Do Taxes Affect Your Credit Score

Whether tax debts appear on your and will impact your credit score depends on what type of legal action the CRA uses to enforce collection.

In general, the Canada Revenue Agency keeps your information confidential and does not report filing or personal information to Canadas credit bureaus. They will only release information where they are legally authorized to do so and if they are forced to take legal action through the courts.

If you have a balance owing after filing your tax return, this is not reported to the credit bureaus. The CRA is not a normal reporting creditor like your credit card issuer, cell phone company or bank.

If you owe a significant amount of money in taxes and do not make efforts to repay, the CRA will get their collections department involved. Debt collection is the process of pursuing payments for the debt owed.

If necessary to pursue you for unpaid taxes, CRA can legally certify, or register, your debt with the Federal Court or get a judgement from a provincial court confirming the amount owed. This court judgement becomes a matter of public record and can appear in the legal section of your credit report.

While your tax debt may not appear on your credit report, if you are applying for a mortgage or large loan, your lender or bank will often request that you provide proof that your taxes are current. This is almost a guaranteed request if you are self-employed or running a small business.

What Happens To Your Credit When You Don’t Pay Taxes

Credit scores are based on information in the compiled at the national credit bureaus . These reports reflect your history of borrowing and repaying loans and also note certain legal proceedings, such as bankruptcy filings and foreclosures. Your credit reports don’t track tax bills or payments, so your record of paying taxes on time, or failing to do so, does not factor into the calculation of your credit score.

Failure to pay your income tax can lead to a federal tax lien against your property. A lien entitles the IRS to take whatever unpaid taxes you owe from the proceeds of the sale of your property.

Tax liens haven’t appeared on credit reports since 2018, so they cannot lower your credit scores, but tax liens can still damage your credit: Lenders can discover tax liens through public records searches when considering applications for mortgages or other loans. Some lenders may consider a tax lien grounds for denying your application.

Topic No 201 The Collection Process

If you don’t pay your tax in full when you file your tax return, you’ll receive a bill for the amount you owe. This bill starts the collection process, which continues until your account is satisfied or until the IRS may no longer legally collect the tax for example, when the time or period for collection expires.

The first notice you receive will be a letter that explains the balance due and demands payment in full. It will include the amount of the tax, plus any penalties and interest accrued on your unpaid balance from the date the tax was due.

The unpaid balance is subject to interest that compounds daily and a monthly late payment penalty up to the maximum allowed by law. It’s in your best interest to pay your tax liability in full as soon as you can to minimize the penalty and interest charges. You may want to consider other methods of financing full payment of your taxes, such as obtaining a cash advance on your credit card or getting a bank loan. The rate and any applicable fees your credit card company or bank charges may be lower than the combination of interest and penalties imposed by the Internal Revenue Code. If you can’t pay in full, you should send in as much as you can with the notice and explore other payment arrangements.

If you’re a member of the Armed Forces, you may be able to defer payment. See Publication 3, Armed Forces’ Tax Guide.

Also Check: Aargon Com

What Are The Irs Penalties For Underpayment

If you didnt pay your taxes, or if something went wrong with your return, you may have outstanding debt. There are two types of underpayment penalties. The first comes with the filing of your tax return because you did not prepay enough taxes through withholding or estimated tax payments. This penalty is determined by the federal treasury rate each quarter during the tax year. The second, and largest, type of underpayment penalty is due when you dont pay your taxes by the due date of your tax return. This penalty starts at .5% of the unpaid taxes, and increases each month to no more than 25% of the taxes owed. Penalties are assessed monthly and interest is compounded daily until you pay the debt. The IRS can take your tax refund each year to help pay the debt, and they might issue claims on your property and/or assets, or even take money directly from your paycheck, which can be a stressful experience.

What Happens If You Owe Hmrc Money

Its highly likely that HMRC will charge penalties for failing to arrange a time to pay agreement. Payments due after 30 days will be subject to a penalty, and payment due after 6 months will be subject to a penalty. It is charged a fee by HMRC to pay penalties late. HMRCs penalty on the original amount payable is 5%, less the interest.

Recommended Reading: How To Remove Hard Inquiries From Transunion

Ially Refundable Tax Credits

Some tax credits are only partially refundable. The Child Tax Credit became refundable in 2018, as a result of the Tax Cuts and Jobs Act . If a taxpayer has a large enough tax liability, the full amount of the Child Tax Credit is $2,000. However, up to $1,400 is refundable even if it is more than the taxpayer owes.

Another example of a partially refundable tax credit is the American Opportunity Tax Credit for post-secondary education students. If a taxpayer reduces their tax liability to $0 before using the entire portion of the $2,500 tax deduction, the remainder may be taken as a refundable credit up to the lesser of 40% of the remaining credit or $1,000.

Liens Are Different From Levies

Some people use the words “lien” and “levy” interchangeably, but they’re two quite different collection measures.

A tax lien is a document that the IRS files with your local government to ensure its ability to collect the money owed. It prevents you from selling the property without the lien being paid from the proceeds, and the government can force the sale in order to be paid.

A levy is the forced collection of taxes due, typically by garnishing your wages, salary, or bank accounts.

Also Check: Does Speedy Cash Check Your Credit

Can I Reverse Or Remove A Tax Levy

You can contact the IRS and request a levy release. The IRS can release a levy if it is causing immediate economic hardship. The IRS will weigh all facts and circumstances to decide if a levy can be released. Often this includes setting up a payment plan for the taxes you owe. The removal of a levy doesnt mean you dont have to pay your tax debt. You must still make arrangements with the IRS to resolve it, or a levy may be reissued. However, if the levy is based on incorrect tax information, you may be able to reduce, even eliminate, the taxes owed. If you have unique circumstances, such as special regular medical expenses, the IRS can take that into consideration and reduce, or eliminate, the amount of the levy.

Tax Liens Removed From Credit Reports

Tax liens used to appear on your credit reports maintained by the three national credit bureaus . Even if you paid the lien, it stayed on your reports for up to seven years, while unpaid liens remained on your reports for up to 10 years.

In 2017, however, all three credit bureaus implemented changes to eliminate civil judgment records and half of all tax lien data. By April 2018, all tax liens were removed from credit reports by the bureaus.

The updated rules are the result of a Consumer Financial Protection Bureau study that found issues with reporting such information correctly.

“A lot of judgments and liens were linked to the wrong people, so someone may share your first and last name, maybe live in a different part of the country, and they might have a lien or judgment that might get linked to your file,” said Ankush Tewari, senior director of credit risk assessment at data firm LexisNexis Risk Solutions, in American Banker.

Don’t Miss: Can A Bank Reopen A Charged Off Bank Account

How To Remove A Tax Lien From Your Credit Report

Tax liens are subject to the same Fair Credit Reporting Act laws that govern all debts. You can dispute them, and if the government cannot prove that you owe the debt, the credit bureaus will remove the tax lien from your credit report.

The government is less likely to ignore a dispute based on erroneous information, especially when the debt is substantial. What most often happens is that the IRS will confirm or update the information, and youll still be stuck with the tax lien on your credit history.

If you pay the tax debt in full, the IRS will release the tax lien, but the released lien still gets reported for seven years after you make payment in full.

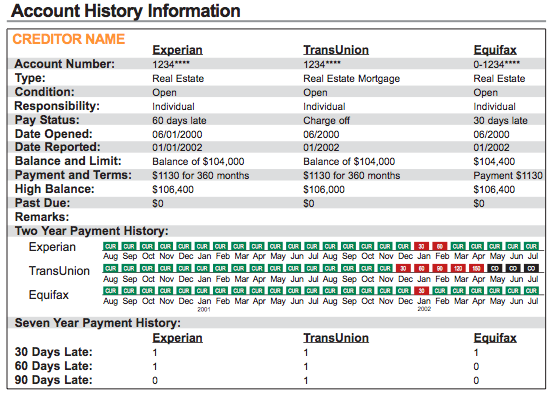

Fortunately, it is possible to dispute and remove a tax lien even when it hasnt been paid in full. Heres an example of tax liens that were disputed and deleted from a TransUnion report:

To do this, you have to request a specific remedy known as a withdrawal. This is different from having a tax lien released after payment has been completed. You can even request a withdrawal while you are still making payments on the lien.

The only catch is that you have to pay the amount in full. The IRS wont withdraw a federal tax lien for settlement offers, and you must keep up with the payment plan or installment agreement.

Despite having to pay the total amount over time, this can be an attractive option when you need to qualify for new credit or sell your home and must have all tax liens cleared.

Can Owing Back Taxes Prevent You From Getting A Mortgage

Getting a Mortgage with a IRS Tax Lien Tax debt is simply owing money to the IRS and/or a state but a tax lien means that your taxes went unpaid long enough to trigger collection actions. If you have an IRS lien on your income or assets, it will greatly diminish your chances at getting approved for a mortgage.

Read Also: Minimum Credit Score For Care Credit

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

The Effect That Irs Tax Debt Has On Your Ability To Refinance

As we previously mentioned, IRS tax liens extend from the time period when the tax was due and owing. The problem with refinancing is that you are essentially re-doing a loan and creating a new debt obligation on a piece of property. So with your prior loan, if you had a mortgage before the IRS filed a tax lien, theres no risk to the existing lender because their security interest was put into place before the IRS got involved.

However, the refinance of an existing obligation changes things quite a bit. With a refinance, the old loan obligation is cancelled and whomever owns the loan would be in a subordinate position to the IRS. The lender is not going to like having their loan subordinate to a tax obligation.

In these cases, you have a couple of options. The preferred option, at least to the lender, is for you to pull cash out of your home refinance and use it to satisfy the IRS and put the lender back into a first position.

As a secondary option, the IRS may consider subordinating its interest to the lender in certain circumstances. Under the Internal Revenue Code, the IRS is able to accept a subordination when it would facilitate the payment of tax.

Keep in mind, however, if the plan is to pull cash out of the refinance and not give it to the IRS or to not otherwise confer some benefit to them, they have no incentive to agree to let you refinance your property. Ultimately, the IRS just wants to get paid.

Don’t Miss: Prosper Webbank On Credit Report

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Will The Irs Ever Forgive Or Negotiate Tax Debt

It is within the IRS best interests to efficiently collect tax on behalf of the government, encourage voluntary compliance, and promote reasonable fairness and consistency. To that end, the IRS does allow certain taxpayers to negotiate their debt to mutually benefit the IRS collection goals and the taxpayers reasonable ability to pay. While the IRS will not traditionally forgive debt, they are willing to negotiate. Because of that fact, debt settlement and resolution remain important assets for taxpayers looking for much needed relief for their situation.

Read Also: Does Affirm Show On Credit Report

When You Pay Taxes With A Credit Card

The IRS authorizes a number of private third-party companies to process tax payments by credit card. When you pay this way, the amount of your payment, plus a fee of nearly 2%, will be added to the balance of the credit card you use to make the payment.

Paying by credit card can be convenient, but keep in mind that you’ll be paying interest at your credit card’s standard rate on the payment unless you pay off the balance in full within one billing cycle. Charges can add up quickly if you’re not able to pay down the balance right away. That can lead to excess credit card debt that could eventually hurt your credit score.

Adding to the balance of a credit card increases your the card’s outstanding balance relative to the borrowing limit. Utilization greater than 30%, on a single card or on all of your credit card accounts combined, can hurt your credit score.

Depending on the size of your tax bill and the borrowing limits on your credit cards, you may want to consider spreading your payment across multiple cards to avoid pushing utilization on any single card over 30%. If your tax payment causes your total utilization to exceed 30%, there’s not much you can do to avoid a credit score reduction, other than pay down your balance as quickly as possible to allow your score to recover.

Working With A Professional Credit Repair Company

In these situations, its often best to work with a professional that understands tax liens and how best to proceed in your particular case. So if you have a tax lien on your credit report and arent sure exactly how to go about removing them, there is help.

Get in touch with our team of credit repair professionals and let them deal with the back and forth with the credit bureaus for you. They can help you improve your credit score and have peace of mind knowing that you have the best chance of getting it removed.

Recommended Reading: Do Evictions Go On Credit Report

Liens Are Public Records

Tax liens are public record because they’re on file with your local government. They’ll appear in the public records section of your credit report. They’re considered to be one of the most negative credit report entries and they can damage your credit score as much as a bankruptcy or foreclosure.

A tax lien entry on your credit report can keep you from being approved for future loans, credit cards, apartment rentals, or even a job.

The normal doesn’t apply for unpaid tax liens. They can remain on your credit report indefinitely, but a credit bureau might remove it within 10 to 15 years, depending on their policies. Unfortunately, this is discretionary, not mandatory.

Paid tax liens can remain for seven years unless they’re withdrawn by the IRS, which should happen when the tax debt is paid. It’s almost like the lien was never filed in the first place when it’s withdrawn. No hint should appear on your credit report, but mistakes can happen. You might have to send the credit bureaus proof of the tax lien withdrawal in order to have it removed from your credit report.