How Far Back Do Credit History Reports Go

How Far Back do Credit History Reports Go?

When it comes to applying for credit, it is important to know how far back lenders look on credit history reports. Just because potential customers have paid all of their bills on time in the past 2 years does not mean that they will get approved for credit. Yes, it is true that credit reports show payment history for the past few years, but reported late payments can remain on credit history reports for several years this information becomes apparent when customers learn that their credit score is not what they expected. Knowing what information is on a credit history report is the only way to maintain a good credit history.

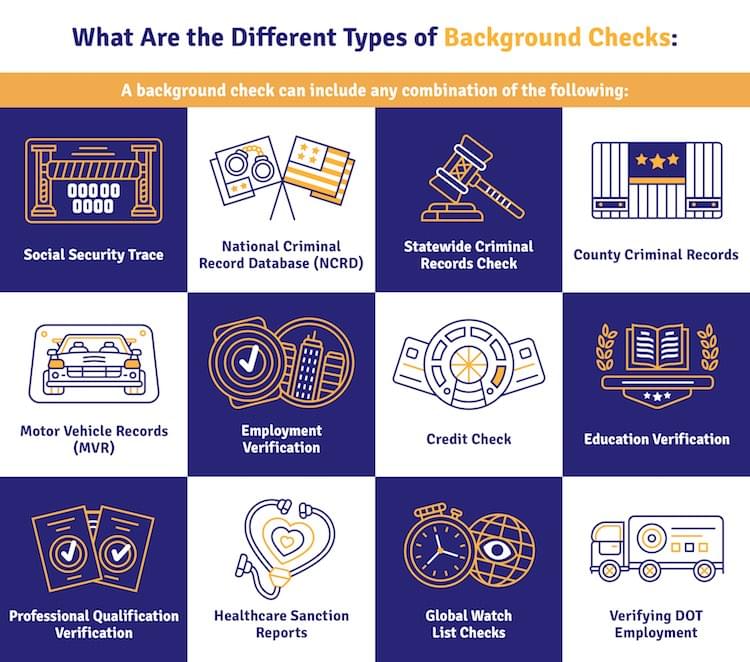

Do I Need To Ask Permission To Run Reports

Remember, an employer must get the applicants permission to run a background check for employment purposes. FCRA requires that employers provide a notification and explanation to applicants. Once they consent, only then can the employer run the report. Make sure you learn which important steps you must take when running a legal background check so you get all the information you need while following regulations.

How Long Does Negative Information Remain On Your Credit Reports

The length of time negative information is allowed to remain on your credit reports is largely defined by the FCRA. Unlike positive information, almost all negative information eventually must be removed from your credit reports. However, not all negative information has the same timeline for removal.

For example, late payments are allowed to remain on a credit report for as long as seven years from the date of their occurrence. This includes any notation that one or more of your accounts was 30, 60, 90, 120, 150 or 180-plus days past due. These are the only late payments that can appear on your credit reports.

Charge-offs, accounts in collections, repossessions, foreclosures and settlements all indicate that you’ve defaulted on an account. In every one of these scenarios, the credit reporting agencies are allowed to report them for no longer than seven years from the original delinquency date that led to their default.

Bankruptcies are another example of negative information that can appear on your credit reports. There are two main types of bankruptcies consumers can file: Chapter 7 and Chapter 13.

Recommended Reading: Is 709 A Good Credit Score

Bankruptcy: Seven To Ten Years

The length of time bankruptcy stays on your credit report depends on the type of bankruptcy, but it generally ranges between 7 and 10 years. Bankruptcy, known as the credit score killer, can knock 130 to 150 points off your credit score, according to FICO. A completed Chapter 13 bankruptcy that is discharged or dismissed typically comes off your report seven years after filing. In some rare cases Chapter 13 may remain for 10 years. Chapter 7 and Chapter 11 bankruptcies go away 10 years after the filing date, and Chapter 12 bankruptcies go away seven years after the filing date.

Limit the damage: Don’t wait to start rebuilding your credit. Get a secured credit card, pay nonbankrupt accounts as agreed, and apply for new credit only once you can handle the debt.

Can You Buy A House With A Credit Score Of 560

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you need to pay only 3.5% down. Those with lower credit may still qualify for an FHA loan. But you’d need to put at least 10% down, and it can be harder to find lenders that allow a 500 minimum credit score.

You May Like: How Long Does Debt Collection Stay On Credit Report

Information Held On The Databases

What loans are included?

- Tax liabilities

Consent for personal information to be included on adatabase

Under data protection regulations, organisations that hold your personalinformation must show why they are holding it.

Central Credit Register

The legal basis for the Central Bank to collect and hold personalinformation in the Central Credit Register is set out in the Credit ReportingAct 2013 and the Regulations.

Since 2017, lenders must submit your personal and credit information to theCentral Credit Register.

Irish Credit Bureau

The ICB relies on the principle of legitimate interests under the GeneralData Protection Regulation as the legal basis to collect and processyour personal and credit information.

The legitimate interests include supporting a full and accurate assessmentof loan applications, helping to avoid over-indebtedness and supporting faster,consistent lending decisions. You can read more about what entitles theICB to process your personal data .

Consent for a lender to check your credit history

When you apply for a loan, the lender must check the Central Credit Registerif the loan is for 2,000 or more. Lenders can also check the Central CreditRegister if the loan application is for under 2,000.

Your consent is not required for lenders to check the Central CreditRegister.

What information about you is held on the databases?

How far back does the information go?

Central Credit Register

How long is information kept?

Fix Your Credit And Improve Your Credit Score

Here are some tips on how to fix your credit and improve your credit score:

If you need help fixing your credit, contact a non-profit credit counseling service that can help you for little or no cost. You can also check with your employer, credit union, or housing authority to see what no-cost credit counseling programs may be available.

It takes time to build up or fix your credit. Unfortunately, there are a lot of fraudsters preying on consumers who want to fix their credit. Avoid any credit counselor or company that promises quick-fix credit repairs, promises to hide your bad credit history, requires upfront payment, or tells you to dispute accurate credit report information or to give false information to creditors.

Here are some resources to help you find a reputable credit counselor:

- Federal Trade Commissions Choosing a Credit Counselor: How to choose a credit counseling service

- Federal Trade Commissions : How to avoid credit repair scams

- Department of Business Oversights : Common questions about credit counseling services

Recommended Reading: Paypal Credit Bureau

Recommended Reading: What Credit Score Do Home Lenders Use

What Is The Best Way For A Felon To Find A Home

#2 Craigslist Craigslist, believe it or not, is probably the best place to look for felon-friendly apartments and housing. The reason for this is that the majority of Craigslist advertisers are small-time landlords who only own one or two rental units.

Many of them wont even conduct a background check.

How Far Back Do Mortgage Lenders Look At Credit History

When you apply for a mortgage, the lender will carry out a credit check on you. Your mortgage lenders will only be able to see the past six years of your credit history.

Before you apply for a mortgage, itâs a good idea to check your credit report and make sure itâs in good shape. If you spot any mistakes, contact the relevant credit reference agency or lender as soon as possible to get them fixed. This should help to boost your score and your chances of acceptance.

You May Like: How To Get Student Loans Removed From Credit Report

Errors On Your Credit Record

When you check your credit report, keep an eye out for anything you don’t recognise or think is wrong. This report impacts many areas of your life, so it’s important it’s accurate. If you find errors, follow these steps:

1. Check credit reports from other companies

There are three credit reporting companies in New Zealand. Lenders and other organisations can go to whichever one they choose to learn about your credit history.

If a report from one credit reporting company shows errors, the others might as well. You need to request a correction from each company that has errors.

2. Report errors to the credit reporting companies

Before you make contact, understand your rights.

Your rights: credit reporting companies must try to make sure the information they hold is correct. These rights are protected under the Privacy Act and the Credit Reporting Privacy Code.

When you complain about errors, the credit reporting company will:

- check the error with its source to get more information, eg your bank, lender, phone provider

- highlight the particular item in your report to show you are questioning its accuracy

- make a decision about the error as soon as possible â if they need more than 20 days, they must tell you why.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Recommended Reading: What Is A Credit Score Definition

How Long Do Inquiries Stay On A Credit Report

Inquiries don’t fall neatly into either the positive or negative information categories. Inquiries are either neutral or negative to your credit scores, but do not indicate mismanagement or the default of a credit obligation, and don’t always result in a lower credit score.

Inquiries are simply a record of access into your credit reports by a third party, like a lender. Inquiries will remain on your credit reports for up to two years, and are considered either “soft” or “hard.”

A soft inquiry results when you or someone else views your credit report for non-lending purposes, such as a credit card preapproval. Soft inquiries don’t affect your credit scores. A hard inquiry will appear as a result of applying for credit or debt. Hard inquiries are visible to anyone who views your credit reports, and too many can lower your credit scores.

How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after they’ve been closed because it’s important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.

Read Also: Does Consolidating Debt Help Credit Score

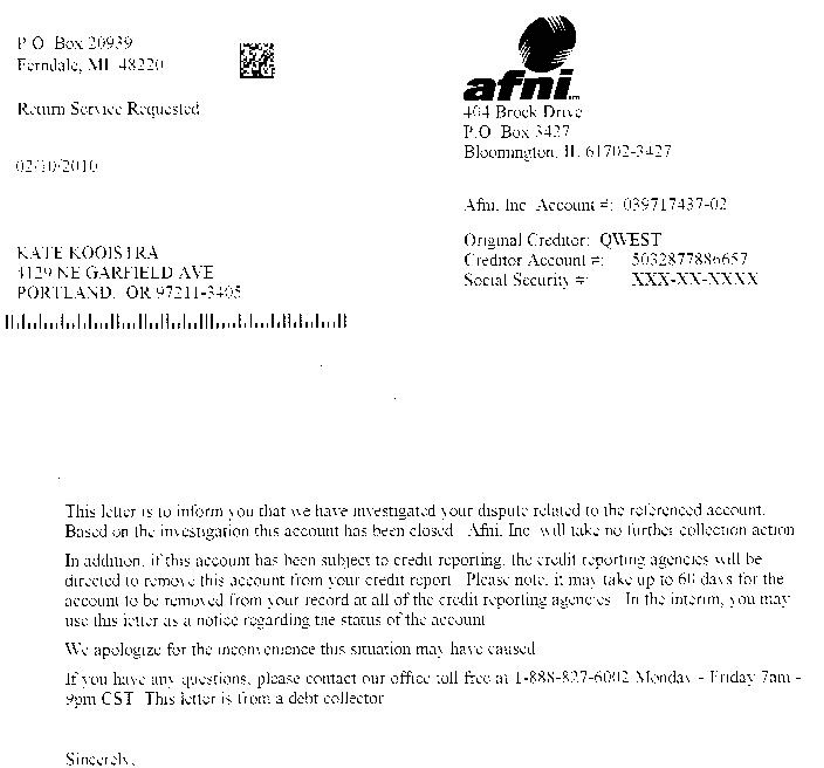

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: How To Remove Settlement From Credit Report

Should You Update The Credit Bureau With Your New Address

You donât have to worry about giving the credit bureaus your current address. As long as your creditors and lenders have your correct billing addressand they should, so that you can receive your billing statementsthe credit bureau will eventually update your credit report to show your most recent address.

How Long Does Negative Information Remain On My Credit Report

A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

Even though the credit reporting companies usually wont report this negative information after the seven year limit, they still may keep your information on file.

There are certain instances where they will report it. These time limits on reporting negative information do not apply if the credit report will be used in connection with:

- Your application for a job that pays more than $75,000 a year

- Your application for more than $150,000 worth of credit or life insurance

Tip: Dont pay fees to repair your credit history.

Many companies promise to repair or fix your credit for an upfront fee. However, no one can remove negative information, such as late payments, from a credit report if it is accurate. You can only get your credit report fixed if it contains errors, and you can do that on your own at no cost.

If you have a problem with credit reporting, you can submit a complaint with the CFPB online or by calling 411-CFPB ..

Read Also: Does Closing An Account Hurt Your Credit Score

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

You May Like: Speedy Cash Repayment Plan

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Read Also: How To Remove Verizon Collection From Credit Report

How Far Back Do Fingerprint Background Checks Go

Fingerprint background check is a catch-all term for screenings that use a candidates fingerprints along with other personal information to locate historical information. Since that information is typically part of a candidates criminal history, reporting restrictions are the same as those that apply to criminal records in a given jurisdiction, as long as the screening is conducted via a background check provider. The information revealed in a fingerprint search can vary, depending on the nature of information you request, the databases used by the screening company, and your legal authority to retrieve criminal information.

Once The Debts Gone Is It Gone Permanently

Credit reporting agencies can retain expired data, though theyre not required to. There are a few exceptions to the seven-year rule. If youre in any of these situations, credit bureaus may report negative information more than seven years old.

- If youre applying for a loan of $150,000 or more .

- If youre applying for a job with a salary greater than $75,000 and the company runs a credit check.

- If youre taking out a life insurance policy worth more than $150,000.

Also Check: What Is Coaf On My Credit Report

How Far Back Does A Criminal Background Check Go

Criminal background checks are a whole different story. Criminal background checks arent limited by a federal act. This means that you could potentially see convictions that happened 50 years ago. While this is beneficial to you as a business owner, it can also create biases against otherwise good candidates.

How can this happen? Imagine that a background report reveals that an older applicant committed a crime when they were 18. This is the only red flag on their background report and since committing the crime theyve proven themselves to be a reliable employee and well-adjusted person. Will you let this single red flag stop you from hiring them?

This decision is yours alone. But, you shouldnt immediately dismiss the application based on this offense. Instead, you should follow fair hiring rules and regulations and determine whether or not this conviction will affect their eligibility for the role.

Depending on the level of responsibility or the type of conviction you might decide to overlook the conviction and hire them anyway. By thinking carefully through this decision, youll benefit from a broader pool of talent than those at other companies.