What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Recent Changes: What Is Credit Karma

Recently, Noddle was bought by American personal finance company, Credit Karma. Credit Karma currently provide free credit reports for over 85 million consumers across the USA and Canada, and will now take control of Noddle.

The credit report will remain free and customer service will stay in the UK, but Noddle will take an entirely new design as it becomes part of Credit Karma.

As a member, you dont have to do much yourself because engineers are moving the data from Noddle to Credit Karma. Once thats complete, you will receive an email inviting you to the new site, where you log in using your old Noddle details.

The information in this article is correct as of May 2019.

Fantastic Free Credit Checker

I have been using Noddle to check my credit score for a few years now. I have always found the site easy to use, with information put in simple terms rather than confusing jargon. There are really great features & advice on how to improve your credit… Read more

I have been using Noddle to check my credit score for a few years now. I have always found the site easy to use, with information put in simple terms rather than confusing jargon. There are really great features & advice on how to improve your credit score or checking if youre likely to be accepted for credit before you apply. I will continue to use Noddle for my credit score as I just think its a fantastic service, especially as its offered for free.

Reviewed on 7th May 2019

Read Also: Why Is There Aargon Agency On My Credit Report

Why Is Your Credit Score Important

Your credit score is a tool used by lenders to work out whether you can qualify for certain financial products like , loans or mortgages.

Its almost like a financial CV and based on your score, lenders will assess your reliability as a borrower.

Having a poor credit score can dramatically impact your chances of being accepted for these types of products and services so its really important to keep on top of yours.

Read our comprehensive investigation for expert analysis about how your credit score impacts your financial decisions.

You can also watch our short video below for tips on how to improve your credit score today.

& nbsp

Please note that the information in this article is for information purposes only and does not constitute advice. Please refer to the particular terms & conditions of a provider before committing to any financial products.

Why Is A Good Credit Score Important

A good credit score means that a lender is more likely to view you as lower risk. This will not only boost your chances of acceptance if youre hoping to borrow money, but will unlock better deals such as zero interest credit cards.

Using a comparison service to find the best credit cards and personal loans will present you with an overview of the market, and the kind of rates you may get.

Many providers also now offer eligibility checkers which allow you to see the likelihood of being accepted for a particular deal without actually applying for it.

This approach leaves your credit file free from footprints which, in turn, can be a deterrent to other lenders when you apply for credit at a later date.

But if you havent checked where your credit score stands, it may be worth doing so before applying for credit especially big-ticket lending such as a mortgage for your first home.

However, dont get hung up on achieving a particular number as a credit score. Whatever your score, this doesnt guarantee that youll be accepted or rejected for a credit application.

This will depend on a range of other factors too including your personal circumstances, annual income, reasons for taking credit, and even the providers own appetite to lend.

Also Check: Does Paypal Bill Me Later Report To Credit Bureau

What Changes Will Noddle Customers See

Starting this month all Noddle customers will become Credit Karma members.

You will still be able to access your and reports for free, while customer service for ex-Noddle members will also remain in the UK too.

There are, however, several changes that Noddle customers will need to look out for. These include:

How To Get A Good Credit Score

About six in 10 Americans worry that their credit score will prevent them from achieving a financial goal, according to from Capital One’s Financial Milestones survey. If you have bad credit or fair credit, follow these tips to help raise your credit score.

- Make on time payments. Payment history is the most important factor of your credit score, so it’s key to always pay on time. Set up autopay or reminders to ensure timely payments.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. This temporarily dings your credit score about five points, though it’ll bounce back within a few months. Try to limit applications as needed and shop around with prequalification tools that don’t hurt your credit score.

Also Check: Is 766 A Good Credit Score

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

What Makes An Impact On Your Credit Scores

While it’s useful to know the specific behaviors in your own credit history, the types of behaviors that can lower your credit score are well-known in general terms. Understanding them can help you focus your credit score-building tactics:

Public Information: If bankruptcies or other public records appear on your credit report, they typically hurt your credit score severely. Settling the liens or judgments at the first opportunity can reduce their impact, but in the case of bankruptcy, only time can lessen their harmful effects on your credit scores. A Chapter 7 bankruptcy will remain on your credit report for up to 10 years, and a Chapter 13 bankruptcy will stay there for 7 years. Even though your credit score may begin to recover years before a bankruptcy drops off your credit file, some lenders may refuse to work with you as long as there’s a bankruptcy on your record.

The average credit card debt for consumer with FICO® Scores of 553 is $4,674.

. To calculate the on a credit card, divide the outstanding balance by the card’s borrowing limit, and multiply by 100 to get a percentage. To calculate your overall utilization rate, add up the balances on all your credit cards and divide by the sum of their borrowing limits. Most experts recommend keeping utilization below 30%, on a card-by-card basis and overall, to avoid hurting your credit score. Utilization rate contributes as much as 30% of your FICO® Score.

Don’t Miss: Does Paypal Credit Show Up On Credit Report

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 553 FICO® Score is significantly below the average credit score.

Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit. Credit card applicants with scores in this range may be required to pay extra fees or to put down deposits on their cards. Utility companies may also require them to place security deposits on equipment or service contracts.

16% of all consumers have FICO® Scores in the Very Poor range .

Roughly 62% of consumers with credit scores under 579 are likely to become seriously delinquent in the future.

Read Also: What Is Syncb Ppc On My Credit Report

Noddle Website To Offer Free Credit Report Service

One of Britain’s main credit reference agencies is to give everyone in Britain free access to their personal credit file but it will also make money from the service by effectively using it to “sell” credit cards and loans.

is breaking ranks with its two main rivals, Equifax and Experian, in announcing a new service that means people will no longer have to pay £2 to see their statutory credit report, or a monthly subscription.

An individual’s credit file contains details of any credit agreements and whether they are up to date with payments, plus publicly available information such as electoral roll details and county court judgments. Lenders and other companies use this to decide whether they want to take on a customer, and how much they will charge. An adverse credit history can mean getting turned down for mortgages or other products.

With the new service, called Noddle, the company said it “plans to give over 40 million Britons free access to their full monthly credit report for life”. A spokesman said: “People don’t really understand credit reports that much It’s only right they should have ready access to the personal information these important decisions are based on.”

Where the service could prove controversial is in Callcredit’s decision to partner an unnamed price comparison website and a technology company to promote credit cards and loans that users are likely to qualify for.

Usda Loan With 651 Credit Score

The minimum credit score requirements for USDA loans is now a 640 . Therefore, with a 651 credit score, you will satisfy the credit score requirements for a USDA loan.

Other requirements for USDA loans are that you purchase a property in an eligible area. USDA loans are only available in rural areas, as well as on the outer areas of major cities. You can not get a USDA loan in cities or larger towns.

You also will need to show 2 years of consistent employment, and provide the necessary income documentation .

Recommended Reading: Who Is Syncb/ppc

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Cnbc Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, CNBC Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

You May Like: Does Speedy Cash Report To Credit Bureaus

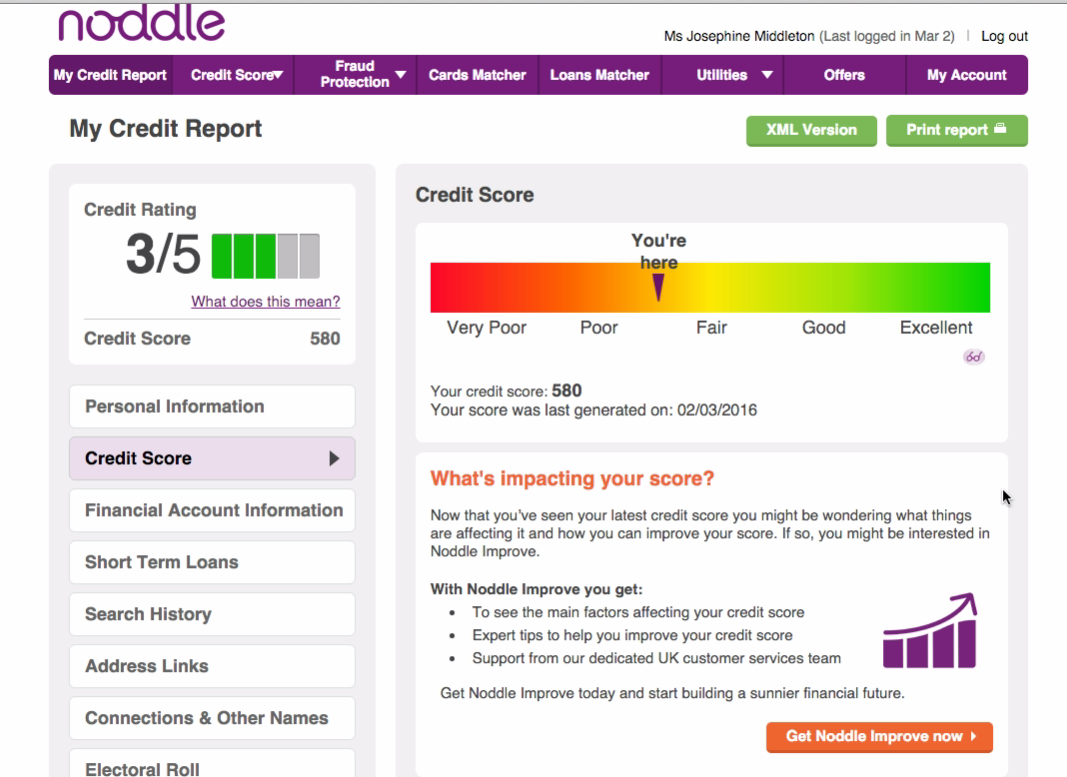

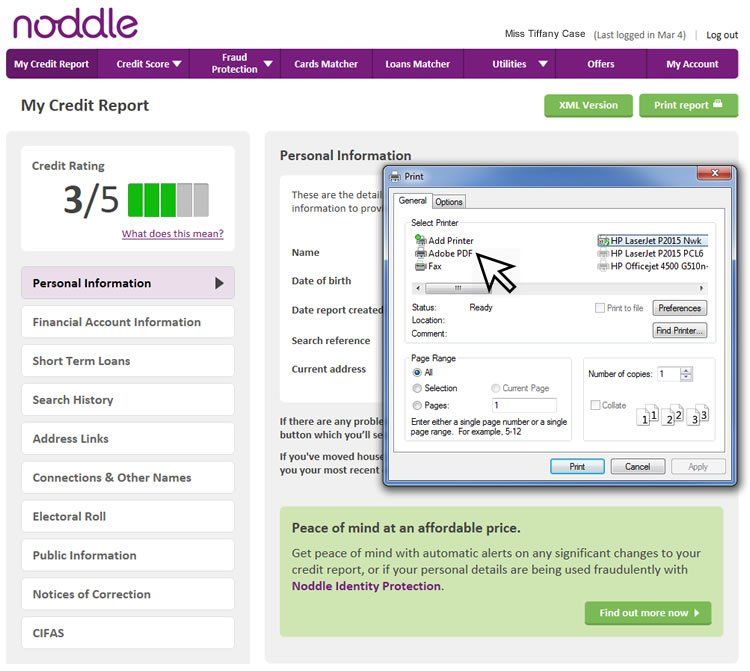

What You Need To Know About Noddle

Noddle is run by UK-based credit analysis company Callcredit, who launched the service in 2011. The service was initially launched on a trial basis, with Callcredit inviting 10,000 users to try the service before their full launch. As well as their free credit report service which allows customers to check their eligibility for and loans Noddle also offers a range of paid services. These include Noddle Improve, which gives users advice and tip on how to improve their credit score, and Noddle Web Watch, which monitors fraudulent use of their customers personal information, highlighting any issues.

Does My Score Matter

Now we get to the confusing bit because, in a way, your score doesnât matter. Thereâs actually no such thing as a universal credit score.

When lenders look at your credit history, theyâre not simply presented with a single score to base their entire decision on. In fact, each credit reference agency has itâs own scoring system, so itâs not possible to get the same mark from each of them anyway. Plus, lenders use scoring systems that are unique to them, too.

You do not have one credit score hovering over your head that defines your entire future as a borrower. Whatâs more important is your , which is the record of your borrowing Noddle and the other agencies keep.

This is what lenders look at to work out how great a risk youâre likely to present to them if they go ahead and lend to you. Itâs this you should pay the most attention to â and keep the score Noddle gives you simply as a useful guide to whether or not your credit history needs improving.

Read Also: What Is Syncb Ntwk On Credit Report

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.