What Does A Credit Score Of 811 Mean

Asked by: Dorian Vandervort

Your 811 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Coronavirus Update For Mortgage Borrowers

The Financial Conduct Authority confirmed that homeowners whose finances have been affected by COVID-19 can apply for a 3-month mortgage payment holiday, which can be topped up to a total of 6 months.

Homeowners unable to make their mortgage payments who have yet to apply for a payment holiday have until 31 March 2021 to do so. Mortgage payment holidays ease the burden of having to make monthly payments at times when you may be struggling to make ends meet. The holiday will not appear on your credit file and wont affect your credit score, however lenders will still be able to find out about it.

You should only take a mortgage payment holiday if you really need to. This is not free money it is simply extending the term of your mortgage by 3-6 months. Your home loan will continue to build up interest during this time, meaning the total amount you will pay back over the term of your mortgage will be higher.

Also Check: Syncb Qvc

If The Information On A Credit Reference File Is Wrong

If you think any of the information held on your credit reference file is wrong, you can write to the credit reference agencies and ask for it to be changed. But you can’t ask for something to be changed just because you don’t want lenders to see it.

You can also add extra information about your situation. For example, you can add information if you have had a past debt but have now paid it off. This is called a notice of correction. This might help you if you apply for credit in the future.

Remove Defaults County Court Judgments Or Bankruptcies

If youve undergone some form of court action, but it happened more than six years ago, this should no longer appear on your file. However, this is not always an automatic process.

Its therefore advisable to check with all three CRAs to ensure all record has been removed completely from your file.

Defaults

If youve failed to make payments on an account with a bank, mobile phone or utility company, usually over a 3-6 month period, the lender will close your account. This is known as a default. A default can occur regardless of how much money you owe .

Defaults are recorded on your credit report and decrease your credit score, making it much harder for you to get credit in the future.

Some lenders will serve a default notice asking you to catch up with missing payments. Its vital to pay that amount immediately to avoid the default happening.

Unless a default was created in error, it will remain on your credit file for six years, regardless of whether you pay off that debt.

However, you should continue to make any remaining payments as the lender could go on to register a County Court Judgement against you.

County Court Judgment

In some instances of missed payment, the lender might bring a CCJ against you. If you pay what you owe within 30 days of the CCJ being issued, it should not appear on your credit file.

Reducing the impact of a CCJ or default payment

But if you are now able to make repayments, doing so will help improve your score again.

Bankruptcy

Also Check: Does Les Schwab Report To Credit

Will My Credit Score Increase Immediately

No, it can take time for any updated information to come through and for you to be given a higher credit score. As such it pays to start as soon as possible, as youll get a good credit score sooner!

Ultimately, if you take action to reduce late payments on your credit cards and get on the electoral roll, youre taking a positive first step towards getting a good credit score.

What Credit Scores Are Used For

Banks, building societies and credit card companies use credit scores to work out how risky it would be to lend money to you. They will analyse your score to decide if:

- you qualify for a product

- what interest rate you will pay

- what credit limit to offer

Your credit score will be checked if you are looking for a mortgage, personal loan, credit card or an overdraft on your current account even a student current account.

Read Also: When Does Paypal Credit Report To Credit Bureau

Is A High Credit Score Better Than A Low One

Throughout your life, credit scores can play a key role in the financial products you take out. For example, when applying for a credit card or mortgage, your could be used to help determine whether your application is accepted and what you end up paying.

People with a higher score are often seen as lower risk, which means lenders are more likely to give them credit.

Its worth remembering that every lender follows a different policy for credit scoring. So, if you dont meet the criteria of one lender, you may still be able to get credit from someone else. However, its important to find out why you were turned down before making another application. You should also be aware that too many credit searches in a short time period may be viewed negatively by lenders.

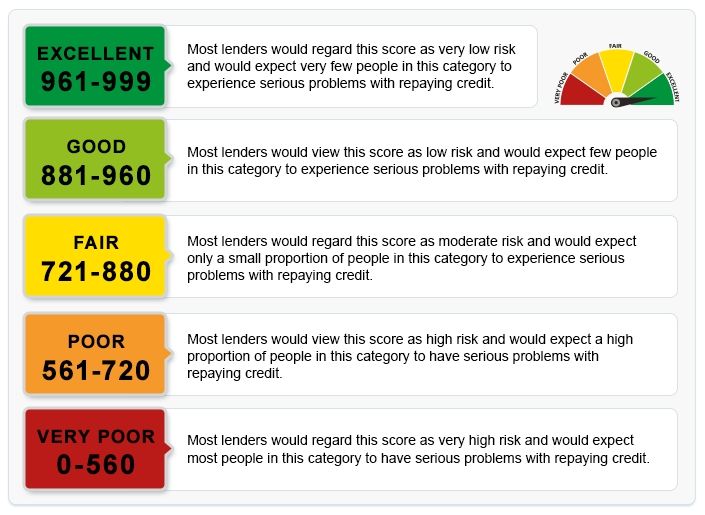

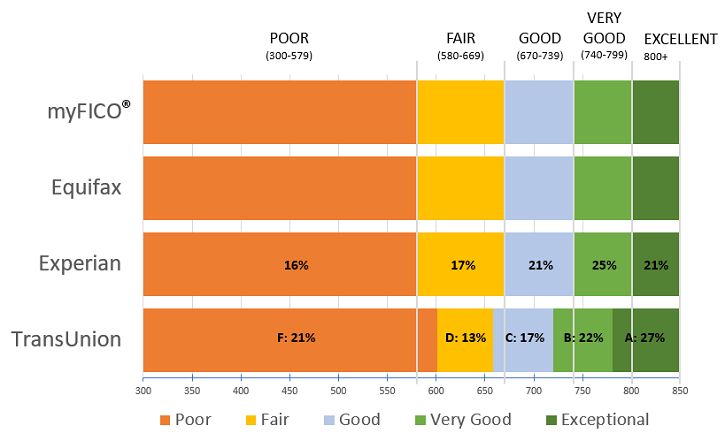

How Are Credit Scores Ranked

While each Credit Reference Agency uses a different numerical scale to determine your credit score, they all have five categories that they sort individuals into.

These are:

- Poor

- Very poor.

You will probably be put into the same category by all three agencies, as they all base their rating on your one credit record. So, if you receive a good Experian credit score, its likely the other two agencies will give you a rating of good too.

Read Also: Is Creditwise Transunion

What Is My Credit Report

Think of your credit report as your financial CV. It contains information that helps lenders confirm your identity and decide whether youre a reliable borrower.

This includes details of credit accounts youve held , your current and previous addresses, and any financial connections for example, the name of the person you share a joint account with.

There are likely to be three slightly different versions of your credit report, because lenders dont always share the same information with all three major credit reference agencies – Experian, Equifax and TransUnion .

Use A Credit Build Card To Build A History & Restore Past Issues

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with a poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won’t be charged interest, so it’s no problem.

Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren’t using, then you can do the same on that without the need to apply for a new one.

You May Like: How To Remove Hard Inquiries In 24 Hours

Check Your Credit Score For Free

If youre taking out credit, or just interested in knowing what is on your files, the good news is that its easy to find out and wont cost you anything.

Request a Statutory Credit Report

You can apply to each of the CRAs independently to request a Statutory Credit Report. Theyre obliged to send it to you for free.

This data is only updated on a monthly basis.

View your credit file and score

For fully up-to-date information, you can view your full credit file from all three of the credit reference agencies for free.

There are also free online services that let you see your credit score and file. These free online services typically update once a month.

If you want more regular updates, consider signing up for a paid subscription service. There is usually a free trial period for 14 to 30 days and you can cancel your subscription if you don’t want to carry on using the service.

What Are Credit Reference Agencies Do Lenders Look At

UK mortgage lenders tend to use three credit reference agencies Experian, Equifax and TransUnion, although there are many others that are referred to by lenders across the UK.

If youve ever checked your credit score before, you may already know that each of these agencies and the many others that provide information about your credit history, use different scoring systems.

This can be frustrating because one lender may refer to Experian and use their scoring system whereas another may use data from Transunion.

Don’t Miss: Can A Closed Account Be Reopened

It’s As Much About ‘will You Make The Lender Money’ As It Is About Risk

Many people write to us incensed after rejection “I’ve a perfect credit score, I’ve never missed a payment, why on earth did they reject me?” This is based on a misunderstanding lenders are credit scoring to see if you match up to their wish list of what makes a profitable customer.

Of course, someone who is a bad risk is likely to be scored out as unprofitable by most companies. But the risk of not repaying isn’t the be-all and end-all.

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know. Here are some other things to look out for:

What Is A Bad Credit Score In The Uk

As with good credit scores, all lenders and financial institutions, as well as the credit reference agencies you use will all have their own threshold for what is considered to be bad or poor credit. Whether youve been searching for how bad is my credit score UK? or youre dreading running a credit score UK check, the pressure of a bad credit score can be stressful at the best of times and so understanding what it is and how it can be managed is important to getting back on your feet financially.

Every creditor will have its own ideal threshold, but a poor credit score can make it difficult to get accepted for loans or get the best rates on utility bills, finance and more.

In most cases, the credit reporting companies wont tell you outright whether your score is considered good or bad for this reason, however, its important to be aware of the health of your credit regardless. Any score below 600 is often considered in need of work, and you should always be working to manage and maintain your credit and finances regardless.

Don’t Miss: Tri Merge Credit Report With Fico Scores

Average Credit Score In The Ukin 2022

Not only are they quite complex financial instruments, their relationship to debt has been frequently, unhelpfully covered in the mainstream media.

This article will take you through what you actually need to know about credit scores, and answer any questions you may have about what the average credit score in the UK is.

Topics that you will find covered on this page

You can listen to an audio recording of this page below.

Don’t Let Your Partner Or Flatmate’s Score Wreck Yours

It’s not usually whether you kiss, hold hands, live together or even being married that links your finances, it’s simply whether you have a joint financial product.

If you are financially linked to someone on any product, that means their files can be accessed and looked at as part of assessing whether to accept you. Even just a joint bills account with flatmates can mean you are co-scored.

Therefore if your partner/flatmate has a poor history, keep your finances rigidly separate, and it should maintain access to good credit for you. If your finances are already linked and you’ve split up with your partner or moved out of your flat-share, make sure you take the time to financially de-link and ask the credit reference agencies for a notice of disassociation .

There are currently only four products that can infer financial linking a joint mortgage, a joint loan, a joint bank account , and in certain circumstances, your utility bills. Being jointly named on a bill with a flatmate shouldn’t mean you are financially linked this should only happen when the energy firm is confident you’re a couple .

It’s worth noting that while many people think they have a “joint” credit card, these technically don’t exist. It’s one person’s account, the other just has a second card to access it.

Recommended Reading: When Do Collections Fall Off Credit Report

What Is A Bad Credit Score

A bad credit score means you might find it more difficult to get credit. Thats because its an indication to lenders of problematic financial behaviour, such as a history of being late with, or entirely missing repayments.

The three CRAs each have a different number that they consider to be a bad credit score:

Experian below 721

-

0 to 560 is considered very poor

-

561 to 720, poor

TransUnion below 566

-

0 to 550 is considered very poor

-

551 to 565, poor

-

604 to 627, good

-

628 to 710, excellent

The key thing to remember is your credit score is a constantly changing thing that can modify with certain types of financial behaviour and can be improved.

If you’re in a lot of debt

If youre in real financial difficulty and in serious debt, improving your score should not be your priority – first you should get out of debt.

There is plenty of free, impartial help available to you from debt charities like StepChange. Theres no need to go it alone.

What Exactly Is A Credit Score

A credit score is a number used by lenders to determine whether you qualify for credit, such as a loan or credit card.

Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

Read Also: How Long Does A Dismissed Bankruptcy Stay On Credit

What Scoring Systems Do Credit Reference Agencies Use

Each credit reference agency employs its own system of scoring

- At Experian scores are marked out of a maximum 999. Above 960 is classed as excellent while 560 or below is very poor

- At Equifax the maximum score available is 700. Above 465 is defined as excellent and below 280 as very poor

- At TransUnion, the scoring system is out of 710 with 628 and above classed as excellent and below 550 as very poor.

What Are The Causes Of A Bad Credit Rating

For example, you should not exceed the credit limit of your overdraft. As mentioned above, you also shouldnt make multiple applications for credit cards at the same time.

Bankruptcies, insolvencies, county court judgments, and defaults on your credit agreements can all call your reliability into question too.

Another thing to note is that you should not automatically close old credit card accounts early. Depending on the lender and how long you have had the account for, having old credit accounts could have either a good or bad impact on your score.

For instance, if you have responsibly used your card for several years, then it may be a good sign to lenders and rating agencies that you can control your finances well.

Having no credit history in your records can also negatively impact your score, because there is no evidence proving that you can borrow responsibly and pay back debt.

Finally, dont forget to check your credit report for errors or any mistake due to fraud or identity theft. There is potential that this could have negatively impacted your score.

If you are still unsure about the credit rating system, it may be helpful to seek expert guidance from an independent financial adviser. They can answer any kinds of credit questions that you have to help you understand the points above as well as the bigger picture.

A guide can also help you sort out your finances if you are having trouble managing your money.

You May Like: Realpage Credit Score