Why Your Credit Score Is Important

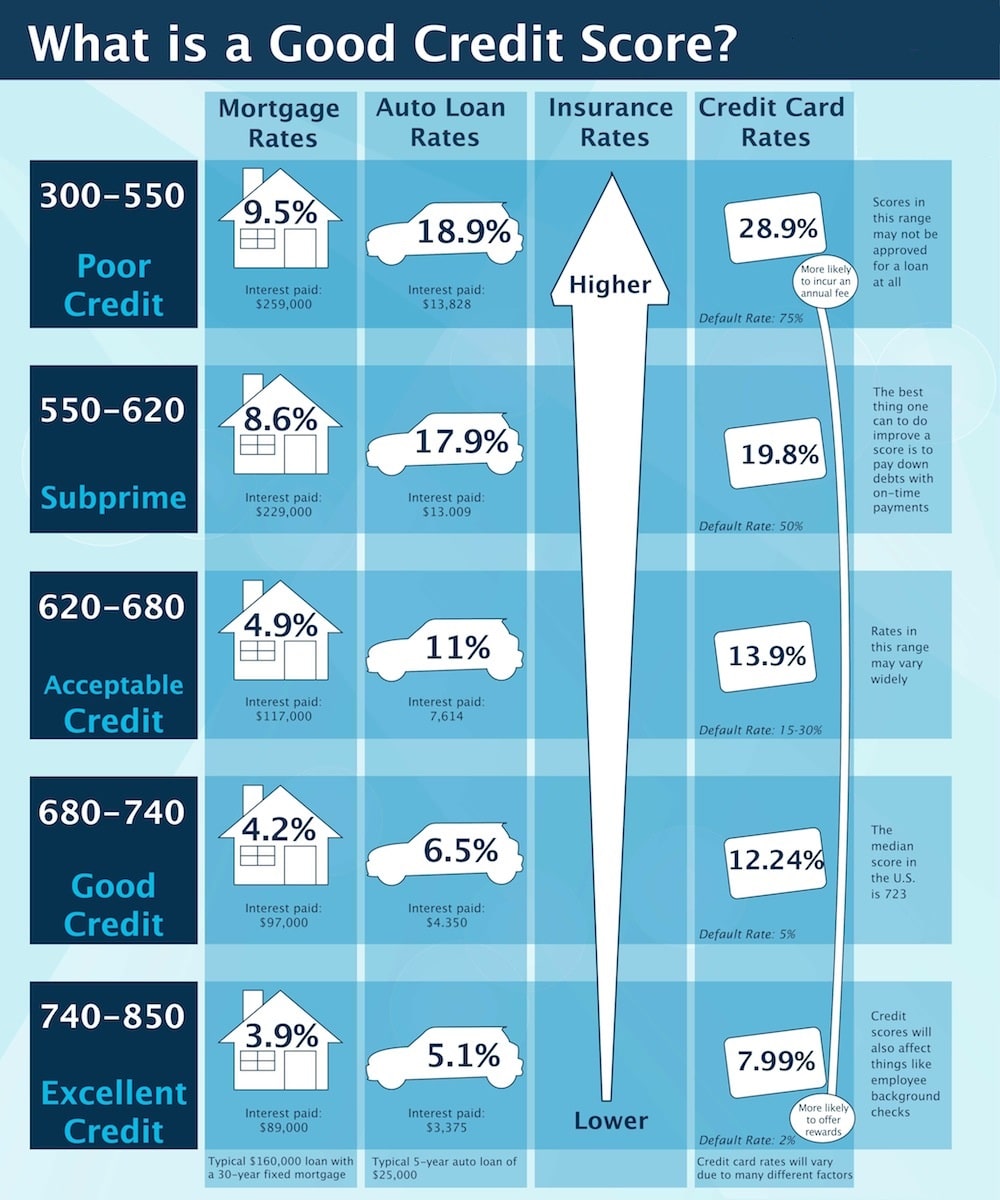

Your is important because lenders use this three-digit number to determine how risky of a borrower you may be. The higher your credit score is, the greater your chances are of qualifying for a loan and securing the best interest rate. Typically, the best rates and loan terms are reserved for people who have good credit .

During your lifetime, a good credit score can help you save a ton of money in interest. It can also help you avoid some fees. For example, if you took out a personal loan, a high credit score could help you avoid personal loan origination feesfees charged to process the loan.

However, If you have a bad credit score or minimal credit history, you might not meet a lenders minimum credit scoring requirements. This can prevent you from getting access to the cash you need. You most likely would need to apply for a loan with a co-signer or co-borrower to qualify, or you can explore bad credit personal loans.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

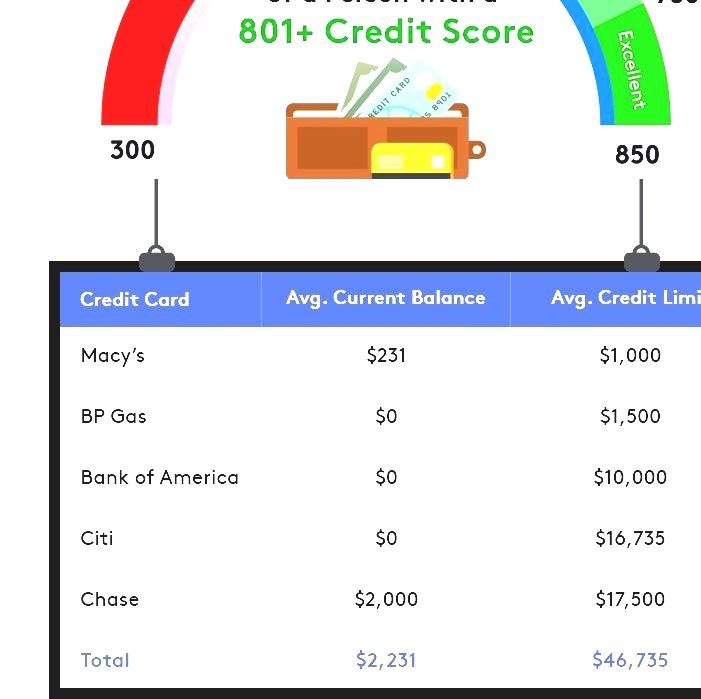

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Platinum Card From American Express

The Platinum Card® from American Express commands an impressive status. It goes well beyond the basics to provide a worthwhile card to those looking for luxurious perks. And you wont have to wait to start making purchases. Instead, an Instant Card Number gives you the ability to start buying immediately after approval. You can use the card number for online purchases or add it to your digital wallet.

- Bonus: Earn 100,000 Membership Rewards Points after spending $6,000 on purchases in the first six months.

- Rewards: Earn 5x points on flights and prepaid hotels booked through American Express Travel.

- Perks: $200 airline fee credit $15 Uber credit every month $200 hotel credit $240 digital entertainment credit $155 Walmart+ credit unlimited Boingo WiFi access 24/7 Premium Global Assist Hotline premium roadside assistance get a fee credit for Global Entry or TSA Precheck access up to 1,100 airport lounges, $189 credit with CLEAR membership $100 annual statement credit for purchases at Saks Fifth Avenue

- Annual fee: $695

Don’t Miss: Does Rent A Center Report To The Credit Bureau

Is It Possible To Get A Perfect 850 Credit Score

An 850 credit score is possible, though only a small percentage of Americans have a score this high. Reaching an 850 credit score comes down to how you use credit. Paying on time, keeping credit utilization low, having older credit accounts, and limiting how often you apply for new credit can help you to get closer to the perfect score range.

Dont Apply For Credit Too Often

When you apply for a loan, a lender pulls your credit, which causes a hard credit inquiry to show up on your report. This inquiry remains on your report for up to two years. According to FICO, each new hard credit inquiry can lower your score by up to five points. Although the impact of this type of credit check lessens over time, it could keep you from having a perfect credit score.

Recommended Reading: Do Tax Liens Fall Off Credit Report

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

Recommended Reading: What Credit Score For Home Loan

Central Minnesota Credit Union

Category: Credit 1. Central Minnesota Credit Union Changes Its Name | KNSI Central Minnesota Credit Union is now Magnifi Financial. Its membership has grown to include North Dakota, central Minnesota, the Twin Cities, Central Minnesota Credit Union , a member-owned financial services cooperative, announced that it is changing its name

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Recommended Reading: How To Raise Credit Score Without Credit Card

How Do You Check Your Credit Score

You can check your credit score from many sources, including Experian. Learning what your credit scores mean and what affects them can help you when you’re getting ready to apply for new credit.

Lenders use credit scores to decide how likely it is you will repay your debts on time. There are hundreds of credit scoring models in existence, though the FICO® Score is the most common. The higher your credit scores, the better offers you are likely to receive from lenders in the form of lower interest rates and other favorable terms.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

Don’t Miss: How To Check Your Child’s Credit Report Free

What The Best Credit Score Gets You

A score of 800+ gives you access to the best the credit world has to offer. A score in this range demonstrates that youve made good choices in every aspect of your financial life. Lenders will essentially see you as a no-risk client.

With the best credit score, youll enjoy:

- The best deals on credit cards and loans. With great responsibility comes great offers. Youll have an interest rate around 5% lower than the average person, along with higher credit lines and more valuable rewards. Getting approved should be no issue.

- Lower insurance premiums. Financial trustworthiness is an attractive trait to insurers. On car insurance alone, people with excellent credit can save from 29%-50% compared to someone with no credit.

- More job options. Employers cant check your credit score. However, they can pull a version of your credit report, upon which the score is based, if you let them. Having the best credit history possible will serve almost like a character reference.

Us Consumer Debt Snapshot

Changes in average debt levels by type of debt were more subdued than the changes seen in 2020, when average credit card balances declined by 14% and student loan balances grew by 9%. Auto loan, mortgage, personal loan and student loan balances continued to grow in 2021, while average HELOCs and credit card balances declined for the second consecutive year.

| Change in Average Balance by Debt Category |

|---|

| Debt Type |

Don’t Miss: Does Requesting A Credit Increase Hurt Score

What Is A Bad Credit Score Exactly

A bad credit score is a general term for a credit score that is below average. There are actually several levels of credit scores that you should be aware of. A truly bad credit score is one that falls between the 300 to 629 range.

300 is the lowest credit score you can possibly have. This score is actually so bad that it is very difficult to get stuck with this score. You would have to miss every single payment, use far too much of your credit, and have far too much debt to ever get your credit score anywhere near this number.

Many people with bad credit scores have their scores in the 500s or low 600s. Whatever the case, having your score in this range is not a good thing. The finance industry will not want to have anything to do with you if you have this kind of credit score.

This is because having such a bad credit score shows that you are not responsible when it comes to paying off your debts. Besides your debts, other things may cause your credit score to drop so low such as filing for bankruptcy. Whatever the case, youll never be able to get approved for loans, credit cards, or anything else if your credit score is so low.

Also Check: What Is The Highest Equifax Credit Score

How Do You Get A Perfect Credit Score

Income, savings, and investments have no bearing on your credit score. Its simply a measure of your debt management skills. A high credit score can be achieved by showing financial institutions that you are always able to repay your loans on time. Aside from on-time payments and low credit utilization, perfect scores are also distinguished by two other factors, notes the team over at Bungalow.

Perfect credit score holders:

- Have a greater number of credit cards. An average of 6.4 credit cards are owned by people with perfect credit scores, almost twice the national average of 3.8.

- Perfect credit card scores averaged $3,025 in debt. Nationally, the average salary is $6,445.

Recommended Reading: How To Fix Credit Score Fast

Keep Your Credit Utilization Low

Maintaining a low credit utilization ratio means you dont want to run up your cards, even if you intend to pay them off at the end of the month. Instead, you might ask the credit issuer to increase your credit limit, or you could apply for a new credit card altogether. Pay attention to how you allocate your monthly spending on a new card to ensure that you are spreading your expenses out evenly.

Youre entitled to receive one free copy of your credit report from Experian, Equifax® and TransUnion® every 12 months. You can order a copy of your report online at AnnualCreditReport.com.

For ongoing monitoring of your credit, you can check your VantageScore® at Rocket Homes.

Percent Of The Us Population That Has A Fico Score Below 550

Fortunately, a low percentage of the U.S. population appears to have low FICO scores. Data released by FICO in 2019 reveals that only 11.1 percent of the U.S. population has a FICO score ranging between 300 and 54913.

It also reveals a downward trend, indicating that the average FICO score is on the rise and the average credit card debt and other debts are on the decline for Americans.

Recommended Reading: Which Information Is Found On A Credit Report Brainly

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

Examine Your Credit Score

Before applying for a loan of any kind, order a copy of your credit report from the three major credit reporting agencies — Transunion, Equifax, and Experian. You can order all three reports at one time from a site like AnnualCreditReport.com. By law, you’re allowed one free copy of your report from each agency once a year.

Look each report over to ensure there aren’t any mistakes. Even minor errors can drop your credit score. Credit reports do not show your FICO score , so you’ll need to find that score elsewhere.

You can pay for it through MyFico.com. Alternatively, most credit card companies provide credit scores for free to their cardholders.

If your credit score is low, you’ll be ahead if you take the time to give it a boost. A strong credit score makes it easier to get a loan, but it can also help when it’s time to rent an apartment or get a job.

Once you have your credit score where you want it, make it a point to check it a couple of times each year, just to make sure nothing has changed. The first — and best — way to ensure a high grade from lenders is to present a high credit score.

Bottom line: Focus on your credit score

Also Check: How Bad Is My Credit Rating

Best Credit Cards That You Can Use Instantly After Approval

Heres a closer look at the top credit cards that you can use instantly after approval.

The Chase Sapphire Preferred credit card is a worthwhile option for anyone looking for a travel rewards opportunity. You can use the card instantly after approval through online payments and in-store purchases with the help of a digital wallet. The compatible digital wallets include Apple Pay, .

- Bonus: Earn 60,000 bonus points after spending $4,000 on purchases in the first three months.

- Rewards: Earn 5x points for travel purchased through Chase Ultimate Rewards and 2x points for other travel purchases earn 3x points on dining earn 3x points on grocery store purchases not including Target, Walmart and wholesale stores earn 3x points on some streaming services earn 1x points on all other purchases.

- Perks: Earn up to $50 in statement credits each account anniversary for hotel stay purchases through Chase Ultimate Rewards

As with many other American Express cards, the Blue Cash Preferred card doesnt require waiting for the physical card to arrive via snail mail. Instead, you can start shopping right away with the Instant Card Number. Once you have the card number, you can add it to a digital wallet. The available digital wallet options include Apple Pay, Samsung Pay, and Google Pay.

The focus of this card is on saving moving on everyday purchases. With that, youll find opportunities for cash back on regular purchases like groceries and gas.