Why File A Dispute With Transunion

Anyone who pays tax in the US is entitled to a free credit report from each of the three main credit reporting agencies each year. Make sure you stay current with whats on your credit reports, as doing so is one of the first ways to spot fraud. Credit fraud is when someone illegally uses your personal details to open accounts and accumulate debt that theyve no intention of paying off. If this isnt caught early, it could have serious repercussions for you.

Filing a dispute with any of the major CRAs is free if you do it yourself. Although many people do hire a company to do this for them, its in fact a simple, if somewhat time-consuming, process. Here, well focus on how to file a dispute with TransUnion.

You may need to file a dispute for the following reasons:

- Incorrect personal information is displayed on your credit report . This may indicate that the credit reporting agency has merged your report with someone elses, meaning their debts could be showing up on your report.

- Account numbers dont match your files.This can be due to an admin error or a mix-up between accounts. Always make sure to double-check account numbers.

- Accounts appear that you dont recognize.This is a red flag for fraud and can mean that someone else is using your personal details to run up debt.

- Closed accounts appear as open.This is usually because the account youve paid off hasnt yet been updated. It typically takes 30 days for a closed account to be reflected on your report.

How To Remove Medical Debt Collections From Credit Report

I am going to show you exactly what you need to do to audit your credit and remove a medical debt collection account from your credit report. First, you need to get a copy of your report here You want to go to the bottom of the credit report where it says Collections Accounts. Look over each account and find out if the Negative Account has reported to any of the three major credit bureaus, Equifax, Experian or Transunion.

My first and most important words of advice DO NOT PAY THE DEBT COLLECTOR until you have read the steps below or scheduled a free credit consultation with us! My second words of advice You should never dispute your credit online You can read about that too, but you want to do everything in writing, you dont want to risk making any mistakes.

Bills Can Be Sent To Collections Even If Youre Paying

Making payments on a large medical bill does not guarantee you will avoid collections. Those who decide on their own to pay only a portion of the bill could have the bill sent to collections. Same with those who are not paying on time

Its important to talk with the provider or hospital when you cant pay all of what is due. Providers typically will set up a payment play, but be sure to get it in writing. Some hospitals the Cleveland Clinic among them have agreements with certain banks that will spread payments over two or three years at no interest, provided payments are made on time.

Communicating with the provider is key to making payments affordable and avoiding collections.

Recommended Reading: Experian/viewreport

How To Negotiate Medical Bills With Collectors

If your medical bill is already in collections, consider negotiating with the collection agency. First, verify that the account is actually yours and the amount is correct. Next, ask them to avoid reporting the bill to the credit reporting agencies. If you can offer a quick payment solution, most collection agencies will work with you and delay reporting.

If theyve already reported the debt, you can make an arrangement known as pay for delete, where you agree to pay the debt fully if they remove the debt from your report afterwards. Whatever plan you agree to with the collection agency, ensure you get it in writing so you have proof.

Get In Touch With A Credit Counseling Agency

It may seem intimidating to negotiate high levels of medical debt with a third-party debt collector. To ensure the process is completed to your advantage, you could consider .

A credit counselor may be able to negotiate with your creditors on your behalf. This can include reaching a debt settlement agreement, waiving late fees and enrolling you in a debt management plan . Credit counseling is often free, but some services may come at a low cost.

Nonprofit credit counseling agencies are regulated by federal law. You can see a full list of accredited credit counselors on the Department of Justice website.

Recommended Reading: Does Klarna Financing Report To Credit Bureaus

Medical Debt: What To Do When You Cant Pay

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more.

People often feel ashamed of their medical debt, seeing it as their moral obligation to pay their bills and their personal failure when they cant afford them. What if you canât pay your hospital bills? What if you have accumulated medical debt and have no way of paying it when itâs due? On both accounts, the consequences can be serious.

People may forego the care they need, including doctor appointments, tests, treatments, and prescription medications, reports the Kaiser Family Foundation , a health policy analysis nonprofit. They may struggle to pay other bills, deplete their long-term savings, damage their credit, and even declare bankruptcyall problems that can take years to overcome.

Can I Stop Medical Bills From Landing On My Credit Report

You can take some steps to prevent future medical bills from affecting your credit.

-

Follow up with your insurance company. Understand your insurance policy and follow up by phone or email to make sure the company is paying the bills it has agreed to cover.

-

Negotiate unmanageable bills. When you cant afford to pay a bill, contact your medical provider and try to negotiate it down or ask for a payment plan. If youre successful, get the new amount you owe in writing so that you have a record of your agreement in case of a future dispute.

-

Consider hiring a billing advocate. If youre overwhelmed by your bills and arent sure how to proceed, think about hiring a medical billing advocate. This professional can sort through your bills and try to negotiate them on your behalf.

-

Crowdfund your medical bill. Set up a fundraiser with a crowdfunding site such GiveForward to get help with your bills from family, friends and strangers though it’s not a surefire way to pay off medical debt.

Read Also: Affirm Credit Score Needed For Approval

Should I Pay A Medical Bill In Collections

Yes, you should pay a medical bill in collections if you can afford to do so. As we mentioned before, paying your debt yourself wont necessarily get it removed from your credit report, but it will update the account to show that it was paid. The newest credit scoring models ignore paid collection accounts, but older models will still factor your paid medical debt into your overall score. But a paid account will likely still look better to lenders, even if it doesnt increase your credit score, so dont discount this as an option.

Whether or not you pay your bill in collections, it should eventually drop off after seven years pass.

Tips For Disputing Medical Bills

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

If youâre struggling with medical debt, youâre not alone. Medical costs in the U.S. are often unmanageable. Even if you have medical insurance, the deductibles, copays, and non-covered services can add up quickly. Mounting medical expenses, high-pressure phone calls, concern about your credit report, and the threat of debt collection lawsuits can make a difficult situation even worse. Fortunately, there are some simple steps that may be able to help you reduce medical debt to a manageable level.

Written bythe Upsolve Team. Legally reviewed byAttorney Andrea Wimmer

If youâre struggling with medical debt, youâre not alone. Medical costs in the U.S. are often unmanageable, and medical debt is one of the main reasons people file for bankruptcy. Even if you have medical insurance, the deductibles, copays, and non-covered services can add up quickly. Mounting medical expenses, high-pressure phone calls, concern about your credit report, and the threat of debt collection lawsuits can make a difficult situation even worse.

Don’t Miss: How Many Years Does An Eviction Stay On Your Record

Dispute Medical Debt On Your Credit Report

The major credit bureaus must wait 180 days before including medical debt on your credit report, according to Experian. This grace period gives consumers six months to resolve medical billing errors, enroll in a payment plan or pay off the debt.

To determine if you were billed inaccurately, look for common medical billing errors like double-billing and incorrect coding. Also request an Explanation of Benefits from your health insurance company to determine if you were charged for a service that should have been covered by insurance.

If you’ve been billed in error, you can file a dispute through the credit reporting agency directly. You can also enroll in Experian credit monitoring services on Credible to identify and address errors on your credit report in a timely manner.

Consolidate Your Debts With A Fixed

Another common way to repay medical bills is with a debt consolidation loan. This is a type of fixed-rate personal loan that you repay in fixed monthly payments over a set period of time, typically a few years.

Since personal loans are typically unsecured and don’t require collateral, lenders determine your eligibility and interest rate based on your credit history and debt-to-income ratio. Applicants with good credit will qualify for the lowest personal loan rates, while those with bad credit may see high interest rates if they qualify at all.

Because you’ll pay interest charges for borrowing a debt consolidation loan, this may be a last resort after debt settlement and medical bill negotiation. But if you’ve exhausted your alternative medical debt relief options, personal loans can provide a fast funding option to help you pay off debt in collections on a predictable repayment schedule.

You can use a personal loan calculator to estimate your monthly payments using this debt consolidation strategy. If you decide to borrow a debt consolidation loan, be sure to compare rates across multiple lenders on an online marketplace like Credible to shop for the lowest rate possible for your financial situation.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

Also Check: Syncbppc

Using Credit Cards To Pay A Debt

Using a credit card for medical debt is the last resort of last resorts.

Only use credit cards to consolidate medical debt if you can pay the credit card bills promptly. If you cant, first discuss whether the medical provider might offer an interest-free payment plan, which would be more manageable than a credit card debt that accrues interest.

Some patients opt to use medical credit cards, which are like conventional cards but are designed exclusively for medical expenses. Application forms are sometimes available in doctors offices.

Before applying for a medical card, especially one that advertises no interest on balances, carefully review the terms. You probably will discover that the no-interest grace period ends in several months and the interest rate charged after that is quite high.

Ask For Financial Aid

It might not have occurred to you to pick up the phone and say, âHey, this bill is too much. Can I pay less?â While you probably donât want to use that exact language, asking for a break on your bill can have surprising results. If the billing department canât help you, ask whether the facility has a patient advocate or medical billing advocate.

This strategy can be especially useful if youâre one of the growing number of people receiving surprise medical bills. The surprise medical bill phenomenon is increasingly common. It can occur when you are treated at a hospital or clinic that is in-network for your insurance carrier, but the facility uses out-of-network providers.

When this happens, you expect to be held responsible for your deductible and copay. But, when the hospital bill arrives, you find that your share is much larger than expected – or that some services arenât covered at all. When this happens, donât be afraid to ask for help.

Of course, your options will vary. They will depend on the healthcare provider, your financial circumstances, and other factors. Here are some of the possibilities you could uncover when you call your medical provider to ask about financial aid:

Read Also: Usaa Free Credit Score

What If Insurance Didn’t Or Won’t Pay

Medical debt collections have to come off the reports if the health insurance company pays up. But what if you don’t have insurance, you can’t get the insurer to pay or you get tired of waiting on insurance and pay off a collections account yourself?

The damage to your credit depends on the type of scoring model and the version used by a potential creditor to check your creditworthiness.

FICO 8, the credit scoring model most lenders rely on, treats collections accounts the same, no matter whether they’re paid or unpaid. So the damage has been done regardless of whether you pay although paying will get the bill collector off your back and remove the risk of it suing you for payment.

The FICO 9 scoring model and the VantageScore 3.0 disregard collections accounts that have been paid. FICO 9 will weigh medical bills in collections less heavily than other types of unpaid accounts. However, FICO 9 is not in widespread use by lenders. VantageScore 3.0, a competitor to FICO, is more widely used.

Collections accounts can take up to seven years to drop off your credit report, although the impact on your credit score will lessen over time. To help your score rebound, the best thing to do is keep consistent credit habits as much as you can, such as paying your other bills on time and keeping your credit card balances low.

Remove Medical Collections That Violate Hippa The Easy Way

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals are here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Read Also: Opensky Late Payment

What You Should Do If You Find Information On Your Transunion Credit Report That Is Inaccurate

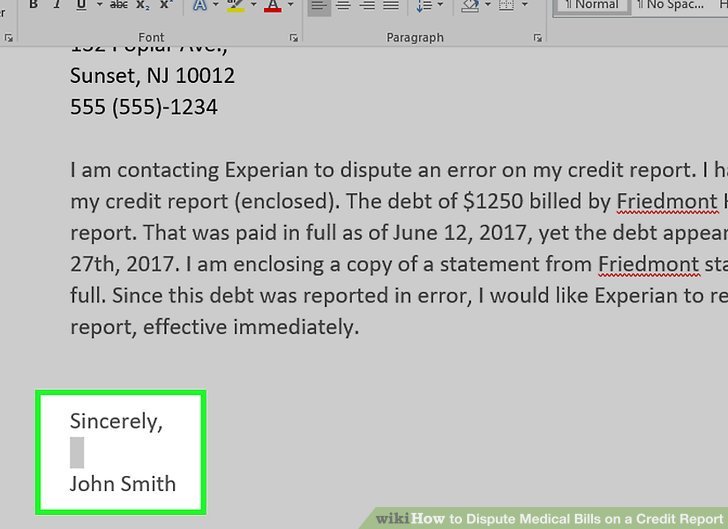

If you spot mistakes on your credit report, you should file a dispute with TransUnion within a week of receiving it. This will help TransUnion resolve the case as quickly as possible. You can file your dispute online, by mail, or by phone. For the reasons weve mentioned above, many people prefer to file a dispute by mail as theyre then protected by FCRA regulations. If you choose to use mail also, youll then have a paper trail to refer to.

To file a dispute via any method:

- Find your file identification number .

- Prepare copies of your drivers license and proof of address.

- Compile documentation for each item you are disputing. This can include:

- Copies of statements confirming payment of the debt

- Copies of any correspondence youve had with the creditor.

How To Dispute Transunion Reports Online

To file your dispute online, go to the TransUnion website dispute page and click Start Dispute. Youll then be prompted to log in or create an account. Once youve accessed your account, you can dispute one piece of information at a time. You can add more disputes on the Review page before submitting.

For each dispute, youll need to upload supporting documents. Youll also get to select the reason why you think the information is inaccurate and add comments.

Youll then see a summary of the dispute youre about to submit, which you should print for your own records. When done, click submit at the bottom of the page to submit your dispute. Be sure to complete your dispute in one go as the system will log you off if your screen is inactive for several minutes. At the time of writing, there was no feature to save an unfinished dispute in progress.

If you wish to dispute your social security number, date of birth, name, or address, youll need to do this via mail. TransUnion requires supporting documents on paper for these kinds of changes. You can, however, delete old phone numbers, addresses, or employers via the online portal.

You can also add a consumer statement to your report online. This is your opportunity to explain your financial situation in your own words. To do this:

If youre not able to access your consumer statement online, you can also update it via phone or mail.

Recommended Reading: Credit Score Needed For Affirm

Using A Medical Bill Advocate

Medical bill or patient advocates are people who understand the medical delivery system, explain it to you and negotiate for you. If you are overwhelmed with the complexity of the system or simply dont have time to unpack your medical bills or proposed charges, advocates can save time and probably money.

Patient advocates often focus on procedures you are contemplating or currently undergoing, while billing advocates can help you review, analyze and appeal bills.

You might have a relative with knowledge of healthcare who can help, but often advocates charge a fee. Some churches and nonprofit organizations also provide advocacy assistance.

If you have already received a medical bill and need help with unmanageable costs, you might want to hire a billing advocate. If you received treatment at a hospital, ask if the institution has advocates on staff. If not, consider hiring one that you know will put your interests first.

Advocates can save you hundreds, or even thousands, of dollars. Some work for an hourly fee, others charge a percentage of the money they save you usually 25% to 35%. Some charge less. You can find one by contacting the National Association of Healthcare Advocacy Consultants or the Alliance of Claims Assistance Professionals.

About The Author