Soft Credit Pull Vs Hard Inquiry Credit: Whats The Difference

When youre renting an apartment, bear in mind that youll be living on someone elses property. Therefore, the landlord needs to know whether or not youll be a financially responsible tenant. For this reason, running an apartment credit check is common practice when applying for rentals.

Your bill-paying history is important for the landlord to foster trust in you as a renter, and as a person. However, not all rental credit checks are the same. Similarly, not all credit checks will affect your credit score.

There Are Two Types Of Credit Checks

When someone does a credit check on you, it falls into two categories: a soft pull, and a hard one.

The former is usually for situations where payments are required, but youve been pre-qualified .

Its also done by prospective employers, as part of an overall background check.

A key difference with a hard check is that you must authorize it .

Do Apartment Complexes Check The Credit Bureau Scores Or Fico Scores

Tenant screening helps landlords determine whether a particular rental applicant is likely to pay rent on time and take good care of the property. Credit history is an important predictor, especially with regard to timely payments. Credit bureaus assign each individual a credit score that corresponds with her credit history. Although Fair Isaacâs FICO set the scoring standard, each bureau has its own version of it. Which FICO an apartment complex uses depends on the complexâs preference.

Read Also: When Does Capital One Report To Credit Bureaus 2020

Don’t Miss: How To Clean Up Your Credit Rating

Do All Apartments Check Your Credit Score

No, not all apartment complexes will run a credit check.

You should be able to determine whether or not a particular complex runs a credit check by simply looking at the application process online. If they mention something about a background or credit check, then they probably run one. If they dont mention it, then they probably dont.

The last thing you want to do though is to call an apartment complex asking if they run a credit check. There is nothing that perks the warning bells of a landlord than this question. It is basically like asking them if they would like to have future problems at their apartment complex.

If you are wanting to get into a place that doesnt run a check, then look for those applications online that dont do it or automatically funnel you to a site to have it done. The apartment complex is going to have YOU pay for your own credit and background check to be completed, just this in and of itself is a barrier to entry for poor tenants.

But remember, you WANT there to be some hoops for tenants to have to jump through to get a unit at the apartment complex. Just like it is proving a barrier for you to rent, it provides that barrier for other people as well. And only the most serious of applicants are going to go through the application process and pay the money to have the checks done.

So, while you may THINK you want a complex that just lets anyone in, trust me, you dont.

What Do Landlords Typically Look For In A Credit Check

As you review an applicants credit report, its important that you know what to look for in order to spot tenant warning signs immediately. As you assess the results of a credit check, landlords should watch for:

1. Low credit score

Landlords may initially believe that a low credit score immediately rules out an applicant, but thats not necessarily the case. What credit score does the average landlord look for? According to TransUnion, there is not a definitive good credit score and many factors determine creditworthiness.

A credit score doesnt necessarily provide a holistic view of the applicants financial state or behavior. In a SmartMove survey, 4 out of 5 landlords responded that reviewing a full credit report is important to understanding the applicants credit history and to getting the story behind the score.

Thats why SmartMoves ResidentScore® feature is a valuable tool you can leverage during the screening process. A generic credit score is usually used to evaluate loan performance ResidentScore is tailored to the unique needs of landlords, taking into account almost 1,000 different credit variables that may point to certain rental outcomes, which has been found to help predict evictions 15% more often than the typical credit score.

Unlike a typical credit score, ResidentScore was built specifically to identify the likelihood of a potential tenant being evicted, which means:

2. Late payments

Read Also: What Is A 640 Credit Score

Renting Apartments And Credit: A Guide To Credit Scores And Reports

Whether you are renting an apartment for the first time or are a seasoned renter, you know that the state of your credit score plays a major role in the leasing approval process. However, what you might not know is all of the details when it comes to accessing and understanding the state of your credit. Use these tips from ApartmentSearch.com as guidelines to learn about your own credit and make sure that the application and approval process when renting is a much better experience. Here are some of the most common questions renters might have about credit scores and credit reports.

What is a credit report?

First, its important to note that there is a difference between your credit report and your credit score. Your credit report is a history, while your credit score is a specific numerical value . Credit reports document your credit history and the status of your credit accounts, which can include bill payment, loans, credit cards, and outstanding debt.

Where can I get my credit report?

If you want to get a free credit report, you can order a free credit report from each of the three major credit bureaus for free once every 12 months. AnnualCreditReport.com is the only source authorized by Federal law to give you this free annual score.

What is my credit score?

Why do apartments check your credit? What do they look for?

How can I improve my credit score?

For more help managing your finances as a renter, visit the ApartmentSearch.com .

Passing Your Apartment Credit Check

You can improve your chances of getting the apartment by checking your credit report. The Fair Credit Reporting Act allows consumers to receive one free credit report per year from each of the three major credit bureaus. Make sure to check for errors on your report, and get them fixed right away.

While you can’t control how a landlord interprets your credit report, you can prepare to answer any questions that might come up. It’s a good idea to check your report, fix any mistakes, gather your pay stubs and references before going through an apartment credit check.

Don’t Miss: How Many Points Does Your Credit Score Go Up

Ways To Help Improve Credit Scores

Credit scores can change over time. Here are a few ways you can show responsible credit use and help improve your credit:

- Pay on time. According to both FICO and VantageScore, your payment history can be a significant factor in determining your credit scores. You could use email reminders or calendar alerts to help you pay on time. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. Interest can add up, cost you more money in the long run and even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. âCredit scoring formulas look at your recent credit activity as a signal of your need for credit,â explains the CFPB. âIf you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

What Do Apartments Look For In Credit Checks

When landlords run a credit check, they want clues to how financially responsible you are. Things like prior evictions from other rental units, your debt load and significant credit mishaps help them determine whether you are likely to pay your rent on time each month. Here’s what they will look for:

Recommended Reading: How To Request Free Credit Report

Legal Issues With Tenant Credit Reports

You are legally free to check tenant credit reports and use the information when selecting tenants, as long as you don’t illegally discriminate in doing sofor example, by only requesting credit reports from certain tenants or by arbitrarily setting tougher standards for renting to a tenant who is a member of a racial or ethnic minority or other protected class.

Also, a federal law known as the “Disposal Rule” requires you to keep only needed information from a tenant’s credit report and to discard the rest.

Learn Why Landlords And Property Managers Often Run Credit Checks On Potential Tenantsand Ways To Help Improve Your Score

Your credit scores can be important when youâre looking to rent an apartment. Thatâs because the landlord or property manager may pull your credit as part of the screening process. Your credit history can show them how youâve managed money in the past and help them determine whether you might be a responsible tenant.

A credit score in the 600s typically places you in either the âfairâ or âgoodâ credit score range and could be a starting point for some landlords and property managers. Meeting their minimum requirements doesnât necessarily guarantee approval. But knowing what they look for could help you position yourself as a great rental candidate.

You May Like: How To Boost My Credit Score Fast

Prove Income Or Savings Balance

If you dont have an established credit history, you may be approved if your income is stable and will adequately cover the rent. Its generally recommended that you keep rent expenses to less than one-third of your take-home pay, so if you make $3,000 a month, youll want to look at apartments with a monthly rent of less than $1,000.

If you dont have a stable income, a high savings balance may suffice. The savings required will vary depending on the apartment complex or management company, but ideally it should cover several months of rent payments.

What Do Landlords Look For On Credit Reports

Beyond credit scores, landlords and leasing companies will also usually check the following on credit reports:

- Late payments

- Delinquent accounts

- Delinquencies related to prior evictions

A couple of late payments, especially if they happened a long time ago, likely wont be a problem for many leasing companies. Its the more serious delinquencies, higher debt loads, and former evictions, coupled with low credit scores, that are typically concerning for landlords.

Also Check: Which Credit Score Do Apartments Use

Find A Third Party Guarantor

If you are unable to obtain a guarantor to get you a no credit apartment, you can seek third party options like TheGuarantors. The company helps applicants that do not meet the landlord’s financial requirements get approved. TheGuarantors understand this is a common obstacle, especially for newcomers to the U.S., so for less than one month of rent, an applicant can secure a lease guarantee which will protect the landlord in the event of a default.

The Difference Between Your Credit Score And Credit Report

There are three credit bureaus that produce : Equifax, Experian and TransUnion. When you open a credit card or loan, the lender will report activity to at least one credit bureau, which will then add it to your credit report. Your credit reports show both current and past credit accounts, as well as legal judgments like liens and bankruptcies.

A credit score is a three-digit number that ranges from 300 to 850. The score is determined by an algorithm that takes all the items on your credit report into account. The higher the score, the more responsible you appear as a borrower.

There are two main companies that produce credit scores: FICO and VantageScore. FICO is responsible for 90% of all credit scores used by lenders, but VantageScore is more common with free credit scoring websites. Both companies use similar scoring models to determine your scores, so there should only be a slight discrepancy between a FICO score and a VantageScore.

There are dozens of credit score iterations, and which one is used depends on the type of lender looking at it. For example, the credit score an auto lender sees may be slightly different than the one a mortgage lender sees.

Also Check: Does Speedy Cash Report To Credit Bureaus

Read Also: How To Remove Charge Off Credit Report

Renting Without Great Credit

If you don’t meet the credit qualifications, all’s not lost. There may be a few ways to get your foot in the door, depending on the landlord. For starters, you may be able to pay a higher security deposit or cover a few months of rent in advance. Paying more money upfront may eliminate some of the risks associated with your previous credit mistakes.

Having someone vouch for you, either rental references or a co-signer can give you some additional credibility. Or, in the case of a co-signer, there’s another person sharing the risk with you, which may make it easier to get approved.

You also may have more success with an individual landlord rather than a property management company whose rules tend to be less flexible.

On the flip side, a higher credit score doesn’t get you a better rental rate, but having good credit may give you the benefit of moving in with a low or no security deposit requirement.

Looking for information on how to manage your credit during coronavirus? Check out Protecting Your Credit During Coronavirus Outbreak.

LaToya Irby

LaToya Irby is a financial writer with over 14 years of experience. She’s been quoted and published as a credit expert in several major publications including USA Today, U.S. News and World Report, TheBalance.com, and The Chicago Tribune.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

What Do Landlords Look For On Your Credit Report

Landlords check your credit for many of the same reasons lenders do: They want to know if you’re likely to pay your bill on time, based on your past history of paying off debt.

In addition to pulling your credit score, landlords may also check your credit report for evictions, bankruptcies, accounts in collections, loan defaults and late payments. Before submitting any rental applications, you’ll want to check your credit report and score. You can do this for free at AnnualCreditReport.com you can also access your Experian credit report and directly through Experian. Looking over your reports and scores will tell you where exactly your credit stands, and will provide clues to what you’ll need to do to increase your scores.

In addition to your credit, landlords may use other types of reports and background checks to screen you as a potential tenant. Tenant screening may also include criminal background checks, a review of your employment history or contacting references. If a landlord has reported your payment history to a credit reporting agency like Experian’s RentBureau, you may have a renter’s credit score that shows whether you’ve paid your rent on time.

Renters in competitive cities like San Francisco, Boston and New York have average credit scores above 700, according to RENTCafé, so you might need to set your sights a little higher if you want to live there.

You May Like: How To Report Credit Card Fraud To Amazon

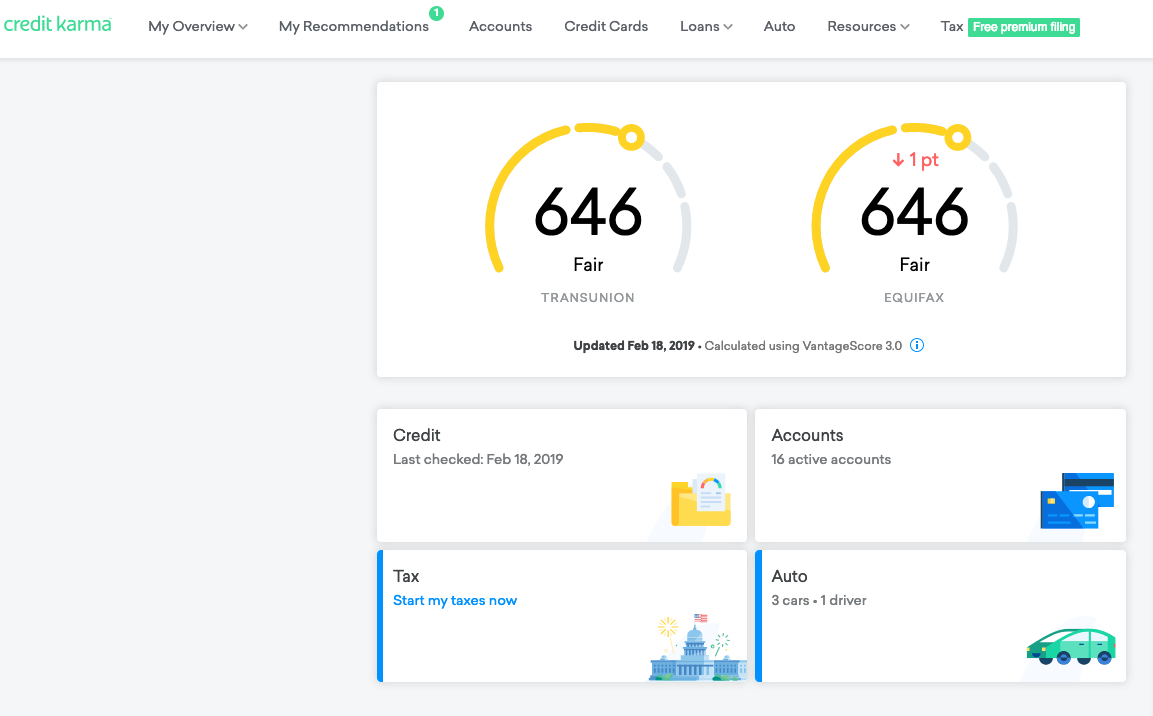

Check Your Credit Score With Creditwise From Capital One

According to a TransUnion study, checking your credit score can potentially lead to more positive credit behavior. About one-third of consumers in the study who monitored their credit were able to increase their credit score over the course of a year.

One way to monitor your credit is by using . With CreditWise you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwhether youâre a Capital One customer or not. And it wonât hurt your credit score.

You can also get free credit reports from each of the three major credit bureaus. Visit AnnualCreditReport.com to learn how.

Your credit is just one factor that landlords use to determine whether to accept you as a tenant. But itâs an important one. Knowing what they look for can help you figure out where you could improve.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

How Do I Check My Credit Score

Also Check: How To Report Rent For Credit