How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries | |

| Money owed to or guaranteed by the government | 7 years |

| 7 years or until the state statute of limitations expires, whichever is longer | |

| Unpaid taxes | Indefinitely, or 7 years from the last date paid |

| Unpaid student loans | Indefinitely, or 7 years from the last date paid |

| Chapter 7 bankruptcies | 10 years |

Escalate The Issue If Required

If you feel that a credit bureau has not treated you properly, you may file a complaint. This complaint can be made in writing to your provincial or territorial consumer affairs office. The federal government does not regulate credit bureaus.

In Quebec, these complaints must be directed to the Commission d’accès à l’information du Québec .

Strategies To Remove Negative Credit Report Entries

Image by Bailey Mariner é The Balance 2020

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Also Check: How To Remove A Judgement Off Your Credit Report

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself for free see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Dispute Inaccurate Or Incomplete Collection Accounts

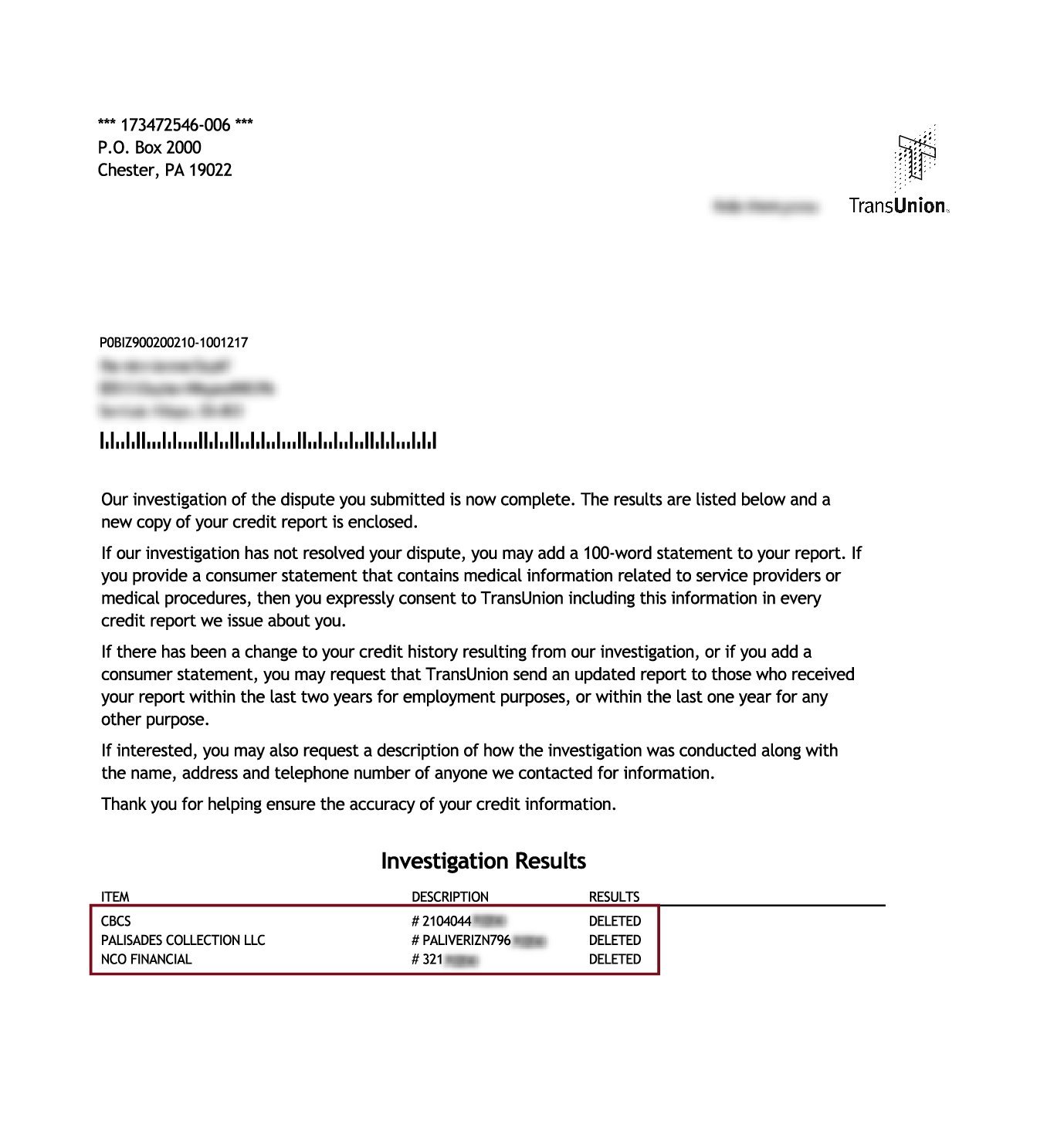

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

Recommended Reading: Is Experian Credit Score Accurate

Personal Information Only What You Provide Is Reported

Your credit report will list your full name, address, and date of birth its vital that you check that this information is correct, especially if you have a common name. Sometimes your account details could be mixed up with another person with similar identifying points. In worst case scenarios, you could be a victim of identity theft.

Your credit report could contain employment information as well, which you provide when you apply for credit and are asked for your employment and salary details.

Your credit report wont, however, list your gender, race, religion, citizenship, political affiliation, medical history, or criminal records . It could list marital status if you applied for joint credit with your your spouse.

Personal information reported on your credit report will be information you provided to a lender at some point. The information can become outdated very quickly, e.g. if you move, get divorced, or switch employers.

Will Making Payments Change The Timeline Or Keep A Collection From Falling Off Your Credit Reports

In general, making payments on a debt in collection should not affect the time it stays on your credit reports.

As the Consumer Financial Protection Bureau notes, however, in some states a partial payment can restart the time period for how long the negative information appears on your credit reports.

A partial payment can also restart the statute of limitations, or period of legal liability, for the debt. If the debt is still within the statute of limitations, a debt collection agency may choose to sue you for your unpaid debt. Each state has its own statute of limitations that determines how much time a debt collection agency has to take legal action, but for many states it ranges from three to six years.

If you do pay off an account in collections, the collection agency may be able to contact the credit bureaus and remove the collection account from your credit reports before the seven-year mark.

You may have to do some extra pushing to make this happen.

Before paying off an account in collection, get on the phone with an agent from the debt collection agency and confirm that the agency will update your credit reports. If the agent cant or wont agree to remove the paid account from your credit reports, ask if the account can be updated as paid as agreed upon once your payment/s are received.

You May Like: How To Remove Discharged Debt From My Credit Report

Getting A Satisfied In Full Reporting

If the collection agency agrees to settle for less than you owe, be sure it also agrees to report the debt it holds as “satisfied in full” to the credit bureaus. Get written confirmation from the creditor and the collector. The debt collector’s confirmation should say that it will acknowledge the debt as paid in full when you pay the agreed amount.

Potential Tax Consequences of Settling Debt

The IRS generally considers canceled debt of $600 or more as taxable, and settling debts for less than what’s owed can increase your tax liability depending on your tax bracket and the canceled amount. Consult a tax professional for more information.

If the creditor, or the debt collector if it has the authority, agrees to delete the original account line, get confirmation that it will submit a Universal Data Form to the three major credit reporting agencies deleting the account/tradeline. If the debt collector doesn’t have the authority to act for the original creditor to delete the account information on the original debt, you might need to contact the creditor and the debt collector separately.

How To Remove Negative Items From A Credit Report

A version of this blog post on How to Get Items Removed From Your Credit Report was originally published by our content partner Money. They are a digital magazine and a resource for personal finance news and information.

Having a good credit score is an important part of most peoples lives. It lets lenders know how trustworthy you are with borrowing money. This can include everything from asmall business loan to a big financial commitment like a home mortgage.

Yet, in 2020, most people still have no idea how their credit score works and the importance of having the correct information on their credit report.

Here are some things to keep in mind next time you think about your credit score.

Recommended Reading: How Many Times Can You Check Your Credit Score

How To Check Your Credit Report

- Check your Experian credit report through their partner website, MoneySavingExperts Credit Club

- Check your Equifax credit report through their partner website, ClearScore

- Check your TransUnion credit report through their partner website,

Its often worth getting a copy of your credit report from all three main CRAs if you havent applied for it before or if you havent checked it for some time.

Thats because they might have different information from different credit providers, although there is quite a lot of overlap between them.

If youd prefer a paper copy of your credit report, you can contact the credit scoring agencies direct:

Find out more about how to get a written copy of your credit report from the Information Commissioner’s Office

What Happens When You Close An Account

When you close an account, it’s no longer available for new transactions, but you’re still required to pay off any balance outstanding by paying at least the minimum owed each month by the due date.

After the account is closed, the account status on your credit report gets updated to show that the account has been closed. For accounts closed with a balance, the creditor continues to update account details with the credit bureaus each month. Your credit report will show the most recently reported balance, your last payment, and your monthly payment history.

Don’t Miss: What Is Utilization On My Credit Report

Pay For Delete Defined

First, its helpful to understand what it means to pay to have bad credit report information removed. According to Paul T. Joseph, attorney, CPA, and founder of Joseph & Joseph Tax and Payroll in Williamston, Mich., Pay for delete is essentially when you are contacted by your creditor, or you contact them, and you agree to pay a portion or all of the outstanding balance with an agreement that the creditor will contact the and remove any derogatory comments or indications of late payment on the account.

What Is A Credit Score

A credit score is the score that a credit provider will use to help them decide which customers to lend to. Its broadly based on three sets of information:

- your application form

- your credit report

- any information they have about you already.

Guide credit scores are created by credit reference agencies. Theyre based on the information included in your credit record, and are only available to you. Theyre designed to help you understand how firms might use your credit information to decide whether to offer you credit.

Guide scores only offer a general indication of how likely it is that firms might offer credit to you. Having a high score doesnt guarantee any particular lender will actually offer you credit. This is because each firm uses its own criteria, which might vary depending on which credit product youre applying for.

The information held on your credit report and your credit application form might be used to decide:

- whether to offer you credit

- how much credit youll be offered

- how much interest you would be charged.

The most recent information on your report will have the most impact. This is because lenders will be most interested in your current financial situation.

However, information about your financial transactions over the last six years good or bad will still be on record.

You May Like: Is It Bad To Check Your Credit Score

Checking Your Credit Report In Canada

Now that youre aware of what can happen if theres an inaccuracy on your credit report, lets talk about what kinds of common errors you may come across:

- Inaccurate Personal Details Simple mistakes such as the wrong name, birthdate, or mailing address can spell disaster because you could end up with someone elses credit information .

- Wrong Account Information Its also possible that your lender didnt report your payment or account activity correctly. For instance, if you paid your debt on time but it was accidentally labelled as late or defaulted.

- Falsified or Stolen Accounts Identity theft and fraud are two unfortunate events that can affect your credit, not to mention complicated and time-consuming to deal with afterward.

- Uncorrected Negative Information Missed payments and other negative credit actions stay on your report for several years . If so, a bureau may forget to remove the information after the allotted time period.

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Recommended Reading: Will Credit Card Companies Remove Late Payments Credit Report

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behavior so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

You May Like: How Do You Remove Inquiries Off Your Credit Report

File A Complaint With The Cfpb

The Consumer Financial Protection Bureau regulates credit reporting agencies as well as many of the companies that furnish data to them. Generally, you will want to try the methods mentioned before to resolve the problem before you contact them. And they can’t help you remove accurate but negative information that you simply don’t want listed on your reports. But if you have a legitimate problem you have been unable to resolve, you can file a complaint. In turn, they may contact the parties involved and you may get results you weren’t able to get on your own.

File A Dispute With The Credit Reporting Agency

Under federal law, you are allowed to dispute any information on your report that is inaccurate or incomplete. Does your charged-off credit card or collection account list an incorrect balance? Are wrong dates listed? You can challenge it. If the information is not confirmed by the original source reporting it in a timely manner — usually 30 days — it must be removed.

In fact, this is the main tactic credit repair companies use. The truth about credit repair is that these companies often send form letters to the credit reporting agencies asking them to investigate negative items on consumers’ credit reports hoping some will not be confirmed and will no longer be reported.

While the fastest way to dispute mistakes is to request an investigation online, in the case of serious mistakes you may want to send a letter to to fully protect your rights. Here’s a guide to fixing credit report mistakes.

Recommended Reading: What Credit Score Do You Need For Klarna

The Pay For Delete Alternative

If you havenât yet paid off the account you hope to delete from your credit history, you may benefit from a âPay for Deleteâ arrangement. This is the term used when a borrower pays a debt in full, and – in exchange – the debt collections agency agrees to remove the item from the borrowerâs credit report.

Many debt collection agencies will not remove paid-off delinquent accounts because they have contracts with the credit bureaus that require them to keep accurate information on your credit report for as long as possible. The contracts have this clause written into them because the customers of the major credit bureaus want to see these items. This way, they can make more informed decisions about whether to offer credit or a loan to a given borrower. If a paid-off collections account shows up on the borrowerâs credit history, the lender may charge the borrower a higher rate of interest or even decline to extend credit, in some cases. This is permissible under the Fair Debt Collection Practices Act.

If a debt collection agency or debt collector was to violate its contract with the credit bureaus by removing an accurate paid-off account from a borrowerâs credit history, then it could lose its contract with the bureaus and thus go out of business.

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

Also Check: Does Chase Credit Journey Affect Credit Score