What Are Your Financing Options

Any lender, whether a bank or credit union will be happy to get your business and will offer you a variety of loan products for your financing needs. Whether you need a boat loan, car loan, RV loan, small business loan, or any mortgage, you won’t meet any serious hurdles due to the excellence of your credit score.

The Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 801 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Age Of Accounts Matters

Across all age groups, the average person with excellent credit has more than 20 years of credit history. The longer a borrower has held onto an account in good standing, the more positive the impact on their credit score. Even millennials, the youngest generation included in LendingTree’s analysis, have an oldest active account of nearly 15 years.

You May Like: What Is The Highest Credit Score Possible

Importance Of Higher Credit Scores

While having a credit score of 800 seems lofty, even scores in the 700s can help home buyers get lower mortgage rates.

Many loan programs have a minimum credit score requirement to get approved for a mortgage. For example, most lenders will require a credit score of 580 to get approved for an FHA loan. Other programs, like USDA mortgages and conventional loans, will require scores of at least 620.

Even though aspiring borrowers only need the minimum amount, a credit score thats well above the minimum requirement can save you money and stress. Your credit history isnt the only criteria that mortgage lenders consider when determining your interest rate, but its a big one.

Your mortgage rate will be determined by the size of your down payment, your debt-to-income ratio, current mortgage rates and your credit score.

For example, a potential homeowner with a credit score of 760 who is planning on making a down payment of 20 percent will have a lower mortgage rate than someone with a score of 620 putting down 10 percent.

The size of the mortgage rate you can get depends on other factors as well, but keeping a high credit score is the best way to ensure buyer-friendly rates.

Youll Qualify For Lower Interest Rates And Higher Credit Limits

With an 800-plus credit score, you are considered very likely to repay your debts, so lenders can offer you better deals. This is true whether youre getting a mortgage, an auto loan, or trying to score a better interest rate on your credit card.

In general, youll automatically be offered better terms on a mortgage or car loan if you have an exceptional credit score . If you have an existing loan, you might be able to refinance at a better rate now that you have a high credit score. Like any refi, crunch the numbers first to make sure the move makes financial sense.

Credit cards are different, and you might have to ask to get a better deal, especially if youve had the card for a while. If your credit score recently hit the 800-plus rangeor if youve never taken a close look at your terms beforecall your existing credit issuers, let them know your credit score, and ask if they can drop the interest rate or increase your credit line. Even if you dont need a higher limit, it can make it easier to maintain a good .

Don’t Miss: When Does Chapter 7 Drop Off Credit Report

Protect Your Exceptional Credit Score

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

85% of identity theft incidents involve fraudulent use of credit cards and account information.

A credit score monitoring service is like a home security system for your score. It can alert you if your score starts to slip and, if it starts to dip below the Exceptional range of 800-850, you can act quickly to try to help it recover.

An identity theft protection service can alert you if there is suspicious activity detected on your credit report, so you can react before fraudulent activity threatens your Exceptional FICO® Score.

Upgrade To Better Credit Cards

Some people like the status quo, sticking with the same cards they first opened in their early 20s. While thats great for length of credit history purposes, you could be missing out on big rewards and benefits especially with a soaring score.

Excellent credit scores will qualify you for the latest rare metal or expensive jewel-named cards whether its platinum or diamond or black, says Rod Griffin, director of public education for Experian, one of the three major credit bureaus. To see which cards you now qualify for, use CreditCards.coms CardMatch tool. By inputting a few key details, CardMatch will pull up card offers based on your credit standing and no hard inquiries are generated.

Beyond the prestige, there are VIP perks that you can unlock, says Michael Foguth, founder of Foguth Financial Group, a Michigan-based retirement planning firm. These cards allow you into exclusive lounges in the airport, access to your own concierge, free breakfast in hotels and more, he says.

You May Like: How To Get Credit Rating Of A Company

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

How Is Credit Score Calculated

The criteria used by agencies like bank, bureau, and others financial institutions are all different but they still follow a regular pattern. The first and foremost thing that stand to be the major determinant of a good or a poor credit score is the credit history.

- How long you have been taking credit?

- How frequent you take credit?

- The limit of credits you take?

- Have you been missing payments at its due time?

- How the late payment interest has been affecting you?

- Are you having more than one unsettled credit together at some point?

- Do you have things worthy of collateral if you cannot meet up with the credit any longer?

If you have a good credit history, the easier and better it will be for creditors, banks and other financial institution to grant you another credit and all together the better your credit score will be.There may not be a general way of calculating a credit score but it is a general procedure that is used in calculating credit score.

Your credit report is used to generate your credit score but it is relieving to know that there are various software that can also calculate your credit score. Both offline and online free apps though some are not free.

Also Check: How To Check Your Real Credit Score

What Does An 801 Credit Score Mean

A credit score of 801 means that your credit reports show that you always pay your bills on time. It indicates to lenders that youre a very low-risk borrower. An 801 credit score is in the highest score bracket in both of the two major credit scoring models in the US , and its well above the national average.

An 801 credit score is very far from the lowest credit score of 300, and its very close to the highest credit score of 850. Your score is good enough to get the best terms on loans and lines of credit from the vast majority of lenders.

To put your score of 801 into context, heres how it compares with the average for various generations:

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Read Also: How To Rebuild Your Credit Rating

How Is My 801 Credit Score Calculated

Lenders need to judge if you’re a credit-worthy individual before they give you a loan or whatever financing you need. That is where your credit comes in handy. Most lenders look at your FICO score, since it is the most widely used credit score, to determine your credit-worthiness. The specifics of how FICO calculate the score are not known, but it all boils down to the information on your credit report. Your credit report is made up of the following components: payment history , the amount owed , the length of credit history , new credit , and types of credit used .

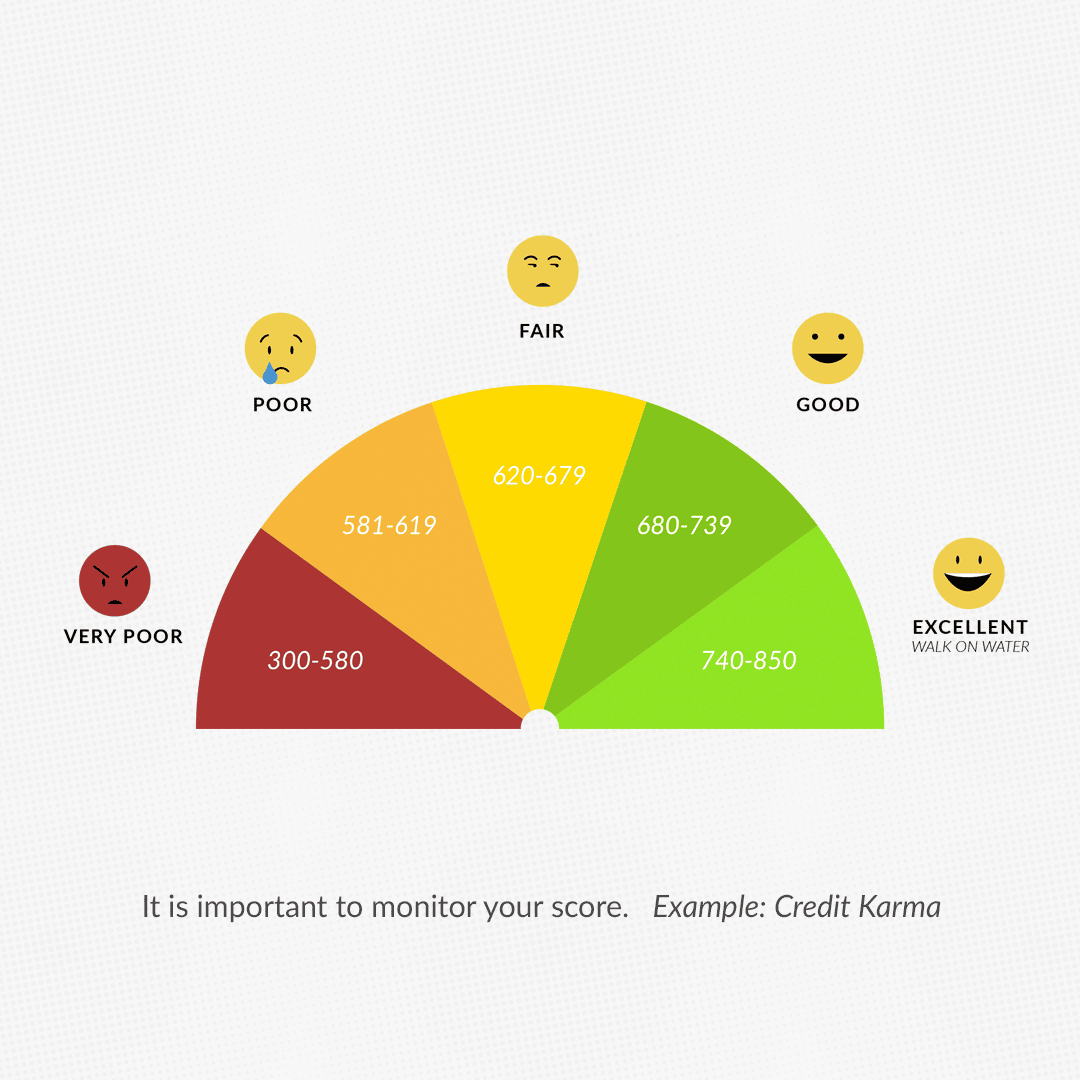

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

Recommended Reading: Do Hard Inquiries Affect Your Credit Score

The Credit Score Needed To Buy A Car

According to Investopedia, the average credit score you will need to purchase a car is 661 and above15.

You may be able to find financing options with a bad credit score, but you will generally need a cosigner or more money to put down towards your car loan when you have bad credit since you are a nonprime or subprime borrower.

You should also consider the role insurance scores play in your car buying journey as credit scores help insurance companies assess risk when you apply for insurance. Make sure your credit score is correct with Experian or other bureaus before you apply for insurance.

What Does Not Count Towards Your 801 Credit Score

There are many things that people assume go into their 801 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Read Also: Why Is My Credit Score Not Going Up

Monitor Your Credit Score

Make sure to check your credit score regularly. Many popular provide you with an updated credit score every week, along with an analysis of why your score might have changed. Learn what is likely to raise your score and what is likely to lower it, and avoid anything that might bring your credit score down.

What Is A Respectable Credit Score

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. … Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent.

Recommended Reading: What Day Does Capital One Report To Credit Bureaus

How To Improve Your 801 Credit Score

A FICO® Score of 801 is well above the average credit score of 714. It’s nearly as good as credit scores can get, but you still may be able to improve it a bit.

More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range . A Very Good score is hardly cause for alarm, but staying in the Exceptional range can mean better chances of approval on the very best credit offers.

Among consumers with FICO® credit scores of 801, the average utilization rate is 11.5%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

Recommended Reading: How Do You Find Out What’s On Your Credit Report

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Preparing Your Credit Report

If youre getting ready to apply for a home loan, you should request your credit report from the major credit bureaus. This will give you a chance to rectify any mistakes in your payment history.

While going through the home buying process, dont make any big purchases or open new credit cards. This can also be a good time to increase your available credit to improve your credit utilization ratio. Be sure to communicate with your lender on how to improve your credit score.

Every little change can matter to your mortgage application. Excellent credit can mean a lower interest rate, which can save you thousands of dollars over the life of your mortgage loan.

Lee Nelson

MyMortgageInsider.com Contributor

Also Check: What Is A Charge Off Account On Credit Report