Classification Of Credit Rating Equity Bond Commercial Paper Individual Asset Backed Securities Country Rating And More

Classification of Credit Rating are as Follows:

Classification # 1. Equity Rating:

The equity shares and preference shares of companies are rated as to its worth. This is a help to prospective investors in taking a decision.

Classification # 2. Bond Rating:

This is the primary and major business of credit rating agencies. Bonds and debentures issued by companies, governments, quasi-governments etc. are included in this type of ratings.

Classification # 3. Commercial Paper Rating:

Commercial papers are issued by companies to raise short- term funds. Regulatory agencies insist that manufacturing companies, banks and finance companies should get credit ratings for issues of commercial paper.

Classification # 4. Individual Rating:

Borrowers and customers are rated to assess their paying capacity. On the basis of assessment the rating agencies put grades to borrowers and individuals. This is a help to the creditors.

Classification # 5. Asset Backed Securities Rating:

These are undertaken to assess the risk associated with debt securitization. The securitization companies would like to know the cash flows from the assets so as to make timely payments.

Classification # 6. Country Rating:

This is also known as sovereign ratings. The international investors would like to know the creditworthiness of a country and its debt paying capacity before making any investment in that country or granting credit to that country.

Classification # 7. Rating of States:

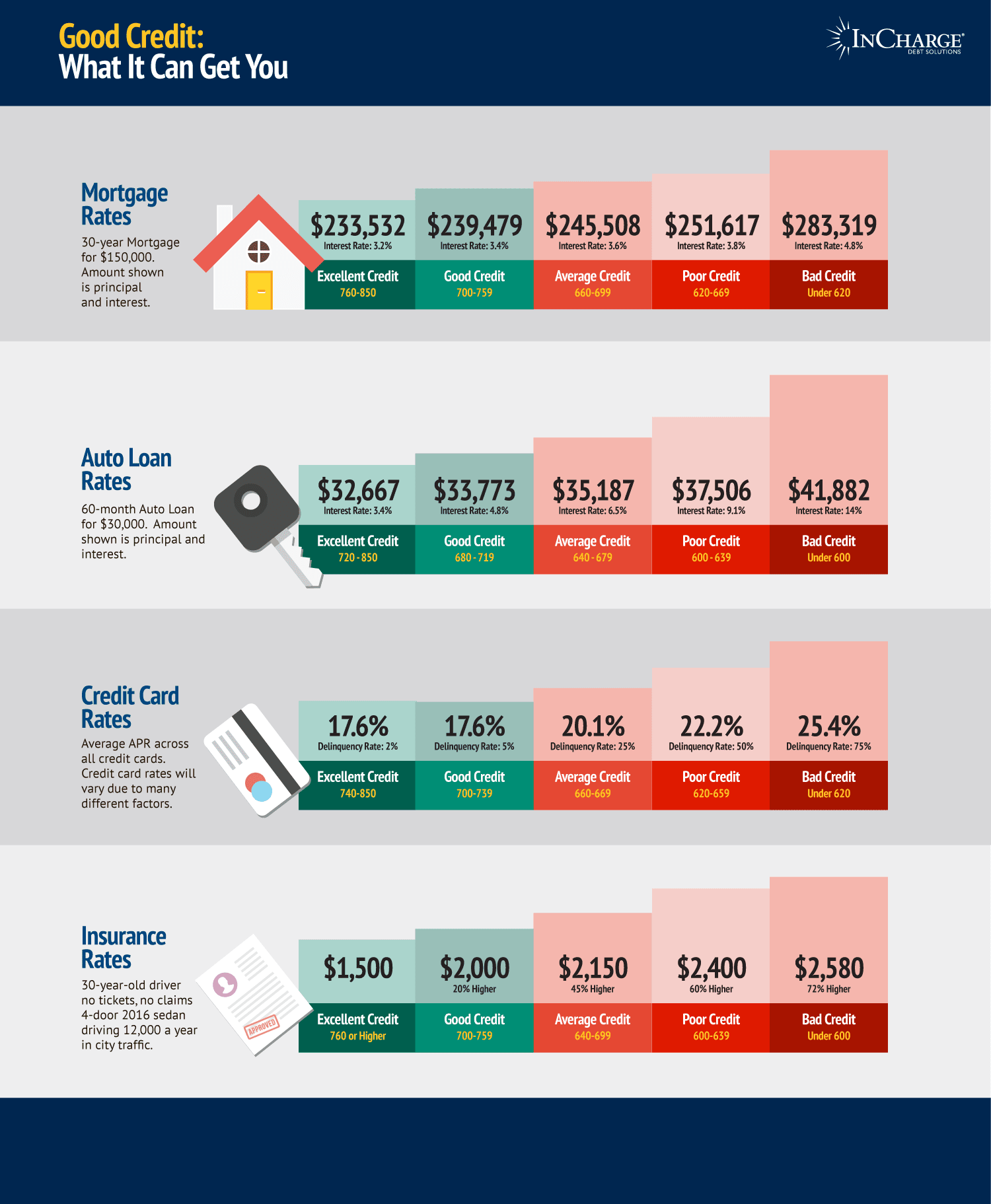

Better Terms And Availability On Loan Products

Borrowers with strong credit scores will have access to the most loan and credit card products available since lenders will want to lend to them. They will be able to shop around and compare rates more effectively. They’ll also find the best terms, including higher dollar limits, which can make it easier to finance big purchases.

Ways To Improve Your Credit

Now that you know more about the benefits of good credit, you may want to work on improving yours. These seven steps for improving your credit could help:

Don’t Miss: How Long Do Hard Inquiries Affect Credit Score

How To Get Good Credit

If you want a good credit score, you need to understand how credit scores are calculated and how to build credit.

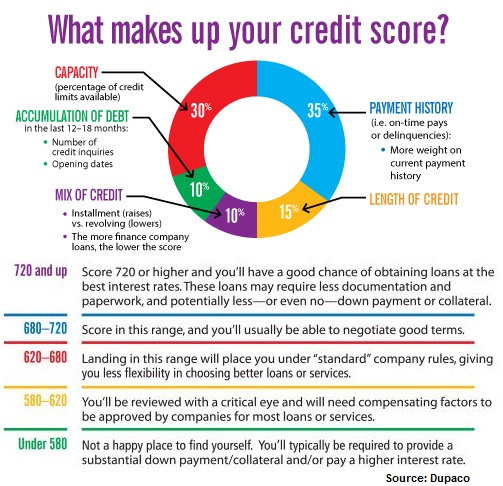

Your FICO credit score is made up of the following five factors:

- Payment history: 35 percent

- Length of credit history: 15 percent

- Recent credit inquiries: 10 percent

If you want to get your credit score into the good credit score range, you need to improve your credit habits as they relate to those five factors.

Merits Of Credit Rating Merits To Investors And To Company

Merits of Credit Rating are as follows:

Merits to Investors:

i. Safeguards against Bankruptcy:

ii. Easy Understanding of Risk:

iii. Credibility of Issuer:

Rating symbol assigned to a credit instrument gives a clue to the credibility of the issuer company. The rating agency is quite independent of the issuer company and has no business connections or otherwise any relationship with it. Absence of business links between the rater and the rated firm establishes ground for credibility and attracts investors.

iv. Saving of Resources:

Investors rely upon credit rating. This relieves investors from botheration of knowing about the fundamentals of a company, its actual strength, financial standing, management details, etc. The quality of credit rating done by the professional experts of the credit rating agency, reposes confidence in him to rely upon the rating for taking investment decisions

v. Ability to Take Direct Decisions:

Usually investors have to seek advice from financial intermediaries, the stock brokers, merchant bankers, the portfolio managers, or financial consultants about good investment proposals.

However, investors need not depend upon the advice of these financial intermediaries for rated instruments as the rating symbol assigned to a particular instrument suggests the credit worthiness of the instrument and indicates the degree of risk involved in it. Thus, investors can make direct investment decisions.

vi. Choice of Investments:

vii. Rating Surveillance:

Also Check: Which Website Gives Free Credit Report

Access To The Best Credit Cards

High credit scores will afford you access to the most rewarding credit cards on the market, including those that offer the lowest interest rates and the best rewards, such as cash back offers, travel points, and other incentives. You are also more likely to qualify for an introductory 0% APR purchase and balance transfer offers, which can translate to significant savings over time.

Meaning Of Credit Report

A credit report is simply a summary of your credit track records. The credit report is a comprehensive record of your present and past debt, including the payment history. The credit report shows where you borrowed and how you managed your credit in the past. The credit rating is critical for an individual, business, or country since it impacts credit decisions. Lenders make use of these reports while taking credit decisions, including what interest rate and credit terms to be defined for a particular loan. Credit rating agencies collect, analyze and store the financial data that you have submitted to your lenders in the past. However, the individual need not report credit history to credit rating agencies. Below are the critical data that a credit report contains.

You May Like: Is 728 A Good Credit Score

How A Poor Credit Rating Can Affect You

A poor credit rating could mean you:

- are charged higher interest rates

- are given a smaller credit limit

- have your credit application declined.

A lender doesnt have to give everyone the interest rate theyre advertising or that you see in best buy tables on comparison websites.

Some lenders operate on the basis of whats called rate-for-risk pricing. This is where the rate you get depends on the risk they think you represent of not repaying on time.

Youll often see a representative APR in advertising. At least 51% of people applying for the product will pay this APR or better.

If the lender uses the rate-for-risk pricing, up to 49% of people applying might be charged a higher rate.

This could be because they have a poor credit history or havent borrowed before.

Before you apply for credit, ask the lender what APR and interest rate youll be charged. However, some lenders might not always be able to tell you this before a formal application has been accepted.

If they need to do a credit reference check before quoting this, ask if they can use a quotation search . This is also called a soft search credit check or an eligibility check.

This is useful either when youre shopping around and not yet ready to apply for credit, or to check your eligibility before you make an application.

Issuers Should Evaluate The Need For Obtaining One Or More Credit Ratings And Develop Appropriate Policies And Procedures For Selecting And Managing Credit Rating Agencies

State and local governments often engage one or more credit rating agencies with respect to the issuance of debt. A rating reflects the independent opinion of a particular agency on the credit worthiness of the issuer to make timely payments of principal and interest on the debt. If engaged, a credit rating agency will assign its rating to a particular debt issue and also to all the outstanding debt issued under the same security or credit pledge. In addition, institutional investors are often restricted from purchasing unrated debt or debt below a certain rating threshold. Accordingly, obtaining one or more credit ratings may provide a material benefit to an issuers cost of borrowing.

The Government Finance Officers Association recommends that issuers evaluate the need for obtaining one or more credit ratings and develop appropriate policies and procedures for selecting and managing credit rating agencies.

Evaluating the Need for a Credit Rating

If an issuers outstanding debt already has one or more credit ratings, it is common practice to request a new rating on any subsequent debt issued under the same security or credit pledge. However, some issuers have elected not to have their subsequent debt issues rated. Issuers should consider the following factors in evaluating the need for a credit rating:

Selecting and Managing Credit Rating Agencies

References:

Don’t Miss: What Is A Bad Credit Score Number

Ways To Build Business Credit

In order to build a successful business, you need more than just a great idea. You also need good credit. Business credit can be used to get loans, lines of credit, and other financial assistance that can help your business grow.

In this article, well discuss 14 ways how to build business credit with business credit bureaus. Lets dive in!

You’ll Get The Best Rates On Car And Homeowners Insurance

According to McClary, having a good credit score can help you save money on your car and/or homeowners insurance.

Most U.S. states allow , where insurance companies assess your risk based on how well you handle your money.

A variety of other factors go into evaluating your rates, and insurance companies don’t rely solely on your credit score in the underwriting process. They cannot penalize you for a bad score by raising premiums, denying coverage or canceling your policy.

But according to the insurance company Nationwide, credit-based scoring results in the most fair assessment of a driver’s risk and the company reports that it actually lowers premiums for about half of its customers.

Getting a free quote from an insurance carrier is the most accurate way to see whether your credit score might bring you savings. You can also view your credit-based insurance score through LexisNexis.

Don’t Miss: Does Overdraft Affect Credit Score

Capital One Travel: $300 Statement Credit

The $300 annual statement credit perk with Capital One Travel is simple. Every account year, you receive up to $300 in statement credits toward purchases made through Capital One Travel, including hotel bookings, car rentals and airfare.

However, the credit is not applicable to travel purchases made through any other channel. While that makes it more restrictive than the annual $300 travel credit available with the Chase Sapphire Reserve, it is still relatively easy to use and substantially offsets the true cost of the cards $395 fee as long as you actually take advantage of it.

There are some downsides to using a third-party booking service . However, Capital One has made significant strides in the travel booking experience, most recently investing in booking platform Hopper and adding customer-friendly features like price-drop prediction and a best-price guarantee.

Why Its Important To Establish Business Credit

When youre just starting out in business, its important to establish credit with business credit bureaus. This will give you access to lines of credit and loans that you can use to finance your business expenses.

And, if you ever need to apply for a Small Business Administration loan, having business credit will improve your chances of getting approved. Building your business credit is not difficult, but it does take some time and effort.

Also Check: How To Increase Your Credit Score Fast

Your Credit Score Matters More Than You May Realize

Your credit score influences much of your personal finances even if you dont realize it. The reach goes far beyond loans and interest rates and impacts everything from your ability to earn to your ability to find a home.

Living with bad credit means paying more for everything from utilities to auto insurance. With so much riding on your credit score, it is too important to ignore. Take the steps to join me in the 800+ club, the savings are closer than you think.

Better Credit Card Rewards

In addition to a higher credit limit, a better credit score also unlocks a wider variety of credit cards. Many of the best rewards cards require excellent credit for approval. This includes travel rewards cards that you can use to fully fund your vacations, and cash-back rewards cards that earn a percentage back on your spending.

Read Also: How Do You Check Your Business Credit Score

Benefits Of Credit Rating Agencies To Investors

Benefits to Investors are as follows:

Safeguards against bankruptcy:

Image Courtesy : businessinsider.in/photo/25223599.cms

ADVERTISEMENTS:

Recognition of risk:

ADVERTISEMENTS:

It becomes easier for the investors by looking at the symbol to understand the worth of the issuer company because the instrument is backed by the financial strength of the company which in detail cannot be provided at the minimum cost to each and every one and at the same time they cannot also analyse or understand such information for taking any investment decisions. Rating symbol gives them the idea about the risk involved or the expected advantages from the investment.

Credibility of issuer:

Rating gives a clue to the credibility of the issuer company. The rating agency is quite independent of the issuer company and has no Business connections or otherwise any relationship with it or its Board of Directors, etc. Absence of business links between the rater and the rated firm establishes ground for credibility and attract investors.

Easy understandability of investment proposal:

ADVERTISEMENTS:

Rating symbol can be understood by an investor which needs no analytical knowledge on his part. Investor can take quick decisions about the investment to be made in any particular rated security of a company.

Saving of resources:

Independence of investment decisions:

ADVERTISEMENTS:

Choice of investments:

Length Of Credit History

Lenders like to see that you can manage credit accounts responsibly over a long period of time. This is why its a bad idea to close old credit cards, even if youre no longer using them. Your credit report only tracks active credit accounts, and when you shut down your oldest credit accounts, you shorten your credit history. If you want to build good credit, keep your credit cards open.

You May Like: How To Get Debt Off Credit Report

How To Earn Capital One Miles

The Venture X accrues miles at the following rates:

- 10 miles per dollar on hotels and car rentals booked via Capital One Travel.

- 10 miles per dollar spent on cars booked through Turo .

- 5 miles per dollar on flights booked via Capital One Travel.

- 2 miles per dollar on other purchases.

This simplicity builds off of the $95-per-year Capital One Venture Rewards Credit Card, a product that has been around for over a decade. In that way, the Venture X represents the best of both worlds high earning potential on travel purchases, specifically, but a solid everyday earning rate thats easy to keep track of.

Read more:

Benefits Of Credit Ratings From The Point Of View Of Regulating Authorities:

1. The regulatory authorities can discipline financial institutions by insisting on good credit rating before going for public issue.

2. By imposing various conditions in credit rating, the financial soundness of the companies is maintained.

3. Any down-grading of credit rating will send clear signals to the regulating authorities to closely monitor the functioning of the company concerned.

4. The general economic condition in the company could also be analyzed by the regulating authorities from the credit rating of various companies.

5. Good Credit rating also provides authority, responsibility and accountability to the regulating authorities.

Recommended Reading: How To Bring Up Credit Score

Advantages And Disadvantages Of Credit Rating

Advantages And Disadvantages Of Credit Rating: According to The Economic Times, Credit rating is an analysis of the credit risk associated with a financial instrument or a financial entity. It is completely based on the credential as well as the financial status of the entity done in terms of lending and borrowing. In America, TransUnion, Experian and Equifax are the three major credit reporting agencies. Credit rating can not be a static number rather it remains dynamic based on new information which is provided by financial institutions. If anyone misses a payment and then tries to apply for new credit at that point, the information gets forwarded to credit reporting agencies. One can have high as well as low credit scores based on their previous payment history. There are different credit rating scales from to represent the risk and companys creditworthiness. For example, AAA refers to the lowest or no credit risk. AA denotes a very good credit rating, A refers to low credit risk, BBB refers to average credit risk, B is high credit risk or low credit rating, C denotes very poor credit rating and D is considered as Defaulted. The companys future potential should be based on current performances, profit-making projects and the ability to pay the debt.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Get A Cell Phone On Contract With No Security Deposit

Another drawback of having a bad credit score is that cell phone service providers may not give you a contract. Instead, youll have to choose one of those pay-as-you-go plans that have more expensive phones. At a minimum, you might have to pay extra on your contract until you’ve established yourself with the provider. People with good credit avoid paying a security deposit and may receive a discounted purchase price on the latest phones by signing a contract.

Recommended Reading: Does Business Line Of Credit Show On Credit Report

The Big 3 Credit Rating Agencies

The credit rating industry is dominated by three big agencies, which control 95% of the rating business. The top firms include Moodys Investor Services, Standard and Poors , and Fitch Group. Moodys and S& P are located in the United States, and they dominate 80% of the international market. Fitch is located in the United States and London and controls approximately 15% of the global market.

Morningstar Inc. has been expanding its market share in recent times and is expected to feature in the top four rating agencies. The U.S. Securities and Exchange Commission identified the big three agencies as the Nationally Recognized Statistical Rating Organizations in 1975.

The big three agencies came under heavy criticism after the global financial crisis for giving favorable ratings to insolvent institutions like Lehman Brothers. They were also blamed for failing to identify risky mortgage-backed securities that led to the collapse of the real estate market in the United States.

In a report titled Financial Crisis Inquiry Report, the big three rating agencies were accused of being the enablers of the 2008 financial meltdown. In a bid to tame the market dominance of the big three, Eurozone countries have encouraged financial firms and other companies to do their own credit assessments, instead of relying on the big three rating agencies.