How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after they’ve been closed because it’s important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Don’t Miss: How To Remove Repossession From Credit Report

Bad Credit & Your Future

If you suspect you may have missed a payment or requested too many credit cards in a short period of time, checking your credit report and score is essential.

You should also stay alert for potential opportunities. For starters, make sure all bad credit moves past the stated timelines are gone, and ensure companies are not reporting anything fraudulent .

How are you fighting back against bad credit moves or problems? Share your strategies in the comments section!

Impact On Your Credit Score

Even though debts still exist after seven years, having them fall off your credit report can be beneficial to your credit score. Once negative items fall off your credit report, you have a better chance at getting an excellent credit score, granted you pay all your bills on time, manage newer debt, and dont have any new slip-ups.

Note that only negative information disappears from your credit report after seven years. Open positive accounts will stay on your credit report indefinitely. Accounts closed in good standing will stay on your credit report based on the credit bureaus’ policy.

When the negative items fall off your credit report, it also improves your chances of getting approved for new credit cards and loans, assuming there’s no other negative information on your credit report.

Read Also: How To Remove Repossession From Credit Report

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

Bottom Line: Leave It To The Professionals

Although its possible to DIY your debt settlement and its removal from your credit report, its a risky venture. Your best option is to reach out to a professional to secure your financial future and professionally settle your debt. Either way, make sure the account in question gets paid off. An account listed as paid as agreed on your credit report will always look better than one that you left unpaid.

If youve already settled and youre trying to fix your credit, the same goes for . Getting professional help is your best bet for fixing your credit if settlement causes it to dip.

You dont have to repair your credit on your own. We can help!

Recommended Reading: What Credit Report Does Paypal Pull

How Many Points Will I Lose After Debt Settlement

When you settle your debt, your can drop between 60 and 100 points, depending on your credit history and where you started. This is one of the major reasons why you should use a professional debt settlement company instead of trying to do it yourself. If you mess up, your score could fall even further and take even longer to repair.

Do debt settlement the right way. Well help you find the best solution for you.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: Does Paypal Credit Affect Your Credit Score

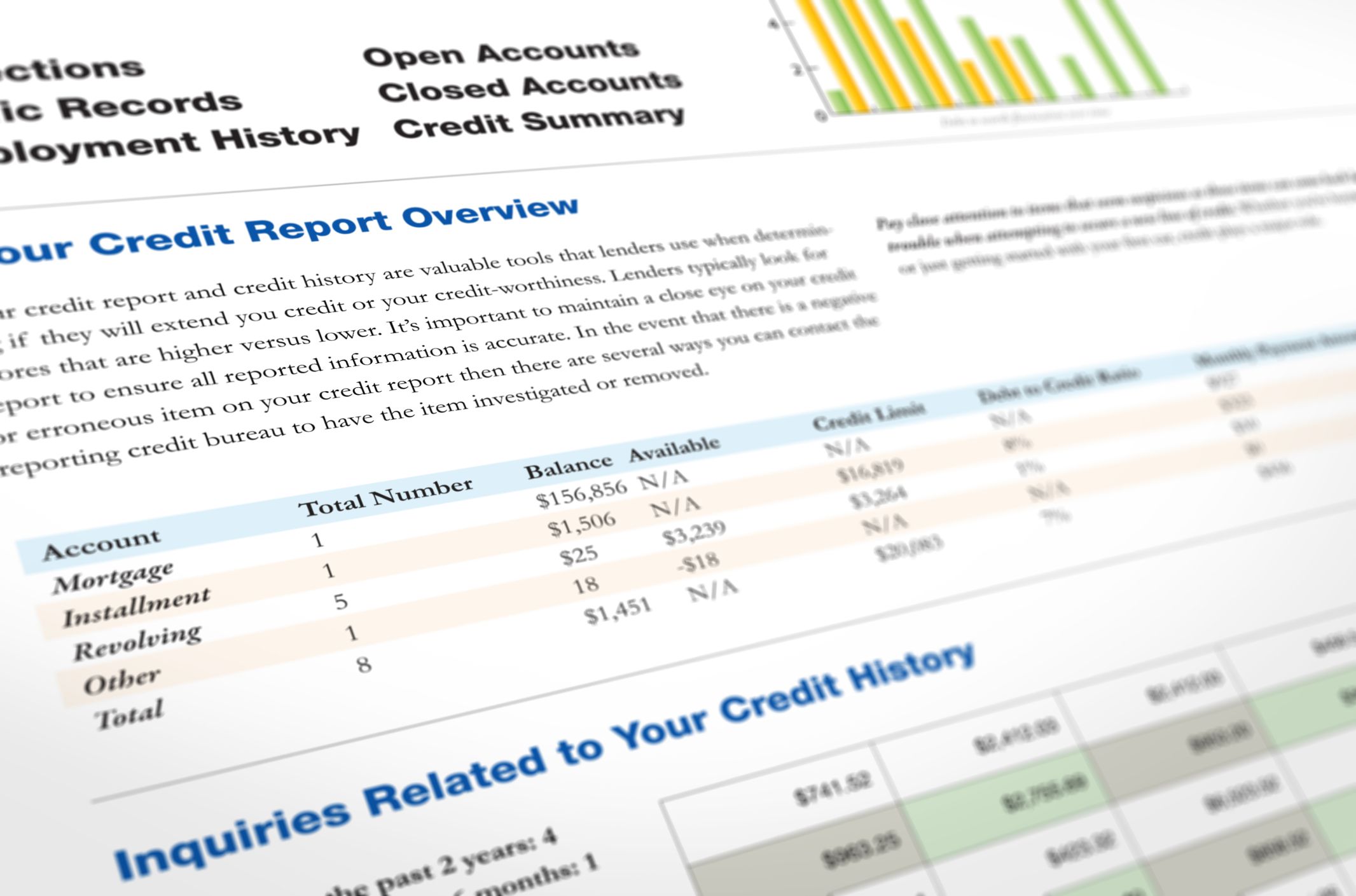

Check Your Own Credit Report

If you are applying for an overdraft, mortgage, credit card or other type ofloan, it is a good idea to check your credit report before you apply. It canhelp you spot any missed payments you did not realise were missed, or mistakesin your credit report.

Importantly, you can get incorrect information corrected. You also have theright to add a statement to your credit report to explain any specialcircumstance see Rules below.

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

You May Like: How To Remove Repossession From Credit Report

Find Out How Long Credit Reporting Agencies Can Report Negative Items On Your Credit Report

By Carron Nicks

The federal Fair Credit Reporting Act dictates how long a negative item will remain your report. Some states have additional laws that limit reporting even further for their residents. Those laws won’t’ override the FCRA. Although, they can put more restrictions on the length of time the can report negative information.

The length of time information stays on your credit report depends on what’s being reported and whether the information is positive, neutral, or negative. The good news is, positive and neutral information can stay on indefinitely and might help improve your . Most negative information will drop off your reports after seven to ten years, but in rare cases, the info will appear longer than ten years.

Here are some common items and when you can expect them to drop off your reports.

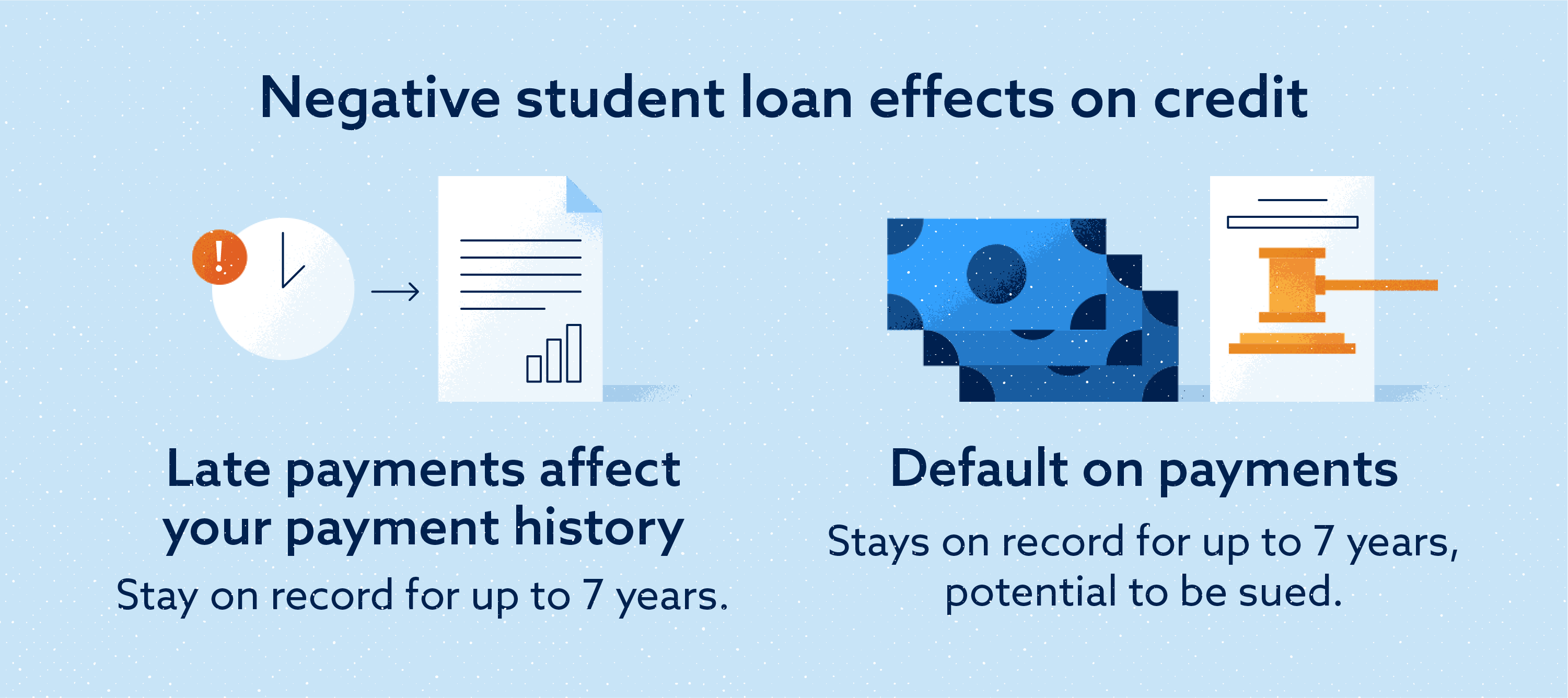

Negative Impacts To Your Credit Score

- Missed payments: This can be everything from loans to bill payments.

- Defaulting on payments: A default is where a payment over $125 is overdue by more than 30 days and the lender has tried to recover the money. This stays on your credit record even if you repay the amount in full.

- Insolvency: Filing for one of the three types of insolvency â debt repayment plan , no-asset procedure or bankruptcy.

- Applying for too much credit: Applying for multiple sources of credit in a short space of time, eg applying for four credit cards in three months.

- Multiple credit checks: Many agencies/organisations checking your credit score shows you may be seeking more loans or credit than you can afford.

- Shifting debt from one credit card to another.

- Debt collections: You owe money and your debt has been passed on to a debt collector.

- Hardship applications: If you applied for hardship with a previous loan, eg repayment holiday.

- Payday loan and quick finance applications: With their high interest rates, other lenders may consider these a last resort.

- No credit: Having no credit history means there’s no way for future lenders to see if you are a risk or not. This can have the same negative impact as having bad credit.

Read Also: Credit Score Of 672

Details Of Current Loans And Repayment History

Since March 2014 your credit report has contained information about your current loans and whether you have made any late payments including:

Not all lenders record all of the above information on your credit report. Large banks are required to record all five types of information listed above, but smaller lenders like payday lenders dont have to. All credit providers have the option to start providing more comprehensive information about your loans, as long as they have notified you.

This information also is not listed for buy now pay later, telecommunication or energy debts even though those types of services can list defaults.

How Long Does Negative Information Remain On Your Credit Reports

The length of time negative information is allowed to remain on your credit reports is largely defined by the FCRA. Unlike positive information, almost all negative information eventually must be removed from your credit reports. However, not all negative information has the same timeline for removal.

For example, late payments are allowed to remain on a credit report for as long as seven years from the date of their occurrence. This includes any notation that one or more of your accounts was 30, 60, 90, 120, 150 or 180-plus days past due. These are the only late payments that can appear on your credit reports.

Charge-offs, accounts in collections, repossessions, foreclosures and settlements all indicate that you’ve defaulted on an account. In every one of these scenarios, the credit reporting agencies are allowed to report them for no longer than seven years from the original delinquency date that led to their default.

Bankruptcies are another example of negative information that can appear on your credit reports. There are two main types of bankruptcies consumers can file: Chapter 7 and Chapter 13.

You May Like: Does Paypal Report To Credit Bureaus

Full Transcript Show #128 On Debt Collection And The Ontario Limitations Act

Doug Hoyes: My firm, Hoyes Michalos & Associates posts a lot of information on 310Plan Facebook page and we get lots of comments. Obviously most of the stuff that we post is about debt so we get lots of people commenting on how to avoid paying debt without going bankrupt or filing a consumer proposal.

Its very common for a commentator on our Facebook page to say something like dont worry, if your debt is old you dont have to pay it, it just goes away. Well, is that true? What actually happens to old debts? Do you have to pay them? Well, those are the questions Im going to answer today on this Technical Tidbits edition of Debt Free in 30.

Now before we discuss what happens to old debts lets start with a more basic question, what exactly is an old debt? Well, there are three possible answers to that question. It could be any debt thats passed due, it could be any debt thats more than two years old or it could be any debt thats more than six years old. Now why are those two years and six years time limits important? Well, lets talk about the lifecycle of a debt.

If a debt is more than six years old, it likely will not show up on your credit report. It doesnt mean you dont owe the debt, it just means at that point they cant really sue you for it and its probably not showing up on your credit report. And again, there are certain debts that are not that dont follow with these rules.

When Can A Default Be Listed On My Credit Report

Before a default can be listed on your credit report:

If you pay a default after it is correctly listed, you can ask for the listing to be updated as paid. The default listing does not disappear just because you have paid it.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

How To Report And Fix Any Errors On Your File

If you do spot any mistakes, challenge them by reporting them to the credit reference agency.

They have 28 days to remove the information or tell you why they dont agree with you.

During that time, the mistake will be marked as disputed and lenders arent allowed to rely on it when assessing your credit rating.

Its also best to speak directly with the credit provider you believe is responsible for the incorrect entry.

Negative information in your name usually stays on your credit report for six years and cant be removed sooner if its accurate. However, if there were good reasons why you fell behind with payments that no longer apply, such as not being able to work during a period of illness, you can add a note to your credit report to explain this. This note is called a Notice of Correction and can be up to 200 words long

Read about notices of correction on the Experian website

Find out more about correcting personal information on your file on the Information Commissioners Office website

You May Like: Does Paypal Credit Report To Credit Bureaus

You Have Defaulted On An Account

An account is in default when the borrower has missed payments and the account is then closed by the lender. There is no set number of missed payments that result in a default being recorded. This is down to the individual lender, but when they believe a debt can no longer be recovered they record a default.

If a debt cannot be recovered many lenders sell the account to a debt collection agency. This will show negatively on your credit file and will remain on it for a period of six years from the default date, regardless of any settlement. After this time it is removed from your report automatically even if the full amount has not been settled.

Although a default will be removed from your report after 6 years the lender may still pursue you for the debt, unless the debt is statute barred. A statute barred debt is a debt which is seen as unenforceable as the creditor has not chased it in the period allowed. If you have not been chased for payment, have not made payment or signed any acknowledgement of a debt in writing for 6 years in England and Wales and 5 years in Scotland then it could be statute barred.

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

You May Like: How To Remove Repossession From Credit Report