seamless and affordable. Rent payment history added to FrontLobby each month can be shared with Landlord Credit Bureau and is added to the Tenants consumer credit report with Equifax as a trade line.

FrontLobby also offers valuable education and assistance, such as providing Landlords with sample disclosures they may use to explain to Tenants the benefits of reporting rent. FrontLobby also provides examples of lease provisions that allow Tenants to better understand their responsibilities under their lease agreement and to maximize the value of rent reporting to build credit.

Besides the Rent Reporting feature, FrontLobby offers two additional services that empower Landlords and Property Managers to secure better renters, reduce the frequency and impact of delinquencies, and drive operating efficiencies. These services include Tenant Screening for fast, easy and affordable Landlord credit reports, as well as Collect to help Landlords recover debts owed by former Tenants.

Also Check: Repo On Credit Report

Landlords Who Report Rent Payments Attract Better Tenants

Tenants who want to use rent to build credit are typically more responsible. When tenants sign up for a rent-reporting service, they show they are serious about their financial commitment. This is an excellent signal that paying rent on time every month will be a top priority to avoid a dip in credit scores.