What Credit Score Is Needed For A Va Loan

The VA does not set a credit score requirement for VA loans, however, most mortgage lenders will want to see a credit score of at least 620 FICO. Although some lenders are willing to go lower, borrowers can expect more scrutiny and lender requirements. Credit scores as low as 580 to 620 are generally required to qualify for a VA loan. There are, however, other options. A VA loan can even be approved with a as low as 500 if the borrower has sufficient residual income.

Contents

Why Your Credit Score Matters

Your credit score affects:

The higher your FICO Score the more likely you are to get approved for a or loan plus, itll usually reduce the interest rate associated with that particular loan or card. Lower scores can raise your interest rates significantly, or may even disqualify you for a product or service completely.

Loans

For many credit cards, especially the most lucrative rewards cards, the cards are only offered to consumers that meet a minimum credit quality. Many of the best cards are exclusively marketed to consumers with excellent credit scores. And when it comes to credit cards, your credit score can determine the breadth of options you can choose from. Most cards are also marketed with a range of interest rates and APRs. The actual interest rate on your specific card will be inversely related to your credit score with higher creditworthiness receiving lower interest rates and vice versa.

Loans

With mortgages and auto loans, lenders behave similarly. Your credit score is used as a component of whether or not a bank will choose to approve a loan or may force you to make additional concessions for approval. It can and generally will move the interest rate you pay on the loan as well.

What Credit Score Is Needed For A Va Home Loan

Veterans Affairs does not set a minimum credit score, however the majority of lenders will do their do diligence and check your credit score to minimize risk. There are other requirements other than credit score for VA loans. According to your military record, you must be eligible for a Certificate of Eligibility . VA generally applies this to:

- Veterans who have met minimum service requirements

- Members of the active military who have served a minimum amount of time

- National Guard and Reserve members

- The surviving spouses who are eligible

- Your new home must be your permanent residence. Investing is not allowed.

- You must meet underwriting requirements, including those for income and credit.

You May Like: Why Does My Credit Score Go Down

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

How Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person. But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game. The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

Also Check: Is 801 A Good Credit Score

How To Boost Credit Score

Building and maintaining credit health may take time, but the commitment is worth every moment spent. Here are the steps to consider:

- Pay all outstanding debts.

- Pay all bills on time to get a good credit history.

- Check and correct all credit score errors.

- Ensure all credit cards are open.

- Limit the urge to apply for additional credits.

- Keep the credit card balances at a minimum.

How Does A Credit Score Impact Home Buying

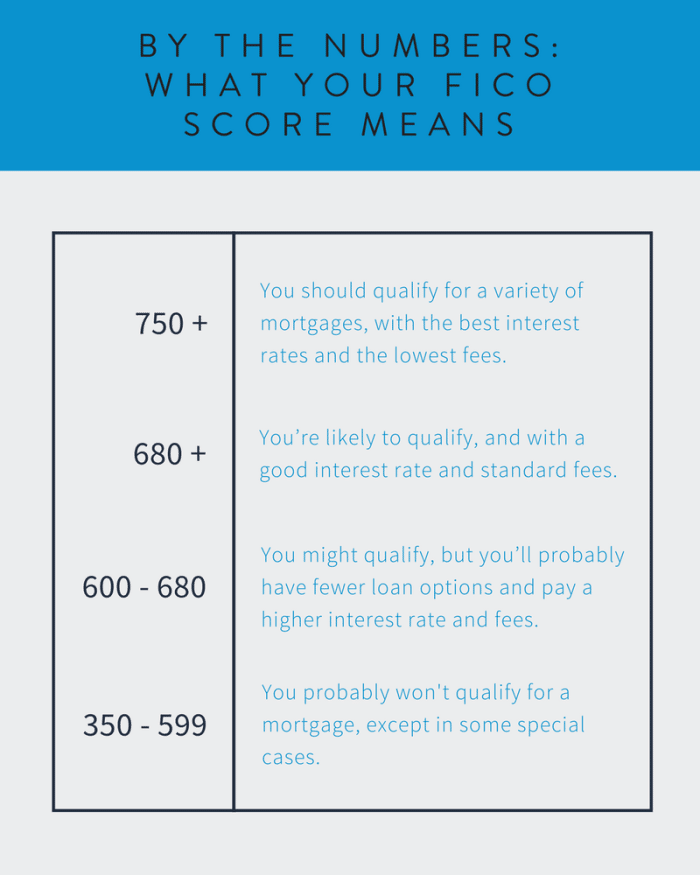

Mortgage lenders use your FICO Score to calculate interest rates and the fees youâll pay through the life of your mortgage. Itâs an important factor in determining what you can qualify for and how much youâll pay on top of the loan itself, but itâs not the end-all-be-all.

Lenders also assess your income, property type, assets, and debt levels to decide on a loan. Since those factors can all vary significantly, thereâs really no precise credit score you need to qualify for a loan. Still, there is good and bad.

Related: Do medical bills affect your credit when buying a home?

You May Like: How Much Does A Hard Inquiry Affect Your Credit Score

Whats The Minimum Credit Score You Need For A Home Loan In South Africa

In South Africa, lenders have different standards when it comes to credit scores. This means that there isnât a minimum credit score required to get a home loan. The majority of lenders in South Africa donât make their credit criteria public and they use different calculations to determine loan eligibility.

- : Although it is unlikely that individuals with this credit score will be able to qualify with the big banks or lenders for a home loan, there are still opportunities to find lenders to assist. Unsecured loans from a second-hand lender may be a viable option for this minimum credit score bracket.

- : Usually, a credit score in this range is considered a risk to mortgage lenders as itâs related to negative lending aspects in credit history. This could mean trouble finding a loan with a low-interest rate and may it result in a larger deposit.

- : Securing a personal loan with this credit score will be quite easy. However, a larger deposit may be required for a large loan amount with a bank or big lender.

- : This is considered a good credit score. The majority of lenders will consider applications with this score and theyâre generally labelled âcreditworthyâ.

- : This is one of the highest credit score ranges, making borrowers in this range much more likely to qualify for a loan. Those who are in this credit range may also be entitled to lower interest rates.

What Exactly Is A Conventional Mortgage

Mortgage loans that are not granted or insured by the FHA, VA, or USDA are referred to as conventional loans .

Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association support the vast majority of conventional loans . The cost of borrowing is reduced since the loans are guaranteed against default by government-sponsored companies.

Private conventional loans are preferred by stronger borrowers over Federal Housing Administration loans. One group of borrowers who are exempt from this rule is those who, because of their military service or rural residency, are eligible for a VA or USDA subsidized loan.

Don’t Miss: Is 656 A Good Credit Score

What Do Mortgage Lenders Consider A Bad Credit Score

What constitutes a bad credit score will vary between mortgage lenders. But, as a rule of thumb, the FICO scoring model considers scores beneath 580 to be poor or bad.

- Below 580: Bad credit

- 580 to 669: Fair credit

- 670 to 739: Good credit

- 740 or above: Excellent credit

Still, some home buyers may qualify for a home loan with scores as low as 500, depending on the loan program.

An Excellent Very Good Or Good Credit Score Means Your Score Shouldn’t Impact Your Chances Of Getting A Loan Once You Get Below That You Need To Make Some Financial Changes

Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it!

How does your credit score affect your chances of getting a home loan? Lenders in Australia dont make their credit criteria public, and most lenders also dont rely credit score alone to determine your level of credit risk. That said, the higher your credit score, the better your chances of getting loan approval.

You May Like: How Long Does Ch 7 Stay On Credit Report

Other Considerations For Your Mortgage Approval

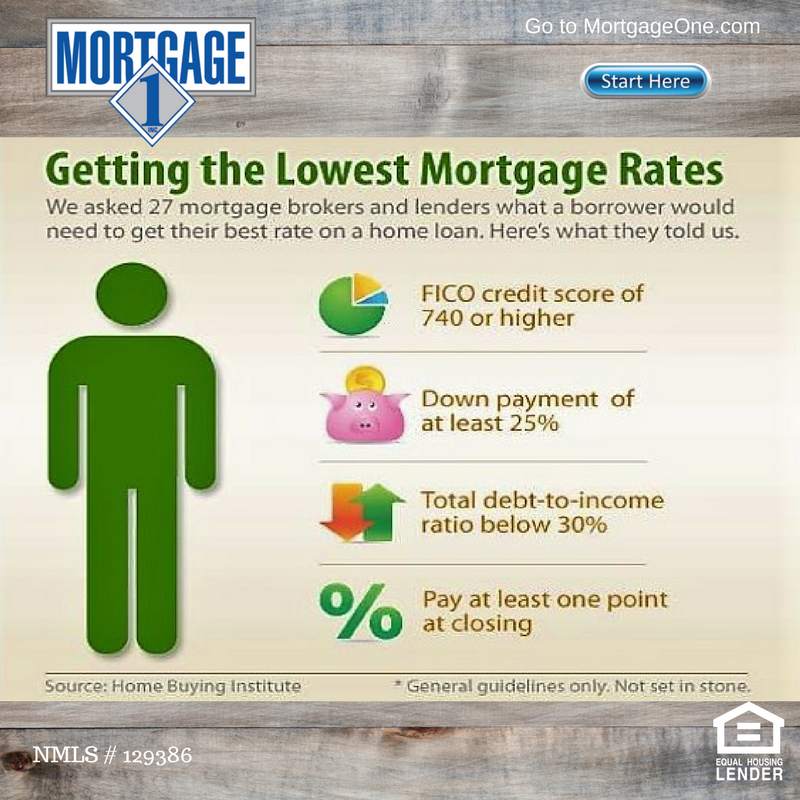

Your credit score isnt the only thing lenders look at when determining if you qualify for a mortgage. Other key factors include:

-

Debt-to-income ratio : This calculation, written as a percentage, lets lenders know if you can handle taking on additional debt. DTI compares all your monthly loan payments to the pre-tax, or gross, amount you earn every month . The lower, the better: Ideally, your DTI should be below 36% to qualify for the best mortgage options.

-

Loan-to-value ratio : This measures how much money youll owe on the loan compared to what the house is worth. A lower LTV makes you less risky to lenders. To bring down the LTV, make a larger down payment.

-

Income and employment history: Most lenders will verify your employment and see if youve been earning a steady income for the past two years. These are key indicators that youll be able to repay your loan. However, if youre retired or not actively working, your lender will ask for other forms of proof that you can make your monthly mortgage payments.

-

Savings and assets: Lenders also look at your overall net worth, such as your cash savings, retirement accounts, investments and other assets. This helps determine how long you could continue to make payments if you lost your main source of income.

» MORE: How to get a mortgage preapproval

What Is A Good Credit Score To Buy A House

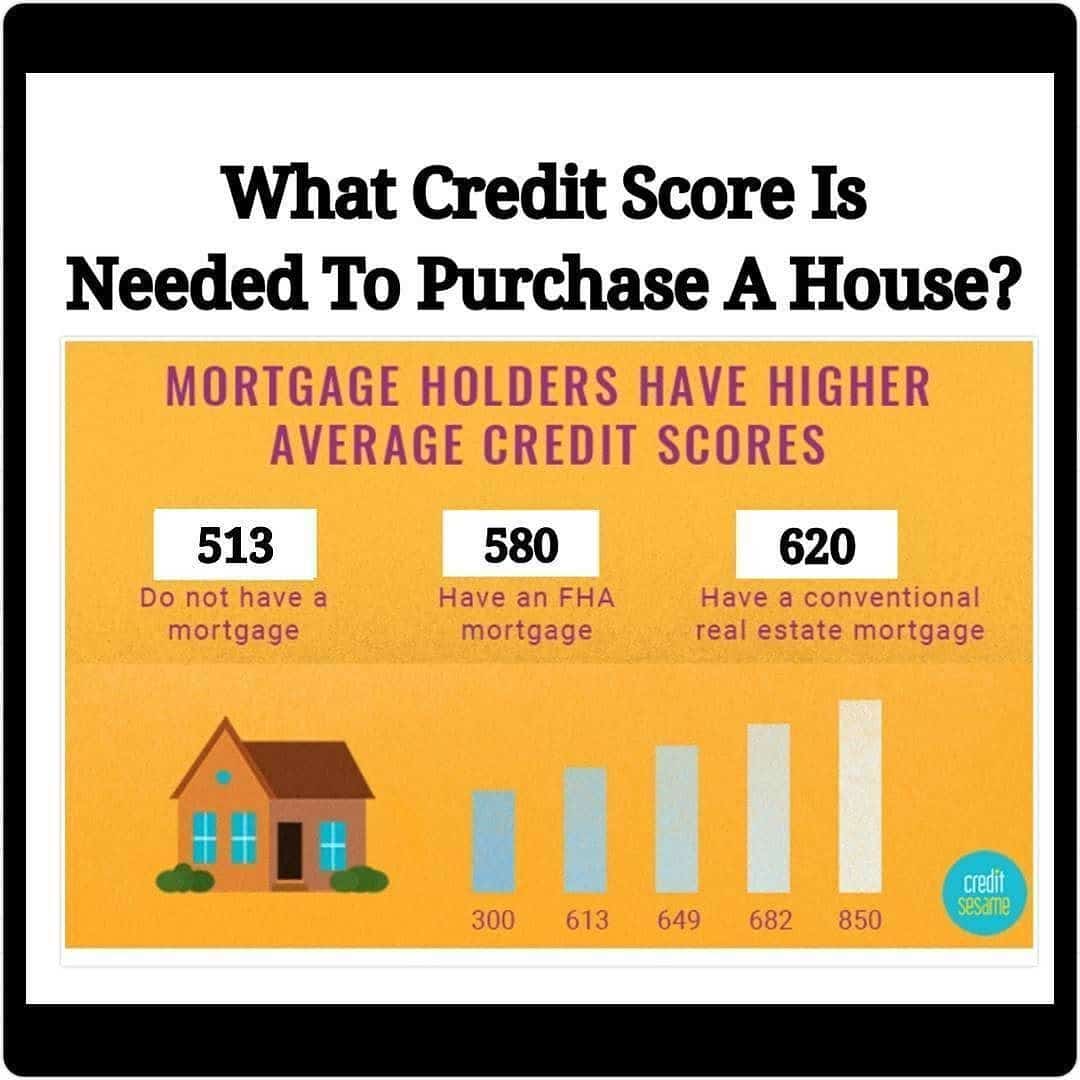

In general, a good credit score to buy a house is 620 or higher. If you have a credit score of at least 620, you qualify for nearly all of the most common mortgage loan types, however, if you do not have a good credit score you may want to search into how to build my credit score so you are able to eventually buy your house.

This is why those looking to buy a house really need to know their credit score. Its also important to learn how the minimum qualifications differ for each loan type. Here are the typical minimum credit scores for each type of mortgage loan:

- Conventional Loan: 620 or higher

- FHA 203K Loan: 620 or higher

- VA Loan: 620 or higher

- USDA Loan: 640 or higher

- FHA Loan: 580 or higher

Its important to note the credit standards listed above are generally considered the minimum for securing a home loan. The better your credit score, the better interest rate you will receive on your mortgage, saving you money in the long run. Here is the general impact of credit scores on mortgage interest rates:

But lenders dont make decisions based on your credit score alone. In reviewing your mortgage application, theyll also consider your income, debt, assets, employment and your ability to pay a down payment. Again, mortgage lenders are looking at the big picture, so its never about just one factor.

Also Check: Can You Buy A House With A 620 Credit Score

Bottom Line On Credit Score Needed To Buy A Home

Theres no universal credit score youll need to buy a house, as score requirements differ based on the type of loan youre applying for. At a bare minimum, youd want a score around 620, unless youre going for a FHA. And, as a general rule, the higher your score is, the easier it will be to qualify for a mortgage. Thats why its essential to improve your credit score for better mortgage rate offers from lenders.

The Bottom Line: Lenders Set Their Own Credit Score Requirements For A Va Loan

The VA doesn’t have a minimum credit score. Instead, lenders can set their own requirements. At Rocket Mortgage, the minimum qualifying credit score is 580. Keep in mind, you can qualify for more favorable terms with a higher score. And, one good thing about the VA guarantee is it gives lenders a chance to help more borrowers who may have less-than-perfect histories.

If you would like to get started with a purchase or refinance, you can apply online today. You should also feel free to give us a call at 326-6018.

1 Rocket Homes is a registered trademark licensed to Rocket Homes Real Estate LLC. The Rocket Homes logo is a service mark licensed to Rocket Homes Real Estate LLC. Rocket Homes Real Estate LLC fully supports the principles of the Fair Housing Act.

For Rocket Homes Real Estate LLC license numbers, visit RocketHomes.com/license-numbers.

California DRE #01804478

Save money on a VA loan today!

Lock in your low interest rate with a fast, online approval.

Don’t Miss: How Many Points Does A Mortgage Raise Your Credit Score

Benefits Of An Fha Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify.

- Competitive Interest Rates You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Lower Fees In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

- Bankruptcy / Foreclosure Just because you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

How Your Credit Score Is Calculated

Learn what your credit score is based on and the many ways you can improve it.

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Score, its a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. By understanding what impacts your credit score, you can take steps to improve it.

You May Like: What Is Thd Cbna On Credit Report

You May Like: What Credit Score Do Apartments Look For

Can I Get A Mortgage With A Low Credit Score

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as your DTI ratio, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

Pay Down Credit Card Balances To Below 30 Percent Of Your Credit Limit

Your credit utilization ratio is the amount of debt you have compared with your available credit. To calculate this, divide the amount of debt into the amount of available credit.

If you have $10,000 in debt and $20,000 in available credit, for instance, your credit utilization ratio is 50 percent. Lenders like to see credit utilization of 30 percent or less.

Don’t Miss: How Far Back Does A Credit Report Go

Requirements For A Conventional Loan

There is a wide variety of lending programs available for conventional mortgages, and each has its own set of guidelines and standards to meet.

While this is the case, there are a few universal criteria that are used by all loan programs to evaluate applicants. Before you start looking for a mortgage loan, its important to have a firm grasp of these ideas.

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lenders decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used.

- Excellent: 800850

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit that you take out.

A persons credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers scores, especially when deciding whether to change an interest rate or on a credit card.

What Is A Credit Score?

Recommended Reading: How To View My Credit Score