Setting Limits Teaches Healthy Spending

CoOwners have the option of setting spending limits and managing controls for Participants to help them spend safely and learn smart money habits. Owners can even receive real-time spending notifications. Participants 18 and older can order their own physical card, and Owners or CoOwners can order them for Participants under age 18.

If Your Application Is Declined Because Your Identification Information Couldn’t Be Verified

Make sure your name, address and other information provided on your Apple Card application is correct. If you find inaccurate information, re-enter the information as needed.

If you are asked to verify with an ID, follow these steps:

After you complete these steps, submit your application again. If your application is declined again for the same reason, contact Apple Support.

Your credit score won’t be impacted if you’re declined, or don’t accept your offer. Your credit score might be impacted if your application is approved and you accept your offer.

You can apply for Apple Card again, but you might receive the same decision.

If you want to receive a different decision on your application when you apply again, you should review your credit report to see if you have conditions that might result in a declined application and then check for these common errors in your credit report.

*If the information on your ID doesn’t match the information you entered for your Apple Card application, try to apply again after you update your ID.

Apple Card Financing Options

| Apple TV, HomePod and AirPods | All | 6 months |

To take advantage of the Apple Cards financing program, simply pick out your new device and select Apple Card Monthly Installments as your payment option in the Apple Store app or online at apple.com. If youre already an Apple cardholder, theres no additional application to fill out.

Don’t Miss: Which Bureau Does Care Credit Pull

Is Financing Your Phone With The Apple Card Worth It

In many cases, it can be a good idea to finance your new iPhone with the Apple Card. Not only will you earn 3% cash back on your purchase, but you can also save on interest charges and pay off the phone over time.

However, while this plan is great if you are already interested in the Apple Card, there are other financing options available with similar terms. Make sure the card is right for you beyond that purchase before you sign up.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Emily Sherman is a senior editor at CreditCards.com, focusing on product news and recommendations. She is also one of the founders of To Her Credit, a biweekly series of financial advice by women, for women. When she’s not writing about credit cards, she’s putting her own points and miles to use planning her next big vacation.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news from product reviews to credit advice with our newsletter in your inbox twice a week.

Assorted Apple Card Benefits

The Apple Card makes mobile account management easy with functionality built right into the wallet app on Apple phones, computers and wearables. Theres color-coding to help you keep track of purchases by category, for example, along with estimated interest charges to encourage paying off more of your balance each month. Plus, cardholders wont always have to hold onto their card, or at least bring it everywhere, considering that a lot of Apple Card purchases can be made directly from a mobile device.

In addition, the Apple Card allows iPhone users to ask customer service questions via text message. It automatically provides users with a virtual card number to use when making online purchases from retailers that dont accept Apple Pay through Safari browser. And having the card gives you the opportunity to take advantage of an interest-free installment plan if you decide to purchase a new iPhone.

Recommended Reading: Suncoast Credit Union Credit Card Approval Odds

Other Iphone Financing Options

In order to finance a purchase with an Apple Card, you must either be a current cardholder or apply for one when you go to make your purchase. For some, the idea of another credit card account might be a turn-off even if you are looking for alternative financing options to pay over time.

The Apple Card offers a good rewards rate for fans of Apple Pay and heavy Apple spenders, but it doesnt make sense for everyone. Plus, theres no guarantee youll be approved for the Apple Card. Luckily, Apple still offers several other payment plans for non-cardholders.

See related: Apple card approval odds and reasons for denial

Fees Rates And Limits

Depending on the cardholder’s credit history and income, there is a minimum APR of 13.24% and a maximum APR of 24.24%. The Apple Card has no yearly fees, no fees for transactions, and no fees for penalties.

It does have credit limits. The limits are determined by the cardholder’s credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000.

Unlike many other credit cards, only one person may use the digital card. Each individual in a household must apply for their own Apple credit card if they wish to use it.

Cardholders were offered the ability to miss their March 2020 payment interest-free by using a new “Customer Assistance Program” with Apple Support.

Goldman Sachs will report credit information to Transunion, and as of July 2020, Experian as well.

Also Check: How To Get Rid Of Repo On Credit

Your Income Is Low Or You Have Heavy Debt

Though they dont appear on your credit report or factor into your credit score, your income and debt-to-income ratio your total monthly debt obligations compared to your total monthly gross income could also affect your Apple Card application.

Even if you dont have a ton of outstanding debt, low income or low income relative to your existing debt obligations like monthly house or car payments could indicate an inability to make card payments.

Apple specifically mentions having unsecured debt obligations that exceed 50% of your income as a possible reason for denial.

Apple Card Beginning To Show Up On Credit Reports Apr Range Lowered

Nearly four months after rolling out in the United States, the Apple Card is now beginning to appear on credit reports.

Goldman Sachs has confirmed that it is working with credit bureau TransUnion to begin reporting Apple Card information, informing cardholders that they will see full details on their credit report within the next five days. This includes the date the Apple Card account is opened, credit balance, payment status, and more.

In other words, like any other credit card, the way you use your Apple Card can now have an impact on your credit score.

Last month, Apple CEO Tim Cook opined that the Apple Card has been the “most successful launch of a credit card in the United states ever,” although that was before allegations surfaced of gender bias during the approval process. Goldman Sachs has since offered to reevaluate credit limits.

To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, your digital Apple Card will be ready for purchases immediately.

We have been working with TransUnion to begin reporting your Apple Card information. Within the next 5 days, you will see the full details on your credit report. GS Bank Support

#AppleCard showed up on my credit report today. Dongjun

Read Also: Syncb/ppc Credit Card

Your Identity Couldnt Be Verified

You may be asked to verify your identity when you apply for the Apple Card. This requires you to use your device to scan your drivers license or state ID. If the information you entered in your Apple Card application including your date of birth, last name and address does not match the information on your ID, your application may be denied.

Apple Juice Runs Through Your Veins

Siri is your spirit guide. Every device in your home, car and office comes from the Apple store . Getting 3% cash back on your numerous Apple purchases would be a big boon, and for all other purchases, you’re already well accustomed to waving your phone over the point-of-sale device at checkout. Here’s a quick look at the current Apple Card rewards categories:

|

Rewards |

|---|

» MORE:

Also Check: Does Speedy Cash Report To Credit Bureaus

I Heard I Can Get The 3% Cashback All Upfront

You heard correctly. When you purchase your iPhone using Apple Card Monthly Installments, 3% of the total amount off your purchase is sent to your Daily Cash balance right away.

Of course, just like anything you purchase, that 3% is subject to any changes you make. If you return the iPhone, you’ll lose that cashback reward.

Apple Credit Card Vs The Competition

The Apple Card isnt the only credit card that can help you save on Apple products. With that in mind, well show you how the Apple Rewards Card compares to some of its stiffest competition in terms of both rewards and financing capabilities. You can find the results in the following table.

| Info |

|---|

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Read Also: Whats A Good Dun And Bradstreet Score

The Simplicity Of Applein A Credit Card

With Apple Card, we completely reinvented the credit card. Your information lives on your iPhone, beautifully laid out and easy to understand. We eliminated fees1 and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score.2 Advanced technologies like Face ID, Touch ID, and Apple Pay give you a new level of privacy and security. And with every purchase you get Daily Cash back. Apple Card. Its everything a credit card should be.

% Cash Back Using Apple Pay

If you already use Apple Pay all the time, or you could easily commit to it, youll love this part of the Apple Card offer. The 2% cash back that you will earn using the Apple Card through Apple Pay is nearly double the market average, and a growing number of retailers accept Apple Pay. That makes the card worth using for more than just Apple-related spending.

But if you dont plan on using Apple Pay much, that alone could tip the scales in favor of other rewards credit card offers.

Read Also: What Score Do I Need For Care Credit

Requirements To Get Apple Card

To get Apple Card, you must meet these requirements:

- Be 18 years or older, depending on where you live.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that isn’t a P.O. Box. You can also use a military address.

- with your Apple ID.3

- If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

- You might need to verify your identity with a Driver license or State-issued Photo ID.

Who Is This Credit Card Best For

- Diligently searches for the best products and delights in a good bargain See more cardsDeal Seeker

- Prioritizes sticking to their budget while buying what they want and need See more cardsSavvy Saver

The minimal fees make this a good, low-cost addition to your Apple Wallet, and thats the only place you should keep it. When making purchases outside of Apple or without Apple Pay, youre better off with one of the many no-annual-fee cards that pay 1.5% or 2% cash back on all purchases and have a variety of benefits. For example, theres no promotional purchase APR, which other cash-back cards often offer.

That said, with Apple Card Monthly Installments, you will get up to 24 months to pay off Apple products purchased from Apple interest-freewhile still earning 3% cash back. If you bought a MacBook Air at $1,000, you’d earn $30 cash back for one purchase and still get two years to pay it off without paying interest.

-

Exceptional rewards for Apple and partner-merchant purchases

-

Interest-free payment plans on Apple products

-

Great rewards rate on Apple Pay purchases

-

Financial-management tools

-

Low end of APR range is among the best

-

Only worth it for Apple users

-

Sub-par rewards rate on non-Apple and non-Apple Pay purchases

-

Few benefits

-

Limited integration with budgeting apps

Recommended Reading: Brandon Weaver Credit Repair Reviews

How Your Initial Credit Limit Is Determined

To determine your initial credit limit, Goldman Sachs uses your income and the minimum payment amounts associated with your existing debt to assess your ability to pay.

In addition, Goldman Sachs uses many of the same factors that are used to assess whether your application is approved or declined, including your credit score and the amount of credit you utilize on your existing credit lines.

Learn how you can request a credit limit increase.

Does A Denied Credit Card Application Hurt My Credit Score

When you apply for a credit card, it will show up on your credit report as a hard inquiry. This will likely cost you a few points on your credit score. It will happen whether your application is approved or denied, and the difference wonât show up on your credit report.

A high number of recent credit applications is a negative factor when applying for an Apple Card or any line of credit.

Recommended Reading: Does Wells Fargo Business Secured Credit Card Report To Bureaus

What Are The Apple Credit Card Requirements

Heres Apples list of requirements:

- You must be at least 18 years or older, depending on where you live.

- You must be a U.S. citizen or a lawful U.S. resident with a U.S. residential address or military address .

- You must own a compatible iPhone with the latest iOS installed.

- You must use two-factor authentication with your Apple ID.

- You must sign in to iCloud with your Apple ID.

Why Your Apple Card Application Was Denied And What To Do

Reviewed by Ana Gonzalez-Ribeiro, AFC®

Some people will be denied when applying for an Apple Card. If you are one of them, you might be wondering why youâve been denied and if you can reapply.

Weâll discuss how insufficient credit history and other factors impact your Apple Card application and how to fix them for future credit applications, including next steps if youâre not approved.

Recommended Reading: What Does Thd Cbna Stand For

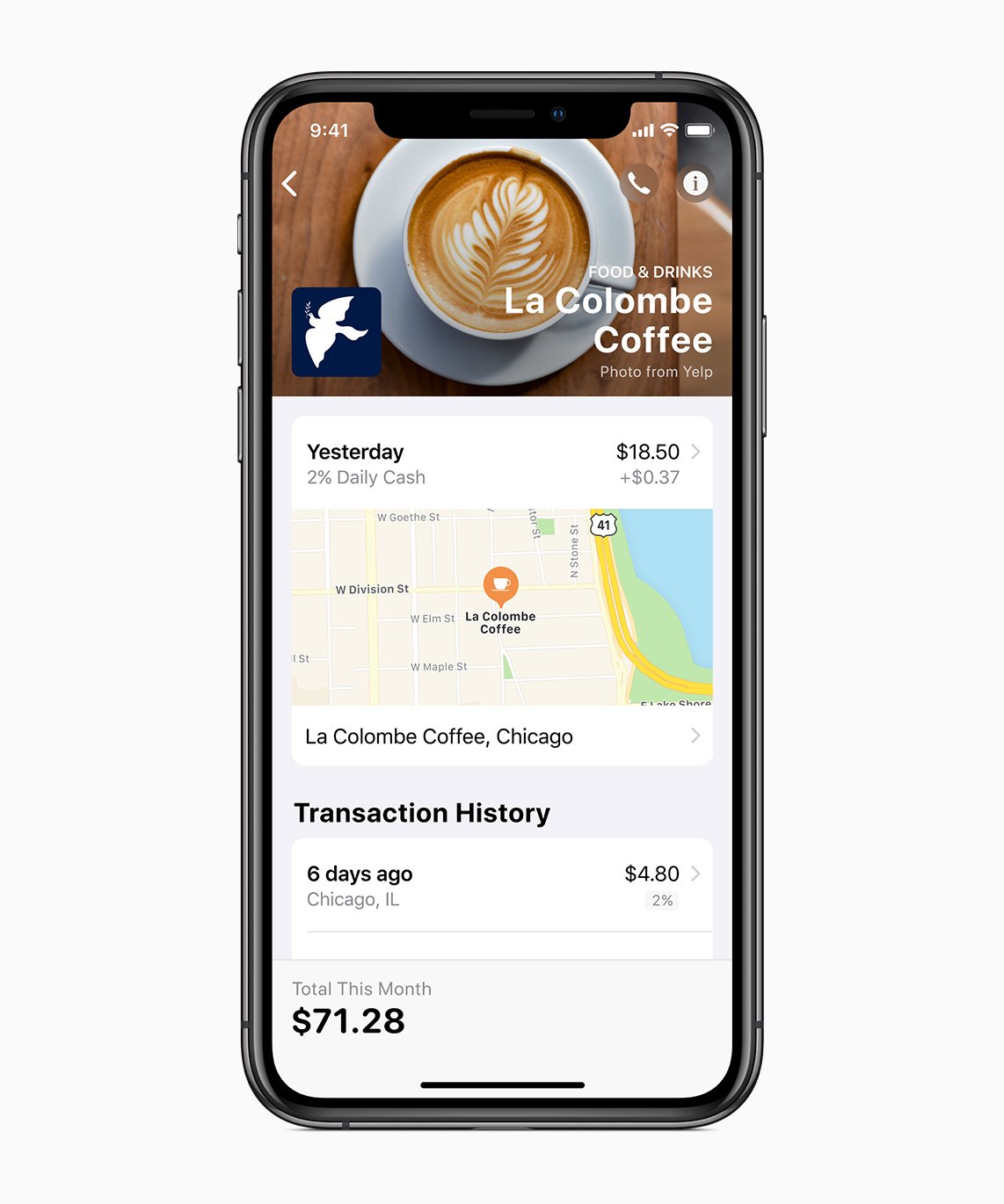

Spend Tracking And Budgeting

All transactions made with the Apple Card are listed clearly in the Wallet app with color-coded categories like Food and Drinks, Shopping and Entertainment, and more. Apple Card also provides weekly, monthly, and yearly spending summaries, again using the same color coding so you can see what you’re spending at a glance.

Along with categorized spend tracking, the Wallet app provides a Total Balance summary that provides a look at your previous monthly balance, new spending (including pending transactions, and any payments or credits that have been made.

Interest charged and Daily Cash earned are also offered up, and users can see PDF statements from past months.

Conditions That Might Cause Your Application To Be Declined

When assessing your ability to pay back debt, Goldman Sachs1 looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application.

If you’re behind on debt obligations4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank .

- You have two or more non-medical debt obligations that are recently past due.

If you have negative public records

- A tax lien was placed on your assets .

- A judgement was passed against you .

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income .

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low ,4 Goldman Sachs might not be able to approve your Apple Card application.

Don’t Miss: Free Credit Report Usaa