You’re Not Labeled For Life

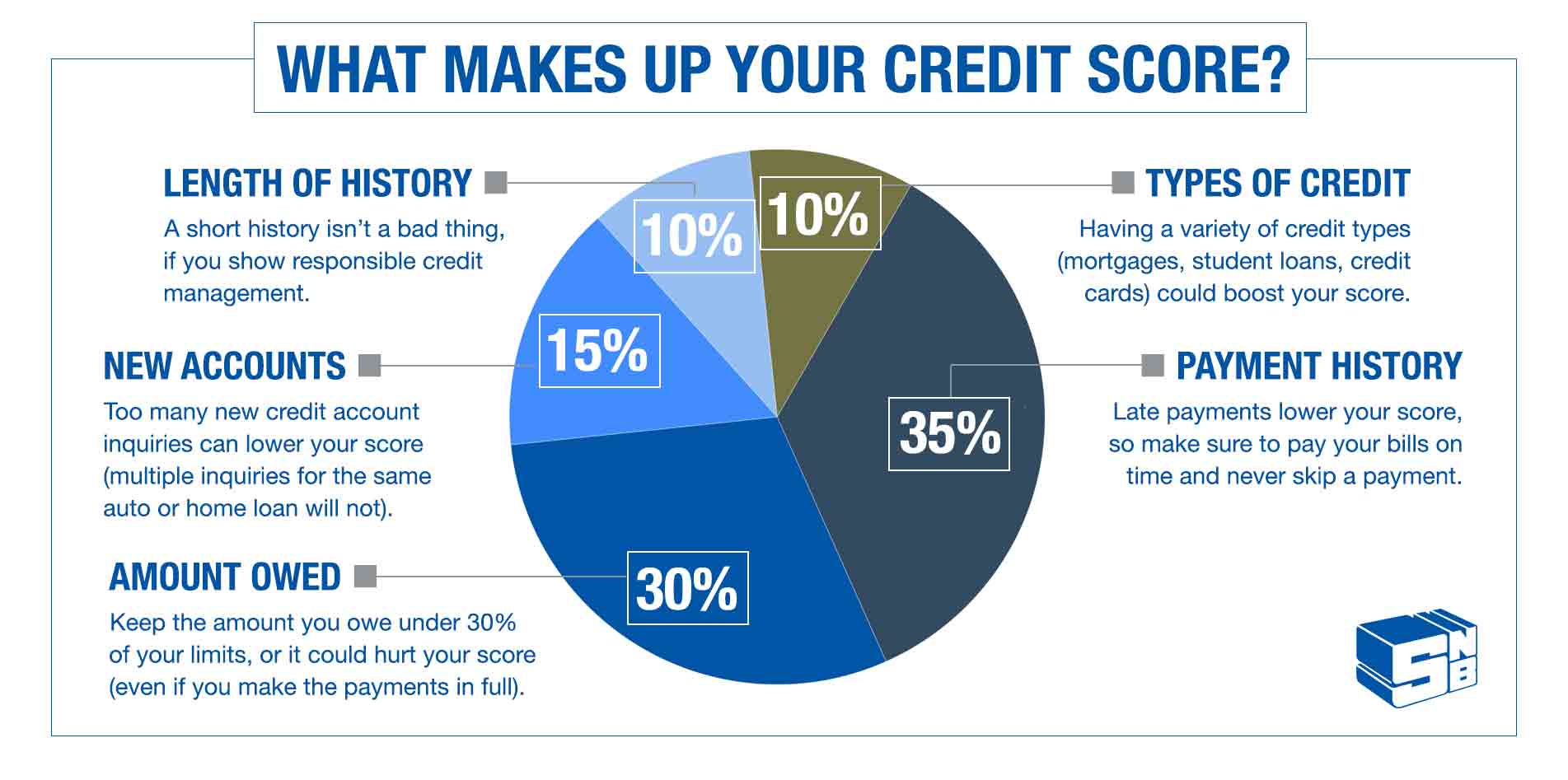

There’s lots you can do to make sure you have a good credit score. Most important, make your credit card and loan payments on time. Thirty-five percent of the FICO score is based on your payment history. Check our other tips.

Those with thin or subprime credit histories might consider signing up for one or both of the new credit improvement programs, Experian Boost and the Fair Isaac Corporation’s UltraFICO. Boost, which launched in March, includes utility payments in the score calculation, and UltraFICO, expected to roll out nationally later this year, reviews banking history. For more information, check these new ways to improve your credit score.

Keep in mind that a major downturn in your luck or behavior could drop your credit score by 100 points, but it’s unlikely to dip it into the 300 range.

Indeed, McClary says he’s never actually seen a 300 FICO scoreor an 850 score, for that matter. The lowest score he’s ever seen was 425, he says, and in that case the holder had already been in bankruptcy and was delinquent with several creditors.

“Obsessing over perfecting your score might be a waste of time,” Ross says. “Your efforts should be more focused on maintaining your score within a healthy range.”

Low Credit Balance On Revolving Accounts

In FICOs model, the second most important factor that contributes to your credit score is your , which is the percentage of your available revolving credit that youre using.

To get a good credit score, keep your credit card balances as low as possible. Ideally, your credit utilization rate will be under 10%. For example, according to FICO, in 2019, people with the maximum credit score of 850 had an average credit utilization rate of 4.1%. 9

In addition to the overall credit utilization rate across all of your accounts, the individual utilization rate for each account also contributes to your credit score. Aim to distribute your debts so that your utilization rate is below 30% for each account.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Don’t Miss: What Do Landlords See On Your Credit Report

What Is The Range Of Credit Scores

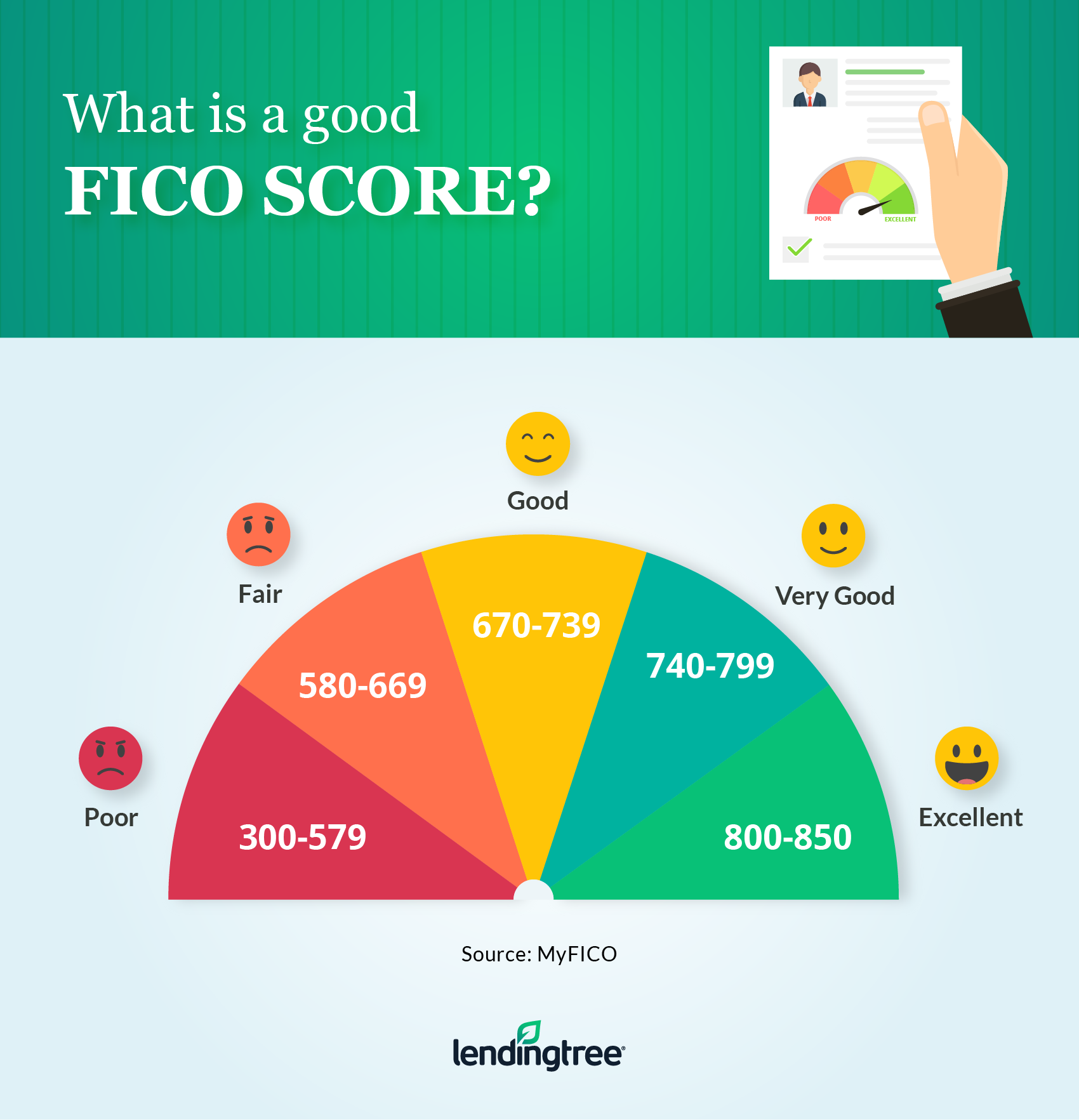

Every FICO credit score falls within one of five ranges: Excellent , Very Good, Good, Fair and Poor. If you have a fair credit score, your credit score ranges between 580 and 669 points. You dont have bad credit, but you dont have great credit either.

Heres how the FICO credit scoring system ranks credit scores:

- Exceptional: 800-850

- Poor: 300-579

Tips For Getting A Good Credit Score

The fundamentals of credit building are the same no matter your starting point. But if youre beginning with bad credit, your first order of business should be to stop the bleeding. If youre delinquent on an account, for example, making the payments necessary to become current will prevent further credit score damage.

Finally, there are more tips and tricks of the trade to discover once youve nailed down the basics. You can learn more about those strategies in our .

Don’t Miss: What Credit Score Do You Need For A Discover Card

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

For Minorities Credit Score Disparities Still Exist

But these upward trends are not across the board.

Young adults in majority-Black and majority-Hispanic communities have lower average credit scores than their white counterparts, according to a separate Urban Institute analysis based on Vantage scores. And they are more likely to see their credit scores deteriorate over time.

From 2010 to 2021, about one-third, or 33%, of 18- to 29-year-olds in majority-Black communities and more than one-quarter, or 26%, in majority-Hispanic communities saw their credit scores decline, compared with just 21% of those in mostly white communities.

Between ages 25 and 29, young adults in majority-Black communities have a median credit score of 582, just barely above the range considered poor, compared with those in majority-Hispanic communities, who have a median score of 644, and those in majority-white communities, who have a median score of 687, the report found.

“These credit disparities are rooted in decades of discriminatory policies that have denied communities of color equal access to affordable financial services and wealth-building opportunities,” the Urban Institute said.

At the same time, FICO’s Dornhelm said, credit scores have helped “democratize credit and enabled consumers to qualify for credit in a fast and fair fashion compared to the days prior when underwriting was more subjective to biases.”

Also Check: Does Missing A Credit Card Payment Affect Your Credit Rating

Apply For A House With Good Credit Score

Strictly speaking, you dont need a credit score to buy a house. If youre paying cash, no one necessarily cares if you have good credit. However, if like most aspiring American homeowners youll need financing, then a credit score is a concern.

Your credit score is one of the most important factors lenders consider when you apply for a house. Not just to qualify for the loan itself, but for the conditions. Typically, the higher your score, the lower the interest rates and better terms youll qualify for.

So, what is a good ? It depends on the type of mortgage youre seeking: Federal Housing Administration loans, conventional loans, and jumbo loans all vary when it comes to the credit score needed to buy a house. Generally speaking, youll likely need a credit score of at least 620 whats classified as a fair rating to qualify with most lenders. If you opt for an Federal Housing Administration loan, you might be able to get approved with a credit score as low as 500.

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lenders decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used.

- Excellent: 800850

- Fair: 580669

- Poor: 300579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit that you take out.

A persons credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers scores, especially when deciding whether to change an interest rate or on a credit card.

What Is A Credit Score?

Recommended Reading: Does Flexshopper Report To Credit Bureau

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

How To Build Good Credit

Approximately 62 million Americans have no credit data to score or are considered thin files . When just starting your credit score journey, it can be difficult to access financial products to build credit if you dont even have a credit history established.

Some easy ways to establish a credit history include:

- Get a secured credit card. With a secured credit card, you put up a deposit and the issuer gives you a credit line based on your deposit. Then you use the credit card as normal, making payments and charging purchases on a rotating basis while the issuer reports to all three credit bureaus Equifax, Experian and TransUnion.

- Use non-bureau reporting information such as utility payments, rent payments or bank account history with a program like Experian Boost or UltraFICO to supplement the data in your file.

- Become an authorized user on a trusted persons credit card. If you have a strong enough personal relationship with someone like a family member, ask them if they could add you as an on their account. You dont even have to use the card, as long as the primary account holder uses the card and pays it on time, youll build credit history.

Recommended Reading: Does Requesting Credit Increase Affect Score

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Don’t Miss: How Long Does Debt Collection Stay On Credit Report

Some Ideas To Improve Your Credit Score

Taking these steps can help improve your credit score over time. If you have any questions or need help correcting inaccuracies on your credit report, contact a reputable credit counseling or repair service. They can help you understand the steps you need to take to improve your credit score.

If youre looking for more tips on how to improve your credit score, visit the Federal Trade Commissions website at FTC.gov. There, you can find helpful articles on credit counseling, repairing your credit history, and more. You can also check out our Credit Center for more information on improving your credit score.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Don’t Miss: Does Car Insurance Quotes Affect Credit Score

Benefits Of A Good Credit Score

Besides increasing the chances of your loan approval, here are some benefits of maintaining a good score:More negotiating power: With a high score you can negotiate for better interest rates and terms on credit facilities. If you have a low score, lenders are unlikely to bulge to your terms.Higher borrowing capacity: Lenders will be willing to let you borrow more money since you have demonstrated that you can pay back on time. As a result, you can make significant investments with a higher loan limit.No collateral requirements: Some lenders will require a deposit to secure your loan. By providing collateral, the lender has an asset to back up the loan if you miss payments. When you have good credit, lenders are more willing to offer you unsecured loans.Higher chances for credit card approval: Having a good credit score doesnt guarantee loan approval. However, your chances of being approved are greater when you apply for a loan with a financial institution. Lenders assess different factors of your application to determine your loan eligibility.Better insurance rates: Most insurance companies use to evaluate consumers and determine how much premium to charge for a homeowner or car insurance policy. With a good score, you can pay less for insurance than other applicants with lower credit scores.

Identify What You Need To Work On

If there are no errors in the report and your credit score is low because of your financial habits, you need to identify what it is that you want to improve.

Payment history has a good influence on the score and it is something you need to work on. Make overdue payments and try to clear as much debt as you can.

Meanwhile, stop making any credit applications as they lead to hard inquiries. Every credit application will only lower the score. Alternatively, you can seek help from the leading credit monitoring services to help you improve the score.

Don’t Miss: Is 660 A Good Credit Score

How A Good Credit Score Positively Affects Your Finances

A good credit score opens your world up to getting the best financial products on the market. Its easier to get loans you want so you can own your own home or invest in a business. If your credit score is really good, lenders will give you the best possible interest rates. Youll save money in the long run. They also offer you special offers and incentives, especially with . You can get cash back credit cards and travel rewards.

Your good credit gives lenders the confidence to loan money to you. Youll be qualified for the many top-tier products out there. Things like unsecured credit loans and low interest loans will be available to you. Here are some of the benefits youll get from having a good credit score:

Check Credit Reports Often

Online companies in Canada like Borrowell or offer free copies of your credit report. This allows you to make sure your information is correct and complete. You can file disputes if information about you isnt accurate. You can also ask to receive a weekly update on your financial habits. They will let you know what you can do to improve your credit score and offer you products that youre most likely able to be approved for. These products can also help improve your credit score if you use them responsibly.

You May Like: How Do You Check Your Credit Report