How To Improve Your Credit

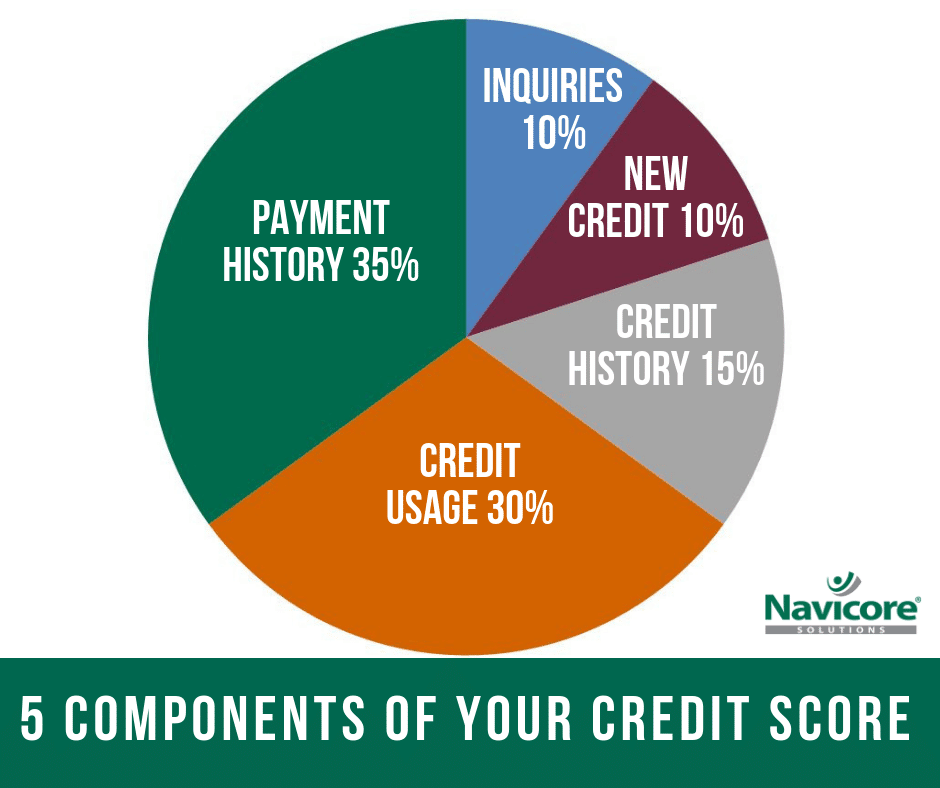

What does your credit score measure? In one word: creditworthiness. But what does this actually mean? Your credit score is an attempt to predict your financial behaviors. That’s why factors that go into your score also point out reliable ways you can build up your score:

-

Pay all bills on time.

-

Keep credit card balances under 30% of their limits, and ideally much lower.

-

Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. Space out credit applications instead of applying for a lot in a short time.

There are several ways to build credit when you’re just starting out, and ways to bump up your score once it’s established. Doing things like making payments to your credit card balances a few times throughout the month, disputing errors on your credit reports, or asking for higher credit limits can elevate your score.

How To Stay On Top Of Your Credit Score

First, keep track of your credit regularly for unexpected changes. As mentioned above, you may be able to do so through your banks or credit card provider, and federal law requires each of the three nationwide credit bureaus to provide one free credit report per year.

Second, set up automatic payments, through online bill pay, to help ensure all your bills are paid on time. Every missed or late payment can have an impact on your credit. Setting up automatic payments helps eliminate human error from the bill payment process while saving time and avoiding late fees.

Finally, use credit smartly. Dont max out your credit cards, and dont apply for credit you dont need. Manage how much of your credit line you use and, if possible, make additional payments to reduce how much of your credit line youve used.

Apply For An Unsecured Credit Card

Unlike a secured card, an unsecured credit card has a starting credit limit based on factors like your credit score and income. Your interest rate and approval odds are also based on your score. Because of this, this option is best for those with some credit history and good credit.

Best Unsecured Card for No Credit

The best credit card for students or borrowers with no credit is the Discover It Student Cash Back card. It offers up to 5% cashback and doesnt have an annual fee.

Recommended Reading: Does Cancelling Credit Card Affect Credit Score

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

When Is My First Credit Score Created

Your credit score wont just randomly appear once youre old enough to apply for credit. You have to actually have a line of credit in your name to start generating a score. Once youve opened a line of credit typically your first credit card your credit score will begin to be calculated. This usually happens within six months.

Contrary to popular belief, your credit score doesnt start at zero. The lowest scores start at around 300, but its unlikely that youll start this low, either. The main factor that could negatively impact your credit score when youre first establishing credit is the length of your credit history, which will likely be very short. But fear not after a few years of smart money management, you could be on your way to a good or even excellent credit score.

Recommended Reading: How To Get A Debt Collection Removed From Credit Report

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, one way to potentially improve improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows may be able to responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

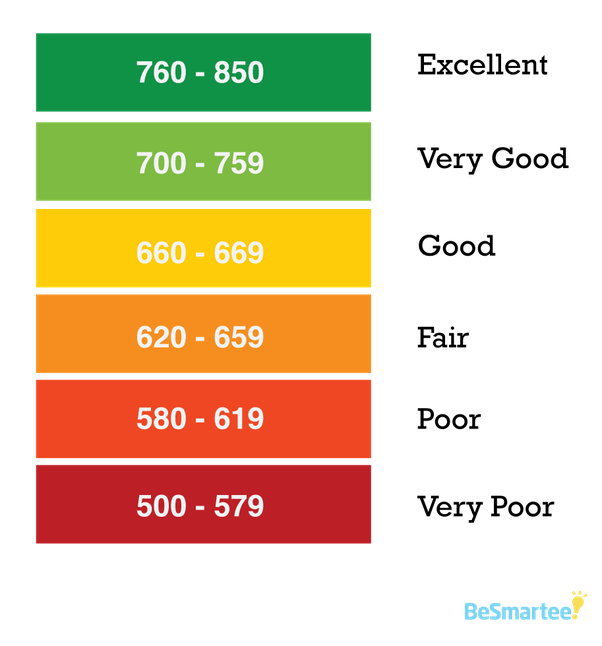

Vantagescore Credit Scoring Model

The original VantageScore credit scoring model ranged from 501 to 990. The current models, VantageScore 3.0 and 4.0, now follow a scoring model more similar to FICO:

- Excellent credit score: 781 850

- Good credit score: 661 780

- Fair credit score: 601 660

- Poor credit score: 500 600

- Very poor credit score: 300 499

The same factors that affect your FICO score also impact your VantageScore. However, VantageScore ranks each factor based on how influential it is to your overall credit. For example:

- Most influential

- Length of your credit history: Less influential

- New credit: Less influential

To get a VantageScore, you must have at least one account of any age reported.

How to Get Free Credit Scores

You can get your FICO or VantageScore for free from various financial institutions and major credit card issuers. This includes Discover, Capital One , Citibank and Ally Bank. You can also access your credit score through Credit Karma. Also, you can monitor your score through MyFICO.com for a small fee or request it from the credit bureaus.

Recommended Reading: What Happens When You Report Fraud On Your Credit Card

Challenges Of Having No Credit

If you dont have credit, it could prevent you from qualifying for things like:

- Financing for a mortgage, credit card, auto loan, personal loan, etc.

- Apartment rental since most leasing agents and property owners will run a credit check

- Better interest rates and loan terms

Try to establish some kind of positive credit history as soon as possible. That way, youll be prepared for any major life events that require financing.

Your Credit Score Doesn’t Start At Zero

Starting with no credit score doesn’t mean your score is zero. Rather, your score simply doesn’t exist. That’s because your credit score is calculated only at the moment that a lender, credit card issuer or other entity requests it to check your creditworthiness. If you haven’t yet built a credit history, there’s no information on which to base that calculation, so there’s no score at all.

Once you begin to establish a credit history, you might assume that your credit score will start at 300 . But it’s highly unlikely your first credit score will be that low, unless you start off with very poor credit habits. Nor will your first credit score be the highest level . When you’re new to using credit, you simply don’t have a robust enough credit history to earn the highest score.

You May Like: How To Make Credit Score Go Up

What Your Starter Credit Score Can Tell You

Once youve pulled your free credit report and know what your score is, heres what you can learn about your current financial information:

- Your Credit Performance: Though establishing credit early on is usually a good thing, youll definitely be able to identify if and why you have a low starting credit score. Because your credit file will be so thin, any errors on your part will be obvious.

- A Check for Identity Theft: If you know that you havent been actively establishing credit over the past few months, yet you see on your report that you have a low credit score, you might have a case of identity theft on your hands. Make sure to double-check your report before jumping to any conclusions, though.

- What Financial Benefits You Can Get: The main reason youll want to keep track of your credit score is that it affects the types of financial benefits you can qualify for, such as certain loans, credit cards and apartments. For example, most landlords wont rent luxury apartments to tenants with anything below a 700 credit score.

What Are The Consequences Of Having A Poor Credit Score

A bad credit score means you’ll be less likely to be approved for credit cards or loans, and the products you will have access to will usually offer less favorable terms, like high interest rates or annual fees.

But fear not â bad credit doesn’t last forever. By using credit rebuilders â like secured credit cards, low-limit credit cards, and credit-builder loans â you can start rebuilding your credit in a matter of months.

Recommended Reading: How To Obtain A Free Credit Report

Starter Credit Score And Insufficient Credit History

If a lender refuses your application based on insufficient credit history, it just means that your accounts arent old enough to satisfy their requirements. Most lenders want to see a detailed history of credit repayments and building credit, and a few months simply isnt long enough to prove your reliability .

The best way to improve your standing is to continue to be responsible with your finances and credit. If you dont have a credit card, you could consider opening one new line of credit and paying it off every month to demonstrate your financial trustworthiness.

5 Ways to Improve Your Starting Credit Score

The good news is that improving your credit score and building credit is fairly simple, and you can see significant improvements in under a year. Here are a few ways you can take responsibility for your credit and improve your credit score:

What Is A Bad Credit Score Range

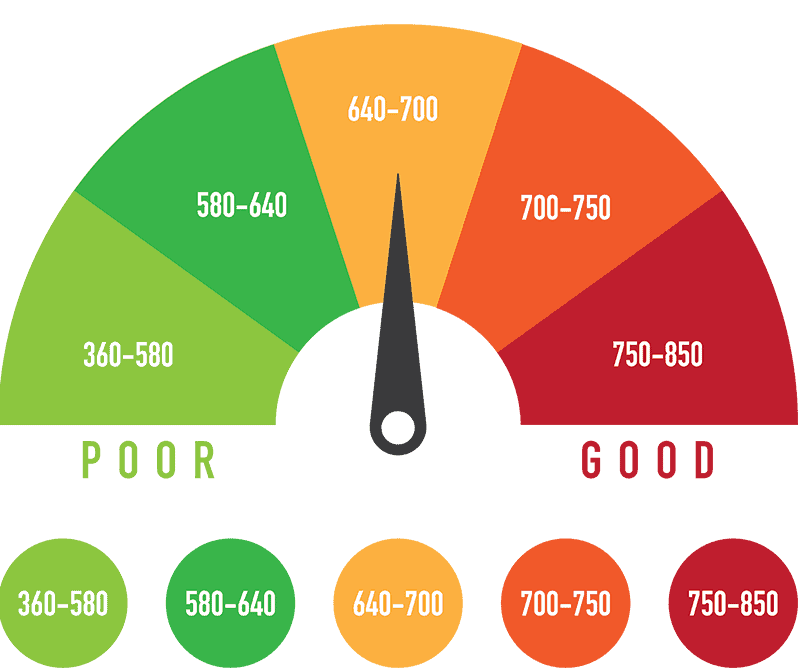

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Read Also: Does Paying Off Collections Help Credit Score

How To Maintain Your Good Credit Score

Once you build or improve your credit score, the next step is to maintain it. Keeping your credit score above 670 will make your life easier in many ways. To ensure it stays in the good or excellent range with minimal surprises, you’ll want to start developing these simple habits:

- Tip 1: Pay bills on time and in full

- Tip 2: Maintain a low credit utilization rate

- Tip 3: Limit new credit applications

Become An Authorized User On A Family Members Account

If someone in your family has good money management habits and a high credit score, ask to become an authorized user on their account. This will add the account to your credit history and give you access to their credit card. As long as you and the account owner use the card responsibly, you can build credit.

Some card issuers charge a small annual or service fee, but becoming an authorized user is usually free. Check with the issuer about their policy.

Don’t Miss: What Is My Business Credit Score

What Affects Your First Credit Score

When someone is building their credit, there are a few situations that might determine what their credit score will be its important to make sure you understand certain situations when you are looking at applicants with fresh credit scores.

1: Short History and Few Accounts

If someone only has one account open, that means they have a short history to pull data from. This means they will most likely have a relatively low credit score. Even if they have been making payments on time and have no negative behavior, they may pull a mid-range score because there is insufficient data to project a higher number. Essentially, there is uncertainty someone will keep paying on time when there has only been a short amount of time to analyze their behavior.

2: Short History and Poor Payments

If someone starts their credit history with missed payments or other negative factors, they can start with an extremely low score. With a short history and missed payments, the forecast of how that consumer will behave moving forward is considered negative.

3: Young Age and High Credit Score

Can I Have A 300 Credit Score

Even though you dont start at 300, you can have a credit score that low if you dont practice smart credit habits. People with multiple collection accounts, repossessions and bankruptcies on their credit reports could find themselves in this range.

If youre currently credit invisible, it doesnt take long to get a credit score perhaps even a very good score.

Also Check: What Credit Score Do You Need To Refinance A Car

What Credit Score Is Needed To Buy A House

The credit score you need to qualify for a mortgage depends on the type of mortgage youre after and the lender in question. While it is possible to get a mortgage with fair/average or no credit history, you stand to get the best terms if you have good to excellent credit.

For conventional loans, you would need a credit score of 620 or higher. You might qualify for a Federal Housing Administration loan if your credit score is 500 or higher. The minimum credit score required to apply for a United States Department of Agriculture loan is 580, although lower scores might qualify in some scenarios. While Veterans Affairs loans come with no minimum credit score requirements, it is common for providers of such loans to look for scores of 620 or higher.

How To Build And Maintain A Good Credit Score

Once you have a credit score, how can you help maintain or improve it? First, you need to understand what is considered a good credit score. Both the FICO® Score and VantageScore models range from 300 to 850. Using the FICO scoring model, a score 670 or higher is considered good and a score of 800 or above is considered exceptional. A VantageScore 661 or above is considered good while a score 781 or above is considered excellent.

The higher your credit score, the more likely you are to be approved for loans or credit at the best rates and most favorable terms. The lower your credit score, the more difficult it will be to get a credit card, obtain favorable terms on a loan or even rent an apartment.

Whether you want to improve your credit score from good to excellent or you’re trying to raise your poor credit score to the fair range, there are plenty of things you can do right away to build credit history and improve your credit score.

Don’t Miss: Why Is Credit Score Important

Free Annual Credit Report

As a result of the FACT Act , each legal U.S. resident is entitled to a free copy of his or her from each credit reporting agency once every twelve months. The law requires all three agencies, Equifax, Experian, and Transunion, to provide reports. These credit reports do not contain credit scores from any of the three agencies. The three credit bureaus run Annualcreditreport.com, where users can get their free credit reports. Non-FICO credit scores are available as an add-on feature of the report for a fee. This fee is usually $7.95, as the FTC regulates this charge through the Fair Credit Reporting Act. The FTC tracks various scams and reports on other sites that provide fake credit reports or charge fees for their services. Instances of illegal behaviors by credit report services have been settled in court such as that of Experian Consumer Direct that was charged with deceptively signed people up for credit report monitoring services that charged them monthly fees.

How Do Credit Score And Credit Limit Relate

Lenders view your credit score as a measure to gauge the risk you pose as a borrower. If a lender looks at you as someone with minimal risk, it might be willing to offer you a higher credit limit than it would have if you had less-than-perfect credit. You might qualify for a higher credit limit than someone with the same income if you have a better and longer credit history that results in a higher credit score.

Your , on the other hand, may have an effect on your credit score through your credit utilization ratio. This refers to the amount youve borrowed from your total available credit and should ideally be 30% or lower. If you have a total available credit limit of $10,000 through different credit products and have borrowed $5,000 so far, your current credit utilization ratio stands at 50%, which is significantly higher than the desired limit.

You May Like: Does Free Credit Report Work