How Do Late Payment Affect Your Credit Score

Among the things, most people strive to keep positive in life is their credit performance. You will never know the importance of a good credit performance until you reach out to your bank for a loan, and you cant get an approval. Therefore, meeting your financial obligations early enough as expected should at all times be on your priority list.

Among the things that can affect your credit performance is late payment. When you approach any lender seeking a loan, among the things that will determine whether the loan is advanced to you or not is your payment history. Lenders look at various factors regarding your finances before considering your loan request, and payment history account for 35% of your credit score.

While some late payments are a genuine error on your end e.g., forgetfulness, others could be failing to make payments due to financial shortcomings. Therefore, the question that you could be battling with is how do late payments affect your credit performance?

How Does A Late Payment Affect My Credit Score

Anyone who’s missed a credit card payment knows how alarming it can be once you realize it. You start thinking about how much this will cost you in late fees, and more importantly, what kind of a hit your will take.

It’s understandable to feel this way, especially when your payment history accounts for about 35% of your FICO® Score. No one wants an honest mistake to tank their credit. But before you worry, you should know exactly how late credit card payments work and whether your payment will even be reported as late.

Its Easier To Recover From Just One 30

There are many things you can do to mitigate the damage done by a single 30-day late payment, Scanlon said.

One of the most common is to request what is referred to as a courtesy deletion or removal.

In a nutshell, Scanlon said, if you have a good payment history, you bring that to the creditors attention and request that they give you a break for your single oversight, which they just might do if you have a good payment history and ask nicely.

Additionally, writing a goodwill letter can help you avoid further damage to your credit score from a late payment, according to Nathan Wade, managing editor for WealthFit Money, a financial education website that provides advice on investing, entrepreneurship and money.

A goodwill letter is a chance to explain your situation to your creditor and kindly ask them to remove a negative mark from your credit report, Wade said.

And he also noted that although creditors are not obligated to grant your request, a goodwill letter will not hurt your credit score if it is rejected.

Keep in mind that it can be a few weeks before your goodwill letter is accepted or rejected, Wade cautioned.

Some tips for writing a strong goodwill letter are to write in a respectful tone, acknowledge your responsibility in paying off debts on time and be detailed about the negative mark you need removed and from which credit bureaus reports.

Recommended Reading: What Is Elan Financial Services On My Credit Report

How To Avoid Late Credit Card Payments

You likely have a busy life, and sometimes, it can be easy to forget a payment. One solution is to set up an automatic payment from your checking account to be sure you make your payments on time. You can also check with your issuer to see if you can set up text and/or email alerts to remind you when your bill is due. For example, with Discover you can login to your account and navigate to the Manage Alerts page to view your options and set up the alerts that best serve you.

Get Late Payments Removed From Your Credit Report

Its possible to get late payments removed from your credit report, but it takes time, effort and patience. The first step is to ask the lender or creditor for forgiveness. You can do this by calling or sending a letter.

Before you reach out, have your documentation ready so you can effectively make your case. Some lenders or creditors will be flexible if they understand the late payment was due to an unforeseen circumstance, such as a medical emergency or a natural disaster, or if you can show that you have a history of making payments on time. However, a lender is not obliged to remove any negative information.

Don’t Miss: What Is The Max Credit Score

The One Late Payment Myth

One prevalent misconception is that a single late payment is no big deal. The reality is that on-time payments are the single most important factor in the FICO formula. Research conducted by FICO shows that a single 30-day late payment on a mortgage can shave 75 or more points off of a consumers credit score. In addition, late payments remain on a credit report for seven years. As a result, what may at first seem insignificant can have a major affect on a FICO score.

Featured Topics

How Do Late Payments Affect Your Credit Score

Your credit score is safe if you get your payment in before that 30-day mark. Any later, and your score could be in trouble. There’s no set amount your score will drop, as the extent of the damage depends on several factors including:

- Your current credit score

- Your previous payment history

- How late your payment was

You have the most to lose if you’ve built a high credit score and haven’t had any late payments in the past. For example, if you have good credit, one late payment might not give you bad credit. But a credit score of 780 with no prior late payments could drop by 110 points with just one credit card marked 30 days past due. As you exceed 60 and 90 days past due, your score suffers more.

If you have a lower credit score to begin with and a couple of late payments on your credit report, then another will likely bring your score down another 60 to 80 points. And every late payment makes it harder to improve your credit score.

Don’t Miss: How To Check My Credit Report

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, itâll remove the risk that youll be sued over the debt.

You May Like: What Is The Minimum Credit Score For A Va Loan

How Do Late Payments Impact Credit Score

When you miss a payment, your credit score is affected. When you are late with a payment by 30 days or longer, as much as 100 points can be taken from your credit score. Your payment history is an essential part of the credit score, which is why its taken into account when calculating it. Therefore, one single late payment is enough to drag down your score.

Read Also: What Credit Score Does Synchrony Bank Use

When Are Late Payments Reported

Now imagine you pay a bill after an entire billing cycle has lapsed, waiting until April 6 to make a payment that was due March 5. That means you’re behind enough for the issuer to furnish that information to the credit reporting agencies. It’s considered a 30-day late payment, and it will be noted on your credit report for up to seven years. Anyone who checks your report will see it and is free to form an opinion about it.

More important, a 30-day late payment will affect your credit scores. The two largest credit scoring companiesFICO® and VantageScorerank payment history as the most important score factor, and thus a late payment will shave points from your score. The extent of the damage depends on the state of your entire credit history. If you have a long and strong pattern of using credit products responsiblypaying on time and keeping revolving debts lowa single late payment isn’t likely to drop your scores drastically. On the other hand, if you have very little on your credit report, your scores will likely decline markedly.

If you continue to let billing cycles elapse, your credit scores will be harmed more severely. The later a payment is, the more alarming it is to creditors and the more dramatically your credit scores will sink. Severely late payments could be an indication that you’re in financial trouble, and a signal to lenders that you pose a credit risk.

Loss Of Credit Card Rewards

Another drawback of paying a credit card late is you may lose your ability to earn and/or redeem rewards. Many card issuers will not pay out rewards according to your rewards plan if the account is not current. Further, you may not be able to redeem your rewards until your account is up to date.

Worst case scenario, you may lose your accumulated rewards permanently if you dont get your account up to date as is required by your agreement.

In most cases, you do have some time before a late payment will be reported to the credit bureaus but you may face other undesirable consequences like those mentioned above. Heres a look at how to minimize the damage caused by late payments.

Also Check: Does Annual Credit Report Affect Score

Recommended Reading: How Long For Credit Score To Update

How Long Do Late Payments Stay On A Credit Report

If youre 30 days behind on your payment, creditors can report your late payment to the major credit bureaus. At that point, late payments can stay on your credit report for up to seven years from the date of the original missed payment, i.e. the delinquency date. Even when youve paid the past-due balance, late payments can stay on your credit report that long. If youre able to get current on your account before the 30-day mark, you can avoid having your late payment reported to the credit bureaus, but youll still face late fees and potentially an increase in your APR from your creditor.

Can A Late Payment Affect My Credit Score

Your reflects how reliable you are with credit, and it affects your ability to borrow money. Each company will calculate your score in their own way to decide if you meet their criteria. They do this using your credit history, details on your application form, and any other information they hold on you .

Some companies take late payments into account when calculating your score. This is because overdue payments can suggest youâre struggling to manage your finances. As a result, you might not meet some companies’ lending criteria.

The Experian Credit Score can give you an idea of how companies see you. Itâs based on information in your credit report, and is the UKâs most trusted score*. If youâve been late with payments, check your Experian Credit Score to understand how your ability to get credit may have been affected.

Recommended Reading: How To Get A Dispute Removed From Credit Report

Why Late Payments Are Bad For Your Credit Report

Although everyone would want to be able to pay their bills on time, its not always possible. People may encounter different issues. They either dont have the time to do so, or they dont have enough money to pay them, so they end up being late. Unfortunately, this will show up on their and affect it.

When it comes to determining your credit score, your payment history is the main factor that allows it to be calculated. This is why its always recommended to pay for everything on time. Depending on factors like your credit history and score, how bad the late payment was, and how long ago it happened, it can seriously harm your credit score.

Your credit score shows your reliability with credit. When you want to borrow money, your score will be calculated by the potential lender to see if you meet the criteria to get a loan. Your credit history comes into play here. There are companies that dont ignore late payments when calculating credit scores, because late payments could be a good sign that the borrower would be too risky. As a result, you may not be able to obtain financing from these companies.

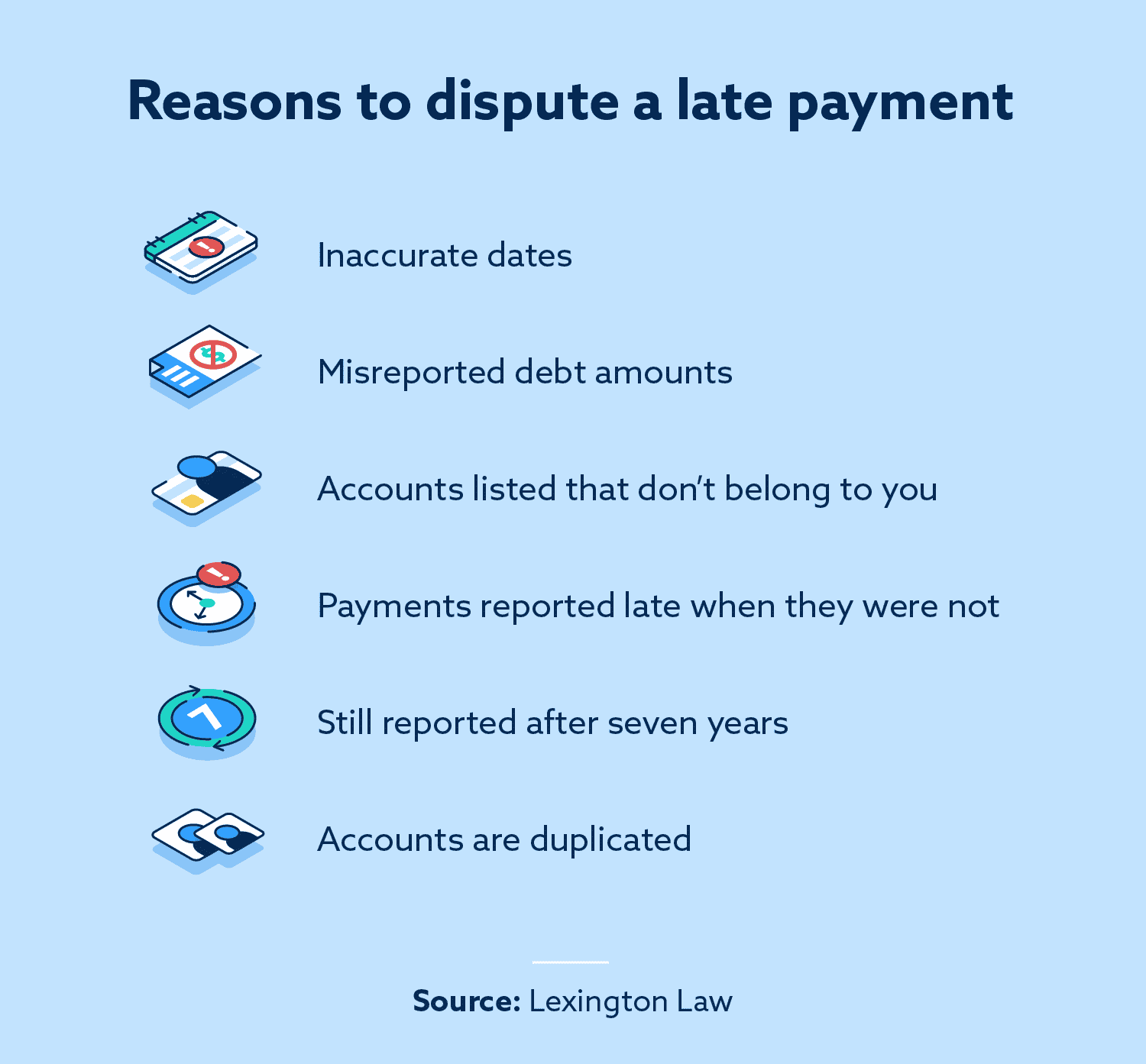

Can Late Payments Be Removed From My Credit Report

If late payments are inaccurate, you can take steps to remove the incorrect information from your credit report. If the debt is legitimate, it will be more difficult to remove the debt, but not impossible. Check out the tips below for removing a late payment from your credit report. If there is no way to remove the delinquent payment, you can take steps in the future to prevent another delinquency.

Recommended Reading: How Can You Build Your Credit Score

Why Do Late Payments Impact Your Credit

Payment history is one of the key details that banks and issuers consider when deciding whether or not to approve you for credit.

A long-standing history of on-time payments suggests that youre a responsible and reliable borrower a poor history of on-time payments suggests to banks and issuers that you may not repay debts and could result in a costly loss to their business.

Because of this, payment history is one of the most important factors that goes into calculating your credit scores. So when you miss a payment or make a late payment, it can have a more dramatic impact on your scores than something like a hard inquiry.

How Long Does A Late Mortgage Payment Affect Your Credit

It happenedyou’ve missed a mortgage payment. Maybe because the due date slipped your mind or you’re in a rough spot financially. A missed mortgage payment isn’t the end of the world, but there are repercussions to keep in mind, including : A late mortgage payment could stay on your credit report for up to seven years.

Fortunately, though, you can take steps to prevent a late payment from happening again and rebuild your credit after making late payment. Here’s what you need to know about late mortgage payments and your credit.

Recommended Reading: Does Klarna Show Up On Credit Report

What Does Your Payment History Include

Accounts that show up on your credit report are largely credit-relatedcredit cards, mortgages, car payments and other installment loans. These are the accounts that are reported regularly. This means your on-time payments are reported, as well as late payments.

There are other accounts on which you may owe money, but these are from businesses that dont see themselves as extending credit. Things like utility payments are not normally reported to the .

Here is what the FICO scoring model considers when calculating a borrowers payment history:

- Payment information on individual accounts, including credit cards, loans, mortgages and retail accounts

- How far overdue delinquent payments are currently, or were in the past

- Amount of money still owed on delinquent accounts, including those that have been sent to collections

- Number of past due payments on a credit report

- Length of time thats passed since each delinquency, adverse public record or collection item was added to your report

- Number of accounts that are being paid as agreed

Get Help Addressing Late Payments

To make this process easier, you can work with a that will help you address inaccuracies on your credit reports. The credit repair consultants at Lexington Law have the knowledge and, most importantly, the time available to help you through the credit repair process from beginning to end.

Reviewed by Miriam Allred, Associate Attorney at Lexington Law Firm. by Lexington Law.

Miriam Allred was born and raised in Southern California. After high school she joined the US Navy. She then went on to get an Economics degree from Chapman University where she got to enjoy an internship at the United States Supreme Court. Miriam then went to Brigham Young University where she received her Juris Doctor. Prior to joining Lexington Law, Miriam worked as a civil rights attorney dealing with discrimination and sexual harassment. In this role she helped write and create policies and investigate sexual harassment and discrimination complaints. Miriam also has experience in family law. Miriam is licensed to practice in Utah.

Recommended Reading: Is 824 A Good Credit Score

How To Get Late Payments Removed

The simplest approach is to just ask your lender to take the late payment off your credit report. That should remove the information at the source so that it wont come back later. You can request the change in two ways:

If the late payment is accurate, you can still ask lenders to remove the payment from your credit reports. They are not required to do so, but they may be willing to accommodate your request, especially if one or more of the following apply:

- You paid late due to a hardship like hospitalization or a natural disaster.

- The late payment was not your fault, and you can document the cause .

- You can offer them something in return, like paying off a loan that youre behind on.

- You usually pay your bills on time and you made a one-time mistake.

Some situations are so complicated or unfair that you need professional help. An attorney licensed in your area can review your case and offer guidance on additional options.