Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Recommended Reading: Comenity Bank Shopping Cart Trick Stores

What Is The Best Credit Score You Can Get Right Now

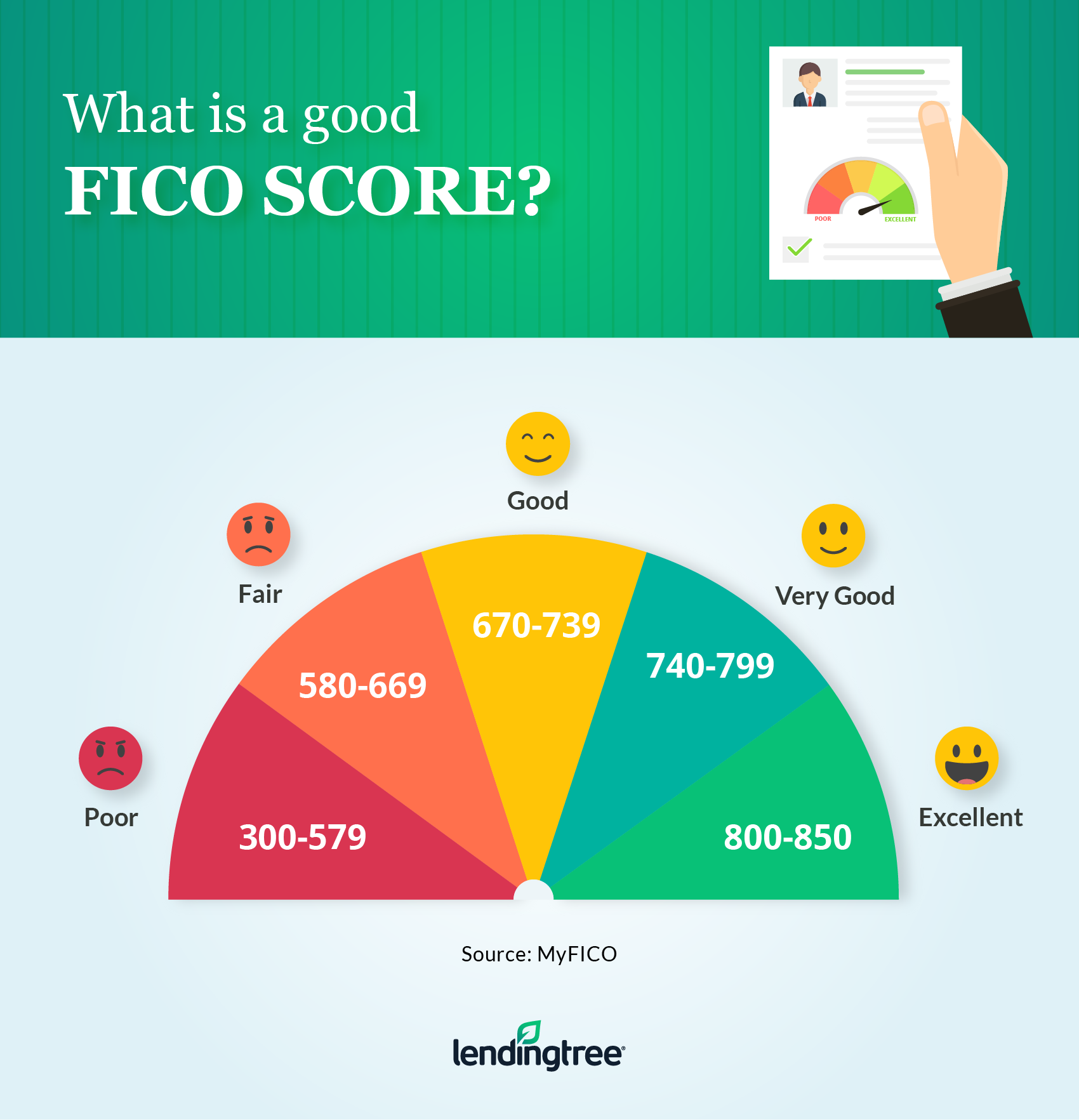

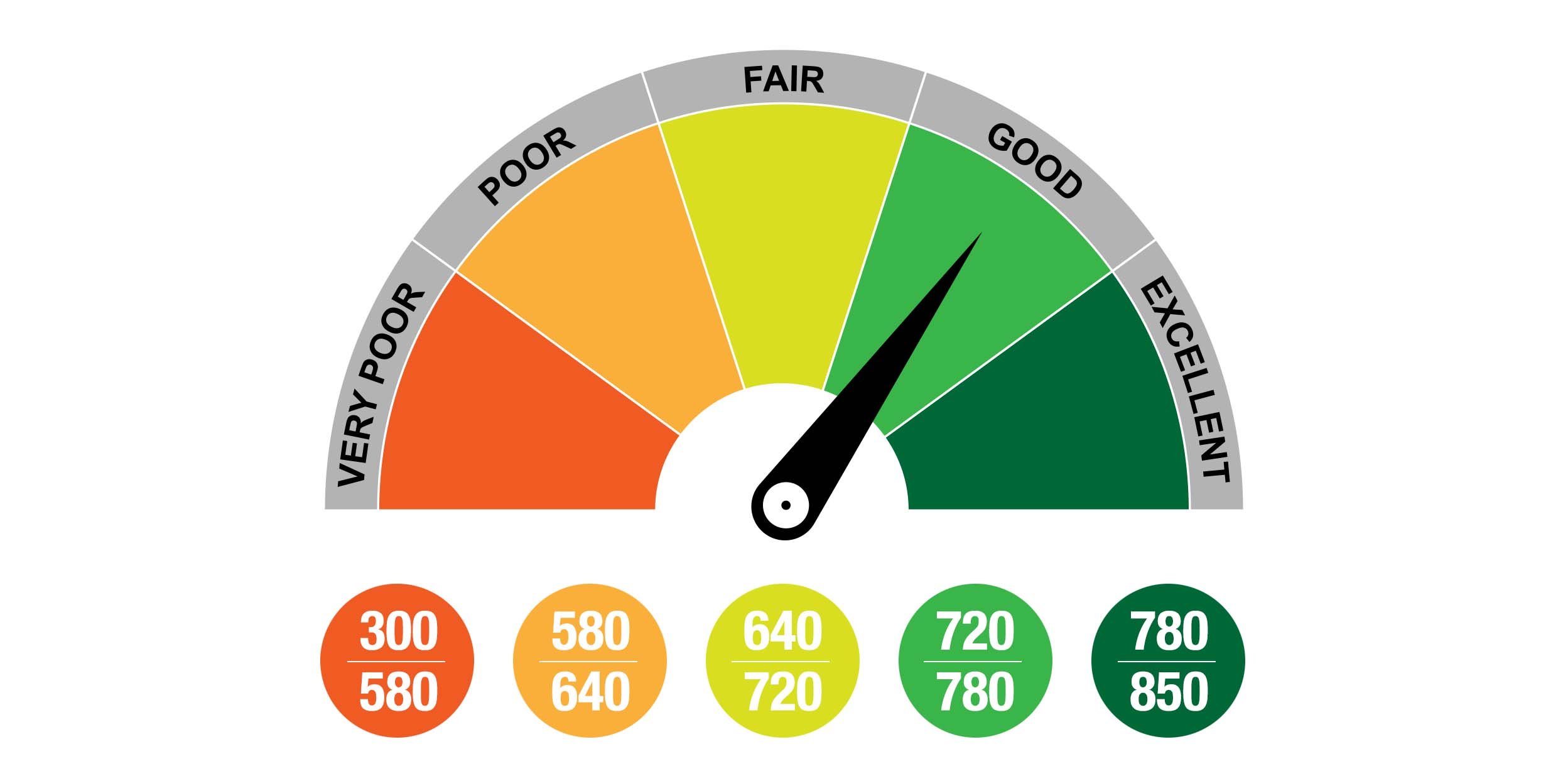

The best and highest possible credit score is 850 for the FICO and VantageScore models. FICO considers a score between 800 and 850 as “exceptional”, while VantageScore considers a score above 780 as “excellent”. A credit rating of 850 is possible but difficult to achieve.

How Long Does It Take To Learn Korean

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Read Also: How To Dispute Repossession On Credit Report

How Much Is Owed

When you apply for credit, how much you already owe really matters to a lender. Your current payments will determine if you can manage any more payments in your budget for the additional money you borrow.

While you might think that you can handle more credit, statistically speaking, theres a chance you might not be able to. If you are close to maxing out all of your credit cards or your line of credit, it means that you are a higher risk to lenders. Higher risk to a lender means that theres a greater chance that you wont keep up with your payments.

Another aspect of this part of your credit score reflects how much of your available credit limits you use on an ongoing basis. If you usually use 60% or more of your credit limit on a credit card or line of credit, it will impact your credit score negatively. This is because if something were to happen to your income and you owe a lot of money, you would find yourself struggling to keep up with payments.

What Can I Do To Improve My Credit Score

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

Recommended Reading: How To Remove Repo From Credit

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

You May Like: How To Remove Items From Credit Report After 7 Years

How To Get The Best Credit Score

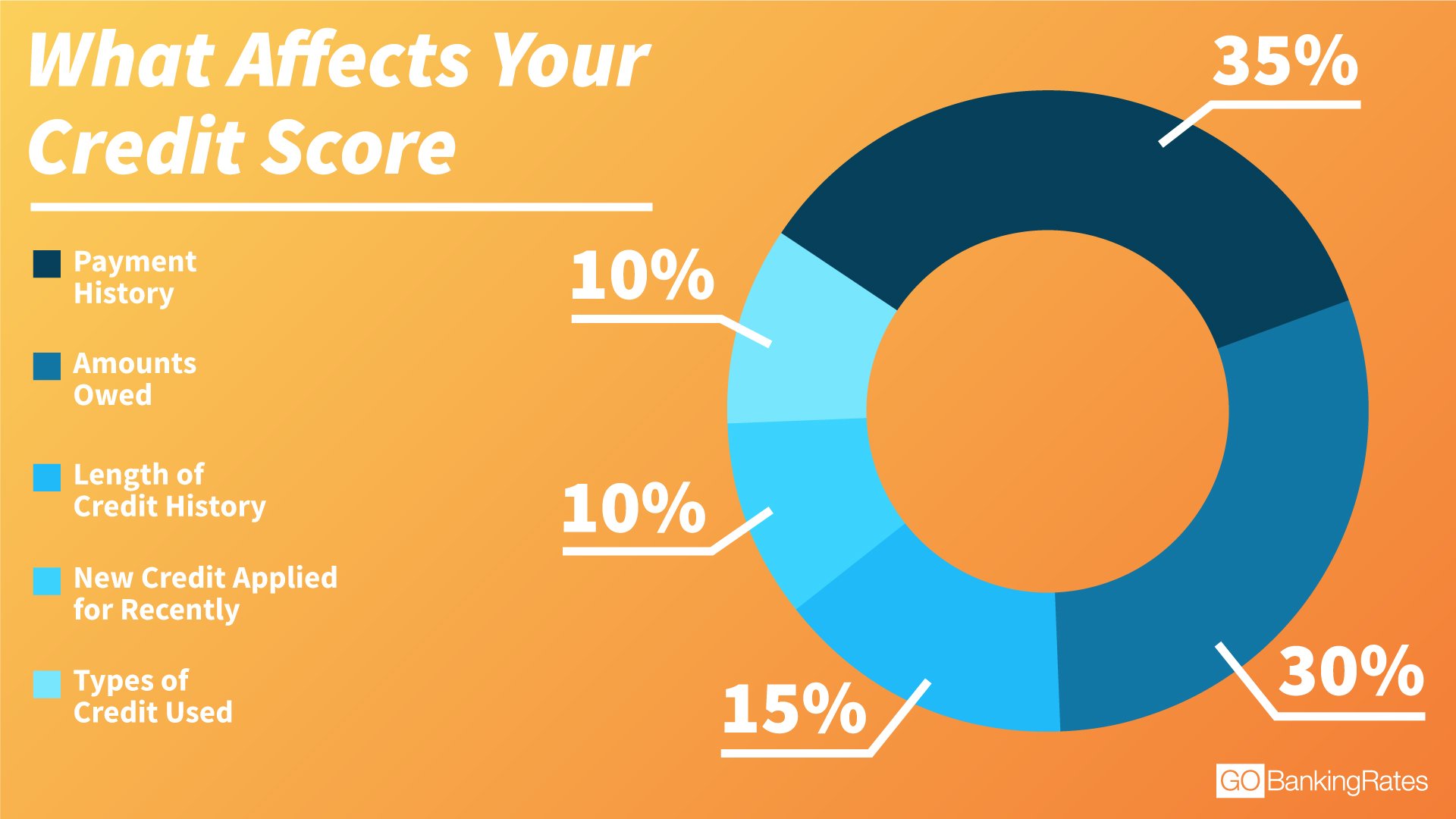

- Pay in time. Your payment history is the most important factor in your credit score, so it’s important to always pay on time.

- Pay the full amount. Although you must always pay at least the minimum amount, they recommend that you pay the bill in full each month to reduce the frequency of use (total balance

- Do not open too many accounts at once.

What Is The Best Credit Score You Can Get For Mortgage

Your outcome affects your ability to get a mortgage, as well as good interest. It is possible to qualify for a home loan even if you have bad credit, but lenders are more likely to give lenders a good credit rating of 670 or higher, and a very good or exceptional credit rating of more than 800 is more likely.. to lenders.

You May Like: How To Report A Death To Credit Bureaus

What Is A Good Credit Score For A Mortgage

Your credit score arguably matters more on a mortgage application than with any other type of personal financing. With a mortgage, a good credit score might save you thousands of dollars in interest every year.

For example, say you have a FICO credit score around 640 when you apply for a $350,000 mortgage. FICOs Loan Savings Calculator estimated that in June 2020, your APR would be around 3.957% on a 30-year, fixed-rate loan. Your monthly payment would be $1,662, and youd pay $248,424 in interest over the life of your loan.

Now, imagine you work to improve your FICO Score to 680. With the higher score, you might qualify for an APR of 3.313%. Based on the lower rate, your monthly payment would be $1,535 for the same home. You would pay $202,726 in interest over your 30-year loan term. Because you improved your credit score from fair to good, you would save:

- $127 per month

- $1,524 per year

- $45,698 over the life of the loan

If youre aiming to qualify for a mortgage lenders lowest rates, that generally falls under a FICO Score of 760 or higher. Of course, getting a great mortgage rate requires more than just a brag-worthy credit score. But the three-digit numbers sold alongside your credit reports are a key factor that mortgage lenders consider when you apply for financing.

Read More:How Your Credit Score Affects Your Mortgage Rates

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

Read Also: Syncb Ppc Credit Card

Are Credit Karmas Credit Scores Accurate

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Read Also: How To Check Credit Score Without Social Security Number

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

What’s The Highest Fico Score You Can Get

The most popular FICO scores range from 300 to 850. In theory, 850 is the highest score you can get. One point, used specifically for auto loans, goes up to 920 and the other to 950. Some ratings have areas that go down: the lower the rating, the lower the credit risk.

Minimum credit score for home loanWhat is an acceptable credit score to a home loan?740 to 850: good670 to 739: fair or acceptable580 to 669: below average or weak300 to 579: badWhat is the minimum CIBIL score for home loan?The minimum CIBIL score for credit approval is 750 or higher. At this point, you can get a higher loan amount, faster approval, and the ability to negotiate the interest rate on the loan.Can you buy a home with

Recommended Reading: Does Paypal Credit Show On Credit Report

What If Im Denied Credit Or Insurance Or Dont Get The Terms I Want

Under federal law, a creditors scoring system may not use certain characteristics for example, race, sex, marital status, national origin, or religion as factors when figuring out whether to give you credit. The law lets creditors use age, but any credit scoring system that includes age must give equal treatment to applicants who are older.

You have the right to:

Know whether your application was accepted or rejected within 30 days of filing a complete application.

Know why the creditor rejected your application. The creditor must

- tell you the specific reason for the rejection or

- that you are entitled to learn the reason if you ask within 60 days.

Learn the specific reason the lender offered you less favorable terms than you applied for, but only if you reject these terms. For example, if the lender offers you a smaller loan or a higher interest rate, and you dont accept the offer, you have the right to know why those terms were offered. Read to learn more.

If a business denies your application for credit or insurance because of information in your credit report, federal law says the business has to

- give you a notice that includes, among other things, the name, address, and phone number of the credit bureau that supplied the information.

- include your credit score in the notice if your credit score was a factor in the decision to deny you credit or to offer you terms less favorable than most other customers get.

If you get one of these notices:

What Exactly Is A Credit Score

A credit score is a three-digit number used by lenders to determine whether you qualify for credit, such as a loan or credit card.

Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

You May Like: Does Zebit Report To Credit Bureaus

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster. In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

Can I Get A Home Loan With A Credit Score Of 620

Borrowers with a credit rating of less than 620 may still qualify for an FHA down payment loan. To qualify for an FHA down payment loan, borrowers must have a credit score of at least 580. However, there are important factors between a credit score of less than 620 and a credit score of more than 620.

Read Also: Check Credit Score With Itin Number

Option : Open A College Student Card

Applying for a college student credit card is a smart way to start building credit early while also taking advantage of rewards and special financing offers.

There are numerous college student cards available, each providing unique benefits for different types of students from travelers and foodies to commuters and international students. Some cards are lenient with credit history requirements, meaning you may qualify with no credit history at all. You do have to be 18 to apply for a credit card and need to have a steady source of income.

See our methodology, terms apply.

You’re Not Labeled For Life

There’s lots you can do to make sure you have a good credit score. Most important, make your credit card and loan payments on time. Thirty-five percent of the FICO score is based on your payment history. Check our other tips.

Those with thin or subprime credit histories might consider signing up for one or both of the new credit improvement programs, Experian Boost and the Fair Isaac Corporation’s UltraFICO. Boost, which launched in March, includes utility payments in the score calculation, and UltraFICO, expected to roll out nationally later this year, reviews banking history. For more information, check these new ways to improve your credit score.

Keep in mind that a major downturn in your luck or behavior could drop your credit score by 100 points, but it’s unlikely to dip it into the 300 range.

Indeed, McClary says he’s never actually seen a 300 FICO scoreor an 850 score, for that matter. The lowest score he’s ever seen was 425, he says, and in that case the holder had already been in bankruptcy and was delinquent with several creditors.

“Obsessing over perfecting your score might be a waste of time,” Ross says. “Your efforts should be more focused on maintaining your score within a healthy range.”

Recommended Reading: Report Death To Credit Bureau